Finance

DOJ Will Not Pursue Campaign Finance Charge Against Sam Bankman-Fried

Topline

The Justice Department will not pursue a campaign finance charge against Sam Bankman-Fried as part of an effort to adhere to the legal obligations of the FTX founder’s extradition from the Bahamas.

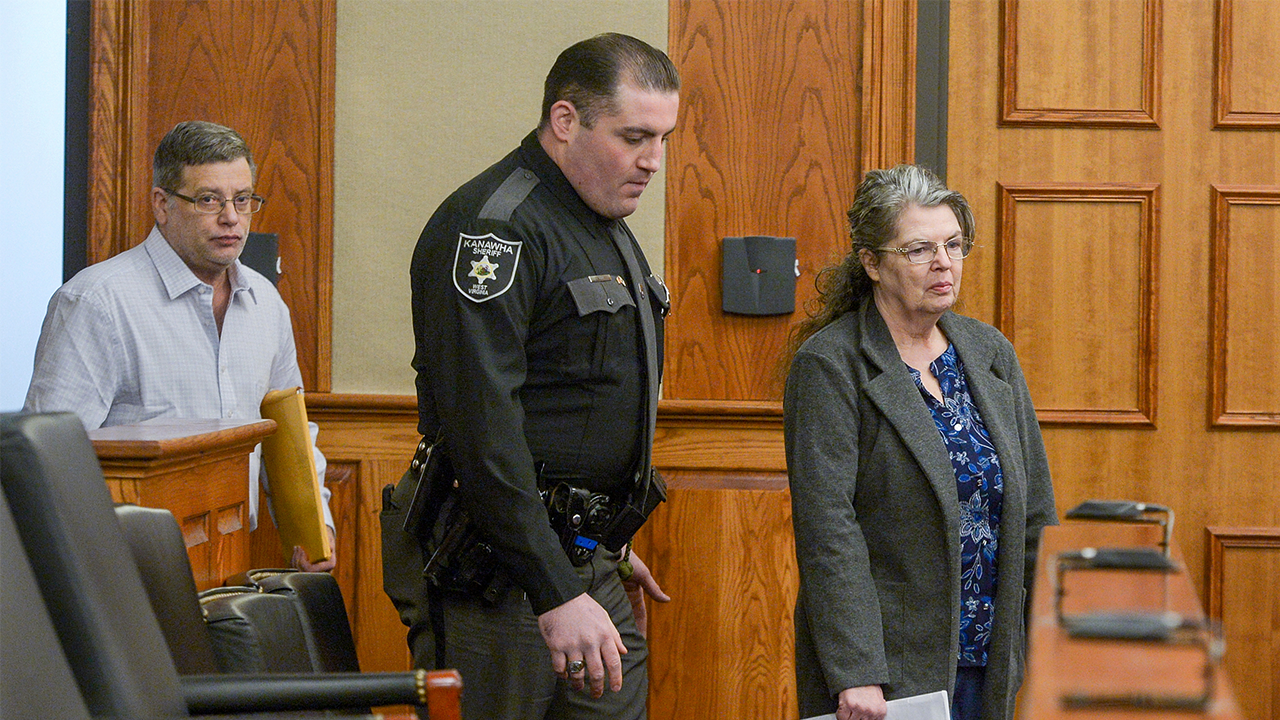

Former FTX chief Sam Bankman-Fried leaves the Federal Courthouse following a bail hearing ahead of … [+]

Key Facts

The campaign finance violation charge was among eight counts present in the DOJ’s original indictment—which also includes wire fraud, securities fraud and money laundering—in December.

In a filing late Wednesday, the DOJ informed New York federal judge Lewis Kaplan that the government had been earlier in the day that the Bahamas “did not intend to extradite the defendant on the campaign contributions count.”

In adherence with the government’s “treaty obligations” to the Bahamas, the DOJ informed Kaplan it “does not intend to proceed to trial on the campaign contributions count.”

The filing was made hours after Kaplan issued a gag order against the former crypto billionaire after prosecutors accused him of leaking former girlfriend and business partner Caroline Ellison’s personal writings to the New York Times.

News Peg

This is not the first instance where the terms of Bankman-Fried’s extradition treaty have impacted the charges brought against him. Last month, the DOJ informed Kaplan it was prepared to try Bankman-Fried on eight counts brought against the FTX founder in its original indictment in December last year—temporarily forgoing the five additional charges that were filed earlier this year. Under the terms of Bankman-Fried’s extradition, any additional charges brought against him would need to be approved by the Bahamian government. A court in the Bahamas has blocked the country’s government from approving the five additional charges—which include bank fraud, operating an unlicensed money-transmitting business, and bribery—until his attorneys have a chance to fight them.

Key Background

In May, Bankman-Fried’s attorneys asked the court to dismiss most criminal charges brought against him by federal prosecutors, arguing that they were “dramatic” and turned “civil and regulatory issues into federal crimes.” The FTX founder’s lawyers also blamed the company’s dramatic collapse on the “crypto winter” of 2022. FTX, which was once valued at $32 billion, collapsed in November last year after facing a liquidity crisis triggered by a selloff of its own FTT tokens. Late last month, Kaplan denied Bankman-Fried’s request to dismiss the charges, saying they “are either moot or without merit.”

Further Reading

Judge Issues Gag Order To Sam Bankman-Fried After Prosecutors Allege Witness Tampering (Forbes)

DOJ Agrees To Try Sam Bankman-Fried On Original Eight Charges—For Now (Forbes)

Finance

Supercharging a New Finance Hub in the Middle East

Finance

‘It Won’t Be Enough’: Financial Experts Warn Gen X About Key Retirement Pitfalls

As the oldest members of Generation X (those born between 1965 and 1980) approach retirement, financial experts warn that many in this group may not be as prepared as they think. Generation X faces unique challenges as they prepare for retired life, from shortfalls in savings to unexpected costs that may arise.

Here’s what experts say Gen Xers need to know to avoid these key pitfalls and ensure a more secure retirement.

Many Gen Xers are significantly behind in their retirement savings. A recent study by Northwestern Mutual found that only 7% of Gen X respondents have saved more than 10 times their annual income–the amount most experts recommend for a comfortable retirement.

Don’t Miss:

Perhaps even more concerning, over half of Gen X respondents say they have only saved three times their annual income or less. Fidelity recommends having at least three times your annual salary by age 40, six times your salary by age 50 and eight times your salary by age 60 to stay on track for a comfortable retirement.

This shortfall in savings is compounded by the fact that many Gen Xers do not have a retirement income plan. According to Allianz, only 30% of Gen Xers have mapped out how they will fund their post-work years, the lowest rate among all generations surveyed.

A common misconception among Americans is that taxes decrease in retirement. However, financial experts caution that many Gen Xers could face higher-than-expected tax burdens. The reason? Most have their retirement savings in tax-deferred accounts, like 401(k)s and IRAs, which require taxes to be paid upon withdrawal.

“The big problem is that a lot of them are going to be faced with a lot of taxes in retirement,” Jonathan Dane, founder and chief investment officer for Defiant Capital Group in Pittsburgh, told U.S. News. He says one way to mitigate this is to stop putting money in tax-deferred accounts and transition to Roth accounts, which allow for tax-free withdrawals.

See Also: The Biggest Disruption to IP since Disney — Get in now as they monetize a $2 Trillion market by building content around the most profitable Character IP in history and combining it with the Patented Technology IP of the future.

Another concern is healthcare costs. While Medicare provides comprehensive coverage starting at age 65, it doesn’t cover everything. Long-term care expenses, like assisted living, typically aren’t included. Experts suggest considering long-term care insurance or using a health savings account (HSA) to prepare for these costs.

Finance

Deregulation to boost banks, a ‘force for strength in the economy’

Bank of New York Mellon (BK) CEO Robin Vince joins Yahoo Finance Executive Editor Brian Sozzi at the 2025 World Economic Forum in Davos, Switzerland, to discuss US President Donald Trump’s return to the White House and his expectations for the president’s second term and the impact on the financial sector.

“To see a government that’s really focused on growth and being able to make the economy everything that it can be, because ultimately, as one of America’s leading banks, we are focused on helping our customers to be able to grow and thrive. You know, that’s what our platforms are all about,” Vince says.

As deregulation under Trump is expected to benefit the financial sector, Vince says he’s “not that concerned” about the risks associated with loose regulation. “We have to be vigilant that that doesn’t happen. We need a strong, healthy financial system,” he says, explaining, ” We’ve seen how the strong banks have been able to actually help the system over the course of the events … We’ve been a force for strength in the economy, and that’s actually the role that we should be playing.”

The CEO underlines, “I’m looking forward. I’m thinking about the innovation. I’m thinking about the investment. I’m thinking about helping to make economies grow and our clients be successful.”

Watch the video above to hear more from the BNY CEO on tariff expectations, a potential uptick in merger and acquisition (M&A) activity, and his crypto outlook.

Click here for more of Yahoo Finance’s coverage from the World Economic Forum in Davos.

Check out Yahoo Finance’s Davos interview with Bank of America (BAC) CEO Brian Moynihan here.

This post was written by Naomi Buchanan.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg) Technology1 week ago

Technology1 week agoL’Oréal’s new skincare gadget told me I should try retinol

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg) Technology7 days ago

Technology7 days agoSuper Bowl LIX will stream for free on Tubi

-

Business1 week ago

Business1 week agoWhy TikTok Users Are Downloading ‘Red Note,’ the Chinese App

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png) Technology5 days ago

Technology5 days agoNintendo omits original Donkey Kong Country Returns team from the remaster’s credits

-

Culture4 days ago

Culture4 days agoAmerican men can’t win Olympic cross-country skiing medals — or can they?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg) Technology1 week ago

Technology1 week agoMeta is already working on Community Notes for Threads

-

Culture2 days ago

Culture2 days agoBook Review: ‘Somewhere Toward Freedom,’ by Bennett Parten

-

Politics5 days ago

Politics5 days agoU.S. Reveals Once-Secret Support for Ukraine’s Drone Industry