Finance

Finance for Biodiversity updates nature target-setting framework for investors

The Finance for Biodiversity (FfB) Foundation has launched an updated version of its nature target-setting framework for asset managers and asset owners.

Developed with FfB members, the guidance follows a beta version released in November, and seeks to help investors align financial flows with the Kunming-Montreal Global Biodiversity Framework to halt and reverse biodiversity loss by 2030.

The Finance for Biodiversity Pledge was launched in 2020 and boasts 177 signatories, including Amundi, Fidelity International, Legal & General Investment Management and Federated Hermes. Signatories commit to collaborate, engage, set targets and report on biodiversity before 2025.

In 2021, the FfB Foundation was set up to “support a call to action and collaboration between financial institutions via working groups as a connecting body for contributing signatories and partner organisations”.

Financial institutions that have signed the pledge can become members of the foundation if they want to be active in the working groups. There are currently 76 members.

Among the updates to Wednesday’s document surround the types of nature targets for investors to set.

Target reshuffle

The beta version outlined four types of targets: initiation, sector, engagement and portfolio coverage.

The latest guidance proposes three types: initiation targets, optional monitoring targets and portfolio targets.

The initiation targets would still see investors committing to assessing and disclosing their exposure to nature-related impacts, dependencies, risks and opportunities in line with the Taskforce on Nature-related Financial Disclosures recommendations.

It also recommends setting targets on governance. For example, an investor could commit to ensuring board or executive-level oversight of the management of nature-related factors by a certain year.

Turning to the optional monitoring targets, these are designed to ensure investors monitor sector-relevant KPIs “across priority sectors and implement stewardship actions to address the identified key impact drivers on nature”.

An example of a monitoring target would be the percentage of companies with a deforestation and conversion-free policy, while a stewardship action could see the investor determine the engagement universe of companies to target on nature.

Finally, for the portfolio targets the Foundation suggests a two-pronged approach: setting portfolio sub-targets, as well as stewardship sub-targets.

An example of a sub-portfolio target could be that by 2030 a percentage of firms from relevant sectors will have committed to implement a validated Science-Based Target for Nature.

A stewardship sub-target could see an investor commit to engaging with a certain number of companies per year on each of the relevant pressures on nature.

“The portfolio and stewardship sub-targets are complementary and indissociable as the latter is the lever through which the investor will influence companies to reduce their pressures on nature thereby achieving the required reduction to meet KPI thresholds,” according to the document.

Unified approach

Another key change since the beta version is the removal of beginner and advanced tracks, which had different timelines for achieving targets.

Instead, the foundation now advocates for a unified approach to applying these targets over time.

“This adjustment ensures that all targets are set to be achieved by 2030, in alignment with the GBF’s mission to halt and reverse biodiversity loss. However, investors retain the flexibility to target shorter timeframes according to their specific goals,” it said.

Currently the framework remains limited to listed equity and corporate bonds – additional asset classes, including sovereign debt, will be integrated into the guidance in future iterations.

The foundation said it is also planning to create guidance on how to set positive impact targets.

ENCORE update

In related news, the ENCORE nature tool has had a major update.

Launched in 2018 to help financial institutions and companies understand how their activities rely on nature, ENCORE is a collaboration between Global Canopy, the UNEP Finance Initiative, and the UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC).

Previous updates included in 2019 when its functionality was extended to enable institutions to also assess their impacts on nature.

One of the latest expansions is growing its previous list of 92 “production processes” to 271 “economic activities”.

These economic activities, ranging from livestock farming to the manufacture of chemicals and nuclear power production, “offer a more detailed breakdown on economic sectors”.

It has also added information on key value chain links, covering two tiers of suppliers and two tiers of consumers for each economic activity, “enabling users to see their indirect nature-related impacts and dependencies”.

“The release of an enhanced ENCORE methodological structure and knowledge base is more than just a procedural update,” said Neville Ash, director of UNEP-WCMC.

“The improvements come in response to pioneering users’ appetite to better understand how nature underpins their operations, and we encourage the business and financial community to use the tool to drive their decision-making towards a sustainable future – for economies, consumers and the planet.”

Finance

Audit finds significant financial mismanagement at Eagle River recreation center

Municipal inspectors looking into accounting practices at a popular recreation facility in Eagle River found “deficiencies in recordkeeping and numerous inconsistencies within their financial records” during recent years.

The Anchorage Police Department confirmed there is an investigation connected with the facility, but declined to provide further details, citing the ongoing nature of the case.

Anchorage’s Office of Internal Audit released its report on the Harry J. McDonald Memorial Center on Dec. 31, 2025.

The facility, often referred to as the Mac Center, is owned by the Municipality of Anchorage, but run by a nonprofit, the Fire Lake Arena Management Inc., under the terms of a contract. Originally built in 1983, the McDonald Center has an Olympic-size ice rink, indoor walking track and large turf field, as well as meeting rooms.

The municipality routinely audits various departments, offices and facilities as part of its oversight of public resources. A previous audit of the McDonald Center in 2017 reported instances of financial mismanagement and accounting errors. A 2023 audit of the same facility found that the contract between the municipality and the nonprofit tasked with running it had lapsed, and as such, investigators couldn’t determine whether or not its terms were being observed.

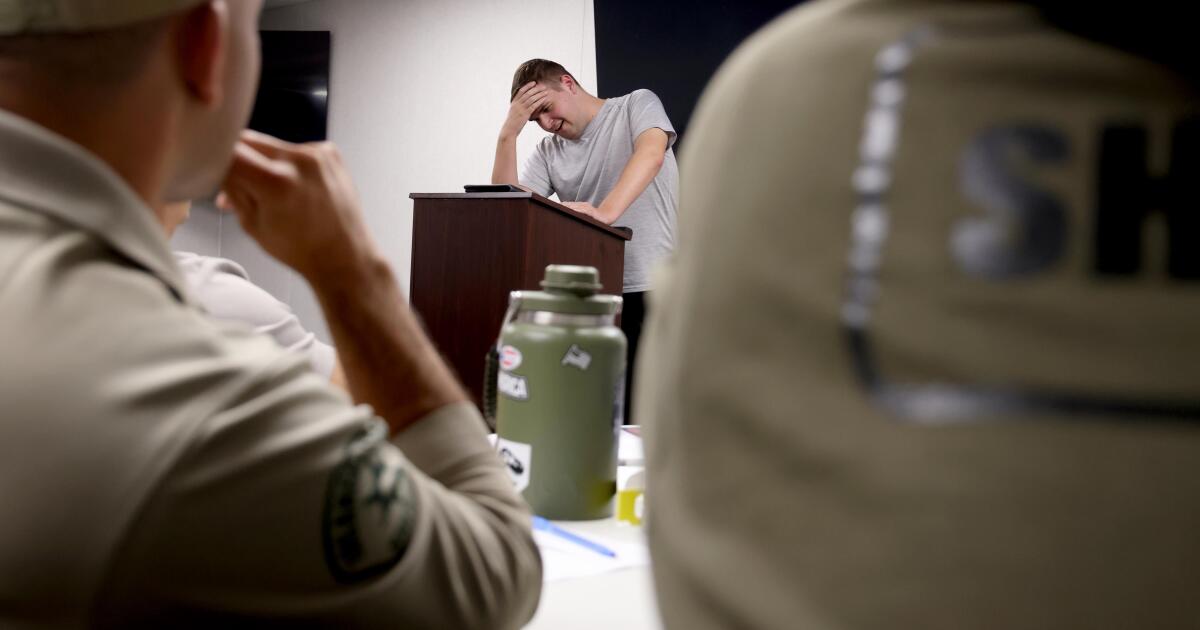

Even before the latest audit began in 2025, Yoshiko Flanagan, the facility’s current general manager, said she alerted the city about “abuses” she spotted when she began working there as a part-time bookkeeper at the end of 2023.

“Honestly, when I first came in, it was a mess,” Flanagan said in an interview last week. “Lotta red flags.”

Upon raising the issue to Mike Braniff, then the head of the Department of Parks and Recreation, staff immediately took it seriously, Flanagan said.

When city inspectors looked into the facility’s financial records, they found a number of irregularities, shoddy practices and probable misconduct that have all made a comprehensive audit of recent fiscal years impossible, according to the report.

“When we started our review, we were provided the financial records in several file boxes,” wrote auditor Kevin Song in the final report. Files were mislabeled, missing or incomplete for a time period stretching from 2021 to 2025, he noted.

There were other problematic findings. Auditors were told by current staff that the former head of the McDonald Center “had privately re-registered the accounting system under their personal account, preventing the current management access to records prior to 2024.”

“The Center’s management informed us of a pending investigation involving a former employee related to alleged misappropriation of resources. The allegations include irregularities in payroll, corporate card expenditures, misuse of funds from facility-hosted events, and reregistering the financial system under their own personal account to manipulate data. A police report was filed, and the investigation is ongoing,” Song wrote in the audit.

According to figures cited in the audit and submitted to police, “the total potential financial impact was estimated to be $18,822.64 when it was reported; however, the exact amount remains unconfirmed pending the outcome of the investigation.”

In response to questions about the investigation, APD spokesperson Gina Romero declined to name the former employee, given that charges have not been filed and the case is ongoing.

One section of the audit details bonuses being paid out to employees even as the McDonald Center was operating in the red.

“In 2024, $8,600 in bonuses were paid to full-time employees despite reporting $90,025.41 over the salary/wage budget and ending the year at a loss of $67,687.87,” according to the audit. “In 2023, the total amount of bonuses was $10,100.”

Elsewhere, investigators found that expenses had been filed for things never approved by overseers on the Fire Lake Arena Management Inc. board in the center’s submitted budgets, including $5,893 one year for “vacation expenses for employees” and $7,000 in “moving expenses.”

“Our review found no justification provided for such expenses,” auditors wrote.

According to Flanagan, under her tenure as general manager at the facility, those sloppy accounting practices have since been replaced with standard industry measures bringing the facility into compliance with its contract terms.

“When I did come in, yes, it was very mom-and-pop, (revenue was) handled very irregularly,” she said.

She attributes some of the issues to the COVID-19 pandemic: The McDonald Center was navigating closures, loss of institutional knowledge among longtime staff and eventually an expansion in services quickly outgrew the old ways of doing things, creating opportunities for misconduct and mismanagement.

“There’s been a big turnaround,” Flanagan said, noting that after in 2024, under the previous general manager, the center ended its year with a deficit around $66,000. Last year, during which she was in charge, the McDonald Center was solidly above its revenue target.

A separate 2021 audit reported a “culture of excess” in procurement and spending practices at the Eagle River/Chugiak Parks and Recreation Division, a distinct entity under the municipality’s larger Parks and Rec Department that technically has oversight over the McDonald Center.

Finance

Blue Shield of California Appoints Veteran Finance Leader Kevin Jacobsen to Board of Directors

OAKLAND, Calif., Feb. 23, 2026 /PRNewswire/ — Blue Shield of California today announced the appointment of Kevin Jacobsen, former Chief Financial Officer (CFO) of The Clorox Company, to the nonprofit health plan’s Board of Directors. Jacobsen brings more than three decades of financial and operational leadership experience across global organizations.

During his seven years as CFO at Clorox, he oversaw financial reporting and controls, enterprise risk management, tax, treasury, internal audit, investor relations, global business services, and mergers and acquisitions.

Kevin Jacobsen to its Board of Directors

“Kevin is a deeply respected financial leader with firsthand experience guiding organizations through major operational and digital transformation,” said Pamela DeCoste, Board Chair for Blue Shield of California. “His ability to navigate complexity while keeping a long‑term view will be invaluable to Blue Shield of California as we continue to modernize healthcare delivery and further strengthen our goal to create a healthcare system that’s worthy of our family and friends and sustainably affordable.”

As a member of Clorox’s executive team, Jacobsen was a coarchitect of the company’s multiyear IGNITE transformation strategy, focused on strengthening operations, advancing digital capabilities, evolving the portfolio and significantly expanding innovation. As part of this role, Kevin oversaw the implementation of Clorox’s global ERP financial reporting and controls and financial planning modules, enhancing enterprise-wide processes and operational efficiency. He also led the creation of a Global Business Services organization designed to deliver productivity savings while improving business outcomes through advanced technology.

Jacobsen brings extensive board and governance experience. In addition to Blue Shield of California’s Board of Directors, he serves on the board of Avista Corporation, where he is a member of the Audit, Operations and Technology Committees. He is a Qualified Financial Expert and has served in leadership roles including Chair of the Board of the Clorox Captive Insurance Company from 2021 to 2025. He was also a prior member of the Economic Advisory Council of the San Francisco Federal Reserve from 2022 through 2024.

“Blue Shield’s mission and values resonate deeply with me, particularly its commitment to affordability, transparency and improving the healthcare system for all Californians,” said Jacobsen. “I’m honored to join the Blue Shield of California Board of Directors, and I look forward to contributing my experience to support the nonprofit health plan’s mission to provide access to quality health care that’s sustainably affordable for everyone.”

Jacobsen holds an MBA from the University of Rochester, completed the Wharton Executive Education Program and earned a finance degree from the University of California, Riverside.

About Blue Shield of California

Blue Shield of California strives to create a healthcare system worthy of its family and friends that is sustainably affordable. The health plan is a taxpaying, nonprofit, independent member of the Blue Shield Association with 6 million members, over 6,500 employees and more than $27 billion in annual revenue. Founded in 1939 in San Francisco and now headquartered in Oakland, Blue Shield of California and its affiliates provide health, dental, vision, Medicaid and Medicare healthcare service plans in California. The company has contributed more than $60 million to the Blue Shield of California Foundation in the last three years to have an impact on California communities. For more news about Blue Shield of California, please visit news.blueshieldca.com. Or follow us on LinkedIn or Facebook.

For more news about Blue Shield of California, please visit news.blueshieldca.com. Or follow us on LinkedIn or Facebook.

SOURCE Blue Shield of California

Finance

My quest for an affordable summer camp without sacrificing my savings

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The year has barely started, and my kindergarten parents group chat is already buzzing with summer camp anxiety. Registrations are opening and spots fill fast.

I’ve been doing research and here’s what I’ve learned: Camps aren’t cheap. But there are creative ways to work camp into your spending plan, this year and next.

The cost of summer camp

For many families with school-aged kids like mine, summer camps are a necessity. Schools are out and many parents work full-time. Summer camps fill an important child care gap.

But even for parents who are high earners, paying for camps can be a shocking expense. If you have more than one kid, paying for camp can seem almost impossible.

Affordable options do exist, says Henry DeHart, CEO of the American Camp Association, which oversees a national accreditation program for camp health and safety.

“There is a quality camp in your community at a price point that will work for you,” DeHart says.

Summer camp prices can differ widely. Costs are often driven by how long a camp runs, whether it’s a day or overnight program, and the activities offered. Specialty camps — such as those focused on horseback riding, boating or STEM — tend to cost more because they require additional staff, equipment or materials.

It’s also hard to pin down an average camp price because there are so many options.

“There are at least 20,000 camps out there,” DeHart says.

Like many services, camp prices have increased in recent years due to inflation. Staffing and food costs are higher, so camper tuitions are often higher, too, DeHart says.

I found a half-day dance camp at a local high school for $225 a week and a full-day KPop Demon Hunters camp for $555 a week. The vacation Bible school at the church up the street only charges $10 for the week for a half-day, which is also on my radar.

Costs start to add up quickly.

How to build camp into your budget

Start planning now

Even if you feel like you are late to the game, there are still early registration discounts available and time to start setting aside money before summer begins.

If you don’t know where to start, the American Camp Association’s “Find a Camp” tool can help narrow your search. Depending on the camp, you might be able to pay any registration fees now, and tuition later — or in installments over time.

Waiting until closer to summer to look for camps can be costly. You may miss discounts, find top-choice camps are full and end up paying more for options that don’t meet your needs — such as limited programming, inconvenient locations or camps without safety certifications.

Break camp costs into monthly payments

For next year, you can plan ahead. Treat camp like a seasonal fixed expense that you account for in your budget every month, similar to a mortgage payment or utility bill. You can create a sinking fund just for camp costs.

If your total camp costs for June add up to $1,200, starting in September will give you roughly 10 months to save about $120 a month. That cushion can help cover early registration fees in winter or spring, while you continue saving for the remaining tuition.

“Saving money automatically before it hits your checking account is a good strategy,” says Carolyn McClanahan, a certified financial planner in Jacksonville, Florida. “Small amounts add up, and having money saved is much less expensive than high credit card payments.”

This year, if your budget for camp feels tight, McClanahan suggests looking around the house. “Consider selling items you don’t need or want,” she says. “Have a garage sale, take items to a consignment store, or sell items online. It is a hassle, but is a good way to raise money without going into debt.”

Offset costs by cutting back elsewhere

Look for costs that naturally go away or shrink during the summer. Can you redirect your aftercare costs into camp savings? Do you scale back or pause extracurricular activities that only run during the school year, such as sports, music lessons or clubs? Use that money to help cover camp costs.

“Think about spending that isn’t bringing you or your child much value, such as unused subscriptions or easy ‘click’ spending on Amazon,” McClanahan says.

Even small shifts can help. Our son’s half day preschool isn’t open during the summer, so we can redirect his tuition to help us cover any camp costs for my daughter.

But some tradeoffs matter more than others, especially when it comes to long-term savings.

“If you have to cut back on savings to pay for camp, always make sure you are saving enough to at least get your 401(k) and HSA match at work because you can never get that money back,” says McClanahan.

Mix high- and low-cost camps

If you need to cobble together multiple camps to get through the summer, consider splurging on your top pick and supplementing with cheaper options, perhaps through local churches, YMCAs, or city or county programs.

Use your dependent care FSA, if you have one

If you have a dependent care flexible spending account, you can use those pretax dollars to pay for eligible summer camp expenses. If you don’t have one but your employer offers them, you can look into signing up next year, which can also lower your tax bill.

For example, if you contribute $2,000 into a dependent care FSA and use it to reimburse summer camp costs, you could save roughly $400-$600 in taxes, depending on your tax bracket. Overnight camps will probably not apply, so check the eligibility.

Plan for hidden costs

Getting your child to and from camp can add to the total cost. This may include daily driving expenses or airfare if the camp is in another state.

Some camps also offer extended hours — such as drop-off before camp starts or pickup after it ends — for an additional fee. On top of that, supplies, field trips and lunches or snacks can increase your costs.

“Coordinating with other parents attending the same camp makes it easy to set up carpools and even share afternoon care, so you can skip some of the costly add-ons,” says Kimberly Palmer, a personal finance expert at NerdWallet.

How camps help families manage costs

There are traditional ways to get help with camp costs, like scholarships and grants offered directly by the camps themselves or through foundations and community organizations, like churches.

Camp directors are also getting more creative with financial assistance.

“There are all sorts of programs built in to help camps be affordable,” DeHart says. “There’s early registration discounts and sibling discounts.”

Referral fees are also popular. Some camps offer discounts if you can get one or two friends or family members to sign up for camp, too.

Some camps offer community service discounts for families working in public service, teachers, nurses, first responders, clergy and members of the military, DeHart says.

Not all forms of financial aid and discounts are advertised, Palmer says, so reach out to the camp’s director.

“If you have a preteen, consider asking if they can serve as a counselor in training for a discount,” Palmer says. “They might be able to earn volunteer hours as well as valuable experience, while saving you money.”

Benefits of summer camp beyond child care

Adding camp as a line item in your monthly budget can feel overwhelming. It’s another expense competing with emergency funds, retirement investing and college savings. But a quality program can offer experiences that are hard to replicate at home, DeHart says.

Your money isn’t just paying for adult supervision. It’s paying for enrichment. Many camps are no- or low-tech, giving kids a chance to unplug.

“It’s time away from social media. It’s time doing face-to-face relationships. It’s time outdoors, being active,” DeHart says. “You know, all these things that parents want.”

My daughter is still young, but going through summer camp sign-ups has made me think about the experiences I want her to have — and how to plan for them.

I ended up picking a few lower-cost camps. Still, I did jot down a few highly recommended camps and feel more confident about asking for creative payment solutions.

I just pulled up my bank app and moved $75 into a high-yield “camp fund.”

Better start preparing for next year.

-

Montana4 days ago

Montana4 days ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Oklahoma6 days ago

Oklahoma6 days agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Technology3 days ago

Technology3 days agoYouTube TV billing scam emails are hitting inboxes

-

Education1 week ago

Education1 week agoVideo: Secret New York City Passage Linked to Underground Railroad

-

Technology3 days ago

Technology3 days agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoChicago-area teacher breaks silence after losing job over 2-word Facebook post supporting ICE: ‘Devastating’

-

Politics3 days ago

Politics3 days agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT

-

News3 days ago

News3 days agoWorld reacts as US top court limits Trump’s tariff powers