Finance

How should you invest for your different financial goals? MintGenie explains

Let us see how you can invest for your different financial goals.

Prioritise your financial goals

First, list your financial goals into short-term, medium-term, and long-term goals. You can estimate the amount you have to accumulate to reach these goals and the required timeline for each of the goals.

After identifying these goals, the next step would be to classify them into regular and exciting goals. Regular goals might include saving for retirement, paying off loans, and building an emergency fund. These goals are important but might not motivate you to start investing towards these goals. On the other hand, exciting goals include those you are likely to invest money in as soon as possible. These are likely to be short-term goals such as travelling the world or purchasing a luxury car.

Combining regular and exciting goals

One of the ways that you can stay motivated is by tagging regular goals like retirement with exciting financial goals such as a yearly vacation.

For instance, if you are considering saving a minimum of ₹5,000 per month for a yearly vacation and ₹25,000 per month for retirement, you can start a Systematic Investment Plan (SIP) for your vacation before you begin investing for retirement. You can even allow a few SIP instalments to pass to become familiarised with the whole process of saving and investing.

Once you see that your vacation fund is nearing your target amount, you will most likely feel encouraged to invest for other long-term goals like retirement. After six months of starting the vacation SIP, initiate the SIP for your retirement fund. When you successfully achieve your vacation goal, you will experience the positive impact of planning and achieving your financial goals. This achievement can serve as motivation to continue investing in your retirement fund.

By linking your vacation and retirement goals, you might find that investing for retirement doesn’t feel like a chore but something enjoyable. You can also increase the SIP amount for your vacation by a certain percentage each year, say 5% or 10%. Simultaneously, raise your SIP for retirement by the same rate, ensuring that both goals progress in tandem.

You might also do it the other way around. You can also look at investing for both goals simultaneously. However, you have to discipline yourself to reduce/pause the SIP for your exciting goal if you pause your SIP for your retirement.

Set up automated savings/investments

There are two main ways to save/invest for your financial goals. The first method is making lump sum payments, and the second is setting up an automated savings or investment plan.

Setting up an automated plan will help you contribute effortlessly to regular and exciting goals. You will stay consistent as the amount will be directly debited from your savings account and moved to your investment account. It will also reduce the temptation to divert funds from your financial goals.

For exciting goals that you need to fulfil within a year or so, you might want to save the money in a Recurring Deposit (RD). For regular goals where you must invest more than seven years, you can invest in diversified equity mutual funds through SIP.

Track progress regularly

After you set up your RD or SIP, it is essential to track your progress periodically. Checking in on your goals every few months allows you to assess whether you are on target to achieve your goals. If not, it gives you time to make the necessary adjustments.

Many online investment platforms let you evaluate your investment’s performance and suggest the steps you need to take to reach your financial goals on time.

Celebrate milestones

Just like we treat ourselves when we hit milestones in our personal or career lives, we can also incorporate it into our financial goals. We know that celebrating milestones helps us stay motivated and make the whole journey a pleasant experience.

So, when you reach specific savings goals, such as completing three years of retirement planning without fail, you can consider treating yourself or your family members to a short weekend trip or a special reward. This will keep you inspired to continue investing for your long-term goals.

Lumpsum investments

In addition to SIPs, additional lumpsum investments can help you reach your financial goals faster. For instance, if you have received a bonus from your employer, you can split 50-50 and invest an equal amount towards both goals.

In conclusion, incorporating exciting and regular financial goals into your planning strategy can transform how you approach your long-term investments.

The objective is to start with the goals you are excited about. Once you are familiar with savings and investments, you can start with your long-term goals that might be essential but not necessarily exciting.

This approach ensures a more balanced financial future and makes the journey enjoyable and fulfilling. You can consult a financial advisor to make your dreams a reality.

Padmaja Choudhury is a freelance financial content writer. With around six years of total experience, mutual funds and personal finance are her focus areas.

Milestone Alert!Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 10 Dec 2023, 10:09 AM IST

Finance

Government finance statistics: net financial worth

The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. The difference between the stock of financial assets and the stock of liabilities is called net financial worth.

At the end of the first quarter of 2025, the EU net financial worth stood at -€8 948 billion or -49.4% of the gross domestic product (GDP). Compared with the end of the fourth quarter of 2024, the EU net financial worth increased by €72 billion. Compared with the end of the first quarter of 2024, the EU net financial worth decreased by €213 billion.

This information comes from data on quarterly government finance published by Eurostat today. This article presents a handful of findings from the more detailed Statistics Explained article.

Source dataset: gov_10q_ggfa

The net financial worth can change due to transactions or due to other economic flows (mainly price changes, also known as holding gains or losses). The main liabilities on the EU general governments’ balance sheets are debt securities. As these instruments are traded on the financial markets, their value changes over time and can be volatile.

At the end of the first quarter of 2025, the continued EU general government deficit (net financial transactions, measured as transactions in financial assets minus the transactions in liabilities, -€166 billion) contributed negatively to the evolution of net financial worth. However, at the EU level, compared with the fourth quarter of 2024, the net financial worth improved due to the financing of the deficit being off-set by positive revaluation of financial assets (+€137 billion), notably equity, as well as negative revaluations of liabilities (-€101 billion), notably debt securities.

Finance

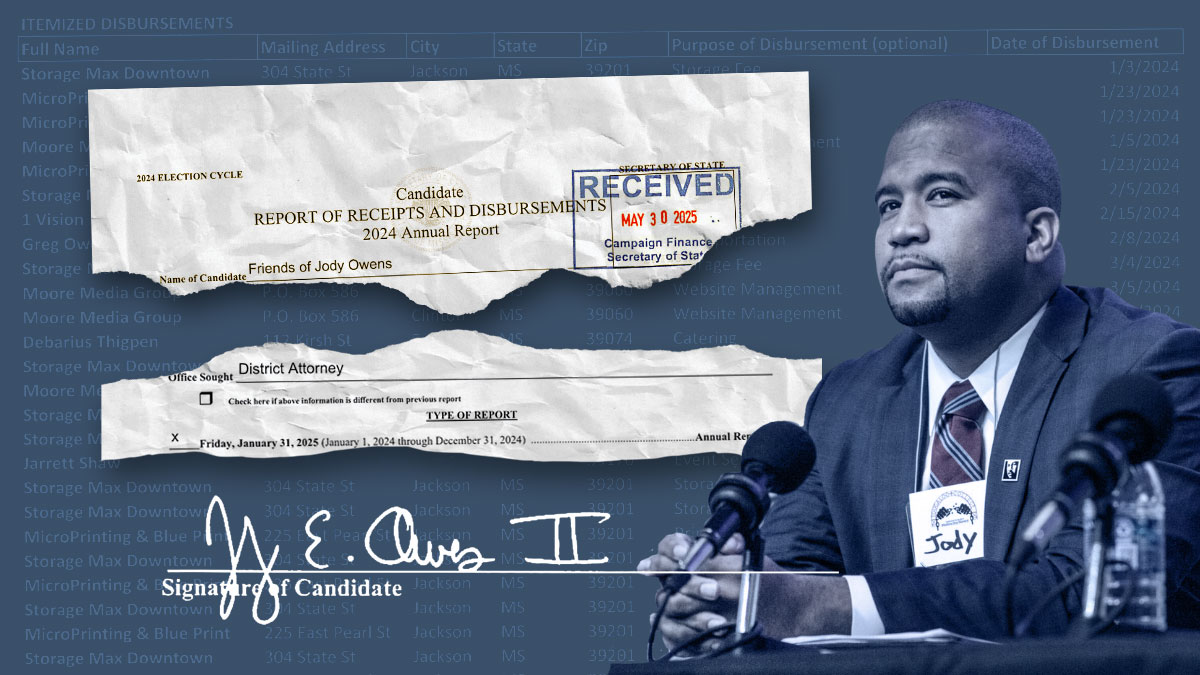

Indicted Jackson prosecutor's latest campaign finance report rife with errors

Finance

Fed independence faces a ‘showdown’ between Trump & the market

00:00 Speaker A

I also want to ask about what’s going on with economic data and the Federal Reserve, guys. Um, Ed, what are you hearing there in D.C.? Right? There is now some reporting out there that Kevin Hassett is kind of the front-runner to potentially take Jay Powell’s place at the Federal Reserve. What are you hearing and what’s the kind of vibe in Washington around this decision?

00:43 Ed

So, Julie, the way I’d view this is that President Trump always loves competition. You know, he came to some of his most recent national prominence by having the Apprentice show. And so, my expectation is that President Trump is going to keep multiple people in the running. Kevin Hassett certainly is in there. Kevin Warsh is in there. I’d put Christopher Waller, who’s already on the Fed board, as well as Treasury Secretary Bessant. I’m watching to see if there’s an opening on the Fed. If a governor steps down, like Michael Barr, now that he’s no longer vice chair for supervision, does one of these individuals get onto the board? I’m also watching for Waller as there are rate decisions here in July and September. Is there going to be a dissent? You generally don’t see dissents among Fed governors, but as you’re auditioning for that role, showing that you would be much more dovish is something that President Trump is going to be looking for and could move him up the list of potential Fed chairs come May of next year.

02:26 Speaker A

Yeah, I think the Apprentice Federal Reserve edition is something that no one asked for, uh, guys. I don’t know, Dory, like, in terms of market reaction to all of this, um, you know, we’ve seen rates kind of remain range-bound here as we get numbers like CPI yesterday and PPI today. But do you think at some point that this competition is going to start to really come to bear in the bond market?

03:25 Dory

Uh, yeah, I think we have a showdown coming. Uh, most people in the marketplace want to preserve the independence of the Fed, and when I say that, I mean that both ways, not just from Trump’s standpoint, but from the Fed’s standpoint. I’ve always said the Fed is, in my mind, Powell being a little political in some of his rate cuts early last year. Having said that, the market has always anticipated for the last couple of years anyway, uh, more rate cuts than actually should have happened or did happen. And I think we’re falling into that trap, and so is Trump as well. I’m kind of a wait-and-see kind of guy right now. I do think the next Fed chair is going to be one of those type of interviews, hey, I’m Donald Trump and I believe this, and if you believe this, I’d like to have you as Fed chair. That points to Hassett being the, uh, being, being there. And, uh, I think that’s going to get some criticism from the market. I think we need that independence. We need good independent valuation. Uh, and, and, you know, I think cutting too soon, soon could be, uh, extremely dangerous when we all know that our deficit is out of control, our debt is out of control, and we don’t want to become a Venezuela.

-

Politics1 week ago

Politics1 week agoConstitutional scholar uses Biden autopen to flip Dems’ ‘democracy’ script against them: ‘Scandal’

-

Politics1 week ago

Politics1 week agoDOJ rejects Ghislaine Maxwell’s appeal in SCOTUS response

-

Health1 week ago

Health1 week agoNew weekly injection for Parkinson's could replace daily pill for millions, study suggests

-

Culture1 week ago

Culture1 week agoTest Your Knowledge of French Novels Made Into Musicals and Movies

-

News1 week ago

News1 week agoSCOTUS allows dismantling of Education Dept. And, Trump threatens Russia with tariffs

-

Business1 week ago

Musk says he will seek shareholder approval for Tesla investment in xAI

-

Business1 week ago

Business1 week agoShould You Get a Heat Pump? Take Our 2-Question Quiz.

-

Sports1 week ago

Sports1 week agoEx-MLB pitcher Dan Serafini found guilty of murdering father-in-law