Finance

Egypt fintech firm MNT-Halan securing $400 million in new finance

CAIRO, Feb 1(Reuters) – Egyptian microfinance lending and funds firm MNT-Halan is securing $400 million in new fairness and finance, bringing its valuation to greater than $1 billion, the corporate mentioned in a press release on Wednesday.

The investments embrace an fairness stake of a minimum of 20% of MNT-Halan price greater than $200 million taken by personal fairness agency Chimera Abu Dhabi. One other $60 million in major capital is being secured from worldwide buyers, the assertion mentioned.

These buyers embrace the Worldwide Finance Company (IFC), in accordance with information on the IFC’s web site.

MNT-Halan obtained $140 million in financing by securitising a part of its mortgage e-book, the assertion mentioned.

MNT-Halan gives small- and micro-business lending, funds, shopper finance and e-commerce, the corporate mentioned. It has greater than 5 million clients in Egypt, of which 3.5 million are monetary shoppers and a pair of million are debtors. About 1.3 million of the purchasers are energetic month-to-month.

Newest Updates

View 2 extra tales

New laws and regulatory adjustments in Egypt, the Arab world’s most populous nation, have been serving to entice a surge in new fintech investments and alter the way in which the nation’s largely unbanked residents do enterprise.

“Following the completion of those investments, MNT-Halan’s valuation will exceed $1 billion,” the assertion added.

Earlier buyers in MNT-Halan embrace Cairo-based Lorax Capital Companions, and Center Japanese enterprise capitalists Algebra Ventures, DisrupTech, Endeavor Catalyst, Egypt Ventures, MEVP and Wamda.

Reporting by Patrick Werr. Enhancing by Gerry Doyle

Our Requirements: The Thomson Reuters Belief Ideas.

Finance

New Interim Finance Director Deal in the Works | South Pasadena Finance Dept. Pushing Through | The South Pasadenan | South Pasadena News

Scott Miller, a retired municipal finance official with four decades in the field, is being considered to serve as South Pasadena’s new finance director on an interim basis, the South Pasadenan News has learned.

Although an agreement has not been signed or finalized, “we are working on it,” said Luis Frausto, Acting Deputy City Manager.

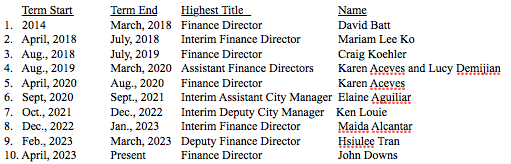

Miller would become the tenth person to manage the city’s volatile finance department since the departure of David Batt in March of 2018.

CITY OF SOUTH PASADENA FINANCE DEPARTMENT PAST DIRECTORS

The news comes shortly after the city confirmed outgoing Finance Director John Downs, who told the city last month he would retire May 2, has been persuaded to stay on “in a limited term capacity to assist with finalizing the fiscal year 2024-2025 budget,” Frausto said. Downs’ “role will transition from managing daily finance operations to focusing on specific projects, with the budget being his primary responsibility. We expect his contributions to extend at least through June.”

The city is currently scheduled to adopt the new budget June 5—a target that is looking increasingly less certain.

According to press reports, Miller was chief financial officer at the city of Beverly Hills for seven years through 2015, where he was credited with helping secure high ratings for the city from the three major credit rating agencies.

Miller then worked briefly as chief finance officer for Broward County, Florida and then with Urban Futures Inc., a local government service agency in California. In March 2016, he became interim chief financial officer for the city of Riverside, initially under a short term contract. Although he became a Riverside employee in early 2017, he left several months later. At the time, a Riverside city spokesman told a local publication he could not say if Miller’s departure from Riverside was a mutual decision.

Prior to joining Beverly Hills, Miller was employed by the city of Palm Desert, the city and county of San Francisco, the University of California–Berkeley and Turner Broadcasting System. He graduated from San Diego State University with a BA in psychology and minor in business administration and he holds a PhD in public administration from Arizona State University.

Finance

Finance Minister Smotrich urges PM Benjamin Netanyahu to kick Turkey out of hostage deal talks

Finance Minister Bezalel Smotrich urged Prime Minister Benjamin Netanyahu to have Turkey removed from the ceasefire talks, in a letter published on Friday.

In the letter, Smotrich stated that he was surprised to have learned that representatives of Israel’s “antisemitic enemy Erdogan” are part of the peace talks, and that “Erdogan should be canceled, and any discussion or ties should be boycotted.”

To back his argument, Smotrich noted that Turkish President Recep Tayyip Erdogan has helped the spread of antisemitism and the hatred of Israel. Turkey joined the legal case against Israel at the International Court of Justice in Hague, and has cut financial ties with Israel. He also noted that the participation of the Turky’s representatives was held in secret from the cabinet.

Peace endangers Israel’s national security

Smotrich further stated the peace talks in Cairo were a “national humiliation,” which harms Israel’s national security and “endangers our existence.” The finance minister claimed that Erdogan had “chosen the terror side of radical Islam” and together with Iran and its proxies, they threaten the peace worldwide.

He then claimed that Turkey’s participation in the peace talks provided Erdogan a form of redemption and international legitimacy, which are a “hard hit” to Israel’s national security.

“For a long time now we have been on a downward slope toward doom,” said the minister in the letter, saying that from feelings of victory, Israel is descending into defeat and surrender under Prime Minister Benjamin Netanyahu’s leadership.

Smotrich ended his letter begging Netanyahu to “stop! Just stop. Before it is too late.” He then asked him to “return Israel to the natural path of unrelenting war against its enemies, of bravery, of national pride and dignity.”

Finance

Japan finance chief sees need for stable forex moves amid weak yen

Japanese Finance Minister Shunichi Suzuki on Friday stressed the need for foreign exchange rates to move stably by reflecting economic fundamentals, saying that excessive fluctuations should be rectified.

Speaking at a press conference during his visit to Georgia, Suzuki declined to comment on whether Japan intervened in the currency market when the yen spiked in a short span of time Wednesday in New York.

Japanese authorities have threatened to take action against excessive volatility in the currency market, with the yen falling sharply against the U.S. dollar.

Japanese Finance Minister Shunichi Suzuki (C) and Bank of Japan Deputy Governor Ryozo Himino (R) give a press conference in Tbilisi on May 3, 2024. (Kyodo)

“Foreign exchange rates should be determined by market forces, reflecting fundamentals. It’s desirable that they move stably,” Suzuki told a press conference in the Georgian capital of Tbilisi on the fringes of meetings related to the Asian Development Bank.

Suzuki added that rapid changes cause negative impacts for households and businesses in making plans. “It may become necessary to smooth out excessive moves,” he said.

Despite market talk of currency interventions by Japanese authorities, Japanese government officials have remained silent, leaving traders in the dark.

“Stealth interventions” are used to make traders jittery and prevent them from making bold moves.

Based on data from the Bank of Japan and market sources, Japan likely spent around 8 trillion yen ($52 billion) this week to step into the market and slow the yen’s decline.

Japanese Finance Minister Shunichi Suzuki (5th from L) and Bank of Japan Deputy Governor Ryozo Himino (4th from L) are among the officials attending a meeting of finance ministers and central bank governors from Japan, China, South Korea and the members of the Association of Southeast Asian Nations in Tbilisi on May 3, 2024. (Kyodo)

The yen, which earlier this week tumbled past 160 to the dollar, has regained some of its strength. It rose to the 151 zone on Friday.

Still, the underlying trend of a weak yen remains intact, reflecting the wide interest rate differential between Japan and the United States.

The BOJ raised interest rates for the first time in 17 years in March, but rapid hikes are not considered likely. The U.S. Federal Reserve, for its part, is now expected to take a longer time before starting to cut interest rates.

Related coverage:

Yen briefly rises to 151 in N.Y. after weak U.S. labor data

Another suspected market intervention likely cost Japan 3 trillion yen

BOJ’s March minutes show no urgency to raise rates further

-

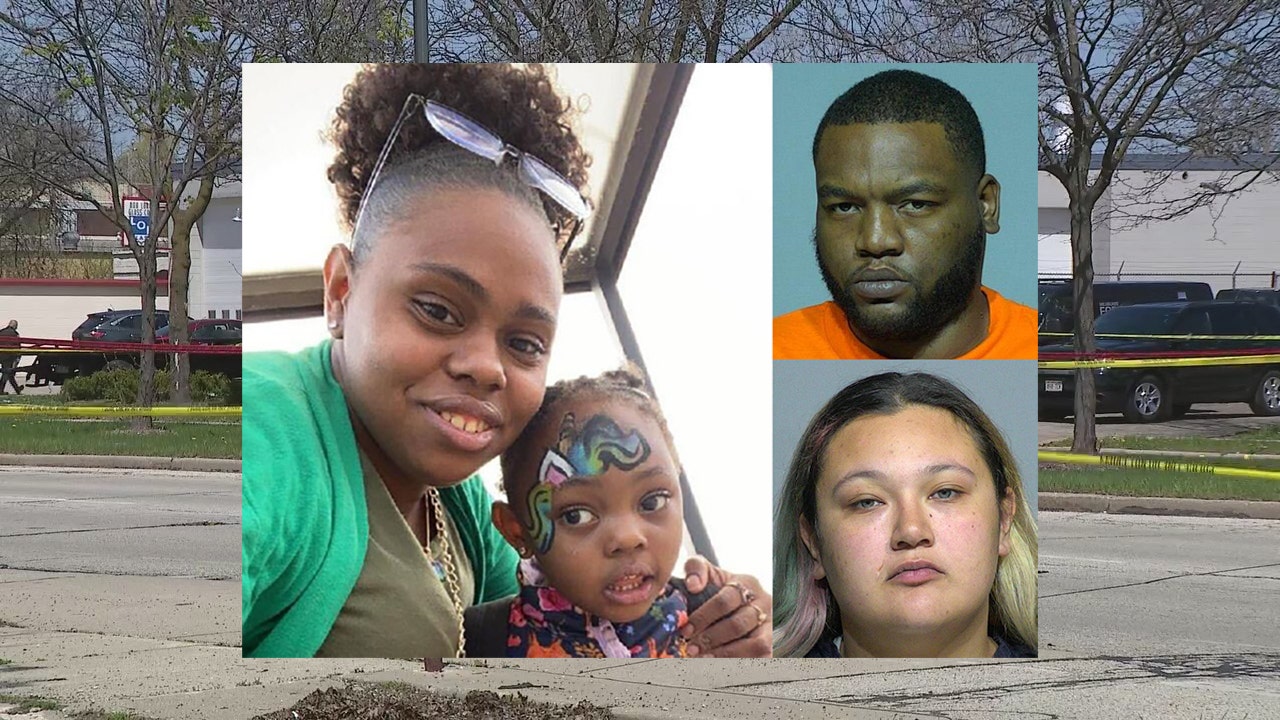

News1 week ago

News1 week agoLarry Webb’s deathbed confession solves 2000 cold case murder of Susan and Natasha Carter, 10, whose remains were found hours after he died

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoSpanish PM Pedro Sanchez suspends public duties to 'reflect'

-

World1 week ago

World1 week agoUS secretly sent long-range ATACMS weapons to Ukraine

-

News1 week ago

News1 week agoAmerican Airlines passenger alleges discrimination over use of first-class restroom

-

Movie Reviews1 week ago

Movie Reviews1 week agoHumane (2024) – Movie Review

-

Education1 week ago

Education1 week agoVideo: Johnson Condemns Pro-Palestinian Protests at Columbia University