Finance

AB Foods has not raised grocery prices since April -finance chief

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4HOBG5O44JOQJIMSWVYNN3XJNY.jpg)

LONDON, June 26 (Reuters) – Associated British Foods (ABF.L) has not pushed through further grocery price increases for its retail customers since it last reported in April, its finance chief said on Monday.

Any signs that food inflation is moderating are being closely watched by consumers, who have been squeezed by rising prices over the last 12 months, and by governments across Europe.

Third quarter to May 27 sales in AB Foods grocery business, which includes Twinings tea, Jordans cereals and Ovaltine drinks, rose 13% to 1.06 billion pounds ($1.35 billion), driven by price increases implemented earlier in the year to offset input cost rises.

Finance director Eoin Tonge said no new “pricing actions” had been implemented by AB Foods since April.

“There’s probably very little new pricing going in through the system in grocery retail in the UK,” he said.

He said the few exceptions included items like sugar.

($1 = 0.7850 pounds)

Reporting by James Davey; editing by Sarah Young

Our Standards: The Thomson Reuters Trust Principles.

Finance

Japan finance chief sees need for stable forex moves amid weak yen

Japanese Finance Minister Shunichi Suzuki on Friday stressed the need for foreign exchange rates to move stably by reflecting economic fundamentals, saying that excessive fluctuations should be rectified.

Speaking at a press conference during his visit to Georgia, Suzuki declined to comment on whether Japan intervened in the currency market when the yen spiked in a short span of time Wednesday in New York.

Japanese authorities have threatened to take action against excessive volatility in the currency market, with the yen falling sharply against the U.S. dollar.

Japanese Finance Minister Shunichi Suzuki (C) and Bank of Japan Deputy Governor Ryozo Himino (R) give a press conference in Tbilisi on May 3, 2024. (Kyodo)

“Foreign exchange rates should be determined by market forces, reflecting fundamentals. It’s desirable that they move stably,” Suzuki told a press conference in the Georgian capital of Tbilisi on the fringes of meetings related to the Asian Development Bank.

Suzuki added that rapid changes cause negative impacts for households and businesses in making plans. “It may become necessary to smooth out excessive moves,” he said.

Despite market talk of currency interventions by Japanese authorities, Japanese government officials have remained silent, leaving traders in the dark.

“Stealth interventions” are used to make traders jittery and prevent them from making bold moves.

Based on data from the Bank of Japan and market sources, Japan likely spent around 8 trillion yen ($52 billion) this week to step into the market and slow the yen’s decline.

Japanese Finance Minister Shunichi Suzuki (5th from L) and Bank of Japan Deputy Governor Ryozo Himino (4th from L) are among the officials attending a meeting of finance ministers and central bank governors from Japan, China, South Korea and the members of the Association of Southeast Asian Nations in Tbilisi on May 3, 2024. (Kyodo)

The yen, which earlier this week tumbled past 160 to the dollar, has regained some of its strength. It rose to the 151 zone on Friday.

Still, the underlying trend of a weak yen remains intact, reflecting the wide interest rate differential between Japan and the United States.

The BOJ raised interest rates for the first time in 17 years in March, but rapid hikes are not considered likely. The U.S. Federal Reserve, for its part, is now expected to take a longer time before starting to cut interest rates.

Related coverage:

Yen briefly rises to 151 in N.Y. after weak U.S. labor data

Another suspected market intervention likely cost Japan 3 trillion yen

BOJ’s March minutes show no urgency to raise rates further

Finance

Fintech's Fight Against Oversight in the Age of Frictionless Finance

Finance

Hong Kong introduces green finance taxonomy to boost fundraising credentials

“The release of the Hong Kong Taxonomy for Sustainable Finance marks a key milestone for Hong Kong’s sustainable finance landscape,” Eddie Yue Wai-man, CEO of HKMA, said in a statement on Friday.

“By providing a common language and framework for sustainable finance, we are equipping market participants with an important tool to make informed decisions, drive impactful cross-border investments and contribute to global efforts in combating climate change.”

The taxonomy covers 12 economic activities under four sectors: energy, transport, construction, and water and waste management.

Having a taxonomy is important to prevent “greenwashing”, the act of making unsubstantiated claims about the environmental benefits of a product or practice.

The HKMA plans to expand the taxonomy soon to cover other sectors like retail and services, said Arthur Yuen Kwok-hang, deputy CEO of HKMA, who added that the authority had received positive feedback following market consultations last May on preparing the taxonomy.

“We encourage the financial sector to use the taxonomy to assess the greenness of projects when they decide to make green loans to these companies,” Yuen said at a media briefing on Friday.

“A green taxonomy is an integral part of the green finance ecosystem. It enables investors to look for green investment opportunities and make informed decisions, thus easing the mainstreaming of sustainable finance flows.”

The taxonomy has adopted local elements such as listing out Hong Kong certifications and standards that could be used to prove the buildings or operations are environmentally friendly and also are in line with guidelines issued by mainland China and the EU.

“This will help companies operating in mainland China and Europe to consider borrowing green loans or raising green bonds in Hong Kong,” Yuen said, noting that Asia alone will require US$66 trillion in climate investments over the next 30 years.

“Addressing climate change requires the support of the financial industry, which in turn will bring about enormous opportunities,” he said. “Hong Kong, which is an international financial centre, is the ideal capital market to support these green financing activities.”

Investments on such a massive scale are needed to meet the global aim of containing global warming within 1.5 degrees Celsius of pre-industrial levels and avoid the worst effects of extreme climate events. Last year was the warmest year on record, according to the World Meteorological Organization.

“Extreme weather is clear evidence of accelerating climate change and a reminder for an urgent need for decarbonisation,” Yuen said.

The Hong Kong government’s decision to extend the US$100 billion Green and Sustainable Finance Grant Scheme for another three years will cover transition bonds and loans for companies to upgrade their equipment to save energy and cut down on pollution.

The move was announced by Financial Secretary Paul Chan Mo-po in his budget speech in February. The current scheme expires on May 10.

“The scheme will encourage more companies and industries in the region to make use of Hong Kong’s financing platform as they move towards decarbonisation,” Yuen said.

Separately, the HKMA will soon launch a cloud-based platform for banks to assess the potential impact of physical risks on residential and commercial buildings in Hong Kong under different climate scenarios, such as flooding and typhoons.

-

News1 week ago

News1 week agoLarry Webb’s deathbed confession solves 2000 cold case murder of Susan and Natasha Carter, 10, whose remains were found hours after he died

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoSpanish PM Pedro Sanchez suspends public duties to 'reflect'

-

World1 week ago

World1 week agoUS secretly sent long-range ATACMS weapons to Ukraine

-

Movie Reviews1 week ago

Movie Reviews1 week agoHumane (2024) – Movie Review

-

News1 week ago

News1 week agoAmerican Airlines passenger alleges discrimination over use of first-class restroom

-

Education1 week ago

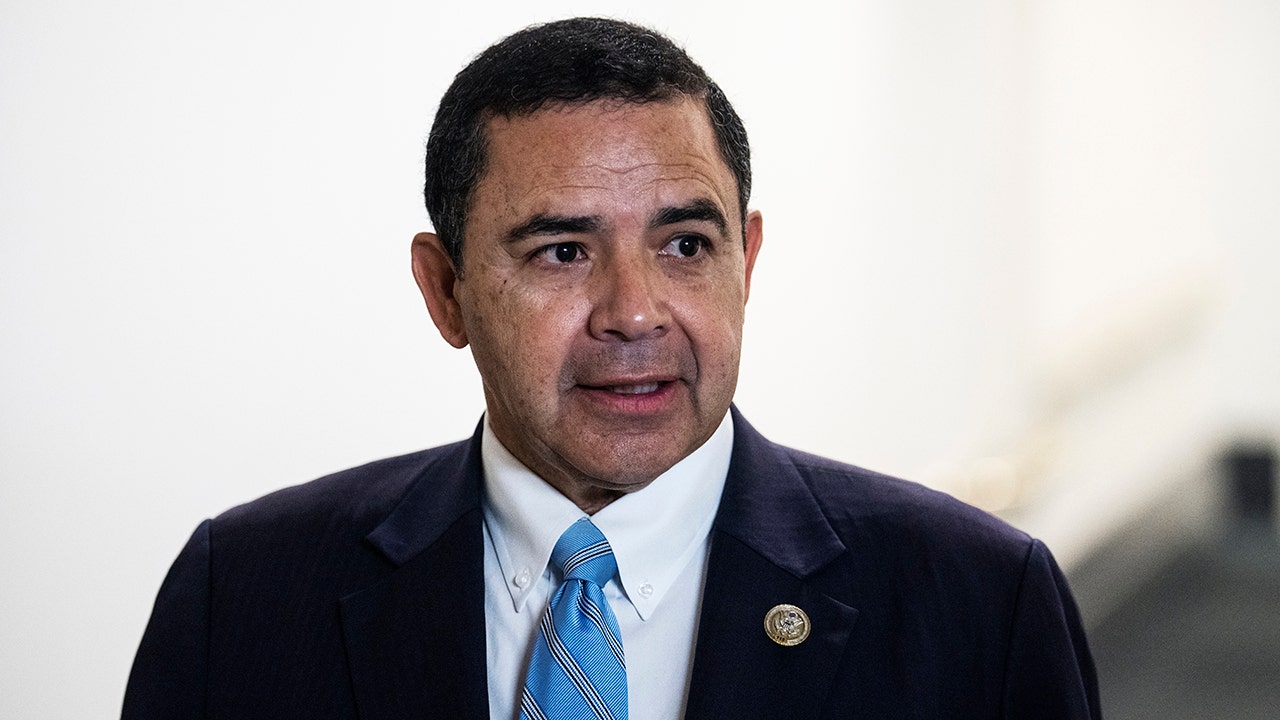

Education1 week agoVideo: Johnson Condemns Pro-Palestinian Protests at Columbia University

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/N25JQMRBVNBM7M4VJKLIRTKF2Q.png)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/QLSANFH2N5CFBP5DXWTDU6TUDQ.png)