Finance

PPP loans and fraud scrutiny: What financial advisors and small businesses need to know

With most tax returns now throughout the submitting deadline, some traders and their wealth advisors are confronting potential scrutiny of the free cash they acquired throughout the pandemic.

Greater than $800 billion in easy-to-get, principally forgivable loans went to roughly 11 million companies in 2020 and 2021, a monetary lifeline supposed to shore up the spine of the American economic system when COVID-19 floor issues to a close to halt. Roughly 92% of the federal loans had been forgiven by the federal government.

Unsurprisingly for fast money requiring little documentation and honor-system assertions, fraud was rampant. The Inner Income Service and Justice Division, together with the watchdog of the brokerage business and the Securities and Trade Fee, are taking discover.

As of March 23, the IRS had introduced 975 fraud circumstances totaling $3.2 billion in opposition to companies and people that improperly acquired Paycheck Safety Program loans in 2020 and 2021. It is probably the tip of the iceberg: One research by three students at The College of Texas at Austin’s McCombs Faculty of Enterprise estimated that as a lot as $117.3 billion was doled out to fraudsters.

Wealth advisors do not at all times know what sure small enterprise shoppers are as much as. If a buyer falls below audit for a PPP mortgage, “you stroll them by find out how to appropriate it,” mentioned Clark Kendall, the president and CEO of Kendall Capital in Rockville, Maryland. “And also you be sure you doc it.”

In the meantime, almost 3,000 funding administration companies, or almost 1 in 4 of all advisors registered with the SEC, tapped the PPP spigot for $590 million, in line with an educational research by students on the College of San Diego and Frostburg State College, in Frostburg, Maryland, that was printed final February within the Journal of Banking & Finance.

The federal government made PPP loans of as much as $10 million out there at 1% curiosity to companies with fewer than 500 workers, a restriction later relaxed for the lodge and restaurant industries. Companies had to make use of the loans for as much as 10 weeks of payroll prices, capped at $100,000 per employee per yr, and preserve wages near pre-crisis ranges throughout the two to 6 months after receiving the mortgage.

Mortgage recipients might additionally use the cash to pay enterprise mortgage curiosity funds, hire, utilities, paid medical go away, insurance coverage prices, and state and native taxes. Corporations might have their loans forgiven in the event that they used a minimum of 60% towards payroll bills.

FINRA, which oversees brokers and tracks impartial advisors, mentioned in January 2021 that it was taking a look at advisors who took the loans to shore up outdoors enterprise actions, akin to promoting non-public securities or dealing in confidential consumer data, that weren’t disclosed to their employers. Brokers and advisors are speculated to disclose such actions in a doc referred to as Kind U4, and the watchdog mentioned some brokers would must replace their disclosures.

Requested to touch upon its scrutiny, FINRA spokesman William Bagley mentioned Monday, “We will not present any details about ongoing evaluations.”

‘Abusing’

The Journal of Banking & Finance research estimated that greater than 6% of the then-$590 million in loans acquired by 2,999 funding advisory companies registered with the SEC had been improper and “abnormally massive.” These loans went “to companies abusing” the federal government program, authors William Beggs of the College of San Diego and Thuong Harvison of Frostburg State College, wrote.

A lot of the {dollars} went to small or tiny monetary planning and wealth administration companies, akin to Sprague Wealth Options in San Ramon, California ($2,585) and Govt Wealth Advisors of Marlton, New Jersey ($3,864). Some 92% of the loans had been forgiven. The Small Enterprise Administration does not distinguish between companies that received free cash and those who repaid it.

However some huge business gamers with boldfaced names in wealth administration additionally received cash.

Dynasty Monetary Companions of St. Petersburg, Florida, a community of advisors overseeing roughly $68 billion, took out greater than $1.3 million in 2020 to retain 69 jobs. It repaid the mortgage in 2021.

Ritholtz Wealth Administration, which oversaw $1.3 billion in 2020, borrowed almost $602,000 in 2020 and shortly repaid, Institutional Investor reported, following a firestorm of public criticism.

Focus Monetary Community of Minneapolis acquired $927,200 and didn’t repay the cash.

Carson Group of Omaha received a $4 million mortgage in 2020 to cowl its occasions and training companies. Megan Belt, an organization spokeswoman, mentioned the corporate repaid the cash.

Some wealth advisors nonetheless view the loans as an indication of economic weak spot, both precise or perceived.

“We simply determined that it wasn’t price it for us,” mentioned Perry Inexperienced, the chief monetary officer and senior wealth strategist at Waddell & Associates in Memphis. “There was an excessive amount of alternative for reputational threat.”

However it could have been price it.

“I have not heard anybody that received that PPP cash regretting it or dropping shoppers due to it,” mentioned Zachary Milam, a vp at Mercer Capital, a valuation and consulting agency for monetary advisors based mostly in Memphis.

Processed by banks, with JPMorgan within the lead, however principally by monetary know-how corporations, the loans had been for payroll prices and common enterprise bills, akin to mortgage curiosity on a enterprise’s property. They weren’t expressly geared toward serving to impartial advisors take care of the sharp market downturn that materialized because the pandemic unfolded.

Nonetheless, mentioned Max Schatzow, a co-founder and associate at RIA Attorneys in Ewing, New Jersey, “Nobody knew the place the heck the economic system was going, the place markets had been going, the place revenues had been going.”

He argued that advisors who earn charges on belongings below administration that plummeted when the S&P 500 fell 34% over February-August 2020 had been justified in taking PPP loans as a result of they’d have needed to “downsize or discontinue their progress plans.”

The Journal of Banking & Finance research mentioned that some funding companies mentioned they’d retain a variety of jobs higher than the payroll figures disclosed on their Kind ADV. Funding companies took “liberties” to “exaggerate payroll wants” that “might have facilitated misconduct within the PPP mortgage procurement course of,” the research mentioned.

The SEC, which oversees registered funding advisors, warned impartial advisors in April 2020 that as fiduciaries, they’re obligated to inform shoppers of any PPP mortgage or different monetary help in the event that they “represent materials info regarding your advisory relationship with shoppers.”

It cited fee of salaries to workers performing advisory features and any questions over a agency’s capacity to fulfill its contractual commitments to shoppers as objects the agency would want to speak in confidence to regulators on their registration type with the Wall Avenue regulator.

Finance

M&M Finance’s Q4 Results: Net profit declines; ₹6.30 per share dividend declared

Mahindra Finance reported a total income of ₹3,706 crores, marking a 21 per cent increase year-over-year (YoY), for the quarter ending March 31, 2024, on May 4. However, the Profit After Tax (PAT) experienced a slight downturn by 10 per cent YoY, settling at ₹619 crores, attributed to a 14% increase in Net Interest Income (NII) which stood at ₹1,971 crores. The Net Interest Margin (NIM) remained fairly stable at 7.1%. The reported disbursements for the quarter saw an 11% rise, totalling ₹15,292 crores, and the Gross Loan Book grew by an impressive 24% YoY to ₹1,02,597 crores.

Also Read | Pakistan coach Gary Kirstein gets brutally trolled after meeting with team online, ‘Is this cricket or…?’

The company also showed marked improvement in asset quality, with a significant reduction in Stage 3 assets to 3.4%, down from 4.0% in December 2023. Credit costs for the year were maintained within the targeted range of 1.5% – 1.7%, indicative of effective risk management strategies.

Also Read | Justin Trudeau says ‘rule-of-law’ after 3 arrested for Nijjar killing, Jaishankar says ‘internal politics’

In its consolidated results, the company posted a total income of ₹4,333 crores for the fourth quarter, up by 23% YoY, and a marginal decrease in PAT by 1%, amounting to ₹671 crores. The consolidated disbursements also noted an increase of 11% YoY, reaching ₹16,174 crores.

Also Read | No Dunki route to London anymore: Why is Rishi Sunak deporting UK’s illegal immigrants to Rwanda? An explainer

The company’s strategic initiatives included bolstering its presence in vehicle finance, particularly in pre-owned vehicle finance, which grew by 18% during FY24. Moreover, Mahindra Finance announced plans to enhance its services in the non-vehicle finance segment, aiming to expand its Asset Under Management (AUM) to 15% over the medium term. This includes increasing investments in sectors such as Small and Medium Enterprises (SME) lending, Lease and Purchase (LAP), and leasing through its Quiklyz platform.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 09:46 AM IST

Finance

Transwarranty Finance Q4 results : profit at ₹2.73Cr, Revenue increased by 166.66% YoY

Transwarranty Finance Q4 Results Live : Transwarranty Finance declared their Q4 results on 02 May, 2024. The topline increased by 166.66% & the profit came at ₹2.73cr.

It is noteworthy that Transwarranty Finance had declared a loss of ₹6cr in the previous fiscal year in the same period.

As compared to the previous quarter, the revenue grew by 68.98%.

The Selling, general & administrative expenses rose by 12.53% q-o-q & increased by 13.69% Y-o-Y.

The operating income was up by 7726.27% q-o-q & increased by 154.53% Y-o-Y.

The EPS is ₹0.98 for Q4, which increased by 148.87% Y-o-Y.

Transwarranty Finance has delivered 0% return in the last 1 week, 24.19% return in the last 6 months, and -6.85% YTD return.

Currently, Transwarranty Finance has a market cap of ₹56.46 Cr and 52wk high/low of ₹15.5 & ₹8.25 respectively.

| Period | Q4 | Q3 | Q-o-Q Growth | Q4 | Y-o-Y Growth |

|---|---|---|---|---|---|

| Total Revenue | 5.12 | 3.03 | +68.98% | 1.92 | +166.66% |

| Selling/ General/ Admin Expenses Total | 1.16 | 1.03 | +12.53% | 1.02 | +13.69% |

| Depreciation/ Amortization | 0.13 | 0.12 | +9.2% | 0.12 | +1.13% |

| Total Operating Expense | 2.42 | 3.07 | -21% | 6.87 | -64.74% |

| Operating Income | 2.7 | -0.04 | +7726.27% | -4.95 | +154.53% |

| Net Income Before Taxes | 2.73 | -0.36 | +862.66% | -6.01 | +145.33% |

| Net Income | 2.73 | -0.36 | +863.53% | -6 | +145.44% |

| Diluted Normalized EPS | 0.98 | -0.07 | +1500% | -2.01 | +148.87% |

FAQs

Question : What is the Q4 profit/Loss as per company?

Ans : ₹2.73Cr

Question : What is Q4 revenue?

Ans : ₹5.12Cr

Stay updated on quarterly results with our results calendar

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 02:36 AM IST

Finance

New Interim Finance Director Deal in the Works | South Pasadena Finance Dept. Pushing Through | The South Pasadenan | South Pasadena News

Scott Miller, a retired municipal finance official with four decades in the field, is being considered to serve as South Pasadena’s new finance director on an interim basis, the South Pasadenan News has learned.

Although an agreement has not been signed or finalized, “we are working on it,” said Luis Frausto, Acting Deputy City Manager.

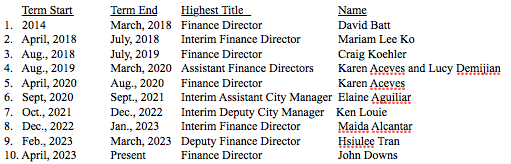

Miller would become the tenth person to manage the city’s volatile finance department since the departure of David Batt in March of 2018.

CITY OF SOUTH PASADENA FINANCE DEPARTMENT PAST DIRECTORS

The news comes shortly after the city confirmed outgoing Finance Director John Downs, who told the city last month he would retire May 2, has been persuaded to stay on “in a limited term capacity to assist with finalizing the fiscal year 2024-2025 budget,” Frausto said. Downs’ “role will transition from managing daily finance operations to focusing on specific projects, with the budget being his primary responsibility. We expect his contributions to extend at least through June.”

The city is currently scheduled to adopt the new budget June 5—a target that is looking increasingly less certain.

According to press reports, Miller was chief financial officer at the city of Beverly Hills for seven years through 2015, where he was credited with helping secure high ratings for the city from the three major credit rating agencies.

Miller then worked briefly as chief finance officer for Broward County, Florida and then with Urban Futures Inc., a local government service agency in California. In March 2016, he became interim chief financial officer for the city of Riverside, initially under a short term contract. Although he became a Riverside employee in early 2017, he left several months later. At the time, a Riverside city spokesman told a local publication he could not say if Miller’s departure from Riverside was a mutual decision.

Prior to joining Beverly Hills, Miller was employed by the city of Palm Desert, the city and county of San Francisco, the University of California–Berkeley and Turner Broadcasting System. He graduated from San Diego State University with a BA in psychology and minor in business administration and he holds a PhD in public administration from Arizona State University.

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

Science1 week ago

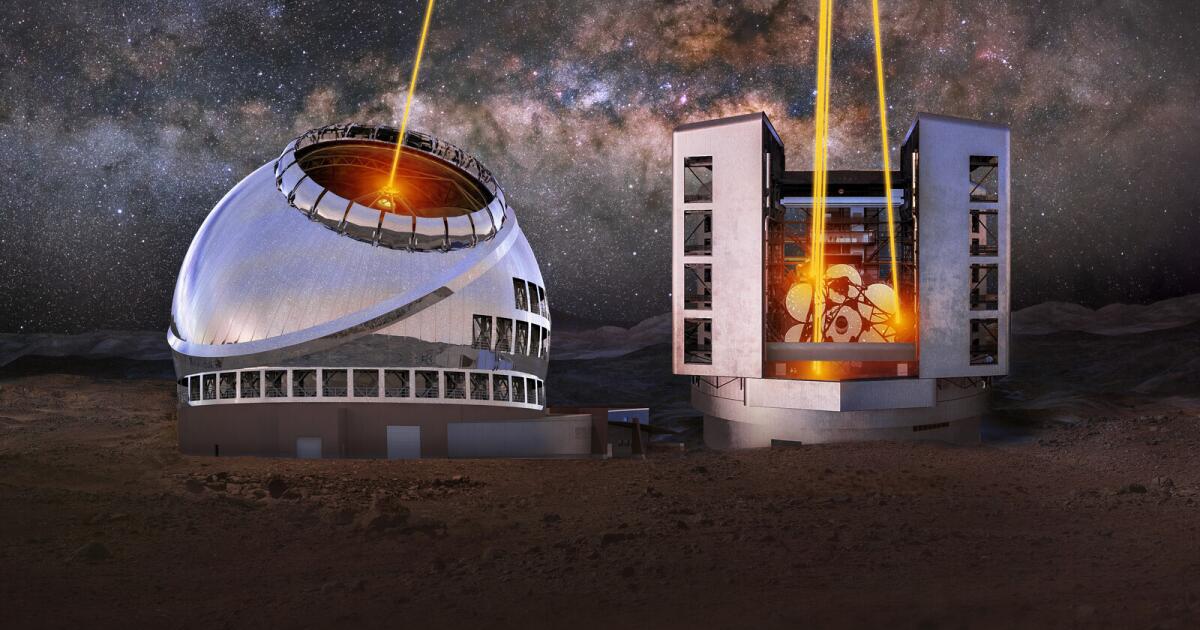

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire

/cdn.vox-cdn.com/uploads/chorus_asset/file/25432052/installer.png)