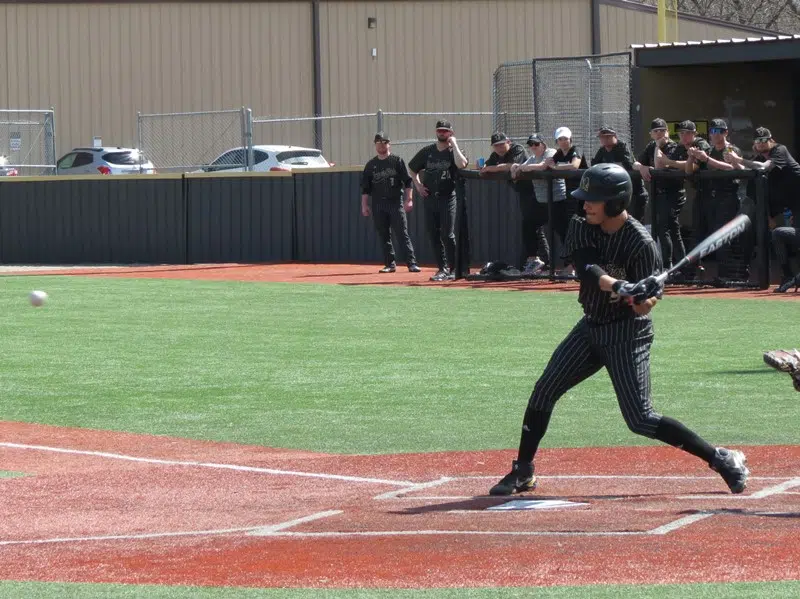

The Emporia State baseball workforce outscored Missouri Western 6-3 Saturday. Centerfielder Blake Carroll had an enormous day on the plate going 3 for 3 with 2 R-B-I.

T.J Racherbaumer and Dylan Werries every drove in a run.

Noah Geekie was the successful pitcher going 4 innings giving up 3 runs on 7 hits. Jarrett Seaton pitched 3 scoreless innings and Braden Meek pitched 2 scoreless innings to earn the save.

The Hornets go for the sequence sweep Sunday afternoon.

With Saturday’s win, Emporia State strikes into eighth place within the MIAA standings.

Missouri

Emporia State baseball outscores Missouri Western 6-3

Missouri

No. 2 South Carolina visits Missouri following Slaughter’s 22-point game

Associated Press

South Carolina Gamecocks (12-1) at Missouri Tigers (11-4)

Columbia, Missouri; Thursday, 7 p.m. EST

BOTTOM LINE: Missouri plays No. 2 South Carolina after Grace Slaughter scored 22 points in Missouri’s 90-51 victory over the Jackson State Tigers.

The Tigers are 9-2 on their home court. Missouri ranks ninth in the SEC at limiting opponent scoring, allowing 57.9 points while holding opponents to 38.0% shooting.

The Gamecocks are 1-1 on the road. South Carolina has an 11-1 record in games decided by 10 or more points.

Missouri makes 46.3% of its shots from the field this season, which is 11.6 percentage points higher than South Carolina has allowed to its opponents (34.7%). South Carolina averages 23.6 more points per game (81.5) than Missouri gives up (57.9).

The Tigers and Gamecocks meet Thursday for the first time in conference play this season.

TOP PERFORMERS: Slaughter is averaging 14.7 points for the Tigers.

Te-Hina Paopao is averaging 11.4 points for the Gamecocks.

LAST 10 GAMES: Tigers: 8-2, averaging 80.6 points, 34.7 rebounds, 14.8 assists, 9.8 steals and 3.0 blocks per game while shooting 47.9% from the field. Their opponents have averaged 59.2 points per game.

Gamecocks: 9-1, averaging 82.8 points, 39.0 rebounds, 16.8 assists, 11.7 steals and 5.9 blocks per game while shooting 47.0% from the field. Their opponents have averaged 53.0 points.

___

The Associated Press created this story using technology provided by Data Skrive and data from Sportradar.

Missouri

Will Missouri grocery stores lose shoppers to Kansas?

KANSAS CITY, Mo. — Kansas is eliminating its sales tax on groceries.

Will Missouri shoppers take their business across the state line to save money?

The state’s tax on Kansas food sales was 2%.

In Missouri, the food sales tax is 1.225% on take-home grocery food items and the revenue it generates primarily supports public schools.

Local governments levy sales taxes on groceries, potentially increasing the total tax rate up to 8%.

The Missouri Department of Revenue has an online tool that shows the full tax breakdown.

A bill to end the grocery tax in Missouri stalled in the legislature last year, with lawmakers citing lost revenue and confusion on how money from the tax would be made up.

“Frankly, I’ve lived in a couple of states where they didn’t have sales tax on food and it always works out better,” said Marcus Moses, a shopper in south Kansas City. “Oh yeah, it’s going to affect how I shop. I’m going to spend a lot more time in Kansas buying food than in Missouri.”.

Grocery store operators are paying close attention to what happens when the Kansas sales tax goes away.

Jack McCormick, KSHB 41

“It’s important to shop in Missouri, to support your state and support your stores, but I also think the store needs to do their job too to keep the customers shopping,” said Moe Muslet, who oversees Farm Fresh Market in south Kansas City. “I mean they’re looking for value, so we need to offer them value or they’re going to go somewhere else.”

Muslet knows his customers want the best deals.

“Us opening this store, we knew it was going to happen and we planned on it already, he said. “Our prices are aggressive, offering good products at good prices, nice customer service, and a store. They’ll continue shopping here.”

One couple said it’s not likely they will change where they shop.

“Where you used to go the store for $35, now it’s $60 or $65,” said Louise and Jimmy Clossick as they shopped Tuesday night. “Grocery prices are going up, so you do watch for bargains or sales. Does it make a difference in where we shop? Probably not that much; it’s more of a convenience for us.”

Jack McCormick

Gas prices will keep one Missouri shopper in the state.

“It costs more in gas to get over there and back,” Jeremy Coleson said. “And time. Time is probably the most valuable.”

Kansas officials estimate the elimination of the tax will save about $500 a year for a family of four.

Muslet says he has a plan to stay competitive at his store.

“Lowering margins, lower our margins so we are losing a little bit here, but we will gain it with increased sales we are hoping,” he said. “I don’t think the sales tax will compete with our store much, but I think their stores will.”

Missouri

Columbia businesses prepare for minimum wage increase under Proposition A

COLUMBIA — Minimum wage in Missouri will increase by more than a dollar on Wednesday after voters passed Proposition A by a significant margin in November.

Minimum wage will increase to $13.75 from $12.30, and some employers will also be required to provide their employees with one hour of paid sick leave for every 30 hours worked.

Proposition A will increase the minimum wage to $15 an hour by 2026.

Some businesses in Columbia say this increase will have an impact on employees and business owners alike.

People in favor of the proposition believe it is a step in the right direction toward giving minimum wage workers a more livable income. However, people against say it will cause another spike in prices.

“Inflation on food products are through the roof — we’re still at 10-to-12% price increases,” said Buddy Lahl, the CEO of the Missouri Restaurant Association. “Adding additional regulations is going to, in turn, continue to add increased prices onto consumers.”

Lahl also believes the mandated paid sick leave could deprive workers of other benefits. “Typically employers provide vacation days and health insurance and then you’d get to sick pay. This is mandating sick pay in front of health insurance and I’m not so sure that’s the right thing to do.”

The Missouri Chamber of Commerce claims Proposition A violates the requirement that ballot measures only address one issue.

A manager at Hitt Mini Mart said business owners can prepare for the wage increase to help keep costs down.

“The best thing that most businesses can do is try to give out deals as much as possible,” Patel said. “Yes, I know prices are going to rise and it will be tough for some people to adjust to the new prices, so the best thing I can do is try to get a deal for them.”

With basic necessities becoming more expensive, experts say higher wages for Columbia residents will go a long way toward keeping the pantry full.

“Currently in 2024, a full-time minimum wage worker earned less than $500 per week,” said Richard Von Glahn, the political director at Missouri Jobs with Justice. “That is not enough to survive in any county in this state. Those rising prices are actually why raising the minimum wage is so important to begin with.”

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business7 days ago

Business7 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health3 days ago

Health3 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology3 days ago

Technology3 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World1 week ago

World1 week agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics1 week ago

Politics1 week agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Politics5 days ago

Politics5 days ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons