Iowa

Why Ron DeSantis Doesn’t Have a Prayer in Iowa

Those social conservatives had won big legislative margins in the 2022 midterms that had gone against Republicans in other states, and they had used their majority to pass a “fetal heartbeat” bill, outlawing most abortions after around six weeks, which in effect comes close to an outright ban. DeSantis had signed a nearly identical bill in Florida; Trump has criticized these measures as too extreme, saying they would backfire on Republicans. So the true believers in Iowa had a substantive reason to turn away from the former President, too.

It was a highly self-selecting crowd at the Thunderdome—people willing to spend a couple of hours of their Saturday at a DeSantis campaign event—but, as I walked around chatting, I did get the impression that the fetal-heartbeat contretemps had given some Trump-skeptical conservatives something to point to, evidence that the former President really wasn’t on their side. I spent a few minutes talking with Jon Dunwell, an evangelical minister who, in 2021, won a state House seat that had been held by Democrats for decades. Dunwell, who, once in office, had sponsored the heartbeat bill, isn’t as smooth as Vander Plaats, but he has an intensity of purpose that I recognized from the Bush-era religious right, too. When Trump had turned against the fetal-heartbeat bills, Dunwell said, “I was shocked. I mean, my jaw dropped. I don’t get it. I look at some of my fellow-legislators—there are a few who support Trump who are also pro-life—and I just don’t get it.” He had endorsed DeSantis. Of Trump, he said, “If he’s willing to compromise on something as important as life, what else is he willing to compromise on?”

The point of the Jasper County event had been to commemorate DeSantis’s completing “the full Grassley,” as everyone seemed to have agreed to call it, in honor of the ninety-year-old Iowa senator Chuck Grassley, who has made it his practice to visit every single county each year. People said the phrase “the full Grassley” so much that you figured an intern backstage had organized a drinking game. Highlighting this made sense from several points of view, including character: whatever else you might think of Ron DeSantis, he does not lack doggedness. The crowd was healthy—maybe two hundred people—but more notably it was mobbed with press, who kept assertively asking voters questions they didn’t really know the answer to, namely how they thought DeSantis could beat Trump.

The setting also seemed to beckon a quality that DeSantis does very much lack, which is folksiness. The plan seemed to be that the candidate would reminisce about all the charming things he had seen on the campaign trail, and all the personal connections he’d made. Onstage, DeSantis kept consulting a list of such visits, but he was short on detail and emotion, making it sound like he was narrating someone else’s scrapbook, or possibly just reciting driving directions. “When we were in Audubon County, my kids and Casey and me went to this big large bull statue, which I think is the largest bull statue in the entire world, and we got to get some good pictures with that, which was a lot of fun,” DeSantis said. “Casey, me, and the kids, when we visited Sac County, we saw the world’s largest popcorn ball. Quite a sight.” On it went. “We were in Chickasaw County . . .”

Iowa

Democrat launches Senate bid against Joni Ernst

Skip to content

Iowa

Cubs option top prospect to Triple-A Iowa amid flurry of roster moves

After a tough 10-4 loss at the hands of the San Diego Padres Monday night, the Chicago Cubs made a flurry of roster moves ahead of Tuesday night’s contest, including sending a top prospect down to Triple-A Iowa.

The Cubs announced they optioned Matt Shaw to Iowa and placed reliever Eli Morgan on the 15-day injured list with an elbow impingement.

In corresponding moves, the Cubs recalled right-hander Daniel Palencia and lefty Luke Little Iowa, while activating Vidal Bruján from the 10-day IL.

Additionally, right-hander Nate Pearson was also optioned to Iowa.

Cubs moves:

• 3B Matt Shaw optioned to Triple-A Iowa

• RHP Eli Morgan (elbow impingement) to 15-day IL

• LHP Luke Little, RHP Daniel Palencia recalled from Iowa

• RHP Nate Pearson optioned to Iowa

• INF Vidal Bruján activated from 10-day IL

— Jordan Bastian (@bastianmlb.bsky.social) April 15, 2025 at 5:34 PM

In 18 games to start his MLB career, 23-year-old Matt Shaw has gone 10-for-58 with 11 runs, one double and one home run with 10 walks.

As for Pearson, the option comes after a disastrous start to the 2025 season, with the righty posting a 10.38 ERA over eight appearances and 8.2 innings, allowing seven walks, 13 hits and 10 earned runs.

The Cubs will turn to Little and Palencia, both of whom have spent time with the big league club in each of the past two seasons.

In 37 career games, Little has amassed a 2.76 ERA in 32.2 innings with 22 walks and 40 strikeouts.

Palencia has also appeared in 37 career games, with a 5.02 ERA over 43 innings, recording 26 walks and 49 strikeouts.

The Cubs will look to hand the Padres their first home loss of the season Tuesday, with first pitch slated for 8:40 p.m. local time.

Iowa

Three arrested for allegedly assaulting 63-year-old in Iowa City

IOWA CITY, Iowa (KCRG) – Three people were arrested after allegedly assaulting a 63-year-old man in Iowa City over the weekend.

Criminal complaints say Treighton McGlothlin, 20, of Waterloo, Braden Jordan, 20, of Cedar Rapids, and Pierce Horak, 21, of Urbana, were following the victim, yelling at him in the area of Clinton Street and Lafayette Street at around 5 a.m. on Sunday.

Police said the three then hit the victim from behind, knocking him to the ground.

The victim suffered injuries to his face and leg. He also had a large, bloody goose egg forming on his head when police arrived.

First responders said it is believed the victim lost consciousness, and he claimed to have been momentarily “stunned.”

The victim was able to identify three men as his attackers.

The criminal complaints for Horak, Jordan and McGlothlin say the men smelled of alcohol, had bloodshot watery eyes and slurred speech and were wearing bar wristbands when police encountered them.

Police also said they found fake ID’s in their wallets.

The complaints say McGlothlin is charged with Assault, Possession of a Fictitious ID and Public Intoxication.

Complaints for Horak say he is charged with Public Intoxication and Assault.

A complaint for Jordan say he is charged with Assault.

There may be additional charges pending in this case.

Copyright 2025 KCRG. All rights reserved.

-

News1 week ago

News1 week ago3 Are Killed in Shooting Near Fredericksburg, Va., Authorities Say

-

Culture1 week ago

Culture1 week agoMen’s NCAA Championship 2025: What to know about Florida, Houston

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: 'Warfare' is an Immersive and Intense Combat Experience – Awards Radar

-

Health1 week ago

Health1 week agoAs RFK Jr. Champions Chronic Disease Prevention, Key Research Is Cut

-

Politics1 week ago

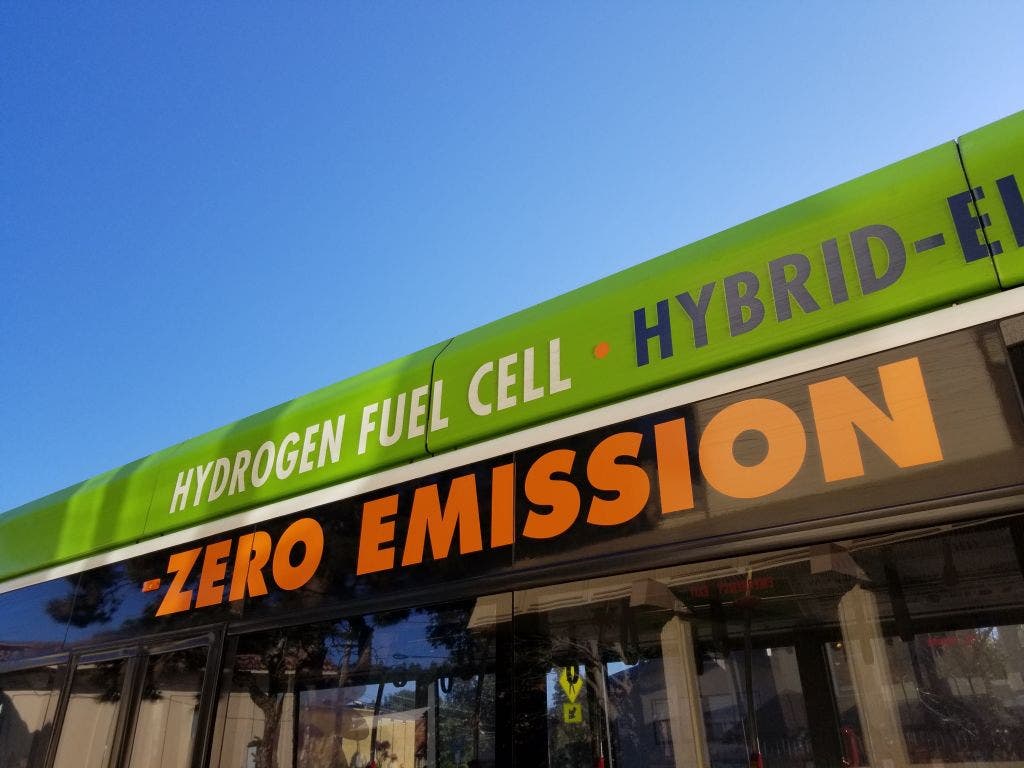

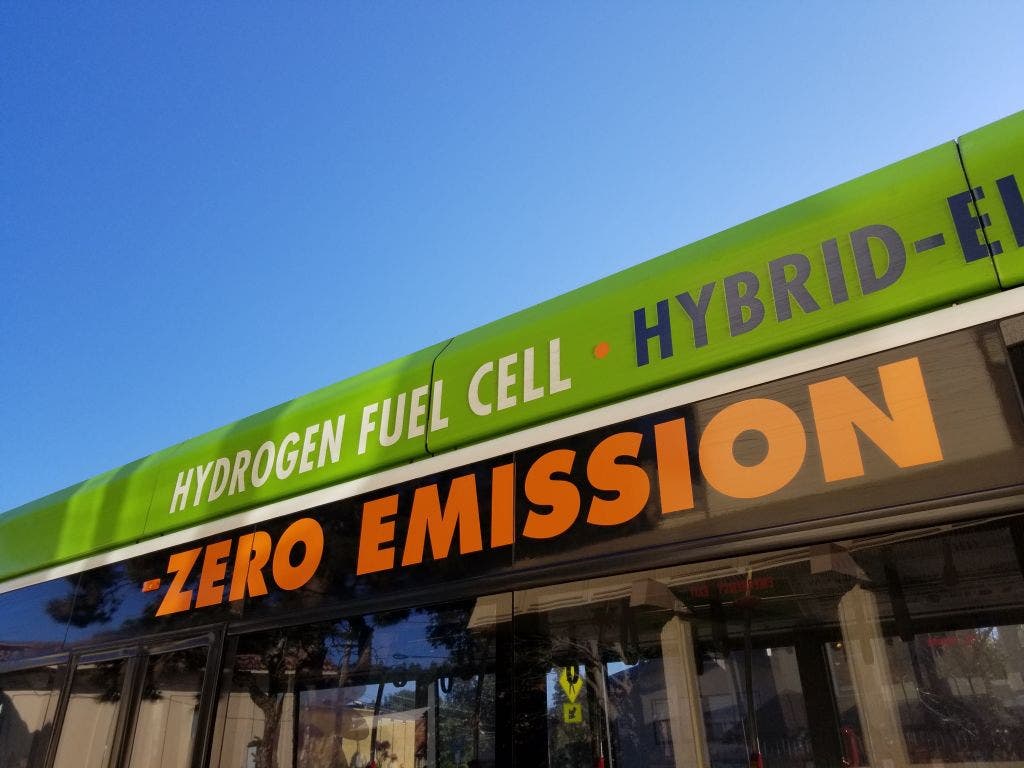

Politics1 week agoH2Go: How experts, industry leaders say US hydrogen is fuel for the future of agriculture, energy, security

-

News1 week ago

News1 week agoBoris Johnson Has Run-In With Feisty Ostrich During Texas Trip

-

World1 week ago

World1 week agoEPP boss Weber fells 'privileged' to be targeted by billboard campaign

-

Technology1 week ago

Technology1 week agoMeta got caught gaming AI benchmarks