Finance

Breakingviews – Big Tech in finance? There’s a regulator for that

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RCPZCAYXW5KZLIXB3YNZN7BOVI.jpg)

The brand for Amazon Net Companies (AWS) is seen on the SIBOS banking and monetary convention in Toronto, Ontario, Canada October 19, 2017. REUTERS/Chris Helgren

WASHINGTON, Aug 1 (Reuters Breakingviews) – Expertise firms have stormed the heights of client finance, however they don’t face the regulation that vexes their old-world rivals. Whereas no single monetary watchdog has oversight of Apple (AAPL.O), Amazon.com (AMZN.O) or Fb proprietor Meta Platforms (META.O), that might change. All of it hangs on the views of a panel of watchdogs often called the Monetary Stability Oversight Council.

When an organization like Apple decides to supply monetary companies, the potential affect is big. Take the iPhone maker’s new buy-now-pay-later service. It’s beginning small, with six-week period loans and a borrowing restrict of $1,000. However in contrast to the Apple-branded bank card that’s successfully run by Goldman Sachs (GS.N), the lending choices and funding for buy-now-pay-later loans are Apple’s personal. Tim Cook dinner’s agency is doing a few of what a Citigroup (C.N) or Financial institution of America (BAC.N) does, however with out the onerous regulation.

It is a query of potential slightly than precise threat. Think about half the variety of iPhone customers in america, or about 59 million based mostly on estimates by Counterpoint analysis, find yourself utilizing the pay-installment service. That will give Apple about as many client prospects as Normal Electrical’s (GE.N) financing arm, GE Capital, had in 2013. GE Capital required a bailout to again almost $140 billion of its debt after it unraveled in the course of the 2008 monetary disaster.

Register now for FREE limitless entry to Reuters.com

The cloud divisions of Silicon Valley giants additionally play a systemic position. The biggest banks like JPMorgan (JPM.N) depend on Amazon and others for varied duties, together with housing knowledge, processing transactions and working purposes. About 45% of banks use Amazon whereas the same proportion depends upon Microsoft (MSFT.O), with many utilizing each, in line with S&P International’s 451 Analysis. A disruption or failure by a hack or pure catastrophe may upend operations and trigger a panic.

In GE’s case, it was FSOC that stepped in when it grew to become clear that the regulatory framework had holes in it. The 15-member panel was created after the 2008 monetary disaster, and now contains Treasury Secretary Janet Yellen, Federal Reserve Chair Jay Powell, Securities and Change Fee chief Gary Gensler and Shopper Monetary Safety Bureau head Rohit Chopra. The council designated GE Capital a systemic threat in 2013, and put it beneath the supervision of the Fed, the place it stayed till 2016.

Tech firms could be a well timed match for FSOC. The group doesn’t carry out day-to-day watchdog features however can farm such duties out to an acceptable panel member. The Fed additionally took supervision of insurer AIG (AIG.N) after the 2008 monetary disaster. Different FSOC members have their very own experience: the SEC’s is over capital markets, for instance.

And as with GE, it wouldn’t have to throw a regulatory internet round the entire of an organization. Apple, say, may very well be requested to carve out its Apple Financing subsidiary right into a separate holding firm, which may then be topic to guidelines on underwriting, credit score high quality and stress testing. Cloud companies like Amazon Net Service or Microsoft Azure may very well be deemed systemically necessary monetary utilities, a label already utilized to different types of market plumbing just like the Chicago Mercantile Change.

None of this might cease tech companies’ monetary march, however it will gradual them down. Regulated entities would want to have their very own chief government, board and provide you with guidelines on cybersecurity and different areas. British authorities not too long ago floated a spread of choices to verify the monetary system may face up to a cloud-computing snafu, together with common cyber resilience checks. And monetary regulators typically parachute examiners into the places of work of the businesses they supervise, who recurrently verify operations for threat administration. That will be an unfamiliar intrusion for Silicon Valley.

Even when FSOC drags its ft, extra crimson tape for tech companies is inevitable. In October, the CFPB requested Apple, Alphabet’s (GOOGL.O) Google, and Fb about their cost programs. The company can situation enforcement actions for violations of person privateness, amongst different issues, and chief Chopra isn’t any stranger to assertively utilizing his place on different regulatory our bodies – as he confirmed when he helped velocity the exit of then-head of the Federal Deposit Insurance coverage Company, Donald Trump appointee Jelena McWilliams.

Nonetheless, a extra coordinated strategy could be higher. With billions of customers and lax regulation, the dangers to customers and the broader system from large tech companies are rising. Watchdogs, in the meantime, are sometimes reacting to previous threats. Placing Silicon Valley on FSOC’s agenda would assist preserve the monetary cops forward of the sport.

Comply with @GinaChon on Twitter

Register now for FREE limitless entry to Reuters.com

Modifying by John Foley and Amanda Gomez

Our Requirements: The Thomson Reuters Belief Rules.

Opinions expressed are these of the writer. They don’t mirror the views of Reuters Information, which, beneath the Belief Rules, is dedicated to integrity, independence, and freedom from bias.

Finance

AI makes zero-based budgeting a practical finance tool

Experts in the pursuit of harnessing nuclear fusion will assure you that the technology is coming — just 30 years away, according to their projections.

The joke is that if you wait three decades and ask them where it is—

In finance and procurement, the concept of

Which is unfortunate. Like the idea of the world utilizing the free, non-polluting energy that a fusion plant would offer, on paper ZBB promises objective, data-based baselines for every budgeting phase that would allow decision-makers to only work with what’s real and current, not what happened last year, or even farther back.

The proposal with ZBB is that by mandating a comprehensive justification and validation of each expense, rather than relying on historical spending patterns, organizations can remove possible blockers within their procurement processes. This approach aims to ensure that what you’re doing is the numerically provable best case for the specific circumstances at hand.

This approach certainly holds immense appeal, so much so that Jimmy Carter

The factors putting ZBB back on the table

History and controversy aside, the core idea of ZBB is clear — it presents CFOs with an approach that mandated comprehensive justification and explicit approval for all expenditures during each new budgetary cycle, typically at the outset of the financial year. This process ostensibly offered CFOs a way to make relevant decisions against a true picture of the company’s cash flow.

But ZBB never truly went away. In fact, it is experiencing a resurgence. Consulting firms like McKinsey have

ZBB idealism is also happening at the micro-level, with social media influencers

The question then becomes how would we make ZBB, long an ideal but one that proved too difficult to implement, work at the enterprise level? It turns out, a viable way exists, or at least we can start the process to get there.

And you won’t be surprised to learn that the game-changer here is AI.

A way to open the door to ZBB

Currently, the spotlight within the artificial intelligence domain is on finding use cases for AI to solve real business problems. Organizations have been at the forefront of this endeavor for several years through an approach we term “autonomous sourcing.”

Specifically, organizations using an autonomous spend management approach source can purchase as many new services and vendors as they need within a given budgetary cycle. However, this process is underpinned by not just genuine and up-to-date market data, but also with the benefit of a corporate knowledge bank. This knowledge base facilitates multidimensional comparisons, enabling organizations to evaluate purchases not only longitudinally (against previous periods) but also orthogonally, meaning across different business units within the enterprise.

This may not be the precise dictionary definition of ZBB. But it represents a radical change from the lack of data and visibility CFOs have struggled with and a way to open the door to the underlying vision of ZBB: data-driven financial accuracy.

This autonomous spend management approach resonates with organizations seeking to rationalize and optimize their budgeting processes, often commencing with their procurement operations. These forward-thinking entities inherently grasp the transformative potential of leveraging machine learning and generative AI capabilities to tackle the sourcing problem.

And the convergence of machine learning, generative AI and autonomous sourcing platforms presents organizations with the ability to realize approximately 90% of the ZBB ideal in the present day. That’s happening via organizations using autonomous sourcing to consciously and strictly seek to rationalize every purchase and make data-driven decisions on every vendor relationship.

The commitment to data-driven evaluation of vendor relationships is actually super-important on the path to any form of zero-based decision-making basis. Why? Because it’s your best way of ensuring that you’re not locked into any partnerships or contractual arrangements that aren’t continuing to add value.

Even starting to explore this area of spend with proper data and analytical tools can move organizations off the proverbial sandbar of inefficiency. Last year, for instance, the Mays Business School published

The exciting prospect lies in the potential for modern businesses with diverse spending categories like marketing, HR, sales, IT, finance, and others to capitalize on significant cost-saving opportunities through AI-powered procurement solutions, e.g., accurate supplier sourcing and matching, e-negotiation and automated awarding capabilities.

ZBB’s future is now, not 30 years off

President Carter’s administration wanted to achieve such objectives and possibly on paper could have done — if they had all the time in the world, and exclusive access to the entire computing power of the United States at the time.

But even under those circumstances ZBB might not have worked — as without the efficiencies afforded by AI, ZBB would require manual sourcing, selecting, bidding, negotiating and awarding for every single purchase and vendor relationship in the business.

The truth is, fulfilling every aspect of ZBB manually, as envisioned by its originator,

Weighing it all up, maybe we can retire the notion that ZBB is the accounting industry’s version of fusion.

Instead, we can use the power of autonomous sourcing to perform the equivalent of fusion in the back office.

Finance

APAC Middle-Market Leaders Embrace External Financing for Growth

We are in the midst of a working capital revolution — one that is increasingly driven by innovation and made more necessary by the macroeconomic backdrop, particularly for those middle-market firms generating annual revenues between $50 million and $1 billion.

As more firms seek out and put external capital to work, they are finding that today’s working capital solutions are providing them with the cash flow requirements needed to meet the day-to-day requirements of their businesses, as well as with the flexibility necessary to scale that business and thrive long term.

“The tightening of monetary policy and inflationary pressures have suddenly made a lot of these corporates realize they need working capital for two reasons,” Chavi Jafa, head of commercial and money movement solutions, Asia Pacific, at Visa, told PYMNTS. “One, for short-term working capital to make sure that they don’t have any operational disturbances. And two, for strategic long-term investments into newer technologies and digital solutions.”

“In a lot of emerging economies, [we are seeing] a leapfrogging of technology and digital-first solutions, and it’s this corporate segment that tends to drive a lot of the growth in digital economization — they need that working capital to invest,” Jafa said.

That’s why, when compared to traditional working capital solutions which include overdraft facilities and working capital loans, today’s innovative and alternative offerings, such as virtual cards, have emerged as a critical imperative for corporates seeking sustainable growth.

Unlocking Working Capital Innovation in APAC Region

The rising tide of digitization in Asia-Pacific (APAC) economies presents an opportunity for working capital innovation.

With a growing preference for mobile-first experiences, digital solutions like virtual cards offer a seamless and user-friendly approach to managing working capital. As Jafa explained, by using the ubiquity of mobile devices and digital-first experiences, businesses can streamline their financial operations and gain greater control over their cash flows.

“When we think about a virtual card, it’s basically a credit line,” Jafa said. “And why is it becoming more interesting to a lot of these corporates? Well, for one, it’s a digital solution that comes with better data, which makes it very powerful. The second reason is around flexibility — it can be drawn upon, as needed, by a business. And thirdly, a lot of controls can be set on virtual cards, allowing them to be used for whatever purpose is needed.”

“The mindset has shifted around working capital solutions because of the value proposition that something like virtual cards bring,” Jafa added, underscoring the operational efficiency that comes with automating an entire working capital workflow end to end via a virtual card.

Recognizing the diverse needs of different sectors, industry-specific working capital solutions are gaining traction. Tailoring solutions to the unique requirements of sectors like eCommerce, healthcare and construction allows businesses to address specific pain points and optimize their working capital management strategies effectively.

“Asia is a pretty disparate region,” Jafa said. “We have very digitally forward economies like Australia and Singapore, but we also have emerging economies like Indonesia, and then you have an economy like India, which is pretty large and quite digitally ahead.”

Businesses in each come with their own sets of needs and trends as they relate to embracing and deploying working capital solutions, she added.

Education, Awareness Needed to Scale Innovations

One of the primary challenges hindering the widespread adoption of alternative working capital solutions is the lack of awareness among businesses. Traditionally, overdrafts and working capital lines have been the go-to options, with many unaware of alternative solutions such as virtual cards.

Bridging this awareness gap requires concerted efforts from industry stakeholders to educate businesses about the diverse array of working capital solutions available to them, Jafa said.

Another transformative trend reshaping the working capital landscape is the concept of embedded finance, she noted. By integrating payment solutions directly into existing business platforms, such as enterprise resource planning (ERP) systems, businesses can enjoy a frictionless payment experience without the need to navigate external banking interfaces. This embedded approach not only enhances efficiency but also democratizes access to working capital across various industries, from eCommerce to healthcare to construction.

“Within the context of the consumerization of B2B payments, everyone wants a seamless payment experience,” Jafa said. “They don’t want to leave the environment they are in.”

By embracing digital-first solutions, using embedded finance capabilities and fostering collaboration across sectors, businesses can unlock new efficiencies and propel their growth in an increasingly competitive landscape. As awareness grows and partnerships flourish, the future of working capital management in APAC looks promising, Jafa said.

Finance

Problems with federal financial aid program leaves many college bound students in limbo

Computer glitches in the U.S. Department of Education’s recently overhauled financial aid system have left many students unable to commit to a school.

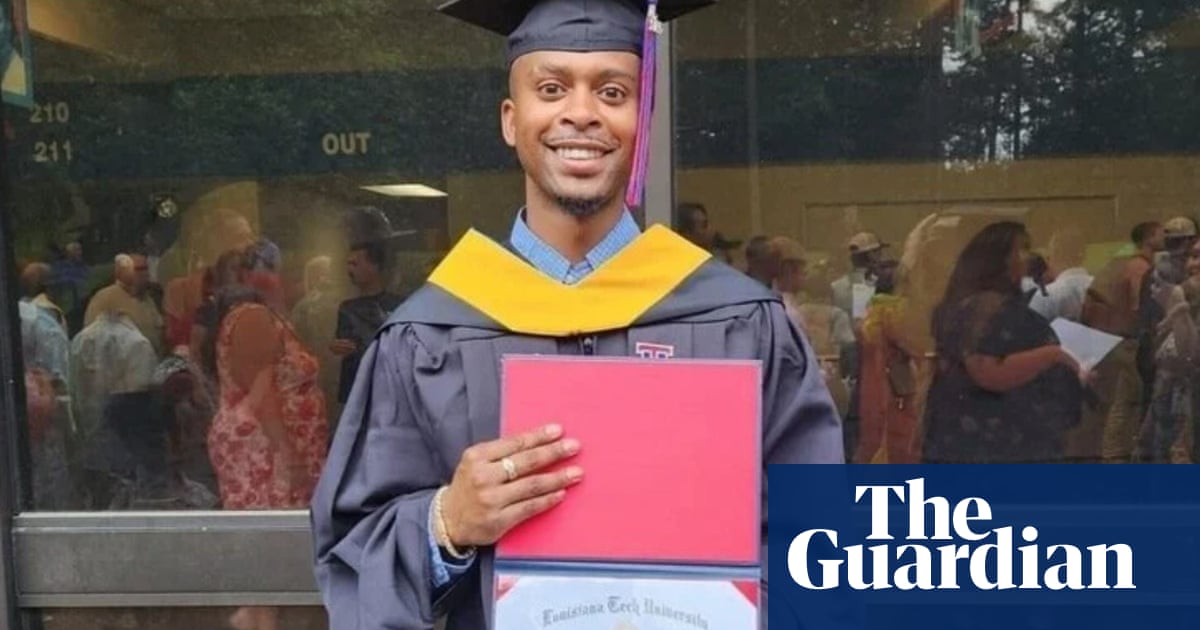

Jojo Henderson, a senior from Pittsburg, Texas, was stuck in limbo for months while waiting to learn what sort of financial aid he might get.

“I’m frustrated because it’s just like, you do everything that you’re supposed to do and then you have to wait on the government to catch up,” Henderson told CBS News.

Henderson filled out the free application for federal student aid, known as FAFSA, almost five months ago. With just weeks to go before graduation, he finally received his financial information last week — after some college deadlines had already passed.

Typically, the Department of Education releases the forms on Oct. 1 and sends the students’ data to colleges within one to three days of a submission. This year, the application forms came out three months late. It’s estimated that more than 25% of colleges have still not sent aid packages, according to a report last week from the National Association of Student Financial Aid Administrators.

New Jersey senior Jailen James finally received her aid package close to the decision deadline. She told CBS News that before it arrived, she considered giving up and not going to college.

“I was just so tired of waiting,” she said.

As the FAFSA fiasco continues, Sara Urquidez, who oversees college counseling for thousands of public school students in the Dallas area, said those who are stuck waiting should follow up as much as possible.

“Ask for extensions. Ask if deposits for housing are refundable. Ask for anything they possibly can to help make [a?] decision,” she told CBS News.

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

World1 week ago

World1 week agoGerman socialist candidate attacked before EU elections

-

World1 week ago

World1 week agoSpain and Argentina trade jibes in row before visit by President Milei

-

Politics1 week ago

Politics1 week agoRepublicans believe college campus chaos works in their favor

-

Politics1 week ago

Politics1 week agoFetterman says anti-Israel campus protests ‘working against peace' in Middle East, not putting hostages first

-

News1 week ago

News1 week agoUS man diagnosed with brain damage after allegedly being pushed into lake

-

World1 week ago

World1 week agoGaza ceasefire talks at crucial stage as Hamas delegation leaves Cairo

-

Politics1 week ago

Politics1 week agoAnti-Israel groups accuse Chicago, DNC of trying to ‘protect’ Biden from protests at 2024 Dem convention