Crypto

Crypto Price Today Live: Bitcoin stays above $20,000; Shiba Inu & Avalanche shed 3% each

The most recent red-hot inflation numbers have put world traders on edge in regards to the potential actions by the US Fed in its assembly subsequent week. The FOMC is prone to push rates of interest by 75 foundation factors, whereas a 100-bps hike can’t be dominated out.

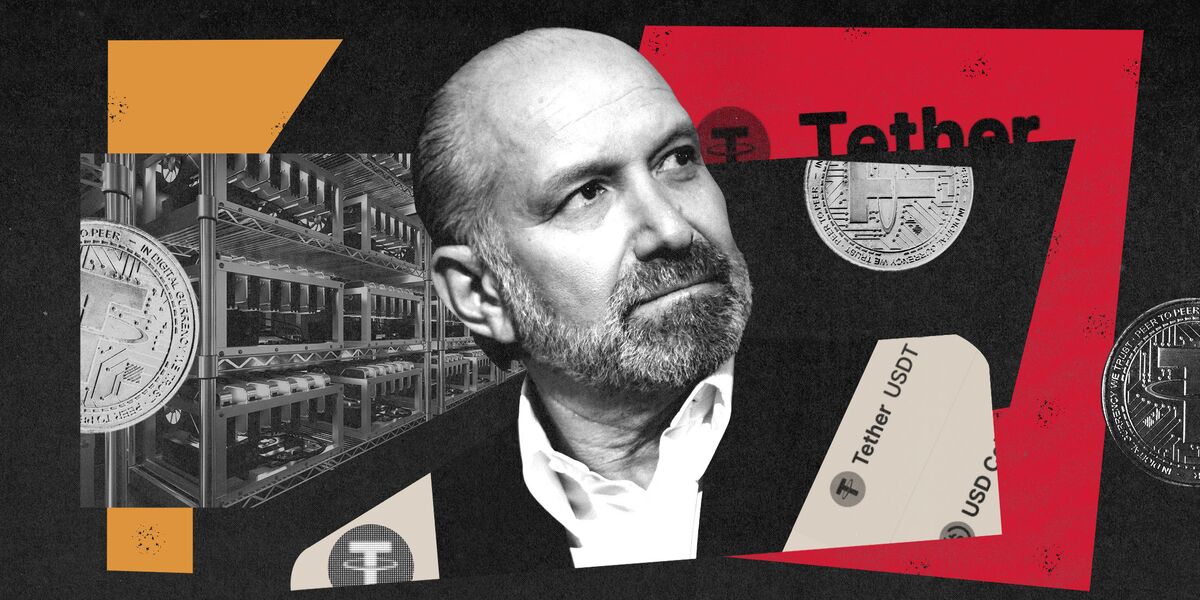

Barring the US dollar-pegged Tether, all different main crypto tokens have been buying and selling decrease on Thursday. Shiba Inu and Avalanche dropped 3 per cent every, whereas Bitcoin, Polkadot and Polygon shed 2 per cent every.

The worldwide cryptocurrency market cap was buying and selling decrease at $990.19 billion, dropping virtually a per cent within the final 24 hours. Nonetheless, complete buying and selling quantity tumbled as a lot as 23 per cent, near $78.30 billion.

Professional Take

Inflation charges as soon as once more influenced the worldwide cryptocurrency market this week which led to the worldwide crypto market cap once more falling under $1 trillion because it reacted to the US client value index, stated Prashant Kumar, Founder and CEO weTrade.

“The 2 prime cryptocurrencies – Bitcoin and Ethereum – that had made positive aspects over the weekend noticed a decline,” he added. “All eyes are on the Ethereum Merge which is scheduled to be accomplished at this time.”

World Updates

A South Korean court docket has issued an arrest warrant in opposition to Do Kwon, the co-founder of the now defunct stablecoin issuer Terraform Labs, based on the monetary crimes unit of the Supreme Prosecutors’ Workplace.

Cryptocurrency alternate FTX is elevating capital in parallel with a possible acquisition, based on an individual aware of the matter.

Crypto markets seemed to be in suspension on Wednesday as merchants awaited the Ethereum blockchain’s historic Merge – the community’s transition to a proof-of-stake (PoS) community, anticipated to happen in about 12 hours.

In April 2021, China hosted what cryptocurrency and artwork media retailers heralded because the world’s first “main” crypto artwork exhibit.

Tech View by Giottus Crypto Platform

Ethereum (ETH), the biggest sensible contract-based blockchain for decentralized purposes, is about to undergo one of many largest occasions in its historical past at this time. The Merge – Ethereum’s transition from a Proof-of-Work primarily based community to a Proof-of-Stake community has been initiated amidst a slew of antagonistic macro actions.

It is going to be attention-grabbing to notice ETH’s value developments at such a vital stage. ETH remains to be buying and selling 23 per cent under its August excessive of $2,000. As of 8 am at this time, ETH is buying and selling at $1,610, up by 1 per cent within the final 24 hours.

Chart-ETH

After reaching a excessive of $2,000 in mid of August, ETH created a collection of decrease highs to backside at $1,400 earlier than it began charting an upward development once more. Since then, ETH has been transferring in an ascending parallel channel and has defaulted twice to interrupt under the channel. To this point, the higher trendline resistance within the channel is performing as a robust resistance, and ETH has been unable to interrupt out. ETH has damaged under the channel, and the .618 fib retracement is at the moment performing as its rapid assist.

Elevated whale exercise and the inflow of institutional investments within the wake of staking positive aspects could brighten ETH’s prospects. Nonetheless, Ethereum wants to beat the psychological resistance of $1,700 to provoke one other value rally. In case of a selloff at this time, $1,500 ought to act as rapid assist although it could break if the Merge is unsuccessful or delayed.

Main ranges

Resistance: $1,650, $1,700

Help: $1,550, $1,490

(Views and suggestions given on this part are the analysts’ personal and don’t symbolize these of ETMarkets.com. Please seek the advice of your monetary adviser earlier than taking any place within the asset/s talked about.)

Crypto

$MELANIA Meme Coin launched: How to buy Melania Trump’s cryptocurrency – check quick guide – The Times of India

$MELANIA meme coin: US President elect Donald Trump’s wife Melania Trump has launched her own cryptocurrency, the $MELANIA meme coin, early Monday, shortly after her husband’s launch of the $TRUMP memecoin.

Melania Trump announced the launch on X (formerly Twitter), posting: “The Official Melania Meme is live! You can buy $MELANIA now.” This announcement generated significant engagement, resulting in increased token value.

For those wishing to acquire $MELANIA tokens, here is a detailed acquisition process:

Solana-Compatible Wallet for $MELANIA meme coin

According to an ET report, the first requirement is establishing a Solana-compatible digital wallet if you haven’t already. Recommended platforms include Phantom and Solflare, which offer secure storage and management of your $MELANIA tokens.

$MELANIA meme coin Official website launched

Access the coin’s official platform at melaniameme.com, where you’ll find comprehensive information about the token and purchase options.

Wallet Integration

Select the “Connect Wallet” option on the website to establish a connection with your Solana-compatible wallet, enabling direct platform interaction and transaction management.

$MELANIA Token Acquisition Methods

The platform offers two primary purchase methods:

Credit Card Transactions: Direct purchases are available using credit cards. Simply input your card information as requested, and the tokens will transfer to your linked wallet.

Cryptocurrency Exchange (SOL): Alternatively, use Solana (SOL) tokens for purchases. If you lack SOL, acquire it through cryptocurrency exchanges before proceeding with your $MELANIA token purchase via the website.

(Disclaimer: The above article is for information purposes only. It should not be seen as a recommendation to buy)

Crypto

Trump’s meme coin creates billions from thin air, rattles cryptocurrency market – The Times of India

A digital token debuted by President-elect Donald Trump has rattled the cryptocurrency market, attracting billions of dollars of trading volume while stoking concerns about conflicts of interest.

Trading under the “Trump” ticker on the Solana blockchain, the token’s market value surged to $15 billion over the weekend, data from CoinMarketCap show, after the Republican touted it on his social media accounts on Friday.

The digital asset’s market capitalization then slid below $10 billion on Sunday in New York after Trump’s wife Melania also unveiled a coin, drawing traders who seek to capitalize on rapidly shifting speculative demand for memes.

Meanwhile, the wider crypto market struggled over the weekend, including a dip in the largest token, Bitcoin, and a shaper retreat for second-ranked Ether. SOL, the cryptoasset associated with the Solana digital ledger hosting the Trump meme coins, bucked the trend and posted a rally.

Speculative flows

The “size of the capital flowing” to the Trump token left most other coins trading “poorly” outside of SOL and some related assets, said Sydney-based Richard Galvin, co-founder of hedge fund DACM.

The website for the president-elect’s token describes it as the “the only official Trump meme.” The project’s art features an illustration of the incoming US president with his fist in the air — a reference to his response in the aftermath of an attempt on his life during a campaign rally last year.

The small print on the website states the president-elect’s token isn’t intended to be an “investment opportunity, investment contract, or security of any type.” Still, crypto-minded Trump fans immediately started buying. Major exchanges like Coinbase Global Inc. and Binance Holdings Ltd. said during the weekend they intended to list the token on their platforms.

The website for Melania’s project also says that the token isn’t supposed to be an investment opportunity or security, adding that “Melania memes are digital collectibles intended to function as an expression of support for and engagement with the values embodied by the symbol MELANIA.”

Trump’s embrace

Trump made explicit overtures to the crypto industry in the months before and after his election. Bloomberg News has previously reported that he’s considering an executive order designating the asset class a “national priority.”

The president-elect’s previous forays into crypto include profitable collections of nonfungible tokens, digital collectibles that show him in a variety of poses and costumes, including as a superhero. Along with his sons, he’s also endorsed World Liberty Financial, a project that has been much-hyped but for which details remain scarce.

Representatives for Trump didn’t return requests for comment.

Crypto is notorious for meme coins, tokens with questionable inherent value that sometimes briefly surge if they catch a social media tailwind before sliding as attention turns elsewhere.

The Trump token traded at about $39 as of 7:30am on Monday in Singapore, down from an earlier peak of $75.35. Bitcoin slid to $100,000, Ether changed hands at $3,161 and a cooling SOL rally left the digital asset at roughly $240.

Crypto

Top Cryptocurrencies To Watch In 2025

2024 was a big year for crypto. What lies in store for 2025 and which are the top cryptocurrencies … [+]

The world of cryptocurrencies never stands still, and 2024 was no exception. It was a year marked by volatility, innovation and significant milestones that may set the stage for the future of digital assets. From regulatory crackdowns in major markets to the surprising embrace of cryptocurrencies by political leaders like U.S. President Donald Trump, the narrative around crypto has become more complex than ever before.

Major cryptos like bitcoin continued to dominate, bolstered by institutional investment and integration into traditional finance. At the same time, Ethereum’s transition to proof-of-stake matured, driving innovations in decentralized applications (dApps) and DeFi. Meanwhile, emerging sectors such as AI-driven tokens and meme coins captured the imagination of a new wave of investors, underscoring the diversity and dynamism of the cryptocurrency space.

Cryptocurrencies are highly volatile and involve significant risks. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. The information provided in this article is for informational purposes only and should not be construed as financial or investment advice.

There are literally millions of cryptocurrencies in existence. Still, the cryptocurrencies below are some of the top cryptocurrencies to watch in 2025, showcasing tokens shaping the present and redefining what is possible in the future of finance and technology.

Methodology Used To Pick These Top Cryptocurrencies

To identify the top cryptocurrencies for 2025, I focused on a mix of market metrics, innovation and real-world utility. Key considerations included market capitalization, price performance, and trading volume, as well as each project’s ability to address challenges in the blockchain ecosystem.

Technological advancements, strong ecosystems and adaptability to macroeconomic trends were critical factors. We also considered cultural relevance and community support, which play a significant role in the success of tokens like Dogecoin. This balanced approach highlights cryptocurrencies that are not only impactful today but are well-positioned for the future.

Bitcoin (BTC)

Bitcoin Overview

- Current Price: $95,575

- Market Cap: $1.9 trillion

- Circulating Supply: ~20 million BTC

Why Bitcoin Is A Top Crypto To Watch

Bitcoin, the world’s first cryptocurrency, continues to dominate the market with the “digital gold” narrative. Its fixed supply of 21 million coins ensures scarcity, which has been one of the drivers of its price rise to over $100,000 in 2024. The coin’s strong resilience in the face of regulatory scrutiny and market volatility has cemented its status as the cornerstone of the crypto economy.

Companies like MicroStrategy remain steadfast in their commitment to Bitcoin. In 2024, MicroStrategy continued to expand its Bitcoin holdings, becoming one of, if not the largest, corporate crypto investors. The company’s strategy underscores the growing trend of enterprises viewing Bitcoin as a strategic asset, not just a speculative one.

Also, in 2024, Bitcoin made headlines during the U.S. presidential election when former President Donald Trump endorsed it as a hedge against inflation and the declining dollar. This unexpected support from a high-profile political figure brought Bitcoin to the mainstream spotlight, sparking renewed interest from retail and institutional investors. 2025 will be critical as the new seemingly crypto-friendly administration gets into place.

So far, national adoption of any Bitcoin standard has been limited to countries like El Salvador. If the United States moves to legitimize Bitcoin further, and institutional demand continues, it will drive the value of Bitcoin to new highs in 2025.

Ethereum (ETH)

Ethereum Overview

- Current Price: $3,189

- Market Cap: $383 billion

- Circulating Supply: 120.1 million ETH

Why Ethereum Is A Top Crypto To Watch

Ethereum entered 2025 after a somewhat underwhelming performance in 2024. While its transition to proof-of-stake and ongoing scalability upgrades have solidified its position as a leading blockchain for decentralized applications (dApps) and DeFi, Ethereum faced stiff competition from faster and more cost-efficient alternatives like Solana.

Compared to Bitcoin’s resurgence in 2024—buoyed by institutional adoption and political endorsements—Ethereum’s growth was more modest. While it remains a powerhouse in the blockchain ecosystem, its market share in key sectors like DeFi and NFTs has declined slightly due to the rise of these alternative platforms.

However, Ethereum’s continued relevance lies in its adaptability and vast developer ecosystem. The rollout of Layer 2 solutions like Arbitrum and Optimism has helped to address scalability issues, ensuring Ethereum remains a foundational layer for decentralized innovation. With the Ethereum ecosystem continuing to evolve, the platform is well-positioned to maintain its leadership role in the crypto space.

Solana (SOL)

Solana Overview

- Current Price: $187

- Market Cap: $90 billion

- Circulating Supply: 400 million SOL

Why Solana Is A Top Crypto To Watch

Solana is one of the newer blockchains, as compared to the O.G.s of Bitcoin and Ethereum but has nevertheless established itself as a leading alternative to Ethereum, gaining traction in 2024 with its unique combination of speed, scalability and low transaction costs. Solana’s infrastructure is capable of processing up to 65,000 transactions per second with near-zero fees, making it a prime choice for applications requiring high throughput, such as gaming, DeFi and NFTs.

While Ethereum struggled with scalability issues, Solana attracted developers and projects looking for faster and cheaper solutions. Major NFT marketplaces expanded their presence on Solana, and DeFi protocols leveraged the platform’s efficiency to offer competitive services. This led to a significant increase in adoption and a steady rise in Solana’s price and market cap throughout 2024.

However, Solana’s rapid ascent hasn’t been without challenges. The network experienced several outages in 2024, raising concerns about reliability. Despite this, the platform’s commitment to improving its infrastructure and expanding its ecosystem has reassured developers and investors alike.

Comparatively, Solana’s price performance in 2024 outpaced Ethereum’s growth percentage-wise, underscoring its increasing popularity and market confidence. With ongoing ecosystem developments and partnerships, Solana is poised to remain a major player in the cryptocurrency landscape in 2025, offering a viable alternative for projects seeking scalability and cost-efficiency.

Fetch.ai (FET)

Fetch.ai Overview

- Current Price: $1.25

- Market Cap: $3.28 billion

- Circulating Supply: 2.6 billion FET

Why Fetch.ai Is A Top Crypto To Watch

Artificial Intelligence (AI) adoption has surged over the past few years, and it was only a matter of time before that spilled over to the crypto space. Although countless tokens focus on AI, Fetch.ai is among the most popular.

Fetch.ai enables the creation of decentralized autonomous agents that can perform tasks like data sharing, trading, and infrastructure optimization. As AI adoption surged in 2024, Fetch.ai gained attention for its practical applications, including smart city infrastructure and supply chain automation.

The platform’s modular architecture makes it highly adaptable for various industries, allowing businesses to build tailored solutions for complex problems. In 2024, Fetch.ai expanded its ecosystem with integrations into popular blockchain networks and partnerships with enterprises focusing on automation and efficiency. These developments increased the token’s utility and attracted a broader range of developers and investors, cementing Fetch.ai’s place as a pioneering force in decentralized AI technologies.

The FET token has benefited from the broader AI hype that resonated across traditional and decentralized markets. Its token saw substantial price growth as investors bet on the intersection of AI and blockchain as a transformative sector for the coming years. Focusing on real-world utility and cutting-edge technology, Fetch.ai remains a top contender for 2025.

Dogecoin (DOGE)

Dogecoin Overview

- Current Price: $0.35

- Market Cap: $50.1 billion

- Circulating Supply: ~148 billion DOGE

Why Dogecoin Is A Top Crypto To Watch

Crypto wouldn’t be crypto without meme coins. Dogecoin, the original meme coin, holds a unique position in the cryptocurrency market. What started as a joke has evolved into a major player, supported by an enthusiastic global community and high-profile endorsements from figures like Elon Musk. In 2024, Dogecoin experienced a resurgence in popularity, driven by a mix of humor, community-driven projects, and increasing real-world utility.

Unlike many speculative meme coins, Dogecoin has started to establish itself as a viable payment solution. Businesses, including major brands, began accepting Dogecoin for transactions, boosting its relevance beyond internet culture. In addition, Musk’s ongoing support on social media has consistently propelled the coin into the spotlight, making it a favorite among retail investors.

Dogecoin also benefits from its simplicity and accessibility, which resonate with new entrants to the crypto space. With its low transaction fees and a fast-growing network of supporters, Dogecoin has proven that it’s more than just a meme—it’s a cultural phenomenon with staying power. As 2025 unfolds, Musk’s focus on crypto, along with industry attention, will likely ensure that Doge remains a key Crypto for 2025.

Bottom Line

The cryptocurrency market in 2025 stands at a crossroads, brimming with potential but shadowed by significant uncertainties. While Bitcoin continues to enjoy institutional backing and cultural relevance, Ethereum faces intensifying competition from alternative platforms like Solana, and newer sectors such as AI-driven tokens and meme coins are still carving out their place in the ecosystem. The optimism around these innovations is tempered by questions about long-term utility, scalability and the sustainability of market momentum.

Beyond the crypto-specific challenges, the broader global economy casts a long shadow. Persistent inflation, rising interest rates and geopolitical tensions threaten to shake investor confidence across all asset classes, cryptocurrencies included. In 2024, these economic headwinds created ripple effects in the crypto space, as tighter monetary policies reduced the speculative capital that has historically fueled the market. If these trends continue, cryptocurrencies may struggle to replicate the explosive growth seen in their earlier years.

Additionally, regulatory scrutiny remains a looming concern, with governments worldwide grappling to establish clearer frameworks—or harsher crackdowns—for digital assets. High-profile bankruptcies, network outages, and concerns over security and decentralization have raised valid skepticism about whether the market can deliver on its lofty promises.

While the projects highlighted in this article showcase some of the most compelling opportunities in the crypto space, they are not without risks. Investors should approach 2025 with cautious optimism, staying informed and critically evaluating the market. Cryptocurrencies may still hold the potential to redefine finance and technology, but their trajectory will depend as much on the resilience of the global economy as on their ability to address internal challenges. The year ahead promises both excitement and volatility, a hallmark of the crypto ecosystem.

-

Science1 week ago

Science1 week agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg) Technology1 week ago

Technology1 week agoAmazon Prime will shut down its clothing try-on program

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg) Technology1 week ago

Technology1 week agoL’Oréal’s new skincare gadget told me I should try retinol

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg) Technology5 days ago

Technology5 days agoSuper Bowl LIX will stream for free on Tubi

-

Business6 days ago

Business6 days agoWhy TikTok Users Are Downloading ‘Red Note,’ the Chinese App

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png) Technology3 days ago

Technology3 days agoNintendo omits original Donkey Kong Country Returns team from the remaster’s credits

-

Culture2 days ago

Culture2 days agoAmerican men can’t win Olympic cross-country skiing medals — or can they?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg) Technology7 days ago

Technology7 days agoMeta is already working on Community Notes for Threads