Crypto

Genesis vs. Gemini: $689 Million Lawsuit

In a new twist to the ongoing saga between crypto

lenders and exchanges, Genesis Global Capital, which filed for bankruptcy in

January, has launched a lawsuit against the cryptocurrency exchange Gemini. The

legal action seeks to recover a substantial sum of $689 million in preferential

transfers, according to court documents filed on November 21.

The origin of this legal dispute can be traced

back to the collapse of the FTX crypto exchange in November 2022. Following the

exchange’s downfall, the two crypto giants, Genesis and Gemini, found

themselves entangled in a public feud over the recovery of funds, leading to

the escalation of conflicts into full-fledged lawsuits.

Genesis alleges that during the critical 90-day

period preceding its bankruptcy filing, Gemini withdrew an “aggregate

gross amount of no less than approximately $689,302,000.” The lawsuit

contends that this withdrawal occurred at the expense of other creditors, and

Gemini continues to benefit by retaining property that Genesis is now

attempting to recover. In response, Genesis’s legal team has called upon the

court to utilize remedies provided by the United States Bankruptcy Code to

rectify the perceived unfairness and restore parity among all creditors.

Beyond the courtroom battles, the CEOs of both

companies engaged in public disputes, accusing each other of non-cooperation

and even issuing threats of legal action. The tension reached a new level when Gemini filed an

adversary proceeding against Genesis on October 27. The filing aimed to

leverage 62,086,586 shares of its Grayscale Bitcoin Trust, which had been used

as collateral to secure loans extended to Genesis through the Gemini Earn

program. At present, the collateral is estimated to be valued at approximately

$1.6 billion.

🚨BREAKING: #Genesis

sues #Gemini

to recover “preferential transfers” worth $689m—

Satoshi Club (@esatoshiclub) November

22, 2023

Winklevoss

Twins Face Allegations of $282 Million Secret Withdrawal

Finance Magnates reported earlier that

Cameron

and Tyler Winklevoss, the Co-Founders of Gemini, were

facing scrutiny following reports of an alleged hidden withdrawal of $282

million from the now-bankrupt crypto lender, Genesis. The withdrawal reportedly

occurred just months before Genesis collapsed entirely, adding another layer of

complexity to the ongoing legal battles within the cryptocurrency industry.

Gemini has recently experienced a series of

setbacks, including layoffs and a decline in trading volumes. The situation

escalated when over $900 million in Gemini customer deposits were frozen due

to the collapse of Genesis,

which facilitated Gemini Earn, an interest-bearing program.

The

withdrawal of funds by the Winklevoss twins has raised questions about whether

the funds were corporate assets or part of their personal crypto holdings.

Internal documents indicate that the substantial withdrawal included various

cryptocurrencies, such as Bitcoin, Ethereum, Gemini’s stablecoin, Dogecoin, and

more. The timing of this withdrawal, just months before Genesis suspended

customer withdrawals, raises suspicions about whether the Winklevoss twins were

aware of the impending collapse.

The

Winklevoss twins had previously sued DCG, the parent company of Genesis, and

its CEO, Barry Silbert, alleging that they were provided with misleading

information about Genesis’s financial health. The

bankruptcy filing by Genesis in January had a ripple effect on the Gemini

Earn program. The lawsuit claimed that DCG offered a promissory note instead of

the promised financial backing. Despite their attempts to exit the Gemini Earn

partnership, the Winklevoss twins asserted that Silbert convinced them

otherwise during a face-to-face meeting.

In a new twist to the ongoing saga between crypto

lenders and exchanges, Genesis Global Capital, which filed for bankruptcy in

January, has launched a lawsuit against the cryptocurrency exchange Gemini. The

legal action seeks to recover a substantial sum of $689 million in preferential

transfers, according to court documents filed on November 21.

The origin of this legal dispute can be traced

back to the collapse of the FTX crypto exchange in November 2022. Following the

exchange’s downfall, the two crypto giants, Genesis and Gemini, found

themselves entangled in a public feud over the recovery of funds, leading to

the escalation of conflicts into full-fledged lawsuits.

Genesis alleges that during the critical 90-day

period preceding its bankruptcy filing, Gemini withdrew an “aggregate

gross amount of no less than approximately $689,302,000.” The lawsuit

contends that this withdrawal occurred at the expense of other creditors, and

Gemini continues to benefit by retaining property that Genesis is now

attempting to recover. In response, Genesis’s legal team has called upon the

court to utilize remedies provided by the United States Bankruptcy Code to

rectify the perceived unfairness and restore parity among all creditors.

Beyond the courtroom battles, the CEOs of both

companies engaged in public disputes, accusing each other of non-cooperation

and even issuing threats of legal action. The tension reached a new level when Gemini filed an

adversary proceeding against Genesis on October 27. The filing aimed to

leverage 62,086,586 shares of its Grayscale Bitcoin Trust, which had been used

as collateral to secure loans extended to Genesis through the Gemini Earn

program. At present, the collateral is estimated to be valued at approximately

$1.6 billion.

🚨BREAKING: #Genesis

sues #Gemini

to recover “preferential transfers” worth $689m—

Satoshi Club (@esatoshiclub) November

22, 2023

Winklevoss

Twins Face Allegations of $282 Million Secret Withdrawal

Finance Magnates reported earlier that

Cameron

and Tyler Winklevoss, the Co-Founders of Gemini, were

facing scrutiny following reports of an alleged hidden withdrawal of $282

million from the now-bankrupt crypto lender, Genesis. The withdrawal reportedly

occurred just months before Genesis collapsed entirely, adding another layer of

complexity to the ongoing legal battles within the cryptocurrency industry.

Gemini has recently experienced a series of

setbacks, including layoffs and a decline in trading volumes. The situation

escalated when over $900 million in Gemini customer deposits were frozen due

to the collapse of Genesis,

which facilitated Gemini Earn, an interest-bearing program.

The

withdrawal of funds by the Winklevoss twins has raised questions about whether

the funds were corporate assets or part of their personal crypto holdings.

Internal documents indicate that the substantial withdrawal included various

cryptocurrencies, such as Bitcoin, Ethereum, Gemini’s stablecoin, Dogecoin, and

more. The timing of this withdrawal, just months before Genesis suspended

customer withdrawals, raises suspicions about whether the Winklevoss twins were

aware of the impending collapse.

The

Winklevoss twins had previously sued DCG, the parent company of Genesis, and

its CEO, Barry Silbert, alleging that they were provided with misleading

information about Genesis’s financial health. The

bankruptcy filing by Genesis in January had a ripple effect on the Gemini

Earn program. The lawsuit claimed that DCG offered a promissory note instead of

the promised financial backing. Despite their attempts to exit the Gemini Earn

partnership, the Winklevoss twins asserted that Silbert convinced them

otherwise during a face-to-face meeting.

Crypto

Golf courses, skyscrapers, crypto: Trump family’s Mideast business booms

Ahead of US President Donald Trump’s Gulf visit next week, his son Eric was promoting his cryptocurrency firm in Dubai, while Don Jnr prepared to talk about “Monetising Maga” in Doha.

Last month, the Trump Organization struck its first luxury real estate deal in Qatar, and released details of a billion-dollar skyscraper in Dubai whose flats can be bought in cryptocurrency.

In a monarchical region awash with petrodollars, the list of Trump-related ventures is long and growing. However, the presidential entourage is not the only party cashing in, analysts said.

“Gulf governments likely see the presence of the Trump brand in their countries as a way to generate goodwill with the new administration,” said Robert Mogielnicki of the Arab Gulf States Institute in Washington.

If the president chose, he could hopscotch the region from one Trump venture to another when he visits Saudi Arabia, Qatar and the United Arab Emirates next week on the first foreign tour of his second term.

From Dubai’s Trump International golf course, to a high-rise residential block in Jeddah and a US$4 billion golf and real estate project on Omani state-owned land, business links are not hard to find in the desert autocracies.

Crypto

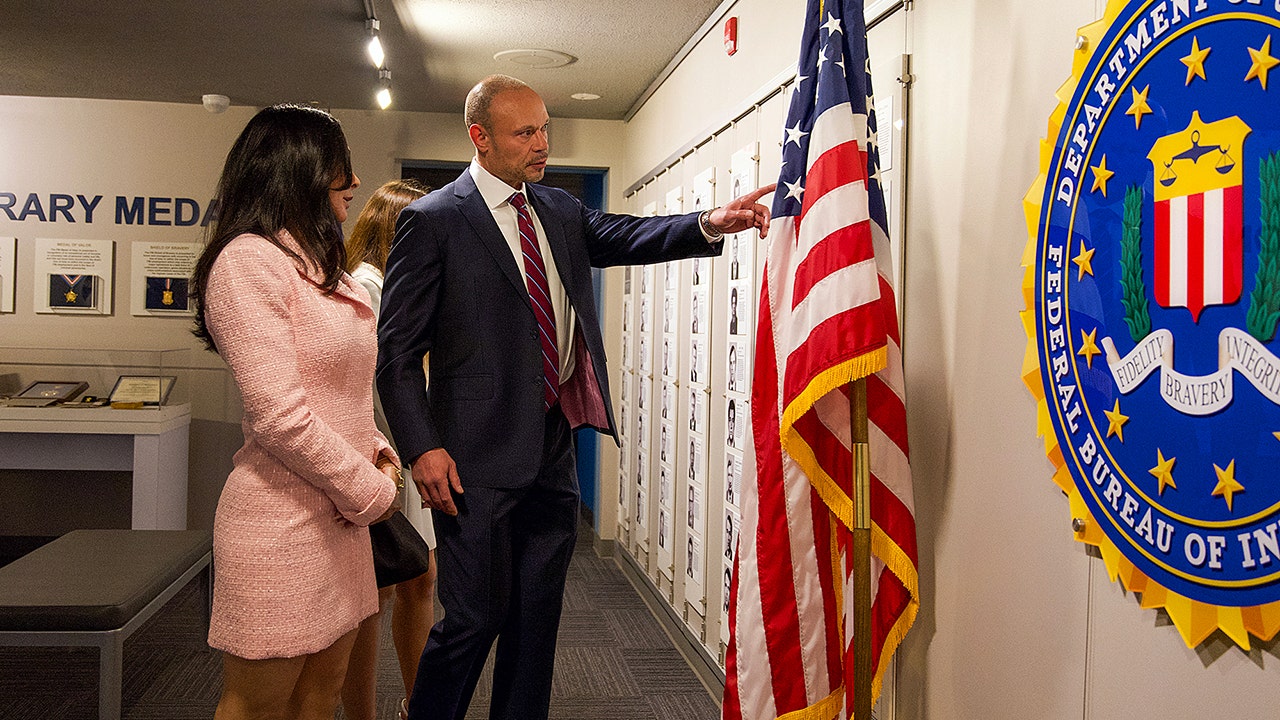

The FBI recovered funds taken from a Kansan in an apparent cryptocurrency scam

What does the future of the cryptocurrency market look like under Trump 2.0?

The president-elect promised to make America the “crypto capital of the planet.”

The U.S. Attorney’s Office in Kansas seized back money siphoned from a cryptocurrency business that had been diverted from a Kansan in an apparent email scam, court records say.

A special investigator with the Federal Bureau of Investigation’s Kansas City Division wrote in an affidavit that a Kansas-based employee of Bizantine Capital Multistrategy Fund, a crypto-based investment company, was deceived into sending $1.2 million worth of the cryptocurrencies Bitcoin and Ether.

The affidavit alleges that then-Leawood resident March Zheng, who worked remotely for Bizantine, received an email that appeared to be from a known customer but was later discovered to be a slightly altered email address being used by a third party.

Zheng traded the cryptocurrencies for “stable coins,” crypto that matches the value of the U.S. dollar, and deposited them into a digital wallet. But when confirming the transfer to the actual client, Zheng learned that the wallet belonged to someone else, the affidavit says.

The FBI traced the transaction through public blockchains, online ledgers that record cryptocurrency transactions, and requests for information from cryptocurrency businesses to locate the funds.

The cryptocurrencies were transferred to at least three different digital wallets and exchanged between several different cryptocurrencies, the affidavit says.

The FBI sent a seizure warrant to the company maintaining the final destination of funds, Tether, which froze the assets and allowed the transfer of just over $1 million to a government-controlled wallet.

There are still missing funds, and the FBI said they suspect the contents of three other cryptocurrency wallets contain fraudulently obtained property and are also subject to seizure.

Cryptocurrencies have been difficult to wrangle back in the past, due to the decentralized, unregulated and multinational nature of the crypto trading. But law enforcement has been getting more adept at countering crypto scams.

Last September, the Kansas Attorney General’s Office recovered money from a Nigerian crypto scammer, calling it “one of the state’s first successful civil actions against an international internet scammer.”

Crypto

Coinbase Earnings: Revenue Dips, But Service Income Hits Record High

Editor’s Note: This analysis was originally published as a stock note by Morningstar Equity Research.

What We Thought of Coinbase Global’s Earnings

Coinbase Global COIN reported sequentially weaker first-quarter earnings as falling cryptocurrency prices during the quarter led to less trading and cryptocurrency asset losses. Net revenue decreased 11% from last quarter, though rose 24% from last year, to $1.96 billion.

Why it matters: While Coinbase’s first-quarter revenue was solid, its net income fell to $65.6 million, or $526.6 million adjusted for cryptocurrency investment losses, from $1.18 billion last year.

• We generally dislike Coinbase’s choice to hold material cryptocurrency investments, as the firm is already heavily exposed to cryptocurrency valuations through its custody, staking, and trading businesses.

• Falling cryptocurrency prices in the first quarter were a headwind to the firm’s trading volume, which was the primary culprit behind the sequential decrease in revenue. Total trading volume decreased 10.5%, driving total transaction revenue down 18.9% to $1.26 billion.

The bottom line: We will maintain our $170 fair value estimate for no-moat-rated Coinbase. We see the shares as modestly overvalued following their strong recovery from April lows.

• Cryptocurrency prices are inherently volatile, which contributes considerable volatility to Coinbase’s quarterly results. That said, the firm has had considerable success in growing its stablecoin revenue, which rose more than 50% from last year, mitigating some of this cryptocurrency price exposure.

Coming up: Earlier in the day Coinbase announced that it intends to buy Deribit, a cryptocurrency derivative exchange, for $700 million in cash and 11 million shares, or roughly $2.9 billion in combined value.

• The deal will bolster Coinbase’s international expansion efforts and its exposure to cryptocurrency derivative markets, in which the firm has only recently established a presence. With nearly $10 billion in cash and stablecoin assets, the acquisition is well within Coinbase’s means.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

-

Technology1 week ago

Technology1 week agoSpotify already has an app ready to test Apple’s new rules

-

Cleveland, OH1 week ago

Cleveland, OH1 week agoWho is Gregory Moore? Former divorce attorney charged for murder of Aliza Sherman in downtown Cleveland

-

News1 week ago

News1 week agoU.S. and China Dig In on Trade War, With No Plans for Formal Talks

-

Politics1 week ago

Politics1 week agoTrump posts AI image of himself as Pope amid Vatican's search for new pontiff

-

Politics1 week ago

Politics1 week agoRep. Mikie Sherrill suggests third Trump impeachment as she campaigns to be next New Jersey governor

-

News1 week ago

News1 week agoFamily of 8-Year-Old Migrant Girl Who Died in U.S. Custody Seeks $15 Million

-

News1 week ago

News1 week agoAre Politicians Too Old? California Democrats Want to Debate an Age Cap.

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Thunderbolts*’ review: Marvel’s most entertaining movie in ages

/cloudfront-us-east-1.images.arcpublishing.com/gray/CMMOB5DOOVHFFBSBAZMBXWLQU4.PNG)