Finance

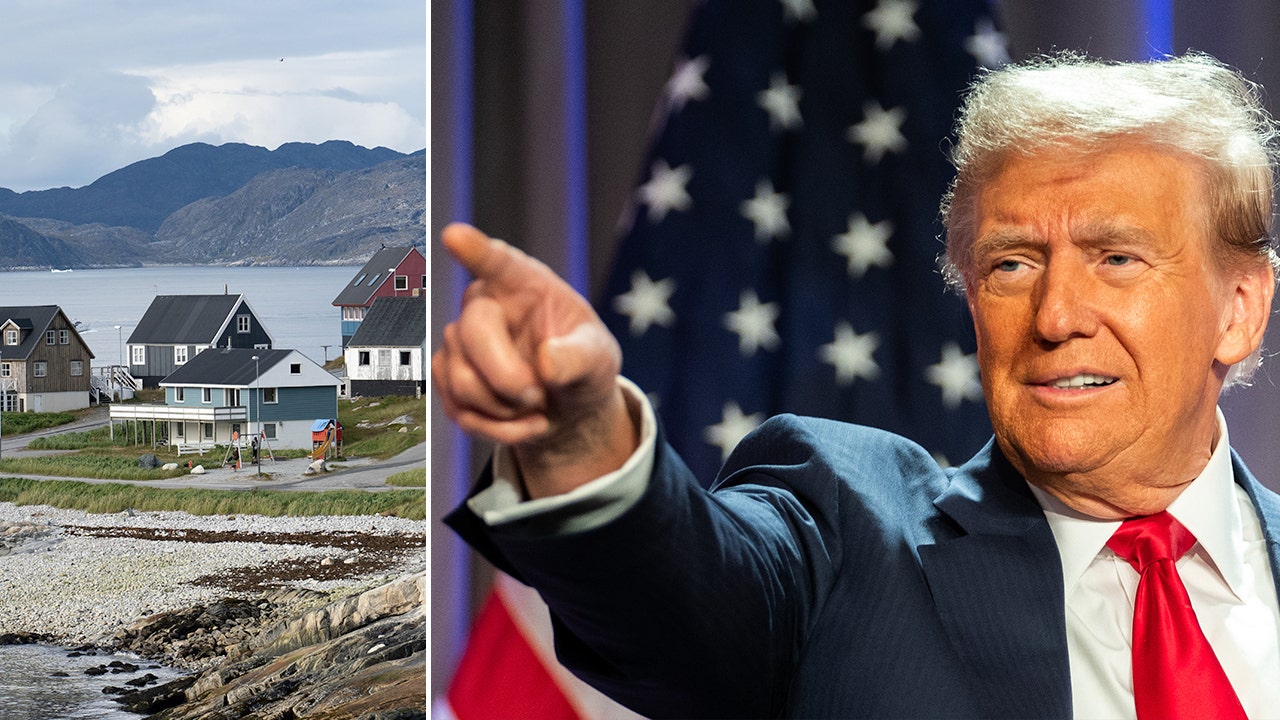

Kevin O’Leary on being dyslexic, where he got his financial chops and why he isn’t really that mean

This story is a part of the Behind the Desk sequence, the place CNBC Make It will get private with profitable enterprise executives to search out out every little thing from how they bought to the place they’re to what makes them get away from bed within the morning to their day by day routines

There’s quite a bit you won’t find out about Kevin O’Leary.

Possibly you did not know the star investor on ABC’s “Shark Tank” grew up dyslexic. Or, possibly you did not know he bought his monetary chops from his Lebanese mom, whom he says “stored a secret [bank] account from each of her husbands, her entire life.”

You may assume he is imply, based mostly largely on his tv persona. O’Leary disputes that assertion. “Individuals name me imply. I do not assume I am imply,” O’Leary, 67, tells CNBC Make It.

As an alternative, O’Leary says, he is merely following recommendation he acquired as a youngster from his late mom Georgette: By no means inform a lie, and you may by no means have to recollect what you mentioned. “In different phrases, I inform it the way in which I see it,” he says.

O’Leary credit that honesty, even when it hurts, to his success — courting again to his first entrepreneurial endeavor, an organization known as Softkey Software program that he launched from his Toronto basement in 1986. The corporate later morphed into the academic software program agency The Studying Firm, which O’Leary and his co-founders offered to Mattel for $4.2 billion in 1999.

Since then, O’Leary has invested in and suggested a slew of companies, from crowdfunding start-up StartEngine to “Shark Tank” firms like DrainWig and Depraved Good Cupcakes. He is additionally a bestselling creator who serves because the chairman of O’Shares ETFs.

The street to get there was removed from simple, he says — from dropping his dad at age seven to creating mulitiple enterprise errors alongside the way in which. Right here, O’Leary talks about rising up with dyslexia, the second that made him a lifelong entrepreneur and why he actually is not that imply.

On rising up with dyslexia: ‘I did not actually have a incapacity. I had a superpower’

I had severe dyslexia once I was younger. I began to fall behind in class in math and studying expertise. However I used to be very lucky to get into an experimental program at McGill College.

It was run by two professors, Sam Rabinovich and Marjorie Golick, who are actually legendary in dyslexia. They taught me that I did not actually have a incapacity. I had a superpower.

At that age, the entire thought was to cut back my nervousness — as a result of I may really learn a e book the other way up within the mirror in entrance of my class. That is one of many attributes sure dyslexics have. As soon as I confirmed them that I can do this, that is how I began studying till it resolved itself.

There are many examples of dyslexics which have achieved nicely in enterprise, later. However they’ve to beat the attributes.

On the second that made him an entrepreneur: ‘For me, it was getting fired … as an ice cream scooper’

Each time I discuss to profitable entrepreneurs, there’s one second of their lives that adjustments their course. For me, it was getting fired at Magoo’s Ice Cream Parlour as an ice cream scooper.

It was the primary and solely job I ever had. I bought fired on the primary day as a result of I did not perceive the concept of the employee-employer relationship. I solely took the job as a result of I needed to be near this woman that I used to be inquisitive about. She was working on the shoe retailer throughout the mall.

On the primary day on the job, the proprietor mentioned, “The ground is totally coated with gum. You have to scrape it off earlier than you permit, and it’s a must to do this day-after-day.” I mentioned, “I can not do this.” I used to be anxious that the woman throughout the mall was gonna see me on my knees, and that was dangerous for my model. So she fired me, and that was the final job I ever had.

I discovered that I can not work for anyone. I’ve to regulate my very own future. I am not in opposition to [the concept of] being an worker, however I can not [personally] do it. That was the course of my ambition from that day on.

On the supply of his monetary chops: ‘My mom … was very hardcore about ensuring she may handle herself and her household’

I feel it has quite a bit to do with my Lebanese mom. Within the Lebanese household hierarchy, matriarchs run the present and so did her grandmother. They set the tone for the household.

My mom was fiercely unbiased. She needed her personal monetary pillar for herself. I feel I inherited that from her: She was very hardcore about ensuring she may handle herself and her household.

She wasn’t an analyst or something. However when she handed away, the executor known as me and mentioned, “You gotta get down right here. Your mom died a really rich lady.”

I had no concept that she stored a secret account from each of her husbands, her entire life. That is simply how she labored.

On one of the best recommendation he ever acquired: ‘By no means inform a lie’

I am going again to one thing my mom taught me once I was a youngster: “By no means inform a lie, and you may by no means have to recollect what you mentioned.” I wasn’t training this again then, however I’ve actually come to comprehend the advantage of it now.

I inform it the way in which I see it. Many individuals do not agree with me, nevertheless it’s those that do not agree with me who get into dialogue and debate, and I feel that is very wholesome.

I do know that will get me the “imply” tag on “Shark Tank.” However when a deal is de facto crappy, it’s best to inform them the reality. Generally, that is very exhausting, however I discover that individuals can scent bull—- a mile away on social media. You have to be sincere, and I feel that engages [people].

I’ve a really giant [following], and I am very inquisitive about what they assume. I quiz them on a regular basis once I wish to determine on one thing. So long as you do not bull—- them, they will be with you for all times.

On the largest false impression about him: ‘I do not assume I am imply’

Finance

Your money habits trace back to childhood, financial psychotherapist says. Here's how to fix them

Child saving money in a glass jar at home

Pinstock | E+ | Getty Images

Your relationship with money might seem random, but one expert says it offers clues about your childhood — and understanding this could help overcome toxic spending habits.

Vicky Reynal, a financial psychotherapist and author of “Money on Your Mind,” told CNBC Make It that there are psychological reasons behind our spending habits, and many of these attitudes stem from childhood experiences.

“Our emotional experiences growing up will shape who we become,” she said.

For example, someone who felt secure during childhood might feel that they deserve good things, and later in life may be more likely to negotiate a higher salary or enjoy the money they have, Reynal said. Whereas someone who experienced childhood neglect may grow up with low self-esteem and act this out through money behaviors.

This could include feeling guilty when spending money because they don’t feel they deserve good things, or splashing the cash to impress because they feel unworthy of attention.

“The little toddler that goes up to their parents to show them their scribble — how they get responded to will give them a message about how the world will respond to them,” Reynal added.

Scarcity or wealth

Reynal said “the money lessons we learn growing up” are largely shaped by whether we grew up in an environment of scarcity or wealth.

“To give you an example, growing up in scarcity, people that manage to move themselves out of that economic reality, and maybe in their own adult life manage to accumulate quite a bit of wealth, it’s quite common for them to struggle with what they call the scarcity mindset,” Reynal said.

This is a pattern of thinking that fixates on the idea that you don’t have enough of something, like money. A scarcity mindset means someone might struggle to enjoy the money they’ve earned and be anxious about spending it, Reynal added.

Alternatively, there are people who grew up with little but became wealthy, and are now very careless with money.

“They’re giving themselves everything that they longed for when they were little so they might go on the other extreme and start spending it quite carelessly, because now they want to give their children everything that their parents couldn’t give them,” Reynal added.

Stop self-sabotaging

The key to overcoming toxic spending habits is to stop self-sabotaging — a common behavior — according to Reynal.

“Often behind a pattern of financial self-sabotage, there are deep-seated emotional reasons, and it could range from feelings of anger, feelings of un-deservedness, to maybe a fear of independence and autonomy,” she said.

To identify these, you first have to determine what your financial habits and inconsistencies are, Reynal said, giving an example of someone who might overspend in the evenings.

“Is it boredom? Is it loneliness? What is the feeling that you might be trying to address with the overspending?” she said.

“That’s already giving you a clue as to what you could be doing different. So, if it’s boredom, what can you replace this terrible financial habit with?”

Reynal said she had a young client who would always run out of money within the first two weeks of the month. She asked them: “What would happen if you were financially responsible?”

The client revealed that they feared risking their relationship with their mother because every time they ran out of money, they called their mother to ask for more.

“Their parents had divorced a long time ago, and the only time they ever spoke to their mother was to ask for money,” Reynal said. “They had a vested interest in being bad with money, because if they were to become good with money, then they had the problem of: ‘I might not have an excuse to call mother anymore and I don’t know how to build that relationship again’.”

The financial psychotherapist recommended being “curious and nonjudgmental” when considering the root of bad spending behavior.

“So sometimes asking ourselves: “What feelings would I be left with if I actually didn’t self-sabotage financially, or if I weren’t so generous with my friends?’ That can start to reveal the reason why you might be doing it,” she added.

Finance

Downing & Co. Elevates Financial Legacy With Expert Estate Planning Services in Portland

Portland-based CPA firm helps clients safeguard their wealth and secure their family’s future with comprehensive estate planning services.

PORTLAND, OREGON / ACCESSWIRE / December 26, 2024 / In a city renowned for its entrepreneurial spirit and thriving businesses, Downing & Co. is taking a bold step forward in helping Portland residents protect what matters most: their legacy. The firm offers specialized estate planning services, designed to ensure their clients’ wealth is preserved and passed down seamlessly to future generations.

With over five decades of experience in financial strategy, Downing & Co. brings a trusted, proactive approach to estate planning. As Portland’s go-to CPA firm, they’ve built a reputation for delivering personalized solutions that go beyond typical financial management. Their estate planning services focus on reducing tax burdens, avoiding costly mistakes, and ensuring assets are distributed according to the client’s wishes.

“Estate planning isn’t just about financial protection-it’s about preserving your life’s work and values for the people you care about,” said Tim Downing, Managing Principal at Downing & Co. “Our goal is to provide peace of mind by ensuring that clients’ wealth stays where it belongs-within their family and community.”

Why Estate Planning Matters in Portland

For high-net-worth individuals and small business owners, estate planning is critical in Portland’s competitive economic landscape. Without a clear plan, families risk losing up to 40% of their inheritance to taxes and government regulations. By offering expert guidance and strategic structuring, Downing & Co. ensures clients avoid these pitfalls while safeguarding their financial legacy.

Key benefits of Downing & Co.’s Estate Planning Services include:

-

Minimizing Estate Taxes: Advanced planning can reduce the tax burden on your estate, ensuring more of your wealth is retained by your heirs.

-

Efficient Wealth Transfer: Clear strategies streamline the process of passing on assets, reducing legal challenges and delays.

-

Preserving Family Legacies: Customized solutions ensure your assets align with your values, supporting the people and causes you care about most.

-

Proactive Risk Mitigation: Estate plans address potential legal and financial risks, protecting your wealth against unforeseen challenges.

A Holistic Approach to Financial Security

Downing & Co.’s Estate Planning Services are part of a broader commitment to comprehensive financial management. Their holistic approach integrates tax planning, wealth preservation, and business advisory services to create a seamless strategy that addresses every aspect of a client’s financial well-being.

Finance

Stock market today: Dow, S&P 500, Nasdaq fall after Christmas break

US stocks fell Thursday as trading resumed after the Christmas holiday, as Wall Street digested one of the only economic data points of the week.

The S&P 500 (^GSPC) was down 0.3% while the the tech-heavy Nasdaq (^IXIC) declined 0.3%. The Dow Jones Industrial Average (^DJI) lost 0.4%, leading the way down.

Meanwhile, bitcoin (BTC-USD) slumped, falling below the $96,000 level as volatile trading continued. Crypto-linked stocks like MicroStrategy (MSTR) tracked the declines.

Markets looked to be struggling in a bid to extend the start of the “Santa Claus rally,” which kicked off with a bang on Tuesday. All three major indexes rose around 1%. The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) are within striking distance of their records after clawing back gains from a Fed-fueled dive last week.

As Wall Street saunters back from its holiday break, the normally routine release on weekly jobless claims took more of a spotlight than usual, as the only piece of the jobs puzzle on the docket this week.

Labor Department data released prior to the market open showed weekly jobless claims fell to 219,000 compared with expectation of 223,000. However continuing claims surged to 1.19 million in the week ending December 14 to the highest level since November 2021, in a sign the labor market may be cooling.

LIVE 1 update

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology6 days ago

Technology6 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News7 days ago

News7 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics7 days ago

Politics7 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment1 week ago

Entertainment1 week ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle1 week ago

Lifestyle1 week agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology2 days ago

Technology2 days agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

News3 days ago

News3 days agoFrance’s new premier selects Eric Lombard as finance minister

/cloudfront-us-east-1.images.arcpublishing.com/gray/DHRBEOGK55ASXJZAE44OVDEL6Y.jpg)