Finance

Miami’s Gold Rush: Finance Firms and Crypto Move In, Bringing Strains

From his new workplace in Miami Seaside, real-estate investor

Barry Sternlicht

is just steps from the ocean. His waterfront mansion is only a brief drive away. Chilly winters and state earnings taxes are a factor of the previous now that he has relocated right here from Connecticut.

Mr. Sternlicht, identified for launching the trendsetting W Lodge model, moved his Starwood Capital Group to the town in 2018. He’s a part of a booming migration of economic companies, expertise corporations and enterprise capitalists that has gained momentum within the years since then, as extra companies abandon the Northeast, Midwest and West Coast for the every day pleasures of South Florida life and its friendlier enterprise local weather.

Led by Mayor

Francis X. Suarez,

Miami is making an attempt one thing so formidable it has not often succeeded wherever earlier than—reworking a metropolis recognized with glitzy seashores and nightlife right into a world-class enterprise and monetary middle.

To date it appears to be working.

Ken Griffin,

who already lives primarily in Florida, stated in June that he’s shifting his big hedge fund Citadel from its Chicago headquarters to Miami. Financiers

Carl Icahn

and Orlando Bravo are among the many billionaires who relocated to the realm through the pandemic. The cryptocurrency change platform Blockchain.com moved its headquarters to Miami final 12 months. The Miami Warmth now play within the FTX Enviornment, named for the crypto change that paid $135 million for the rights.

Barry Sternlicht escaped chilly winters and state earnings taxes.

Picture:

Starwood Capital Group

However Miami is experiencing loads of rising pains alongside the best way. Rich tech and finance professionals are crowding out many lifelong residents. Residence rents are rising sooner within the Miami space than wherever else within the nation, by 58% over the previous two years via March, in line with Realtor.com. In some fascinating neighborhoods, landlords are doubling the lease after a lease expires as a result of they know transplants from the Northeast and West Coast are prepared to pay that rather more.

Starwood’s new headquarters have been speculated to be accomplished final 12 months, however a supply-chain crunch and allowing delays imply Mr. Sternlicht remains to be ready. Mr. Sternlicht would really like all his high executives to reside in Miami Seaside, however quite a lot of them have school-age youngsters and say they gained’t transfer as a result of the realm’s non-public colleges have lengthy ready lists.

State-to-state internet earnings migration from 2019 to 2020

For the highest 5 highest-gaining states:

For the underside 5 states:

And the way a lot of the highest-gaining states’

migrated earnings got here from N.Y. and Calif.:

For the highest 5 highest-gaining states:

For the underside 5 states:

And the way a lot of the highest-gaining states’

migrated earnings got here from N.Y. and Calif.:

For the highest 5 highest-gaining states:

For the underside 5 states:

And the way a lot of the highest-gaining states’

migrated earnings got here from N.Y. and Calif.:

Now he worries that Miami may be overextending itself simply as storm clouds collect over the nationwide economic system. When he appears at Miami’s Wynwood neighborhood—lengthy a mixture of warehouses and artwork galleries that’s now exploding with new workplace and residential buildings—the Starwood chief govt sees a thicket of cranes. As head of one of many world’s largest property house owners, he worries it’s harking back to different sizzling areas that ramped up earlier than experiencing busts.

“Everybody and their cousins want to construct a constructing right here,” he stated. “I’m getting nervous.”

Monetary corporations which have opened places of work within the metropolis over the previous 18 months signify round $2 trillion in belongings beneath administration, in line with the Metropolis of Miami. Hedge fund Elliott Administration Corp. moved its headquarters to West Palm Seaside, and loads of others are establishing or increasing their footholds within the space, together with Point72 Asset Administration, Schonfeld Strategic Advisors and Millennium Administration.

The Starwood Capital Group headquarters in Miami Seaside.

New York real-estate builders have additionally flocked to the magic metropolis to accommodate all of the newcomers, scooping up land in what some have known as a frenzy.

Steve Witkoff moved his operations right here, Miki Naftali purchased prime area in downtown Miami and Harry Macklowe is growing residence buildings close to a mass-transit entry level. Billionaire developer Stephen Ross just lately introduced plans to redevelop the historic Deauville Seaside Resort in Miami Seaside and is becoming a member of with

Swire Properties Ltd.

on what they are saying would be the tallest workplace tower on Brickell Ave., Miami’s premier enterprise hall.

And now a number of massive legislation companies together with Winston & Strawn, King & Spalding and Sidley Austin have adopted the cash to Miami as nicely. All are searching for workplace area, and stock is tight.

On the tech facet, the Miami space is now residence to 10 “unicorns,” or startups valued at $1 billion or extra, together with the addition this 12 months of Yuga Labs, which owns the Bored Ape Yacht Membership and CryptoPunks NFT collections. It raised $450 million in seed funding again in March earlier than the crypto market turned. Enterprise-capital funding within the metropolis greater than doubled in 2021, to greater than $4.6 billion, in line with information agency CB Insights. Within the first quarter of this 12 months, Miami-area VC offers topped $1 billion.

Drawn to the motion, Andreessen Horowitz, a Bay Space-based venture-capital agency, is shifting its crypto workplace, a16z Crypto, to Mr. Sternlicht’s constructing, in line with individuals accustomed to the matter.

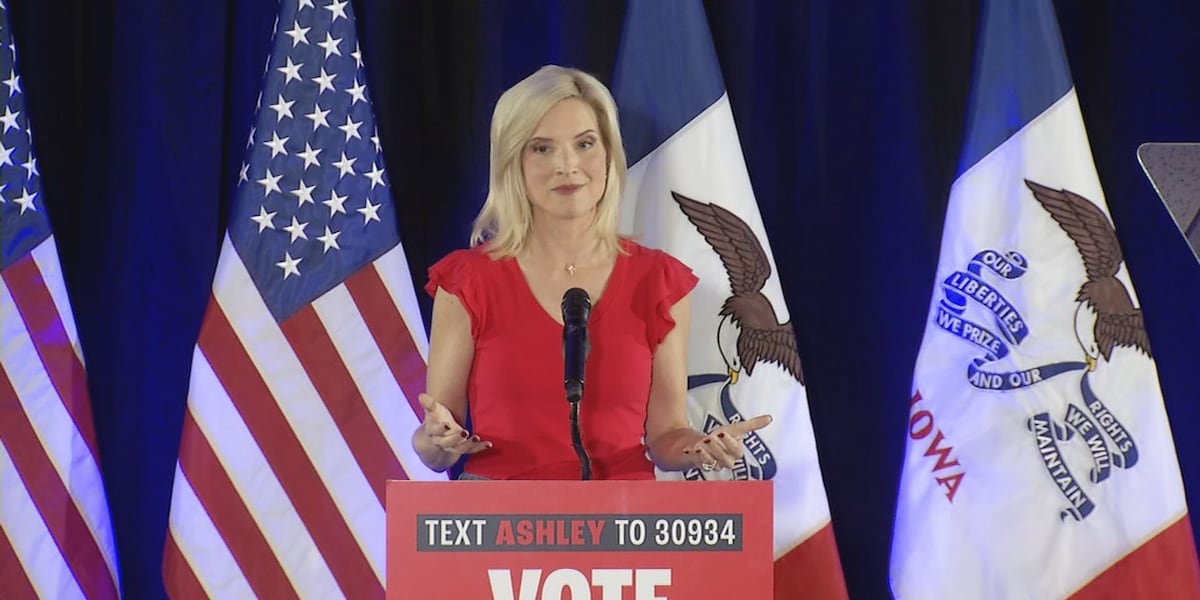

Miami’s 44-year-old Republican mayor will get a lot credit score for the town’s latest success in attracting new companies. Mr. Suarez, a lawyer who served as a metropolis commissioner for eight years, moved to Metropolis Corridor in 2017, pledging “to make Miami a metropolis the place everybody can have a possibility to succeed by gaining access to the roles of tomorrow.”

Miami Mayor Francis X. Suarez, left, poses in entrance of the Miami Bull on the Miami Seaside Conference Middle, unveiled to kick off the Bitcoin 2022 convention.

Picture:

Wilfredo Lee/Related Press

The U.S. Congress gave his efforts a lift that 12 months when the brand new federal tax legislation capped state and native tax deductions in locations like New York, New Jersey and California. With out that deduction, these states turned much more costly to reside and do enterprise in than Florida, which has no state earnings tax.

When Covid-19 erupted in 2020, New York Metropolis was an early epicenter. Droves of Wall Avenue executives decamped to South Florida, the place restrictions have been much less extreme and the temperate local weather meant individuals might meet exterior year-round. Miami additionally eased pandemic-related restrictions far sooner. Whereas New York Metropolis shuttered eating places for greater than 10 months, Miami reopened after two.

Mr. Suarez made nationwide headlines in December 2020, when somebody within the tech group recommended on Twitter that Silicon Valley ought to relocate to Miami. “How can I assist?” the mayor responded in a tweet that went viral and has come to epitomize a metropolis that pledged to do what it took to draw companies.

Annual earnings tiers for the roughly 850,000 individuals who migrated to Florida and New York in 2019 and 2020

Miami-Dade County skilled a larger inflow of recent companies through the pandemic than ever earlier than. A report from the U.S. Census Bureau cited 106,810 new enterprise functions in Miami-Dade throughout 2020. That was up greater than 24% from 2019, which was the document on the time. A brand new excessive of 135,710 enterprise functions have been made final 12 months, the bureau stated.

“New York was once the monetary middle of the world, it’s not for my part,” Mr. Suarez stated throughout an interview at Miami Metropolis Corridor, the odor of Cuban espresso within the air. “You not must be bodily current in New York to do offers.”

Whereas New York noticed an exodus of residents who reported $21 billion in whole earnings on their 2019 federal returns, in line with the IRS, Florida noticed an inflow of residents who reported $41 billion in earnings, probably the most any state obtained.

A view of the Paramount Miami Worldcenter rental tower from one of many property’s swimming pools.

Longtime Miami businessmen say they discover the distinction.

“We’ve been working at this for a really very long time,” stated Nitin Motwani, the lead developer of Miami World Middle, a multibillion-dollar mission with 27 acres of retail, residential, workplace and lodge amenities.

It took Mr. Motwani and his companions 5 years to boost the primary $1.5 billion for the mission, he stated, and fewer than 12 months to boost the following billion.

Whereas some Miamians are swimming within the spoils introduced by newcomers, others are getting worn out. Valerie Lopez moved together with her household from Colombia to Miami within the Eighties. In 2017, she co-founded Angle, a images market that connects individuals and companies with skilled photographers.

She did her firm’s fundraising in California. When enterprise capitalists requested why she was staying in Miami, her response was at all times: “As a result of it’s inexpensive and I find it irresistible.”

That’s modified dramatically over the previous two years. She and her husband have been paying $3,700 for a three-bedroom residence going through the bay in Miami’s Edgewater neighborhood. In December their landlord wished to boost their lease to $5,000, after which somebody from New York provided $7,000. In March, the couple moved to a smaller residence within the Wynwood neighborhood.

James Curnin is a developer who moved to Miami in 2019 and is now constructing a multifamily property in Bay Harbor close to Miami Seaside. He loves the climate, the seaside, and says he’s by no means leaving.

Miami resident Valerie Lopez moved to a smaller residence after newcomers drove up rents.

Nonetheless, he has observed that enterprise doesn’t proceed as easily because it as soon as did.

Proper earlier than the pandemic, when he moved to Miami, he stated it took not more than 4 months from when he submitted improvement plans to when he bought metropolis approval. Now, with the variety of initiatives swamping Miami Seaside’s employees and assets, that very same course of takes almost a 12 months, Mr. Curnin stated.

Miami has largely been in a position to keep away from hot-button political points when interesting to companies, however that’s turning into extra difficult. Mr. Suarez has warned {that a} legislation championed by Florida Gov. Ron DeSantis banning the dialogue of gender identification in early college grades might feed into tradition wars that harm Miami’s capability to draw new companies and residents.

The Supreme Court docket ruling that overturned Roe v. Wade presents one other potential problem, enterprise executives say. The Florida governor signed a legislation in April that banned abortions after 15 weeks. A circuit court docket choose on June 30 struck it down, however the state filed an enchantment.

Janine Yorio, chief govt of the New York Metropolis startup Everyrealm, stated she and her greater than 60 staff final 12 months mentioned relocating to Miami. The agency, which develops actual property within the Metaverse, an immersive three-dimensional community of digital worlds, is an efficient match for Miami’s ambitions. Her staff additionally cherished the climate and visiting the town.

She finally determined to maintain the headquarters in New York, the place a core of staff reside close by. Now, the abortion subject provides her another excuse to not transfer there, she stated.

A waiter arms out menus on the Miami satellite tv for pc of the favored New York eatery Carbone.

“It’s clearly a setback for ladies,” Ms. Yorio stated, including that the court docket ruling might grow to be a recruitment dilemma for corporations based mostly in Miami.

And whereas the mayor likes to boast that Miami “went all in crypto,” it’s removed from clear whether or not this shall be a successful wager. Mr. Suarez introduced late final 12 months that he would settle for his wage in bitcoin and he aggressively pursued the sponsors of the bitcoin convention, persuading them to carry the marquee trade occasion in Miami as a substitute of Los Angeles, the place it was initially deliberate.

Nonetheless, bitcoin’s latest loss in worth has some fearful that the crypto affiliation is a dangerous one.

The MiamiCoin, the city-branded cryptocurrency created by a corporation known as CityCoins, has misplaced 98% of its worth from its peak in September. Whereas Miami was in a position to money out $5 million from it, traders have been left holding the bag.

Mr. Suarez stated MiamiCoin could not succeed, however his No. 1 objective continues to be bringing what he calls a “confluence of capital” into the town.

A method Miami hopes to draw that capital is by internet hosting splashy occasions, many with a global enchantment, constructing on its Artwork Basel franchise. The town just lately authorized a plan to construct a soccer stadium for the native Inter Miami CF group and Miami shall be one of many 11 U.S. host cities for the 2026 World Cup.

In Could, Miami Seaside hosted the primary annual Aspen Concepts: Local weather convention in Miami Seaside, attracting chief sustainability officers from corporations equivalent to Google,

Normal Motors Co.

and

BlackRock Inc.

“We’re a reasonably good canvas to speak about local weather change,” stated Miami Seaside Mayor

Dan Gelber.

Some areas of the Metropolis of Miami Seaside expertise common flooding throughout heavy rainfall and excessive tides. As an alternative of avoiding the subject, the town has embraced the climate-change dialog, and is engaged on elevating its roads to assist fight the issue.

ZZ’s is one in every of a couple of dozen new non-public golf equipment which have opened in Miami to cater to the brand new elite.

Later that month Miami hosted a Method One Grand Prix, attracting a world viewers. Quite a few Wall Avenue financiers flew down for the race, and resorts reported a rise in 25% income per obtainable room for that week in contrast with prepandemic years.

South Florida’s meals scene can also be booming, aided partly by New Yorkers who’ve made Miami their new residence. Jeff Zalaznick, a co-owner of Main Meals Group, fled to Miami to journey out the pandemic. Prior to now two years he and his companions have opened up 5 eating places within the metropolis, together with a satellite tv for pc of their well-liked New York eatery Carbone.

“I got here for per week and I by no means left,” stated Mr. Zalaznick, who had lived in New York his total life.

He and his companions additionally opened a non-public membership known as ZZ’s that they’re now planning to launch in New York. It’s one in every of a couple of dozen new non-public golf equipment which have opened in Miami to cater to this new elite. The companions are additionally codeveloping a luxurious condo-hotel in Miami’s monetary middle known as “Main” that they are saying would be the tallest tower within the metropolis.

The town’s culinary fame obtained a lift in June, when Miami eating places have been awarded 11 Michelin stars for the primary time, becoming a member of cities equivalent to Chicago, New York, San Francisco and Los Angeles.

Share your ideas

Do you assume Miami can reach pivoting its economic system? Why or why not? Be a part of the dialog under.

“We’re white sizzling,” stated Rolando Aedo, chief working officer of the Larger Miami Conference & Guests Bureau, who helped provoke the trouble to get Michelin all the way down to Florida.

But even the town’s expanded leisure choices are experiencing their very own rising pains. On the Method One race, company complained of the searing warmth on the stadium, which supplied little shade. A few of the stair lifts that have been used to get disabled company up and throughout the pedestrian bridges situated all through the venue misplaced energy, requiring employees to hold these company so they might attain their seats.

“Wonderful issues are occurring within the metropolis,” stated Ms. Lopez, the startup founder. “It’s a brand new period, which is nice. It brings plenty of advantages but in addition plenty of points.”

Write to Deborah Acosta at deborah.acosta@wsj.com

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Finance

Financing opportunity: Q&A with Harold Pettigrew on the future of the CDFI Sector – Kresge Foundation

As the community finance field enters a new era—shaped by economic uncertainty, shifting capital flows, and growing calls for accountability—how can CDFIs prepare for what’s ahead? The Kresge Foundation spoke with Harold Pettigrew, the president and CEO of the Opportunity Finance Network (OFN) to help answer that question. This article is part of a series highlighting the impact of CDFIs and how the sector is adapting to the current environment.

MD: CDFIs play a unique role in our financial ecosystem, often serving communities that mainstream banks overlook. Why are CDFIs so critical for advancing economic growth and creating opportunities in underserved communities?

HP: In every corner of America, CDFIs show that impact and financial performance aren’t at odds—they reinforce each other. We address market gaps and go where traditional capital doesn’t: listening first, solving for need, and providing capital to people and financing projects that strengthen families and communities. Whether it’s a small business on Main Street or a housing development in a rural town, CDFIs make investments that build wealth and create opportunities that reach people and communities that need it most.

MD: CDFIs seem to have broad support in Congress, even when some administrations have looked to reduce funding or support. Is bipartisan support materially different today? What role has OFN played in telling the CDFI story and maintaining that support?

HP: Bipartisan support for CDFIs remains strong because our work cuts across political divides — we’re about creating jobs, building businesses and revitalizing communities. What’s different today is the urgency and scale of the need, and the growing recognition that CDFIs are essential partners in solving some of our nation’s toughest challenges. OFN and CDFIs tell real stories of impact—stories of people across the country whose lives and livelihoods have changed thanks to the capital provided by CDFIs. Through advocacy, research, and direct engagement with policymakers, we’ve elevated a clear, consistent message: For over 30 years, CDFIs have delivered results addressing market gaps in providing access to capital to communities across the country.

MD: Beyond federal funding concerns, what are the current challenges and needs CDFIs are facing in their day-to-day efforts to support communities?

HP: CDFIs are navigating a complex economic environment— rising interest rates, tighter capital markets, and growing community needs are stretching our resources like never before. Many CDFIs are being asked to do more with less, while also investing in their own operations to scale effectively and sustainably. OFN is working to develop diverse pools of flexible capital, make deeper investments in talent and technology, and new policy frameworks that support and recognize the unique value CDFIs bring. The demand is clear — what’s needed now is bold investments to meet the moment and craft new solutions for the future.

MD: Philanthropies and community development departments of banks and insurance companies have always been crucial partners for CDFIs — how can they best support and invest in CDFIs right now?

HP: Our partners in philanthropy and financial services have been critical to the success of CDFIs, and now they have a critical opportunity to strengthen the CDFI industry for the future. That means moving beyond transactional grantmaking to long-term, trust-based partnerships. It means offering flexible, risk-tolerant capital that lets CDFIs innovate and expand, and it means investing in the infrastructure — people, systems, data — that helps us operate at scale.

MD: What keeps you optimistic about the future of the CDFI sector?

HP: What keeps me optimistic is the impact and commitment I see every day, from the entrepreneurs we finance, to the communities we serve, to the CDFI leaders innovating with courage and conviction. The sector is growing, diversifying and deepening its impact. We’re not just responding to the moment — we’re helping define the future of expanded access to finance and financial services. And with every new loan, every new partnership, every life changed, we’re proving that when we expand access to opportunity — we don’t just finance projects, we shape the future of communities across the country.

Harold Pettigrew is the President and CEO of Opportunity Finance Network (OFN)

Finance

Reimagining Finance: Derek Kudsee on Coda’s AI-Powered Future

Derek Kudsee is a veteran of the enterprise software industry, with senior leadership roles at industry giants such as SAP, Salesforce, and Microsoft under his belt. So, when he took the helm as the new Managing Director for Unit4 Financials by Coda, ERP Today sat down with Kudsee to discuss his vision for Coda, the promise of agentic AI to make work feel lighter for finance teams, and his mission to transform the classic system of record into a dynamic system of intelligence for the Office of the CFO.

What was it about the opportunity at Unit4, and specifically the challenge of modernizing Coda, that convinced you to take this role?

A rare combination of having a deeply trusted platform and a clear opportunity to reimagine the finance function drew me to Unit4, and specifically the Coda business. Some of the largest enterprise customers have been running on this platform for decades. I’ve been brought in to help these finance teams run more efficiently and provide greater insight through agent-driven automation. We live in a world where technology has converged in our consumer and professional lives. Therefore, modernization is not only about addressing complex systems, but also about enhancing the user experience. This combination of running a deeply trusted platform, reimagining its capabilities in an AI-driven world, and modernizing the user experience was attractive.

Unit4 Financials by Coda’s goal is to deliver an “AI-fueled office for the CFO” using agentic AI. How will a finance team using Coda experience this in their day-to-day work?

When one thinks of an AI-fueled Office of the CFO, it’s about having agents deep inside those finance processes that will suggest, explain, and act within guardrails that finance teams can set. The work should feel like the machine is performing tasks that were previously done manually or laboriously.

A simple example is in an accounts payable department. An agent can automate everything from invoice capture using AI-driven OCR, verify that the invoices are within policy, queue them for approval, send them to the respective individuals, and flag exceptions along the way. Users can see how the work feels lighter because the machine handles everything from capture to the final stage, including payment release.

How do the AI functionalities offered by Coda differ from what competitors are offering right now?

Many vendors today have a finance module. However, we aim to be the best standalone financial management system, not a generic suite. We’re not trying to be finance because we want to sell an HR or CRM system. That means we need to embed intelligence deeply within the finance processes so that the software acts, takes action, and performs activities for the finance function. For that, the agentic AI needs to operate with autonomy, understand financial context, and learn from user behavior.

Moreover, fundamentally, Coda has always been built on a unified financial model. We’ve never had Accounts Payable separate from Accounts Receivable that needed to be consolidated. Our AI works on clean, structured data from day one, and that’s the foundation for accuracy. We don’t need to chase hype to incorporate AI. We’re going to redefine the finance function with AI at its core.

How do you plan to balance the introduction of these cutting-edge innovations without disrupting the core stability that Coda is known for?

The safest way to modernize finance is to add certainty around the core, rather than disrupting it. Our core is why customers have been running Coda for 20-30 years. Thus, stability is not a nice-to-have; it’s non-negotiable. Our customers run mission-critical processes, and that trust is sacred to us. Therefore, every innovation we deliver, whether it’s UX modernization or AI, will be built on one simple principle: if it compromises stability, we don’t build it. We don’t ship it.

With that rock-solid foundation in place, we can layer intelligence and usability on top. While some software providers are still determining the stability of their platform, we can offer customers the best of both worlds. They’ll have the reliability they’ve counted on for decades, and now we bring them the innovation they need to stay ahead.

What This Means for ERP Insiders

Your biggest enemy is decision latency. According to Kudsee, the primary challenge for modern finance is the gap between a business event occurring and the ability to respond intelligently. This decision latency, caused by fragmented data, batch processes, and manual workarounds that are standard in traditional ERP environments, prevents finance from being a proactive and strategic partner. Coda’s goal is to shrink that gap from weeks or days to near-real-time.

Shift the ERP mindset from system of record to system of intelligence. For decades, the primary function of ERP finance modules has been to record transactions accurately. This is no longer sufficient, as Kudsee notes. A modern financial platform must function as a system of intelligence that not only records data but also analyzes, predicts, and automates actions within core financial processes, effectively acting as the intelligent brain of the CFO’s office.

Prioritize financial depth over suite breadth. Kudsee suggests that the single ERP for everything strategy can result in a finance module that is a jack-of-all-trades but master of none. The alternative approach is to prioritize depth and best-in-class functionality for the critical finance function. Instead of settling for the generic finance module within a larger suite, consider how a dedicated platform like Unit4 Financials for Coda, focused on deep financial control, insight, and automation, can deliver more agility and tackle core challenges, such as decision latency, more effectively.

Finance

‘Worst kind of setup for the Fed’: What Wall Street is saying about the central bank’s next rate decision

Weak labor market data overshadowed a sticky inflation print last week, keeping investor expectations intact that the Federal Reserve will cut interest rates at its policy meeting on Wednesday.

Government data released Thursday showed that consumer prices rose 0.4% in August from the previous month, an uptick from July’s 0.2% increase. Meanwhile, separate data showed weekly jobless claims rising to 263,000 — the highest in nearly four years, up from a revised 236,000 the prior week.

The Fed weighs its dual mandate of full employment and price stability when deciding whether to change interest rates. Given the dynamic of a slowing jobs market coupled with sticky price increases, Wall Street strategists told Yahoo Finance that the Fed has a complicated decision ahead.

“It’s the worst kind of setup for the Fed,” Claudia Sahm, New Century Advisors chief economist and former Federal Reserve Board economist, told Yahoo Finance. “They will not be cutting because we have good news on inflation. They’ll be cutting because we have bad news on employment.”

Sahm expects the Federal Reserve to cut rates by 25 basis points during its two-day meeting this week. She noted, though, that inflation is “still too firm.”

Other strategists agreed: “Inflation is still elevated. It’s been elevated, and it’s moving in the wrong direction right now,” Collin Martin, fixed income strategist at Schwab Center for Financial Research, told Yahoo Finance.

Sticky inflation may keep the Fed cautious after September, RSM chief economist Joe Brusuelas said.

“Yes, you’re going to get your rate cut out there in trading land,” Brusuelas told Yahoo Finance. “But I have to tell you, the underlying tenor of the data doesn’t suggest that it’s a lock that you’re going to get three rate cuts before the end of the year.”

Read more: How jobs, inflation, and the Fed are all related

As of Friday, investors were pricing in a 76% probability of three rate cuts this year, according to the CME FedWatch, as the labor market shows increasing cracks.

Thursday’s jobless claims data was the latest to underscore the slowdown. A sweeping jobs revision released earlier this week showed the US employed 911,000 fewer people between April 2024 and March 2025 than originally reported.

Still, the slowdown doesn’t appear to be pushing the economy over a cliff.

“We’re not getting this hard landing like collapse in the job market,” Economic Cycle Research Institute co-founder Lakshman Achuthan said. “This could get rough at some point … but it’s not yet.”

-

Health1 week ago

Health1 week agoWho Makes Vaccine Policy Decisions in RFK Jr.’s Health Department?

-

Finance4 days ago

Finance4 days agoReimagining Finance: Derek Kudsee on Coda’s AI-Powered Future

-

Lifestyle1 week ago

Lifestyle1 week agoBobbi Brown doesn’t listen to men in suits about makeup : Wild Card with Rachel Martin

-

Business1 week ago

Business1 week agoHow Nexstar’s Proposed TV Merger Is Tied to Jimmy Kimmel’s Suspension

-

North Dakota4 days ago

Board approves Brent Sanford as new ‘commissioner’ of North Dakota University System

-

Technology3 days ago

Technology3 days agoThese earbuds include a tiny wired microphone you can hold

-

Crypto3 days ago

Crypto3 days agoTexas brothers charged in cryptocurrency kidnapping, robbery in MN

-

World1 week ago

Russian jets enter Estonia's airspace in latest test for NATO