Media

Bitcoin.com is the premier source for everything crypto-related.

Contact the Media team on ads@bitcoin.com to talk about press releases, sponsored posts, podcasts and other options.

sponsored

On January 3, 2009, Satoshi Nakamoto mined the Genesis Block on a small server in Helsinki, Finland, and received a reward of 50 bitcoins, which marks the beginning of crypto mining.

From CPU to ASIC

In Satoshi Nakamoto’s initial vision, BTC mining could be performed using CPUs installed on PCs. During its infancy, Bitcoin remained obscure and offered no value.

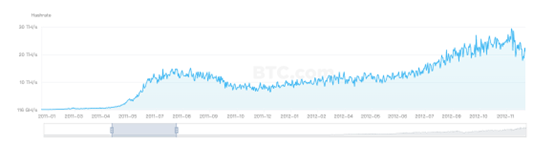

It wasn’t until 2010 when Bitcoin enthusiast Laszlo Hanyecz argued that GPUs could perform more computations per second than CPUs and tried to use GPUs for mining, and he was correct. After Hanyecz shared his GPU mining code with the community, Bitcoin saw its first hashrate surge by 20,000 times, from 6 MH/s in January 2010 to 120 GH/s in December 2010.

What’s interesting is that Hanyecz, who introduced GPU mining, was also the one who started Bitcoin Pizza Day. Hanyecz earned plenty of bitcoins through the GPU mining approach he invented and spared no efforts to promote the crypto. For instance, the guy bought two pizzas with 10,000 BTC, giving real value to the new currency for the first time.

The appearance of GPU mining and the surging BTC price led to a mining arms race, and miners were constantly seeking new ways to improve their hashrate. In 2011, someone shared the code of FPGA mining machines on GitHub, which started a new era dominated by specialized mining rigs. In 2011, the Bitcoin hashrate rose from 116 GH/s at the beginning of the year to nearly 30 TH/s at the end of the year, a nearly 300X growth.

2012 saw the birth of ASIC mining machines, which are superior models, and the Bitcoin hashrate skyrocketed from 20 TH/s to 12 PH/s, an increase of 600 times. Since then, ASIC models have replaced CPUs, GPUs, and FPGA machines as the mainstream BTC mining machine.

From Solo Mining to Pool Mining

The growing hashrate raised new concerns — Is bitcoin mining still profitable as more and more miners join the business? Upon realizing the limitations of solo mining, Czech programmer Marek Palatinus found a solution: unite BTC miners, pool the resources, and share the profits. In 2010, Marek started slushpool, the world’s first mining pool. Since then, BTC mining has gradually transitioned from solo mining to pool mining.

Although mining pools gather a large number of miners, miners are not always tied to one pool, which has led to the sudden rise and fall of many pools. For instance, in 2013, GHash.IO attracted plenty of miners with its zero-fee policy. By 2014, the pool’s peak hashrate had even surpassed 51%, raising concerns in the Bitcoin community. However, this giant pool eventually shut down in 2016 due to repeated large-scale DoS attacks.

Clearly, mining pools demand strong technical capacity. In the early days, many pools underestimated the technical requirements of the industry. As a result, they suffered attacks and eventually shut down, just like GHash.IO.

Having realized the immature technologies and products in the pool industry, Haipo Yang, an early Bitcoin builder, decided to build a stabler and more efficient pool to empower BTC mining, a key channel for maintaining the normal operations of the network. In just two months, he independently completed the coding of ViaBTC Pool, which officially went live on June 5, 2016.

ViaBTC Riding the Waves

Born in a time of fierce competition, ViaBTC has remained a top player in terms of hashrate, thanks to its stable technologies, innovative products, and satisfying user experiences.

Shortly after its launch, ViaBTC invented the PPS+ payment method based on the conventional PPS and PPLNS methods. This new approach guarantees stable mining revenue while sharing miner fees, allowing ViaBTC miners to earn more coins than their peers in other pools. Later on, mainstream pools started to embrace the PPS+ payment method. ViaBTC’s invention of PPS+ has catalyzed changes in industry rules and brought higher and stabler mining revenue to miners.

At ViaBTC, technology is always a priority. For instance, the pool optimized the broadcasting and transmitting process of the BTC network through its independently developed BTC client. Thanks to its high-speed block updating networks distributed around the world, miners can discover and broadcast new blocks more quickly. Furthermore, these efforts have lowered the orphan rate, ensured stable mining revenue, and improved the operating efficiency of the network. To date, ViaBTC remains the mining pool with the lowest orphan rate.

Over the years, ViaBTC has also introduced a wide range of functions and tools, including the Transaction Accelerator, Auto Conversion, Smart Mining, Hedging Service, Crypto Loans, Hashrate Fluctuation Notification, Revenue Sharing, and Referral Commission, to provide users with faster, stabler, and more lucrative mining and derivative services.

Looking back at the past seven years, ViaBTC has seen the ups and downs of crypto mining. GHash.IO is just one of many pools brought down by network attacks. Moreover, there are also pools hurt by disrupted cash flows, as well as pools abandoned by miners due to unstable block output. ViaBTC, on the other hand, has remained committed to products and technology, with a focus on users. These efforts have paid off as it becomes one of the few crypto companies to celebrate its seventh anniversary.

ViaBTC now provides mining services for more than one million users in over 130 countries and regions, covering 10+ cryptos that include BTC and LTC. Moreover, the pool is a top player in terms of the mining hashrate of cryptos including BTC and LTC, with multi-billion dollar worth of cumulative mining output.

Going forward, ViaBTC will continue to provide professional, efficient, secure, and stable crypto mining services for miners, while developing comprehensive, reliable, secure, and satisfying crypto products through dedicated efforts. At the same time, ViaBTC will drive the progress of the mining industry to witness the new blockchain future together with its users.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

The crypto market has been surging since the end of 2024, driven by the general shift in the outlook on crypto towards positive. This rally has reignited investor interest, with altcoins and new projects experiencing significant traction.

The overall market sentiment has been at its most bullish in years, and the regulatory environment is increasingly favoring cryptocurrencies – and with Donald Trump re-entering the presidential office, this rings even more true.

Government regulators seem to be leaning toward fostering innovation rather than restricting it, and institutional adoption is growing. This combination of market growth and political favorability is creating an environment where new projects have immense potential.

Due to these favorable conditions, now could be the time to identify the top new cryptocurrencies with the highest potential. Below we look at four new crypto coins that could be set to explode this February.

Solaxy ($SOLX) aims to become the world’s first Solana Layer-2 blockchain, promising to deliver lightning-fast transaction speeds and customized solutions. It aims to address Solana’s major issues, including network congestion, scalability limits, and failed transactions.

Solaxy’s native token, $SOLX, has already raised an impressive $15.9 million in presale, proving strong investor demand. The key innovation of Solaxy is its off-chain transaction processing, which reduces the burden on Solana’s Layer-1 and prevents network slowdowns. By utilizing rollups, Solaxy ensures that transactions remain fast, seamless, and uninterrupted, even during peak congestion times.

PRICE IS GOING UP! YOU BETTER GET IN NOW!

Beyond speed, Solaxy is highly scalable, making it ideal for meme coins and high-volume transactions. Its fully customizable infrastructure allows developers to build and optimize dApps without the limitations of Solana’s mainnet. The ability to bundle transactions further enhances efficiency, keeping costs low and throughput high.

$SOLX can also be staked to generate an impressive dynamic APY (annual percentage yield) of up to 249%. So far, 4.5 billion out of the entire 138.046 billion supply is staked. This strong staking incentive makes it a potentially highly lucrative asset for long-term holders.

Visit Solaxy

Best Wallet Token ($BEST) is designed to power the Best Wallet ecosystem, offering users a range of benefits and utilities. In its presale, $BEST has already raised $8.5 million, making it one of the most anticipated launches in the space.

One of the biggest advantages of $BEST, apart from being part of an already successful ecosystem, is its ability to reduce transaction fees for its holders. Additionally, holders gain early access to new projects and presales at Stage 0, providing a major advantage in securing high-potential investments before they become publicly available.

BestWallet Is The Best Crypto Wallet And Hottest Crypto Launchpad Of 2025!

The token also plays a vital role in governance, allowing holders to vote on key decisions within the ecosystem. Staking rewards are significantly enhanced for $BEST holders, making it a valuable asset for those looking to maximize their returns.

The token’s supply is capped at 10 billion, with 127 million tokens currently staked, delivering a live APY of up to 209%. Best Wallet also offers an airdrop program where users can earn $BEST tokens by completing daily or weekly quests, further incentivizing engagement. Currently, $BEST is priced at $0.023775 in presale.

Visit Best Wallet Token

Official Trump ($TRUMP) launched on January 17, 2025, and within hours, it reached a market cap of $15 billion. The token hit an all-time high of $73 before correcting to its current price of $27.4, with a market cap of $5.4 billion and a 24-hour trading volume of $2.7 billion.

This token is unique because it is the official meme coin of the 45th President of the United States, Donald Trump. Following the success of $TRUMP, Melania Trump, the First Lady, launched her own token, $MELANIA, further fueling speculation that political figures could drive future crypto trends.

$TRUMP remains highly volatile but offers significant potential for high returns. The strong backing from Trump’s supporters and political influence makes it a token to watch, especially with speculation that government policies could favor its growth.

With major price swings and immense trading volume, $TRUMP presents an opportunity for traders looking for high-reward investments.

Popcat ($POPCAT) is a meme coin inspired by the viral internet sensation featuring a cat named Oatmeal. The token was launched in December 2023 on Raydium and quickly gained traction with the meme coin community.

Despite being 82% below its ATH of $2.05 (reached in November 2024), Popcat remains one of the most exciting meme coins in the market. Currently priced at $0.36 with a market cap of $359 million, Popcat trades 9,500% above its lowest price of $0.0037 per token.

Its popularity is fueled by its strong online presence and dedicated community. Unlike many meme coins that lack real utility, Popcat has positioned itself as more than just a joke. Its ecosystem aims to integrate with online platforms and gaming communities, leveraging its meme status to drive widespread adoption.

With high trading volume and a proven history of reaching new highs, Popcat is a solid contender for explosive growth. If meme coin trends continue, it has the potential to reclaim its ATH and beyond.

It’s all systems go for Coinbase to launch in Argentina after regulators in that South American nation gave their approval for the U.S.-based cryptocurrency exchange to begin operating there, the company said Tuesday (Jan 28).

The expansion will be led by Matías Alberti, who previously worked for Latin American crypto firm Buenbit. “Matías brings a wealth of experience and a deep understanding of the local market,” said Fabio Plein, director for the Americas at Coinbase. “We’re confident in his leadership as we work to bring crypto services to millions of Argentinians.”

The Argentine economy has been on better footing as of late, with credit rating agency Moody’s upgrading the country, Fortune reported on Jan. 25. This was due mostly to President Javier Milei recently introduced economic reforms. And while crypto did not seem to figure in the Moody’s upgrade, Argentines are keen for it.

According to Coinbase, 5 million Argentinians use crypto daily, with 87% believing crypto can boost financial independence. Already, 76% of the country’s adults see crypto as a solution to some of their financial frustrations, such as inflation and high transaction costs, while 79% are open to receiving their payments, including wages, in cryptocurrency.

“Economic freedom is a cornerstone of prosperity, and we are proud to bring secure, transparent and reliable crypto services to Argentina,” added Plein in a company announcement. “For many Argentinians, crypto isn’t just an investment, it’s a necessity for regaining control over their financial futures.”

As part of its launch there, Coinbase has secured a Virtual Asset Service Provider (VASP) registration from the country’s National Securities Commission (CNV). This will allow Coinbase to operate within the country’s legal framework for virtual assets as it begins rolling out its products in 2025.

The CNV registration will also allow Coinbase to augment its efforts in Argentina by offering localized services in Spanish, including local payment methods and customer support. To further raise the comfort level of Argentine consumers toward crypto, Coinbase plans to launch what it calls educational initiatives to enhance financial literacy for its users. The company reasons that a knowledgeable customer base will be able to navigate the crypto ecosystem with greater confidence.

The expansion into Argentina follows the announcements of the upgrade to the Coinbase One subscription program, introducing a premium tier, and the integration of Apple Pay as a payment method for Coinbase Onramp, both announced last December.

On Tuesday, light truck clean energy solutions provider Worksport Ltd (NASDAQ:WKSP) announced that it had selected Coinbase Global, Inc (NASDAQ:COIN) as its preferred custodian partner.

Worksport cited Coinbase’s substantial regulatory compliance, robust security measures, and insurance-backed custody solutions.

This strategic move aligns with Worksport’s Cryptocurrency Treasury Strategy announced on December 5, 2024, wherein the company expanded its Corporate Treasury and allowed a portion of its surplus cash reserves to be held in Bitcoin (CRYPTO: BTC/USD) and (CRYPTO: XRP).

Worksport’s Board of Directors determines investable excess cash, which allows Worksport to make initial purchases.

Also Read: Amazon To Shut 7 Quebec Fulfillment Centers, Axe Around 2,000 Jobs

Worksport chief Steven Rossi stated that having a top-tier crypto custodian is like having a top-tier banking partner who aligns with Worksport’s commitment to safeguarding corporate assets.

The treasury update aligns with Worksport’s ongoing growth initiatives, including a multi-fold revenue increase, a push toward cash flow positivity, and the imminent launch of three new product lines in 2025, the company said.

Worksport anticipates that this collaboration will streamline the company’s entry into the cryptocurrency space.

Price Actions: WKSP stock traded higher by 4.36% at $0.92 premarket at the last check on Tuesday.

Also Read:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article EXCLUSIVE: Worksport Taps Coinbase As Cryptocurrency Custodian For Treasury Strategies originally appeared on Benzinga.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Book Review: ‘Somewhere Toward Freedom,’ by Bennett Parten

Judges Begin Freeing Jan. 6 Defendants After Trump’s Clemency Order

Hamas releases four female Israeli soldiers as 200 Palestinians set free

Instagram and Facebook Blocked and Hid Abortion Pill Providers’ Posts

Oklahoma Sen Mullin confident Hegseth will be confirmed, predicts who Democrats will try to sink next

Israel Frees 200 Palestinian Prisoners in Second Cease-Fire Exchange

A Heavy Favorite Emerges in the Race to Lead the Democratic Party

How to Watch Jannik Sinner vs. Alexander Zverev Australian Open Men’s Tennis Final Online Free