Finance

EU Seeks Input From Small Businesses On ESG And Green Financing

European union flag against parliament in Brussels, Belgium

Green finance and environmental, social and governance are the focus of a new survey organized by SMEunited and Eurochambres. The collected data will be used by the Platform on Sustainable Finance, an advisory body established by the European Commission to assess the European Union’s sustainable finance policies. While a survey conducted by members of an advisory group may not seem noteworthy, it indicates a broader movement in the development of sustainability and ESG.

ESG is a type of financial investing where non-financial factors are considered. Most of the controversy relating to ESG is under the social category, where companies have engaged in policies that some deem to be political and not within the scope of best business practices. However, the environmental category is driving the regulatory development. As ESG reporting standards are being drafted, they are focusing primarily on sustainability efforts by companies.

On a global scale, these efforts generally align with the net zero goals of the Paris Agreement. In the leadup to COP26, the 2021 United Nations Climate Change Conference, an emphasis was added on the funding of green initiatives. That theme continued in 2022’s COP27 and is being renewed as COP28 approaches.

Climate financing is not focused solely on the infrastructure and resilience projects of governments. It also takes into consideration sustainable investments of businesses. As the business sector priorities environmentally friendly policies, the availability of financing for those projects is gaining importance. There are also calls for a realignment of priorities of major lending organizations to dedicate more funding towards environmental projects, therefore reducing available funding for other projects.

Focus on this area will continue to increase as ESG reporting becomes standardized, requiring companies to document their sustainability actions. The development of global ESG reporting standards is currently focused on publicly traded companies. However, the European Union will eventually require small, privately held companies to participate in reporting. The Platform on Sustainable Finance’s SME Questionnaire on Sustainable Finance is clearly a precursor to those requirements. As the European Union is leading the development of ESG reporting standards, American companies should take note of their processes as they may soon be applied to the U.S.

Finance

Crow Wing County is nationally recognized for financial reporting

BRAINERD — For the 10th consecutive year, Crow Wing County was awarded the Certificate of Achievement for Excellence in Financial Reporting and the Award for Outstanding Achievement in Popular Financial Reporting.

The Certificate of Achievement is the highest form of recognition in the area of governmental and financial reporting. The honor is given out by the Government Finance Officers Association of the United States and Canada.

The Certificate for Excellence in Financial Reporting was awarded to Crow Wing County for its 2022 Comprehensive Annual Financial Report compiled in 2023.

The award represents a significant accomplishment by a government and its management, the county noted in a news release.

“This is a testament to the type of work that is being done in our Finance Department,” said Finance Director Nancy Malecha. “This award recognizes our commitment in ensuring that our financial data and information is reported accurately, timely and provides transparency that the taxpayers of Crow Wing County deserve.”

Crow Wing County is one of only 16 counties in Minnesota to have earned this award.

The Award for Outstanding Achievement in Popular Financial Reporting was awarded to Crow Wing County for its 2022 Popular Annual Financial Report.

The annual report extracts information from the Comprehensive Annual Financial Report and summarizes the financial position of the county in a simple, easy to read format. Crow Wing County is one of five counties in Minnesota that have received the national award.

Financial reports are available on the Crow Wing County website at

www.crowwing.gov/771/Financial-Statements

.

Finance

Tata Motors’ subsidiaries – TPEM and TMPV join hands with Bajaj Finance, offers financing program for authorized passenger and electric vehicle dealers – Tata Motors

Press release -

May 20, 2024

Tata Motors’ subsidiaries – TPEM and TMPV join hands with Bajaj Finance, offers financing program for authorized passenger and electric vehicle dealers

Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) join hands with Bajaj Finance to offer financing program for authorized passenger and electric vehicle dealers. In the image, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd. at the MoU signing in Mumbai.

In a bid to improve options and ease of financing for the dealers, Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) – subsidiaries of Tata Motors, India’s leading automotive manufacturer, have joined hands with Bajaj Finance, part of Bajaj Finserv Ltd., one of India’s leading and most diversified financial services groups, to extend supply chain finance solutions to its passenger and electric vehicle dealers. Through this memorandum of understanding (MoU), the participating companies will come together to leverage Bajaj Finance’s wide reach to help dealers of TMPV and TPEM access funding with minimal collateral.

The MoU for this partnership was signed by Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd.

Commenting on the partnership, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd., said, “Our dealer partners are integral to our business, and we are happy to actively work towards solutions to help them in ease of doing business. Together, we aim to further grow the market and offer our New Forever portfolio to an increasing set of customers. To that effect, we are excited to partner with Bajaj Finance for this financing program, which will further strengthen the access of our dealer partners to increased working capital.”

Speaking on this partnership, Mr. Anup Saha, Deputy Managing Director, Bajaj Finance Ltd, said, “At Bajaj Finance, we have always strived to provide best-in-class processes by using the India stack for financing solutions that empower both individuals and businesses. Through this financing program, we will arm TMPV and TPEM’s authorized passenger and electric vehicle dealers with financial capital, which will enable them to seize the opportunities offered by a growing passenger vehicles market. We are confident that this collaboration will not only benefit dealers but also contribute to, and enhance the growth of, the automotive industry in India.”

TMPV and TPEM have been pioneering the Indian automotive market with its groundbreaking efforts it both ICE and EV segments. The company’s overarching New Forever philosophy has led to the introduction of segment leading products which are being appreciated by consumers at large.

Bajaj Finance is one of the most diversified NBFCs in India with presence across lending, deposits and payments, serving over 83.64 million customers. As of March 31, 2024, the company’s assets under management stood at ₹3,30,615 crore.

Media Contact Information: Tata Motors Corporate Communications: [email protected] / 91 22-66657613 / www.tatamotors.com

Finance

Drive Finance announces EGP 1.4bn securitisation bond issuance – Dailynewsegypt

Drive Finance, a GB Capital subsidiary and part of GB Corp’s financial division, has closed its fifth securitisation bond issuance, valued at EGP 1.4bn. This marks the second issuance under Capital Securitization’s fifth program, which aims for a total of EGP 5bn.

Following the previous issuance in December, this latest development highlights the company’s portfolio growth and investor confidence.

Ahmed Osama, Managing Director of Drive Finance, welcomed the robust investor response, noting that interest surpassed the issuance amount twofold. “This enthusiasm underscores our strong market position and our sustained creditworthiness amidst economic challenges,” he remarked.

Remon Gaber, Drive Finance’s Treasury Head, took pride in the issuance’s success, attributing it to the strategic diversification of funding sources. This approach has bolstered the company’s objectives, broadened its financing services, and extended its market presence, thereby boosting its share in consumer finance and factoring sectors.

The issuance comprised three tranches:

- First Tranche: EGP 546.8m, 13-month term, AA+(sf) rating.

- Second Tranche: EGP 644.9m, 36-month term, AA(sf) rating.

- Third Tranche: EGP 210.3m, 58-month term, A(sf) rating.

Commercial International Bank (CIB) played a pivotal role as the financial advisor, manager, arranger, and promoter. Arab African International Bank was the custodian, underwriter, and subscription handler. Legal advice was provided by the El-Derini Law Office, while Sherif Mansour Dabus–Russell Bedford conducted the audit. Middle East Rating & Investors Service (MERIS) assigned the ratings.

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

Movie Reviews1 week ago

Movie Reviews1 week ago“Kingdom of the Planet of the Apes”: Disney's New Kingdom is Far From Magical (Movie Review)

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region

-

Politics1 week ago

Politics1 week agoTales from the trail: The blue states Trump eyes to turn red in November

-

World1 week ago

World1 week agoBorrell: Spain, Ireland and others could recognise Palestine on 21 May

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement

-

Politics1 week ago

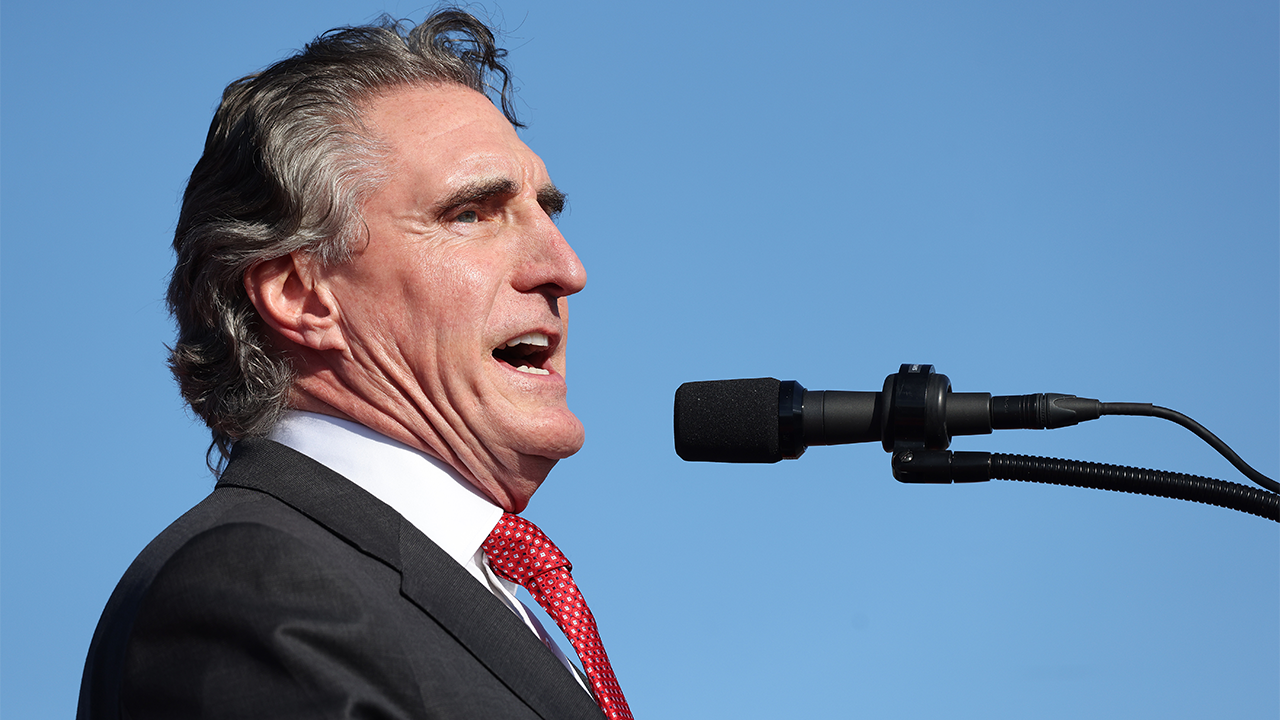

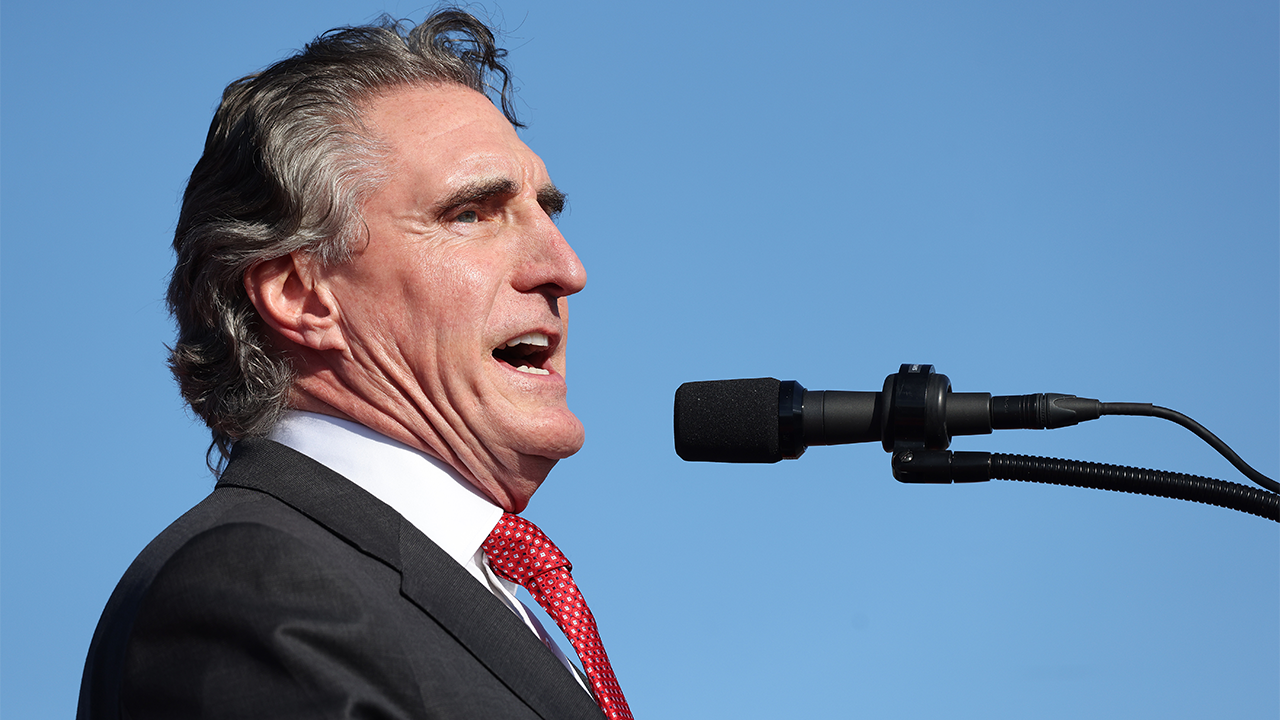

Politics1 week agoNorth Dakota gov, former presidential candidate Doug Burgum front and center at Trump New Jersey rally