Finance

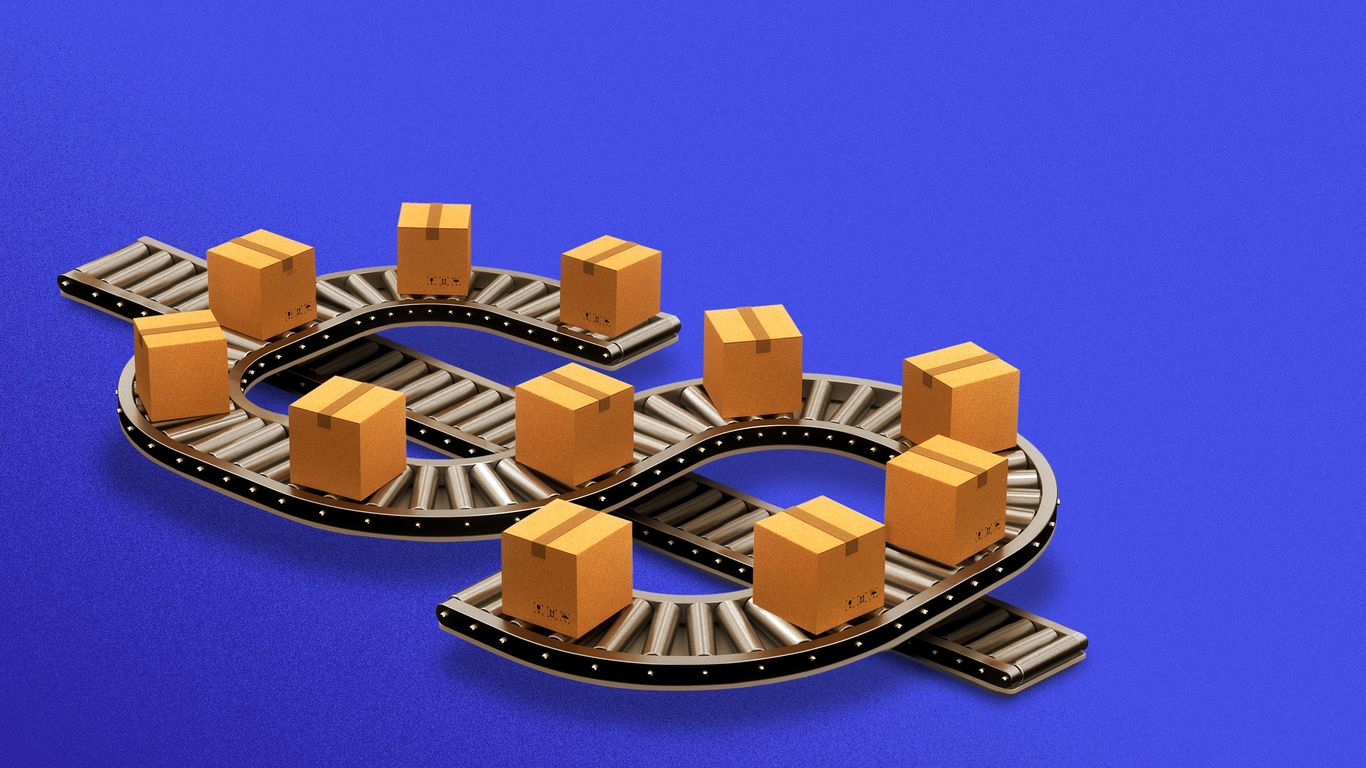

Supply chain finance startup Twinco is raising a $100 million debt facility.

Twinco, the Madrid-based provide chain finance firm targeted on the attire trade, is elevating a $100 million debt facility, CEO Sandra Nolasco tells Axios.

Why it issues: Twinco goals to streamline the sophisticated and fragmented means of financing attire manufacturing from manufacturing to supply of products.

Particulars: To date Twinco, which retained structured-debt boutique Alantra as its monetary adviser, has raised $30 million towards the asset-backed debt facility, Nolasco says.

- The finance startup is presently in negotiations with various credit score funds and funding banks to safe the rest, she says.

- The quantity of curiosity paid is dependent upon the quantity of danger traders within the debt facility are prepared to tackle.

- Traditionally this sort of financing has a really low default price, Nolasco provides.

Driving the information: Twinco closed a $12.5 million Collection A comprising development fairness and enterprise debt this week.

- It was led by Quona Capital, with participation from Working Capital and current traders Mundi Ventures and Finch Capital. Zubi Capital offered the enterprise debt.

- Proceeds will assist develop Twinco’s presence in nations which can be main suppliers of attire merchandise and in its expertise and information capabilities, notably tied to ESG.

- The corporate has raised, together with pre-seed and seed rounds, a complete of about €15.5 million of development fairness and €3 million of enterprise debt, Nolasco says, or a bit over $20 million in all.

The way it works (normally): Historically, when a U.S. clothes model seems to be to supply attire manufacturing, it submits a purchase order order to a producer based mostly in a rustic like Vietnam or Bangladesh.

- The producer must go to a neighborhood financial institution to safe a mortgage to buy the supplies, comparable to cotton, to start producing that order.

- On the opposite finish, the attire wholesaler would retain an element or factoring providers to acquire money upfront on the invoices or items they obtain whereas additionally they watch for cost.

The way it works (now): Twinco steps in to cowl your entire cycle from buy order to closing bill cost.

- This helps small and medium-sized companies in rising markets receive supplies at decrease price, and grants attire manufacturers and retailers higher transparency on sourcing by way of environmental and labor practices, Nolasco factors out.

By the numbers: In 2020, its first yr, Twinco funded $7 million value of buy of orders, Nolasco says.

- In 2021, that quantity grew to $37 million, and in 2022 to $100 million. This yr it would fund between $300 million and $350 million in buy orders.

- Twinco’s clients purchase greater than $10 billion a yr in items and the corporate is rising between three and 4 instances yr over yr.

What’s subsequent: Twinco is initially targeted on the attire trade, however will develop its observe into different classes comparable to shopper electronics, Nolasco says.

- As soon as Twinco processes between $3 billion and $4 billion in buy orders per yr, at which it would have a transparent path to profitability, it might probably ponder an exit comparable to an IPO, Nolasco says.

Finance

Stocks rise, S&P 500 set to break losing streak: Yahoo Finance

The S&P 500 is set to end its 5-day streak of losses. The major indexes (^DJI,^GSPC, ^IXIC) are all trading higher thanks to big-name tech stocks like Nvidia (NVDA) and Tesla (TSLA). One stock that is trading lower is US Steel (X), which fell sharply after President Biden announced he will block Nippon Steel’s (NPSCY) purchase of the company. Other trending tickers on Yahoo Finance today include Rivian Automotive (RIVN), Adobe (ADBE), and Oklo (OKLO).

Key guests include:

3:05 p.m. ET – Ahmed Riesgo, Insigneo Chief Investment Officer

3:15 p.m. ET – Brian Gardner, Stifel Chief Washington Policy Strategist

4:00 p.m. ET – David Miller, Catalyst Funds Co-Founder, Chief Investment Officer and Senior Portfolio Manager

4:35 p.m. ET – Rachel Tipograph, MikMak, founder and CEO

Finance

Tesla to Announce Q4 2024 Financial Results on January 29, 2025

Tesla (NASDAQ:TSLA) is planning to report its Q4 2024 results displaying their net income and cash flow of the business’s profitability and financial position on January 29, 2025 after market close.

Tesla experienced different stock price fluctuations, as market responses, between 9% and 22% within one day after releasing the results.

Tesla’s management will also give their 2025 guidance such as production, models, technology including Full Self-Driving (FSD).

The one-year price targets for Tesla given by 45 analysts are USD 278.47 at the average while ranging from as high as USD 515.00 and the lowest at USD 24.86. The average target is -26.58% from the current price at $379.28.

GuruFocus calculates the GF Value for Tesla one year ahead to be at $298.99 which indicates the stock to be overvalued -21.17% from the current price $379.28.

You can make more informed investment decision by visiting GuruFocus now and deep dive into Tesla’s performance with charts, breakdowns, 30-year financial data, and more!

This article first appeared on GuruFocus.

Finance

State lawmaker hopes to close campaign finance loophole in 2025 legislative session

SIOUX FALLS, S.D. (Dakota News Now) – A South Dakota lawmaker has filed multiple pieces of legislation he says could help address government accountability.

Senate Bill 12 would limit the amount of money that may be loaned to a candidate or a political action committee (PAC).

Sen. Michael Rohl (R) of Aberdeen hopes that the bill will close a loophole in the South Dakota campaign finance world.

“PACs shouldn’t be personal checking accounts for the ultra-wealthy to be able to buy politicians,” Rohl said.

Currently, South Dakota law limits contributions to a candidate and a PAC at $1,000 and $10,000 respectively.

However, the state allows unlimited loans, which can be forgiven as bad debt.

“We don’t have campaign finance laws in South Dakota. We just have them for people that are everyday citizens that are trying to follow the spirit of the law, but the bad actors don’t have to follow them,” Rohl said.

Rohl wants to limit the loans to the $1,000 and $10,000 figures that are used for contributions.

In the midst of several fraud investigations amongst state employees, Senator Rohl says accountability in all parts of government is desperately needed.

“I think politicians for a long time have been saying we want to have more transparency in government, but nothing seems to happen so I’m drafting legislation and trying to be true to what I told people I represent I would do.”

But Rohl is very prepared for a lot of pushback.

“There’s going to be some opposition to it and there’s going to be opposition for the very reason that it needs to go away, and that’s because people are going to be afraid to make their donors mad,” said Rohl.

The Aberdeen senator also filed Senate Bill 11, which limits the amount of money that a political committee may accept from an inactive candidate campaign committee.

The 100th legislative session starts on January 14th.

Copyright 2025 Dakota News Now. All rights reserved.

-

Business1 week ago

Business1 week agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health6 days ago

Health6 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology6 days ago

Technology6 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World1 week ago

World1 week agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics1 week ago

Politics1 week agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Business3 days ago

Business3 days agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Politics1 week ago

Politics1 week ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons

-

Culture3 days ago

Culture3 days agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951501/VRG_Illo_STK170_L_Normand_TimCook_Positive.jpg)