Finance

New Interim Finance Director Deal in the Works | South Pasadena Finance Dept. Pushing Through | The South Pasadenan | South Pasadena News

Scott Miller, a retired municipal finance official with four decades in the field, is being considered to serve as South Pasadena’s new finance director on an interim basis, the South Pasadenan News has learned.

Although an agreement has not been signed or finalized, “we are working on it,” said Luis Frausto, Acting Deputy City Manager.

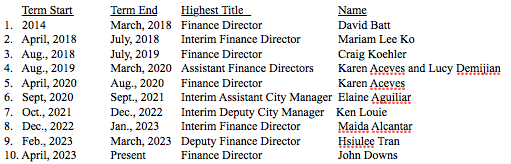

Miller would become the tenth person to manage the city’s volatile finance department since the departure of David Batt in March of 2018.

CITY OF SOUTH PASADENA FINANCE DEPARTMENT PAST DIRECTORS

The news comes shortly after the city confirmed outgoing Finance Director John Downs, who told the city last month he would retire May 2, has been persuaded to stay on “in a limited term capacity to assist with finalizing the fiscal year 2024-2025 budget,” Frausto said. Downs’ “role will transition from managing daily finance operations to focusing on specific projects, with the budget being his primary responsibility. We expect his contributions to extend at least through June.”

The city is currently scheduled to adopt the new budget June 5—a target that is looking increasingly less certain.

According to press reports, Miller was chief financial officer at the city of Beverly Hills for seven years through 2015, where he was credited with helping secure high ratings for the city from the three major credit rating agencies.

Miller then worked briefly as chief finance officer for Broward County, Florida and then with Urban Futures Inc., a local government service agency in California. In March 2016, he became interim chief financial officer for the city of Riverside, initially under a short term contract. Although he became a Riverside employee in early 2017, he left several months later. At the time, a Riverside city spokesman told a local publication he could not say if Miller’s departure from Riverside was a mutual decision.

Prior to joining Beverly Hills, Miller was employed by the city of Palm Desert, the city and county of San Francisco, the University of California–Berkeley and Turner Broadcasting System. He graduated from San Diego State University with a BA in psychology and minor in business administration and he holds a PhD in public administration from Arizona State University.

Finance

San Bernardino finance director claims she was fired after raising concerns about costly project

SAN BERNARDINO, Calif. (KABC) — The former finance director of the city of San Bernardino is alleging she was threatened and fired by the current city manager, after raising concerns about the potential cost of a project to renovate the old city hall building.

Barbara Whitehorn made the allegations during the public comment portion of the city council meeting on May 15.

“I came back from vacation today, and I was fired today,” said Whitehorn, at times tearing up while making her statement. “I am no longer in the employ of the city of San Bernardino after being threatened today (by the city manager) of having information damaging to my career released into the public domain.

“Then after saying, ‘Please do so, Mr. city manager, because you’ll have to fire me before doing that, he said, ‘Oh, then I’ll just fire you without cause.’”

Whitehorn alleges that the costs to retrofit the old city hall building are spiraling out of control. The building has sat empty since late 2016 after being vacated over concerns that it could collapse during a big earthquake.

“It’s a project that has expanded from $80 million to about $120 million and that number is nowhere to be seen on this (public) agenda. This city does not have that money,” she said.

A presentation was made to the city council in January 2024 outlining the process by which city hall would be retrofitted. City manager Charles Montoya said the city is currently incurring increasing costs for leasing space in separate buildings to maintain city services.

“If we don’t do this now, sooner or later that building is just going to become a gigantic door stop,” said Montoya during the meeting.

He acknowledged when asked by city council members that there is no projected final cost for the project yet.

“The reason we’re doing it this way is speed, to get this thing done. Our lease in the city building is up in two years; we don’t want to sign another lease where we’re just throwing money out the window.”

Two days after her appearance before the council, the city released a statement in response to Whitehorn’s remarks.

The statement claimed Whitehorn was fired for reasons unrelated to the city hall project and disputed some of her other claims.

“However, contrary to Whitehorn’s claims, the renovation project has yet to be designed, and construction costs have yet to be determined,” read the statement, attributed to Public Information Officer Jeff Kraus. “Construction cost estimates and project financing options will be presented to the Council during future meetings.”

“The City of San Bernardino has confirmed that Whitehorn was an at-will employee and was terminated for cause involving financial issues that were unrelated to the City Hall project.”

The statement also said discussion of the city hall project was postponed from that night’s council agenda because there was not enough time to consider the matter and hear from the public.

Copyright © 2024 KABC Television, LLC. All rights reserved.

Finance

Photos from The Best Crystals for Love, Finance, Career and Health – E! Online

Clear Quartz: “Often referred to as the ‘master healer,'” astrologer Aliza Kelly told E! News. “Clear quartz is a versatile crystal that amplifies energy and intentions. It can be programmed to focus on career goals, enhance clarity of thought and promote focus and productivity.

Tiger’s Eye: “Tiger’s eye is known for its protective and grounding properties,” she noted. “It helps to boost confidence, courage and willpower, making it an excellent crystal for achieving career goals, overcoming challenges and making important decisions.”

Finance

How to stop your CFO leaving you for private equity

Highly skilled and ambitious finance chiefs have long been attracted to the dynamism of private equity. In fact, a lack of experience in the industry can be considered a major hindrance to a CFO’s career progression, according to recruitment experts.

“It’s no secret that hardworking and ambitious financial professionals aspire to be a private equity CFO. I’d be very surprised if a candidate stated that they didn’t want to end up there,” says Mike Mesrie, founder and director of executive search firm MDM Resourcing. “It’s long been regarded as the promised land where there’s great riches to be had.”

In recent months, private equity firms have been largely focused on driving value in their existing portfolios and navigating headwinds. The result has been not only fewer deals but a higher turnover of CFOs, says Ben Graham, founder of executive recruitment firm Triton Exec. As a result, “CFO hiring into PE-backed businesses has risen sharply from Q4 2023 and is showing no sign of slowing down.”

It’s not for the faint-hearted, but the potential rewards are significant

With a heightened focus on jump-starting stagnating portfolio performance, demand from private equity for CFOs with the unique skills needed to navigate today’s high inflation and rising interest rates is increasing. “As the need for a successful exit grows, portfolio businesses are being actively encouraged to replace their CFO,” Graham says. “We’ve seen an increase in CFO mandates over the last 6 months.”

Businesses are paying more than ever for top finance talent. And with private equity firms now on the lookout for new CFOs, many of whom are equally eager to join the elusive club, boards and CEOs need to know how to hold onto theirs.

Understanding the pull of private equity

Understanding the nuances of the CFO role in private equity can help businesses better understand the appeal of the job – and start implementing a more effective retention strategy.

While it may be tempting to assume that financial incentives are the main motivating force, there are other equally important factors at play.

The adrenaline rush of working towards an acquisition or a sale is stressful, but exciting. And the shorter stints typically spent in a portfolio company while working towards a deal close provides an end-date that many find refreshing.

“Working in this realm presents a unique opportunity where you feel like you can directly shape the trajectory of the organisation and make tangible, impactful changes,” says Catherina Butler, interim CFO at software business Aryza. “The potential to make an impact stretches far beyond financial metrics, encompassing strategic realignments, talent cultivation, organisational structures and operational efficiencies and processes. It’s not an arena for the faint-hearted, but for those willing to embrace it, the potential rewards are significant and the journey is exciting.”

From a cultural perspective, there is a lot less juggling of personalities and shareholder demands. CFOs will typically work with just one or two sponsors, communicating financial results, working through capital structure issues or M&A opportunities and generally speaking the common language of finance. “There is a sense of alignment that is often lacking in other businesses,” says Harry Hewson, managing director of executive recruitment firm Camino Search. “You’ve got a management team that are all working towards the same goal and are motivated to get to the next stage. Finance chiefs really love that.”

It also demands a different style of leadership. Private equity CFOs have fewer external-facing duties, which can appeal to executives who tend to be more introverted. They aren’t in the spotlight as much so they get to spend more time with their team, adding value to the business. “Basically doing parts of the job they enjoy the most,” says Hewson.

A private equity firm will usually hire a finance chief with a specific goal in mind; whether it is to help execute a complex carve-out or turn around a distressed company. Working in more challenging and niche areas allows CFOs to sharpen their skills and become an experts in their field. “This is something they may not get a chance to do in their current roles,” Hewson adds.

It’s easy to see the attraction of private equity: fast-paced, strong incentives, tax benefits and less public scrutiny. Admittedly, these aspects of the job are hard to compete with. But scratch the surface and a different reality emerges.

The survival rate of CFOs in private equity is notoriously low: most are replaced within 18 months of investment and those able to make it past that point still have an average tenure of 20% less than their listed counterparts, according to accounting firm EY.

“It might sound super glamorous if it goes well. But, realistically, a lot of the time it doesn’t,” Hewson says. There is an opportunity for businesses to use that to their advantage.

The most effective retention strategies

Competition from private equity may be tough, but there are steps that businesses can take to boost CFO retention and strengthen loyalty.

Recognition and tailored reward systems, including competitive salaries and bonuses are “a must” for retaining top financial talent, stresses Doug Baird, CEO at leadership consultancy New Street Consulting Group. More important still, he argues, is the need to design compensation packages that not only reward past performance but incentivise future success. “Offering equity participation through long-term incentive plans or growth schemes is becoming more common. These schemes help to instil a sense of ownership and belonging, giving CFOs a vested interest in the success of the company – and a strong incentive to stay.”

Sustainability and digital transformation are becoming increasingly decisive factors for CFOs when considering a position, Baird adds. “CFOs will be looking to see if a company’s values and missions are clearly aligned with them on this.”

Private equity has long been regarded as the promised land

In Mesrie’s view, CFOs typically become disengaged when they feel underappreciated. Public acknowledgments in company meetings can boost morale and emphasise the value of the CFO to the entire organisation. Equally important is a culture within the C-suite that promotes a collaborative environment through open and honest communication, Mesrie adds. “For CFOs to feel personally and professionally valued, they need to be made to feel part of the team.”

Given how closely they work together, special attention should be given to the relationship between the CEO and CFO, Mesrie stresses. “It needs to be a proper partnership where the CFO is listened to. An overbearing or irrational CEO will quickly leave any finance chief feeling disenchanted, pushing them out the door.”

“The life of a CFO can be a lonely one,” Hewson adds, so anything companies can do to provide additional support and stability is key. Learning and development programmes should be tailored to finance leaders’ individual goals, he says, while flexible working hours and the option to work remotely can help them to manage their demanding roles without sacrificing personal or family time. Hewson believes this could be where businesses have the upper hand over private equity firms which tend to be less amenable to flexible working.

Continue to invest in succession planning

While having a solid retention strategy in place can keep CFOs happy, motivated and away from circling private equity firms, it’s important to manage expectations about the extent to which they will help.

Hewson believes that continuous investment in a CFO succession plan is the most effective way to safeguard financial leadership in the long term.

And yet many businesses are failing to take it seriously: only 26% of UK companies stated that they have a succession plan in place for their C-suite, according to data published by recruitment firm Robert Half. A further 17% said they have an unofficial or informal plan, while the majority (57%) admitted that they do not have any succession plan at all.

This is even more surprising given that CFO turnover is at an all-time high. Over the last 12 months, 20% of FTSE 100 CFOs left their jobs, compared with 13% in 2019, according to data published by Russell Reynolds Associates.

Hewson sees it as a “huge missed opportunity” for businesses to identify, train and develop the next generation of CFOs. “Right now, there is a pool of diverse, young and talented finance professionals that are waiting to step up into CFO positions. They’re hungrier, more motivated and they’ve got a point to prove.”

An empty CFO chair in the C-suite puts businesses at tremendous risk of instability. A failure to plan properly for that possibility is not only putting the business in jeopardy, it is shutting the door on a cohort of new finance leaders.

Three ways to motivate your CFO

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

News1 week ago

News1 week agoStudents and civil rights groups blast police response to campus protests

-

Politics1 week ago

Politics1 week agoCalifornia Gov Gavin Newsom roasted over video promoting state's ‘record’ tourism: ‘Smoke and mirrors’

-

Politics1 week ago

Politics1 week agoOhio AG defends letter warning 'woke' masked anti-Israel protesters they face prison time: 'We have a society'

-

News1 week ago

News1 week agoNine Things We Learned From TikTok’s Lawsuit Against The US Government

-

Politics1 week ago

Politics1 week agoBiden’s decision to pull Israel weapons shipment kept quiet until after Holocaust remembrance address: report