Finance

Half of U.S. states now offer personal finance classes for high school students

(Gray News) – Half of U.S. states now offer standalone personal finance courses for high school students.

In December, Pennsylvania passed an education policy bill to become the 25th state to guarantee a personal finance course for high schoolers.

Senator Chris Gebhard (R-48) sponsored the original bill.

“An alarming number of our high school students are currently entering adulthood and the workforce without an appropriate knowledge of basic financial concepts,” Gebhard said in a statement. “I want them to have the best foundation possible as they start their own lives.”

The bill was supported by policymakers on both sides of the aisle, and it also garnered support from parents, business groups, nonprofit organizations, and educators from across the state.

Pennsylvania’s personal finance course requirement will begin with the 2026-2027 school year and will cover topics such as budgeting, saving, credit management, investing, and understanding loans and interest rates.

Copyright 2024 Gray Media Group, Inc. All rights reserved.

Finance

M&M Finance’s Q4 Results: Net profit declines; ₹6.30 per share dividend declared

Mahindra Finance reported a total income of ₹3,706 crores, marking a 21 per cent increase year-over-year (YoY), for the quarter ending March 31, 2024, on May 4. However, the Profit After Tax (PAT) experienced a slight downturn by 10 per cent YoY, settling at ₹619 crores, attributed to a 14% increase in Net Interest Income (NII) which stood at ₹1,971 crores. The Net Interest Margin (NIM) remained fairly stable at 7.1%. The reported disbursements for the quarter saw an 11% rise, totalling ₹15,292 crores, and the Gross Loan Book grew by an impressive 24% YoY to ₹1,02,597 crores.

Also Read | Pakistan coach Gary Kirstein gets brutally trolled after meeting with team online, ‘Is this cricket or…?’

The company also showed marked improvement in asset quality, with a significant reduction in Stage 3 assets to 3.4%, down from 4.0% in December 2023. Credit costs for the year were maintained within the targeted range of 1.5% – 1.7%, indicative of effective risk management strategies.

Also Read | Justin Trudeau says ‘rule-of-law’ after 3 arrested for Nijjar killing, Jaishankar says ‘internal politics’

In its consolidated results, the company posted a total income of ₹4,333 crores for the fourth quarter, up by 23% YoY, and a marginal decrease in PAT by 1%, amounting to ₹671 crores. The consolidated disbursements also noted an increase of 11% YoY, reaching ₹16,174 crores.

Also Read | No Dunki route to London anymore: Why is Rishi Sunak deporting UK’s illegal immigrants to Rwanda? An explainer

The company’s strategic initiatives included bolstering its presence in vehicle finance, particularly in pre-owned vehicle finance, which grew by 18% during FY24. Moreover, Mahindra Finance announced plans to enhance its services in the non-vehicle finance segment, aiming to expand its Asset Under Management (AUM) to 15% over the medium term. This includes increasing investments in sectors such as Small and Medium Enterprises (SME) lending, Lease and Purchase (LAP), and leasing through its Quiklyz platform.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 09:46 AM IST

Finance

Transwarranty Finance Q4 results : profit at ₹2.73Cr, Revenue increased by 166.66% YoY

Transwarranty Finance Q4 Results Live : Transwarranty Finance declared their Q4 results on 02 May, 2024. The topline increased by 166.66% & the profit came at ₹2.73cr.

It is noteworthy that Transwarranty Finance had declared a loss of ₹6cr in the previous fiscal year in the same period.

As compared to the previous quarter, the revenue grew by 68.98%.

The Selling, general & administrative expenses rose by 12.53% q-o-q & increased by 13.69% Y-o-Y.

The operating income was up by 7726.27% q-o-q & increased by 154.53% Y-o-Y.

The EPS is ₹0.98 for Q4, which increased by 148.87% Y-o-Y.

Transwarranty Finance has delivered 0% return in the last 1 week, 24.19% return in the last 6 months, and -6.85% YTD return.

Currently, Transwarranty Finance has a market cap of ₹56.46 Cr and 52wk high/low of ₹15.5 & ₹8.25 respectively.

| Period | Q4 | Q3 | Q-o-Q Growth | Q4 | Y-o-Y Growth |

|---|---|---|---|---|---|

| Total Revenue | 5.12 | 3.03 | +68.98% | 1.92 | +166.66% |

| Selling/ General/ Admin Expenses Total | 1.16 | 1.03 | +12.53% | 1.02 | +13.69% |

| Depreciation/ Amortization | 0.13 | 0.12 | +9.2% | 0.12 | +1.13% |

| Total Operating Expense | 2.42 | 3.07 | -21% | 6.87 | -64.74% |

| Operating Income | 2.7 | -0.04 | +7726.27% | -4.95 | +154.53% |

| Net Income Before Taxes | 2.73 | -0.36 | +862.66% | -6.01 | +145.33% |

| Net Income | 2.73 | -0.36 | +863.53% | -6 | +145.44% |

| Diluted Normalized EPS | 0.98 | -0.07 | +1500% | -2.01 | +148.87% |

FAQs

Question : What is the Q4 profit/Loss as per company?

Ans : ₹2.73Cr

Question : What is Q4 revenue?

Ans : ₹5.12Cr

Stay updated on quarterly results with our results calendar

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 02:36 AM IST

Finance

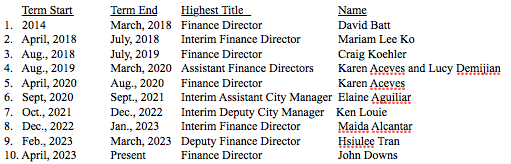

New Interim Finance Director Deal in the Works | South Pasadena Finance Dept. Pushing Through | The South Pasadenan | South Pasadena News

Scott Miller, a retired municipal finance official with four decades in the field, is being considered to serve as South Pasadena’s new finance director on an interim basis, the South Pasadenan News has learned.

Although an agreement has not been signed or finalized, “we are working on it,” said Luis Frausto, Acting Deputy City Manager.

Miller would become the tenth person to manage the city’s volatile finance department since the departure of David Batt in March of 2018.

CITY OF SOUTH PASADENA FINANCE DEPARTMENT PAST DIRECTORS

The news comes shortly after the city confirmed outgoing Finance Director John Downs, who told the city last month he would retire May 2, has been persuaded to stay on “in a limited term capacity to assist with finalizing the fiscal year 2024-2025 budget,” Frausto said. Downs’ “role will transition from managing daily finance operations to focusing on specific projects, with the budget being his primary responsibility. We expect his contributions to extend at least through June.”

The city is currently scheduled to adopt the new budget June 5—a target that is looking increasingly less certain.

According to press reports, Miller was chief financial officer at the city of Beverly Hills for seven years through 2015, where he was credited with helping secure high ratings for the city from the three major credit rating agencies.

Miller then worked briefly as chief finance officer for Broward County, Florida and then with Urban Futures Inc., a local government service agency in California. In March 2016, he became interim chief financial officer for the city of Riverside, initially under a short term contract. Although he became a Riverside employee in early 2017, he left several months later. At the time, a Riverside city spokesman told a local publication he could not say if Miller’s departure from Riverside was a mutual decision.

Prior to joining Beverly Hills, Miller was employed by the city of Palm Desert, the city and county of San Francisco, the University of California–Berkeley and Turner Broadcasting System. He graduated from San Diego State University with a BA in psychology and minor in business administration and he holds a PhD in public administration from Arizona State University.

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Movie Reviews1 week ago

Movie Reviews1 week agoCity Hunter (2024) – Movie Review | Japanese Netflix genre-mix Heaven of Horror

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

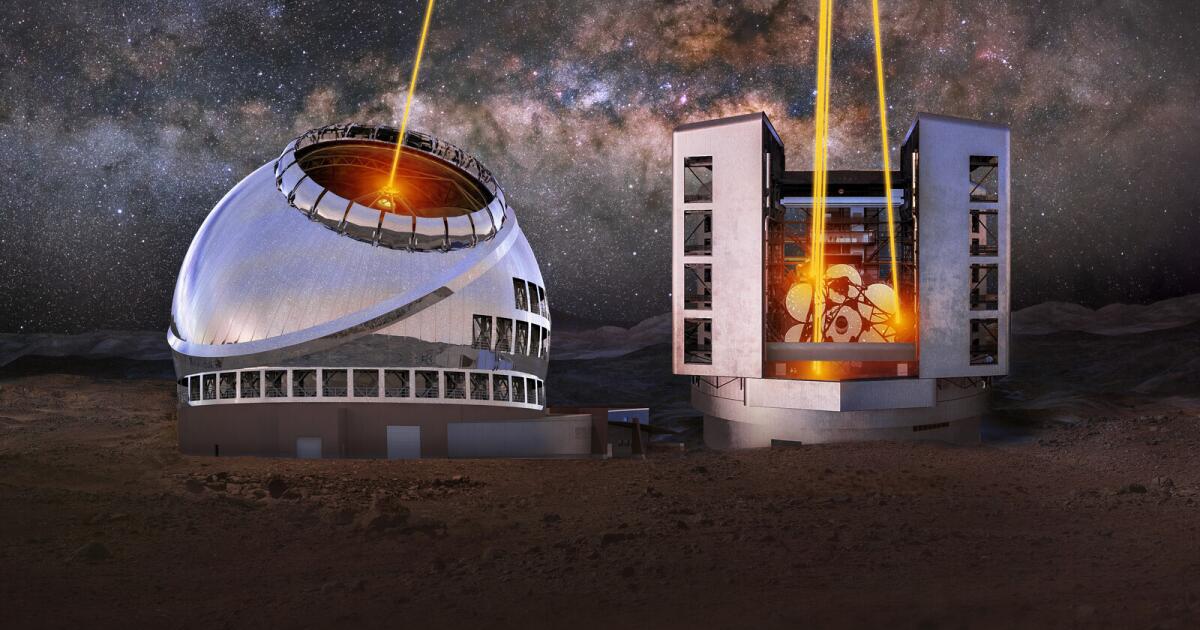

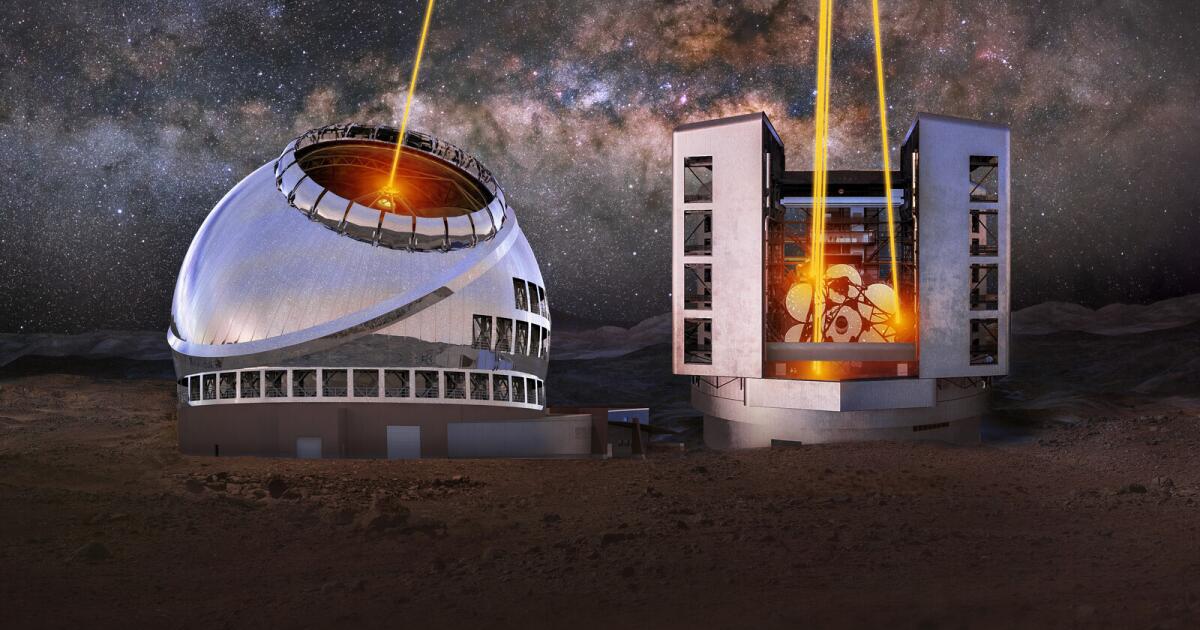

Science1 week ago

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes