Crypto

Cryptocurrency Titan Coinbase Providing “Geo Tracking Data” to ICE

Coinbase, the most important cryptocurrency change in the US, is promoting Immigrations and Customs Enforcement a set of options used to trace and establish cryptocurrency customers, in keeping with contract paperwork shared with The Intercept.

Information of the deal, doubtlessly price as a lot as $1.37 million, was first reported final September, however particulars of precisely what capabilities can be provided to ICE’s controversial Homeland Safety Investigations division of have been unclear. However a brand new contract doc obtained by Jack Poulson, director of the watchdog group Tech Inquiry, and shared with The Intercept, reveals ICE now has entry to quite a lot of forensic options offered by way of Coinbase Tracer, the corporate’s intelligence-gathering instrument (previously often known as Coinbase Analytics).

Coinbase Tracer permits shoppers, in each authorities and the personal sector, to hint transactions by way of the blockchain, a distributed ledger of transactions integral to cryptocurrency use. Whereas blockchain ledgers are sometimes public, the big quantity of information saved therein could make following the cash from spender to recipient past tough, if not inconceivable, with out assistance from software program instruments. Coinbase markets Tracer to be used in each company compliance and legislation enforcement investigations, touting its potential to “examine illicit actions together with cash laundering and terrorist financing” and “connect [cryptocurrency] addresses to actual world entities.”

Based on the doc, launched through a Freedom of Info Act request, ICE is now capable of monitor transactions made by way of practically a dozen completely different digital currencies, together with Bitcoin, Ether, and Tether. Analytic options embrace “Multi-hop hyperlink Evaluation for incoming and outgoing funds,” granting ICE perception into transfers of those currencies, in addition to “Transaction demixing and shielded transaction evaluation” geared toward thwarting strategies some crypto customers take to launder their funds or camouflage their transactions. The contract additionally gives, provocatively, “Historic geo monitoring information,” although it’s unclear what precisely this information consists of or from the place it’s sourced. An e mail launched by way of the FOIA request reveals that Coinbase didn’t require ICE to comply with an Finish Consumer License Settlement, customary legalese that imposes limits on what a buyer can do with software program.

Coinbase didn’t present an on-the-record remark.

Coinbase has lately made a concerted effort to pitch its intelligence options to authorities companies, together with the IRS, Secret Service, and Drug Enforcement Administration. Earlier this month, Coinbase CEO Brian Armstrong testified earlier than a congressional panel that his firm was keen to help the reason for Homeland Safety. “In case you are a cyber legal and also you’re utilizing crypto, you’re going to have a nasty day. … We’re going to monitor you down and we’re going to search out that finance and we’re going to hopefully assist the federal government seize that crypto.” Coinbase’s authorities work has proved extremely controversial to many crypto followers, owing maybe each to the long-running libertarian streak in that group and the truth that these currencies are so continuously used to facilitate varied types of fraud.

The Coinbase Tracer instrument itself was birthed in controversy. In 2019, Motherboard reported that Neutrino, a blockchain-analysis agency the corporate acquired with a view to create Coinbase Tracer, “was based by three former staff of Hacking Workforce, a controversial Italian surveillance vendor that was caught a number of instances promoting adware to governments with doubtful human rights data, resembling Ethiopia, Saudi Arabia, and Sudan.” Following public outcry, Coinbase introduced these staffers would “transition out” of the corporate.

Homeland Safety Investigations, the division of ICE that bought the Coinbase instrument, is tasked not solely with immigration-related issues, aiding migrant raids and deportation operations, however broader transnational crimes as properly, together with varied types of monetary offenses. It’s unclear to what finish ICE can be utilizing Coinbase. The company couldn’t be instantly reached for remark.

Crypto

Crypto NFT Today: The Latest News in Blockchain, Cryptocurrency, & NFTs- May Week 2 – Innovation & Tech Today

Welcome to another edition of Crypto NFT Today! The past two weeks have been full of must-know events that’ll be defining points for the future of blockchain, cryptocurrency, and NFTs.

With President Biden blocking a Chinese bitcoin mine, Wells Fargo announcing new investments in ETFs, and more, there’s lots of essential news you should know about. So, let’s dive in and see what’s happening!

President Biden Blocks Chinese Bitcoin Mine

On May 14, President Joe Biden issued a directive prohibiting a Chinese-backed cryptocurrency mining company from possessing land adjacent to a nuclear missile base in Wyoming, citing concerns about national security.

The directive mandates the sale of property utilized as a cryptocurrency mining facility near the Francis E. Warren Air Force Base. MineOne Partners Ltd., a company partially supported by Chinese investors, and its subsidiaries are instructed to dismantle specific equipment on the premises.

This action coincides with the United States’ plans to impose significant new tariffs on electric vehicles, semiconductors, solar equipment, and medical supplies imported from China.

Wells Fargo Announces Investments in ETFs

According to a regulatory disclosure, Wells Fargo & Company (WFC) has revealed its involvement in cryptocurrencies by investing in several Bitcoin exchange-traded funds (ETFs). This move reflects a growing interest in digital assets within the financial sector.

The disclosure indicates that Wells Fargo has acquired shares of Grayscale’s GBTC Bitcoin ETF, providing the bank with approximately $141,817 worth of exposure to the digital currency. Additionally, Wells Fargo has made a smaller investment of less than $1,200 in the ProShares Bitcoin Strategy ETF (BITO). This ETF enables investors to gain exposure to Bitcoin futures contracts, allowing them to speculate on the future price movements of the cryptocurrency.

Wisconsin Buys Blackrock Spot Bitcoin ETF

According to a filing, the U.S. state of Wisconsin acquired 94,562 shares of BlackRock’s iShares Bitcoin Trust (IBIT) in the first quarter, valued at nearly $100 million.

Following this news, Bitcoin experienced a 1% increase, currently trading at $61,957. However, it saw a 1.7% decline over the past 24 hours, coinciding with the release of new inflation data exceeding expectations during U.S. morning hours.

Wisconsin, which submitted its quarterly 13F report to the Securities and Exchange Commission (SEC) on Tuesday, becomes the first state to publicly disclose its bitcoin investment. Additionally, the state’s investment board bought shares of Grayscale’s Bitcoin Trust (GBTC) valued at approximately $64 million.

OKX Australia Launches

OKX, a cryptocurrency exchange, has launched its services in Australia, offering spot and derivatives trading options for local users.

This move follows OKX’s establishment of a Sydney office in May last year and marks the latest expansion into international markets, joining previous entries in countries like Turkey and Singapore.

OKX’s expansion into Australia reflects the growing interest in cryptocurrencies among Australians. Notably, the Australian Securities Exchange (ASX) is considering the potential introduction of Spot Bitcoin ETFs by the end of 2024.

Crypto

Cryptocurrency Litecoin Falls More Than 3% In 24 hours By Benzinga

Benzinga – by Benzinga Insights, Benzinga Staff Writer.

Over the past 24 hours, Litecoin’s (CRYPTO: LTC) price has fallen 3.08% to $78.86. This continues its negative trend over the past week where it has experienced a 3.0% loss, moving from $82.02 to its current price.

The chart below compares the price movement and volatility for Litecoin over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has increased 2.0% over the past week while the overall circulating supply of the coin has increased 0.0% to over 74.53 million which makes up an estimated 88.73% of its max supply, which is 84.00 million. The current market cap ranking for LTC is #21 at $5.88 billion.

Powered by CoinGecko API

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Crypto

Cryptocurrency Regulation Debate Escalates as Senators Question DOJ’s Handling of Money Transmission Laws – The UCW Newswire

In a recent development that will set the stage for a battle concerning cryptocurrency regulation, United States Senators Cynthia Lummis and Ron Wyden have penned a letter to Attorney General Merrick Garland, expressing their apprehensions regarding the Justice Department’s (DOJ) interpretation of money transmission licensing.

The letter, signed by both senators, raises concerns over the DOJ’s application of money transmission laws in the case against Roman Storm, the co-founder of crypto mixer Tornado Cash. Storm faces charges related to operating an unlicensed money transmission operation, among other serious allegations.

Central to the senators’ concerns is the discrepancy between the DOJ’s interpretation and established definitions outlined by the Bank Secrecy Act and the Treasury Department’s Financial Crimes Enforcement Network (FinCEN). According to Lummis and Wyden, non-custodial crypto service providers, like Tornado Cash, do not meet the criteria set forth in these definitions.

The senators argue that bitcoins and other cryptocurrencies have a clear, unilateral owner throughout the transaction process, eliminating any ambiguity regarding ownership. They assert that custody and control are the fundamental factors determining the occurrence of “acceptance and transmission” on crypto networks.

Highlighting FinCEN’s role as the primary interpretive authority on money transmission registration requirements, the senators caution against the DOJ’s broad application of its interpretation. They warn that such an approach could extend regulatory scrutiny to a wide array of services, including internet service providers and even the postal service.

Echoing similar sentiments, crypto advocacy groups filed a joint amicus brief in April with the Southern New York District Court, supporting Storm’s position. Storm’s legal team filed a motion to dismiss the charges in March, arguing that Tornado Cash did not meet the definition of a money transmission business.

However, prosecutors contend that Storm bears responsibility for operating Tornado Cash and allege that the service facilitated criminal activities. They accuse Storm of designing software that aided criminality and assert that Tornado Cash was involved in the transmission of funds derived from criminal offenses.

Storm, who was arrested in August on charges of sanctions violations, facilitating money laundering, and unlicensed money transmission, faces up to 45 years in prison if convicted. He has pleaded not guilty to the charges and is currently out on $2 million bail with travel restrictions.

The letter from Senators Lummis and Wyden underscores the growing debate surrounding cryptocurrency regulation in the United States and the reach of the SEC, highlighting the need for clarity and consistency in interpreting existing laws in the rapidly evolving crypto landscape. Perhaps a new administration will see this and force a clear outline so that compliance can be adhered to clearly by all in the industry as opposed to it being a guessing game.

Terry Jones

Digital Assets Desk

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

World1 week ago

World1 week agoSpain and Argentina trade jibes in row before visit by President Milei

-

Politics1 week ago

Politics1 week agoFetterman says anti-Israel campus protests ‘working against peace' in Middle East, not putting hostages first

-

World1 week ago

World1 week agoGerman socialist candidate attacked before EU elections

-

News1 week ago

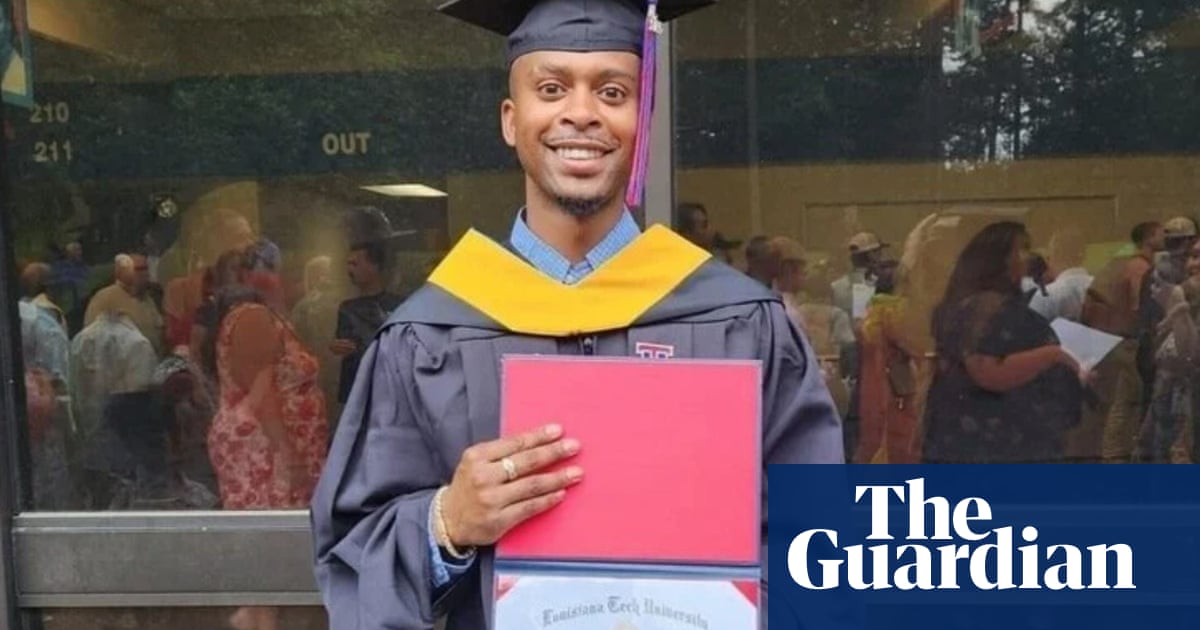

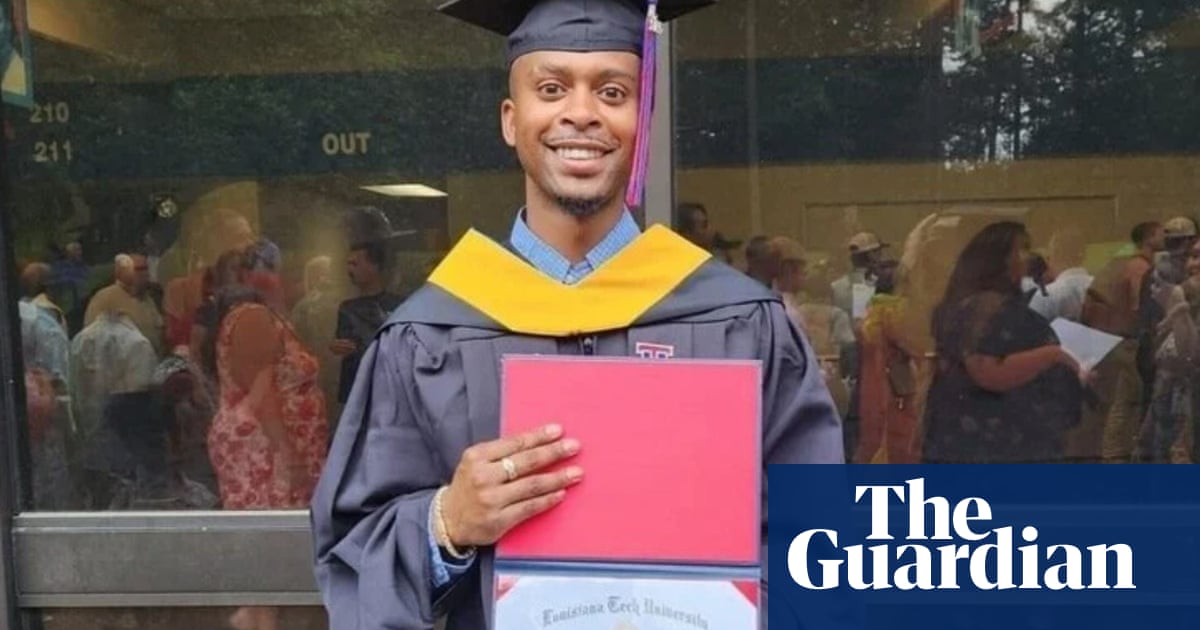

News1 week agoUS man diagnosed with brain damage after allegedly being pushed into lake

-

World1 week ago

World1 week agoGaza ceasefire talks at crucial stage as Hamas delegation leaves Cairo

-

Politics1 week ago

Politics1 week agoRepublicans believe college campus chaos works in their favor

-

Politics1 week ago

Politics1 week agoConservative beer brand plans 'Frat Boy Summer' event celebrating college students who defended American flag