Finance

Climate finance: What India aims to achieve at COP27

The twenty seventh version of the Convention of Events (COP) to UNFCCC will begin Sunday and it’ll see India looking for readability on the definition of local weather finance and nudging developed nations to boost provide of know-how and finance wanted to deal with local weather change and ensuing disasters.

Union Atmosphere Minister Bhupender Yadav will lead the Indian delegation on the convention which can run from November 6 to eight at Sharm El-Sheikh, Egypt. 100 and ninety eight events to UNFCCC collect every year to debate easy methods to collectively handle local weather change.

US President Joe Biden, UK Prime Minister Rishi Sunak and greater than 100 heads of states are anticipated to attend the convention. It isn’t but clear if Prime Minister Narendra Modi will attend it.

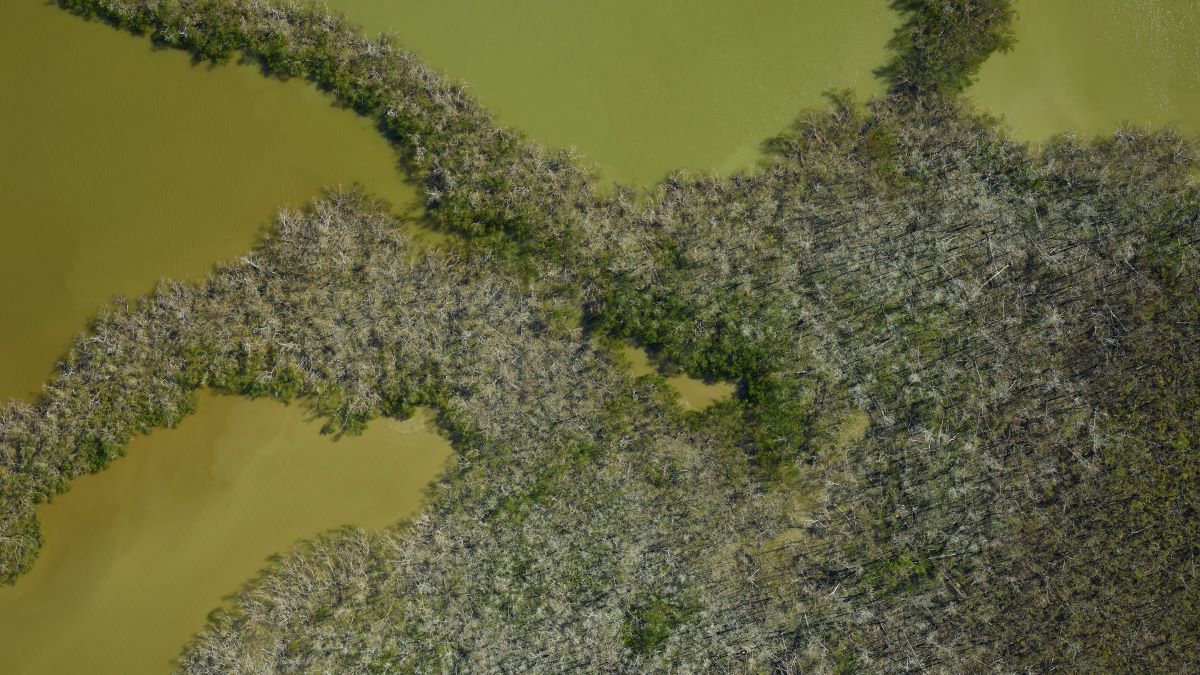

Learn | Local weather change: Grim forecast for India

In accordance with the Union Atmosphere Ministry, India seems ahead to substantial progress on the discussions associated to local weather finance and readability on its definition.

“As it’s a saying that ‘what will get measured will get executed’, extra readability is required on the definition of local weather finance for the creating nations to have the ability to precisely assess the extent of finance flows for local weather motion,” it mentioned in a press release.

The absence of a definition permits developed nations to greenwash their funds and go off loans as climate-related assist.

“India will search readability as to what constitutes local weather finance whether or not it’s grants, loans or subsidies,” Yadav instructed reporters on Thursday.

At COP15 in Copenhagen in 2009, developed nations had dedicated to collectively mobilise USD 100 billion per 12 months by 2020 to assist creating nations sort out local weather change, however they’ve miserably failed in doing so.

Together with different creating nations, India will ramp up strain on wealthy nations to ship on this promise.

In accordance with the fourth Biennial Evaluation of the Standing Committee on Finance of the UNFCCC, the whole public monetary assist reported by developed nations in October 2020 amounted to USD 45.4 billion in 2017 and USD 51.8 billion in 2018.

Creating nations, together with India, may even push wealthy nations to conform to a brand new international local weather finance goal – often known as the brand new collective quantified objective on local weather finance (NCQG) — which they are saying must be in trillions as the prices of addressing and adapting to local weather change have grown.

“Any consensus on an enhanced scale of monetary mobilisation might be a welcome takeaway from COP27,” mentioned RR Rashmi, Distinguished Fellow, TERI, and former local weather negotiator underneath UNFCCC.

“The determine of USD 100 billion for creating nations was agreed upon a lot earlier than the Paris Settlement was signed. Primarily based on the Nationally decided contributions (NDCs), the whole cumulative financing necessities of the creating world is something within the vary of USD 5.8-5.9 trillion until 2030,” Rashmi mentioned.

“The objective of USD100 billion per 12 months of local weather finance by 2020 and yearly thereafter via 2025 is but to be achieved. As a result of lack of frequent understanding, a number of estimates of what has flown as local weather finance can be found. Whereas the promised quantity should be reached as rapidly as attainable, there’s a want now to considerably improve the ambition to make sure ample useful resource move underneath the brand new quantified objective post-2024,” the atmosphere ministry mentioned.

It mentioned the dialogue on NCQG within the ad-hoc working group should give attention to the amount of the useful resource move and its high quality and scope.

“Points referring to entry and ideas for enchancment within the operate of the monetary mechanisms are additionally essential. Apart from, an enchancment in transparency to make sure applicable oversight of the quantum and course of flows is crucial,” the ministry mentioned.

Poor and creating nations additionally wish to see a brand new finance facility to fund the “loss and injury” ensuing from local weather change — for instance cash wanted for relocating individuals displaced by floods.

Developed nations have opposed this new fund which can maintain them legally liable for enormous damages brought on by local weather change.

“The prevailing monetary mechanisms, like World Atmosphere Facility, Inexperienced Local weather Fund and Adaptation Fund, underneath the UNFCCC haven’t been in a position to mobilise or ship funds for loss and injury as a consequence of local weather change,” the ministry mentioned.

It mentioned these are under-funded, many of the cash is for mitigation (stopping and lowering emissions) and accessing it’s cumbersome and time-consuming.

“These are the circumstances based mostly on which G77 and China have proposed adoption of an agenda merchandise on loss and injury finance. It’s the time that this concern is accorded prominence on the local weather agenda that it rightfully deserves,” the ministry mentioned.

Underneath the Paris Settlement, all events had determined to have a World Objective on Adaptation which goals to supply a system for monitoring and assessing nations’ progress on adaptation actions, and for catalysing adaptation funding.

India says there must be important progress on actions, indicators and metrics in respect of the GGA. “There should not be any hidden agenda of mitigation, particularly within the type of nature-based options, within the identify of co-benefits.”

At COP26 in Glasgow, events agreed to develop a Mitigation Work Program (MWP) to “urgently scale up mitigation ambition and implementation” .

Mitigation means avoiding and lowering emissions, ambition means setting stronger targets and implementation means assembly new and current objectives.

Creating nations have raised issues that wealthy nations, via the MWP, will push them to revise their local weather targets with out enhancing the provision of know-how and finance.

India says the Work Programme on Enhanced Ambition in Mitigation and Implementation can’t be allowed to “change the objective posts” set by the Paris Settlement.

“The GST course of and the opposite mechanisms of the Paris Settlement, together with enhanced NDCs and submission of the long-term low emissions growth methods, are ample.

Within the Mitigation Work Programme, greatest practices, new applied sciences and new modes of collaboration for know-how switch and capability constructing could also be mentioned fruitfully,” the ministry mentioned.

Wealthy nations are looking for a dialogue on Article 2.1(c) of the Paris Settlement, which is about making all monetary flows in keeping with a “pathway in the direction of low greenhouse gasoline emissions and climate-resilient growth” — means the funds are tied to low emissions-based developments.

India says “reaching the USD 100 billion per 12 months objective should come first, and the developed nations should be requested to indicate the roadmap for a similar.”

On the UN local weather convention, India may even emphasise once more on its invitation to all nations to hitch the LiFE motion – “Life-style for Atmosphere”, a pro-people and pro-planet effort that seeks to shift the world from senseless and wasteful consumption to aware and deliberate utilization of pure sources.

Finance

The Future of Decentralized and Traditional Finance Integration

The future of finance, especially global finance, is not on the horizon — it’s happening now. Countries and Institutions that embrace interoperability, real-time compliance, and quantum-resilient security are positioning themselves as leaders of this transformation.

The financial system is in the midst of a monumental shift. Central Bank Digital Currencies (CBDCs) are gaining momentum as governments and regulators aim to modernize monetary systems, while Decentralized Finance (DeFi) continues to challenge conventional financial services with speed, transparency, and decentralization. However, despite their potential, these two forces — along with traditional financial systems — remain disjointed. This fragmentation results in inefficiencies, rising costs, and settlement delays, hindering global financial connectivity. Bridging these worlds is no longer optional — it’s essential to create a faster, more secure, and more inclusive financial future.

The Problems Holding Finance Back

For decades, the global financial system has relied on legacy infrastructure and fragmented regulatory and banking industry frameworks. While it has supported cross-border payments and international trade, it has done so at an exorbitant cost in terms of both time and money. The involvement of global politics has added an additional level as well to an already complex system. The emergence of blockchain-based DeFi platforms introduced new possibilities but failed to solve the underlying issues of scalability and compliance. Meanwhile, CBDCs add a new layer of complexity as central banks look to maintain control while modernizing payments.

The key obstacles are clear:

- Slow and Expensive Payments: Cross-border payments processed through SWIFT are slow and require multiple intermediaries, each adding fees, delays, and points of failure. The type of transfers are limited.

- Disjointed Regulatory Compliance: Payments crossing borders must comply with a patchwork of jurisdictional regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Current processes are slow, manual, and costly.

- Lack of Interoperability: DeFi platforms, CBDCs, and traditional banking systems all operate on isolated infrastructures, making it difficult to move money between them efficiently.

- Scalability Issues: DeFi platforms face network congestion during high-volume periods, resulting in slower transaction speeds and higher fees — far from ideal for large-scale financial operations.

These challenges are not theoretical. They’re real-world problems faced by financial institutions, payment providers, and central banks trying to create more efficient, resilient systems.

See also: Transforming the Financial Sector: The Impact of Automation in Banking

Interoperability: The Bedrock of the Next Financial System

True interoperability is not a feature — it’s a requirement. For traditional finance, DeFi, and CBDCs to coexist, they must be able to communicate and transfer value across one another. Without this capability, cross-border payments will remain slow, and multi-system operations will continue to require expensive manual reconciliation. Interoperability enables payments to flow seamlessly between bank networks, DeFi protocols, and CBDC platforms, cutting out intermediaries and automating settlement.

What true interoperability requires:

- Multi-Ledger Transaction Support: Payments must move across different financial ledgers — from commercial banks to DeFi protocols to central bank digital currency networks — without reconciliation bottlenecks.

- Real-Time, Multi-Currency Settlement: Payments involving fiat, cryptocurrencies, and CBDCs must be processed and settled in real time, enabling frictionless commerce at scale.

- The governance, regulatory, privacy, and Nation-State requirements need to be automated in the new Platform.

- Universal Payment Flows: Payment solutions must enable a single payment to cross multiple networks — legacy, private, blockchain, and government-issued systems — without requiring separate processing channels.

The results are undeniable: greater efficiency, lower settlement costs, and a path to instant cross-border payments. This shift eliminates the need for batch processing and multi-step settlement chains, replacing them with real-time payment routing and automated multi-ledger transfers.

Compliance Can’t Be Bolted On – It Must Be Embedded

Cross-border payments are subject to varying regulatory requirements, which are enforced by regional authorities. Ensuring compliance with KYC, AML, and sanctions screening has traditionally been a manual, labor-intensive process, leading to costly delays. But the future of compliance is no longer manual — it’s embedded. By embedding compliance checks directly into payment flows, financial institutions can meet regulatory requirements in real time, reducing risk, eliminating delays, and supporting faster payments.

Key elements of embedded compliance:

- On-Demand KYC/AML Screening: Compliance screening occurs automatically, with KYC/AML checks happening as the payment is processed, not after.

- Dynamic Rule Adjustment: When payments cross borders, the system recognizes which jurisdictions are involved and applies the proper compliance rules in real time.

- Automated Risk Scoring: Transactions are evaluated for risk on the fly, with high-risk payments flagged for review while low-risk payments flow uninterrupted.

- Immutable Audit Trails: Every payment is accompanied by an immutable, tamper-proof record that supports regulatory audits and provides transparency.

By automating and embedding compliance into the payment process itself, financial institutions lower operational costs, reduce exposure to regulatory risk, and accelerate payment settlement. This approach moves compliance from being a roadblock to being an enabler.

Securing Payments for the Quantum Era

As quantum computing advances, the cryptographic protections that underpin today’s financial system are at risk. Many existing encryption methods, like RSA and ECC, could be cracked by a quantum computer. While quantum computing may seem distant, its implications for financial security are real. The financial sector must act now to prepare for a post-quantum world.

Key security measures to counter quantum threats:

- Quantum-Resistant Cryptographic Protocols: These protocols are immune to attacks from quantum computers, ensuring that even future advancements won’t compromise financial data.

- Post-Quantum Key Exchange: Secure key exchange protocols ensure encryption keys remain secure during transmission, even if intercepted.

- Zero-Day Threat Detection: AI models track network activity, flagging and neutralizing unknown threats before they can do harm.

- New file systems that rely on a multi-layered approach that separates the data in a way to enhance security, speed, and scalability.

The transition to quantum-resistant encryption isn’t speculative. Financial leaders know that, when quantum computing matures, it will disrupt financial security as we know it. Early adoption of quantum-safe protocols future-proofs payment infrastructure, ensuring financial stability in a rapidly evolving threat landscape.

Distributed Edge Processing: Faster Payments with Local Control

For decades, payment processing has relied on centralized data centers that route transactions through a central hub. While effective, this model introduces latency, network congestion, and single points of failure. The future of payment processing is at the edge.

Edge processing pushes payment activity to the “edge” of the network — closer to where the payment originates — reducing travel time and allowing payments to be processed locally. Instead of relying on a central server, mini-processing nodes handle payments on-site, enabling near-instant settlements.

How edge processing changes the game:

- Real-Time Settlement: Payments are processed on-site, at the source, rather than waiting for clearance from a central location.

- Resilient Infrastructure: Multiple nodes create redundancy, so if one node goes offline, the others maintain operational uptime.

- Reduced Latency: Local processing eliminates the round-trip delay that occurs when payments are routed to and from a central server.

This shift in processing models enables faster cross-border payments and lays the groundwork for true real-time settlement. Localized processing nodes create resilience, reduce downtime, and remove bottlenecks in global payment flows.

Sustainability and Financial Inclusion as Critical Imperatives

ESG (Environmental, Social, and Governance) factors are playing a larger role in financial infrastructure design. From environmental sustainability to financial inclusion, future-ready payment infrastructure must meet new societal expectations. This shift is not just ethical; it’s strategic. Institutions are under pressure from regulators, investors, and customers to create more equitable, transparent, and sustainable financial systems.

ESG-driven imperatives shaping financial infrastructure:

- Environmental Impact: Centralized data centers consume enormous amounts of energy. By adopting distributed processing, institutions reduce energy use and carbon emissions.

- Financial Inclusion: Millions of people remain unbanked. Financial inclusion solutions enable low-cost cross-border payments, giving underserved communities access to global finance.

- Transparency and Accountability: Blockchain-based payment records create immutable, tamper-proof audit trails, ensuring visibility into every transaction.

The Call to Lead the Financial Future

The future of finance, especially global finance, is not on the horizon — it’s happening now. Countries and Institutions that embrace interoperability, real-time compliance, and quantum-resilient security are positioning themselves as leaders of this transformation. Delays are no longer an option. The financial world will reward those who act with speed, precision, and foresight. The question is not if change will come — it’s whether you’ll be ready to lead it.

Finance

Your money habits trace back to childhood, financial psychotherapist says. Here's how to fix them

Child saving money in a glass jar at home

Pinstock | E+ | Getty Images

Your relationship with money might seem random, but one expert says it offers clues about your childhood — and understanding this could help overcome toxic spending habits.

Vicky Reynal, a financial psychotherapist and author of “Money on Your Mind,” told CNBC Make It that there are psychological reasons behind our spending habits, and many of these attitudes stem from childhood experiences.

“Our emotional experiences growing up will shape who we become,” she said.

For example, someone who felt secure during childhood might feel that they deserve good things, and later in life may be more likely to negotiate a higher salary or enjoy the money they have, Reynal said. Whereas someone who experienced childhood neglect may grow up with low self-esteem and act this out through money behaviors.

This could include feeling guilty when spending money because they don’t feel they deserve good things, or splashing the cash to impress because they feel unworthy of attention.

“The little toddler that goes up to their parents to show them their scribble — how they get responded to will give them a message about how the world will respond to them,” Reynal added.

Scarcity or wealth

Reynal said “the money lessons we learn growing up” are largely shaped by whether we grew up in an environment of scarcity or wealth.

“To give you an example, growing up in scarcity, people that manage to move themselves out of that economic reality, and maybe in their own adult life manage to accumulate quite a bit of wealth, it’s quite common for them to struggle with what they call the scarcity mindset,” Reynal said.

This is a pattern of thinking that fixates on the idea that you don’t have enough of something, like money. A scarcity mindset means someone might struggle to enjoy the money they’ve earned and be anxious about spending it, Reynal added.

Alternatively, there are people who grew up with little but became wealthy, and are now very careless with money.

“They’re giving themselves everything that they longed for when they were little so they might go on the other extreme and start spending it quite carelessly, because now they want to give their children everything that their parents couldn’t give them,” Reynal added.

Stop self-sabotaging

The key to overcoming toxic spending habits is to stop self-sabotaging — a common behavior — according to Reynal.

“Often behind a pattern of financial self-sabotage, there are deep-seated emotional reasons, and it could range from feelings of anger, feelings of un-deservedness, to maybe a fear of independence and autonomy,” she said.

To identify these, you first have to determine what your financial habits and inconsistencies are, Reynal said, giving an example of someone who might overspend in the evenings.

“Is it boredom? Is it loneliness? What is the feeling that you might be trying to address with the overspending?” she said.

“That’s already giving you a clue as to what you could be doing different. So, if it’s boredom, what can you replace this terrible financial habit with?”

Reynal said she had a young client who would always run out of money within the first two weeks of the month. She asked them: “What would happen if you were financially responsible?”

The client revealed that they feared risking their relationship with their mother because every time they ran out of money, they called their mother to ask for more.

“Their parents had divorced a long time ago, and the only time they ever spoke to their mother was to ask for money,” Reynal said. “They had a vested interest in being bad with money, because if they were to become good with money, then they had the problem of: ‘I might not have an excuse to call mother anymore and I don’t know how to build that relationship again’.”

The financial psychotherapist recommended being “curious and nonjudgmental” when considering the root of bad spending behavior.

“So sometimes asking ourselves: “What feelings would I be left with if I actually didn’t self-sabotage financially, or if I weren’t so generous with my friends?’ That can start to reveal the reason why you might be doing it,” she added.

Finance

Downing & Co. Elevates Financial Legacy With Expert Estate Planning Services in Portland

Portland-based CPA firm helps clients safeguard their wealth and secure their family’s future with comprehensive estate planning services.

PORTLAND, OREGON / ACCESSWIRE / December 26, 2024 / In a city renowned for its entrepreneurial spirit and thriving businesses, Downing & Co. is taking a bold step forward in helping Portland residents protect what matters most: their legacy. The firm offers specialized estate planning services, designed to ensure their clients’ wealth is preserved and passed down seamlessly to future generations.

With over five decades of experience in financial strategy, Downing & Co. brings a trusted, proactive approach to estate planning. As Portland’s go-to CPA firm, they’ve built a reputation for delivering personalized solutions that go beyond typical financial management. Their estate planning services focus on reducing tax burdens, avoiding costly mistakes, and ensuring assets are distributed according to the client’s wishes.

“Estate planning isn’t just about financial protection-it’s about preserving your life’s work and values for the people you care about,” said Tim Downing, Managing Principal at Downing & Co. “Our goal is to provide peace of mind by ensuring that clients’ wealth stays where it belongs-within their family and community.”

Why Estate Planning Matters in Portland

For high-net-worth individuals and small business owners, estate planning is critical in Portland’s competitive economic landscape. Without a clear plan, families risk losing up to 40% of their inheritance to taxes and government regulations. By offering expert guidance and strategic structuring, Downing & Co. ensures clients avoid these pitfalls while safeguarding their financial legacy.

Key benefits of Downing & Co.’s Estate Planning Services include:

-

Minimizing Estate Taxes: Advanced planning can reduce the tax burden on your estate, ensuring more of your wealth is retained by your heirs.

-

Efficient Wealth Transfer: Clear strategies streamline the process of passing on assets, reducing legal challenges and delays.

-

Preserving Family Legacies: Customized solutions ensure your assets align with your values, supporting the people and causes you care about most.

-

Proactive Risk Mitigation: Estate plans address potential legal and financial risks, protecting your wealth against unforeseen challenges.

A Holistic Approach to Financial Security

Downing & Co.’s Estate Planning Services are part of a broader commitment to comprehensive financial management. Their holistic approach integrates tax planning, wealth preservation, and business advisory services to create a seamless strategy that addresses every aspect of a client’s financial well-being.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology6 days ago

Technology6 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News1 week ago

News1 week agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics1 week ago

Politics1 week agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment1 week ago

Entertainment1 week ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle1 week ago

Lifestyle1 week agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology3 days ago

Technology3 days agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

News4 days ago

News4 days agoFrance’s new premier selects Eric Lombard as finance minister