Press release -

May 20, 2024

Tata Motors’ subsidiaries – TPEM and TMPV join hands with Bajaj Finance, offers financing program for authorized passenger and electric vehicle dealers

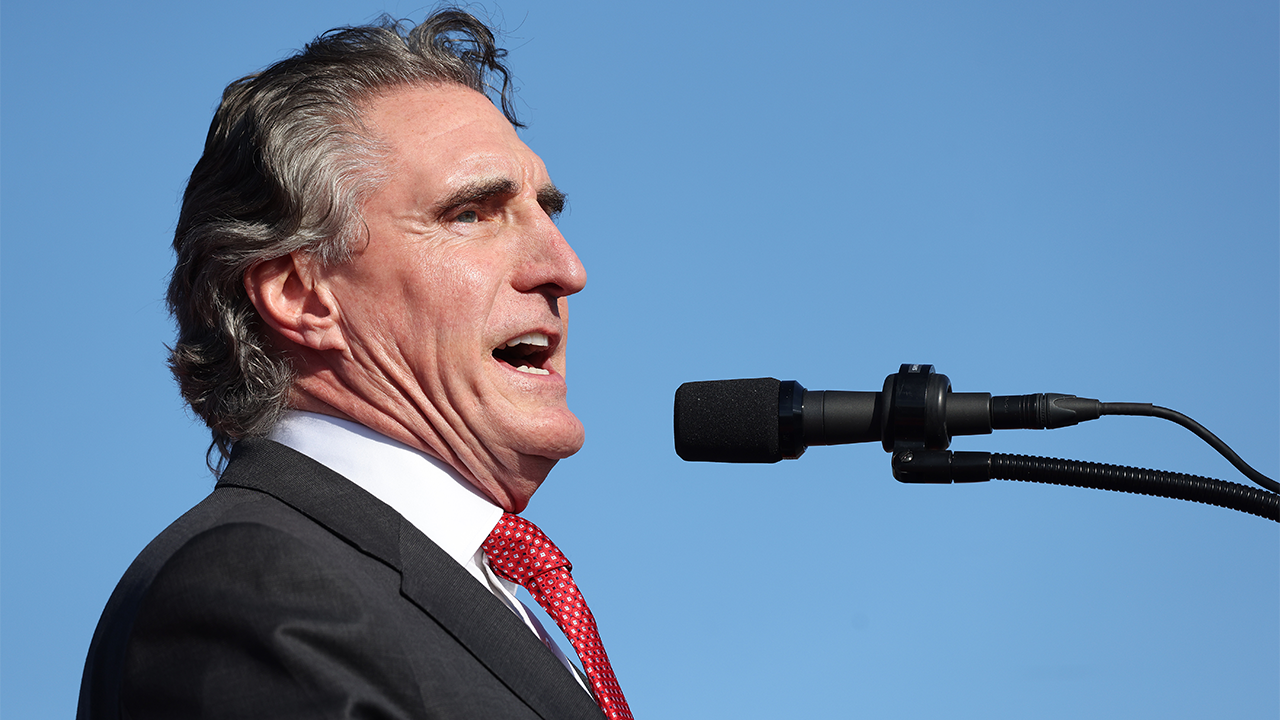

Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) join hands with Bajaj Finance to offer financing program for authorized passenger and electric vehicle dealers. In the image, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd. at the MoU signing in Mumbai.

In a bid to improve options and ease of financing for the dealers, Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) – subsidiaries of Tata Motors, India’s leading automotive manufacturer, have joined hands with Bajaj Finance, part of Bajaj Finserv Ltd., one of India’s leading and most diversified financial services groups, to extend supply chain finance solutions to its passenger and electric vehicle dealers. Through this memorandum of understanding (MoU), the participating companies will come together to leverage Bajaj Finance’s wide reach to help dealers of TMPV and TPEM access funding with minimal collateral.

The MoU for this partnership was signed by Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd.

Commenting on the partnership, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd., said, “Our dealer partners are integral to our business, and we are happy to actively work towards solutions to help them in ease of doing business. Together, we aim to further grow the market and offer our New Forever portfolio to an increasing set of customers. To that effect, we are excited to partner with Bajaj Finance for this financing program, which will further strengthen the access of our dealer partners to increased working capital.”

Speaking on this partnership, Mr. Anup Saha, Deputy Managing Director, Bajaj Finance Ltd, said, “At Bajaj Finance, we have always strived to provide best-in-class processes by using the India stack for financing solutions that empower both individuals and businesses. Through this financing program, we will arm TMPV and TPEM’s authorized passenger and electric vehicle dealers with financial capital, which will enable them to seize the opportunities offered by a growing passenger vehicles market. We are confident that this collaboration will not only benefit dealers but also contribute to, and enhance the growth of, the automotive industry in India.”

TMPV and TPEM have been pioneering the Indian automotive market with its groundbreaking efforts it both ICE and EV segments. The company’s overarching New Forever philosophy has led to the introduction of segment leading products which are being appreciated by consumers at large.

Bajaj Finance is one of the most diversified NBFCs in India with presence across lending, deposits and payments, serving over 83.64 million customers. As of March 31, 2024, the company’s assets under management stood at ₹3,30,615 crore.

Media Contact Information: Tata Motors Corporate Communications: [email protected] / 91 22-66657613 / www.tatamotors.com