Both Ethereum (ETH 6.03%) and XRP (XRP 3.76%) are tried-and-tested blockchains which have survived (and sometimes thrived) for years on end. That means they’re both sturdy enough to be candidates for a big investment, like $5,000, and for holding over the very long term, or even forever.

So which of these two leading coins is the better option for a forever hold?

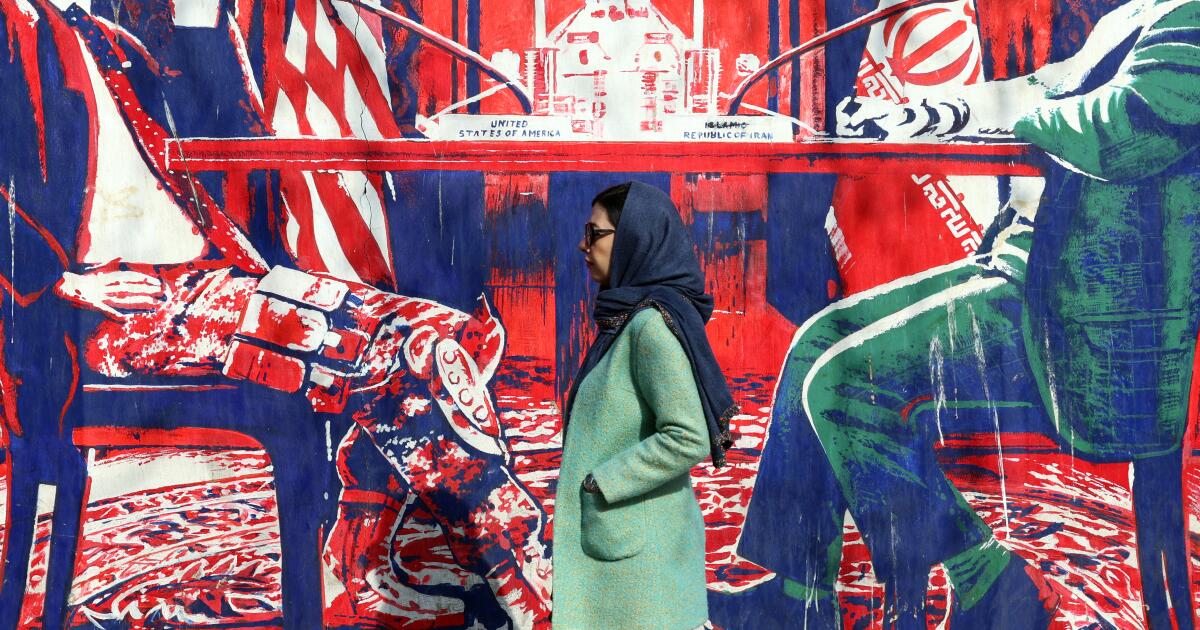

Image source: Getty Images.

Ethereum has more ways to grow

Forever is a long time, especially for an investment in an emerging sector like crypto. Therefore, an asset’s optionality regarding where it can derive growth is a key factor, as today’s growth drivers might peter out and new ones are likely to emerge.

On that front, Ethereum has plenty of options. It already hosts a large decentralized finance (DeFi) ecosystem worth more than $53 billion today, powered by a massive stablecoin base of $159 billion. That existing base of capital is a strategic asset because it gives developers and financial institutions a reason to build new products right where liquidity already lives. It also gives investors exposure to many possible growth lanes at once, from the onboarding of tokenized real-world assets (RWAs) to the development of new settlement rails for payments between AI agents.

Today’s Change

(-6.03%) $-123.58

Current Price

$1924.97

Key Data Points

Market Cap

$232B

Day’s Range

$1898.54 – $2048.55

52wk Range

$1398.62 – $4946.05

Volume

20B

Another advantage is that Ethereum has a track record of consistently shipping large protocol upgrades. The Pectra upgrade, for example, landed on the mainnet in May 2025, followed by the Fusaka upgrade in December. Two similarly large feature packages are expected for 2026, and they should help to build the chain’s ability to scale up without spiking transaction costs.

If you plan to hold an asset indefinitely, this network’s culture of iterative improvement reduces the risk that its technical capabilities will become irrelevant as emerging opportunities for growth arise. Its habit of attracting and retaining substantial capital also helps prevent that outcome.

XRP has to keep winning specific fights over time

XRP is not a bad crypto asset by any means, but its long-term burden is its far narrower positioning than Ethereum.

Ripple, the coin’s issuer, built the XRP Ledger (XRPL) ecosystem as a toolkit of financial technologies to support specific workflows in institutional finance, especially cross-border payments and money transfers, and, more recently, the management of tokenized asset capital. The coin’s value is thus derived from the utility of its ledger.

That focus could pay off if the financial companies the chain targets like what it’s offering, but it also concentrates risk. Financial institutions move cautiously, and winning them over is a slow, grinding process of catering to their needs and building strong relationships. Their technology adoption process can stall for years, even when the product works, and decision-makers broadly want to adopt the new tech.

To Ripple’s credit, the XRP Ledger includes plenty of features that match institutional requirements and seek to minimize their potential pain points. The network’s authorized trust lines, for instance, let tokenized asset issuers whitelist who can hold their issued tokens, which is a feature that supports regulatory constraints around who can legally custody an asset. Similarly, the ledger supports freezing tokens when suspicious activity appears, which is a control that traditional finance teams tend to expect in regulated asset workflows.

Today’s Change

(-3.76%) $-0.05

Current Price

$1.35 Market Cap

$83B

Day’s Range

$1.34 – $1.42

52wk Range $1.14 – $3.65

Volume

2.8B

Key Data Points

But holding a coin forever is unforgiving of sustained competitive pressure, which XRP doubtlessly faces. Its competitors include fintech companies and other cryptocurrencies, not to mention the internal tech development capabilities of many of its target users in big banks. So it’ll need to continuously one up the other players in its space if it’s going to grow over the long term, and it’s hard to believe that it’ll win every round that counts.

The verdict

The decision here is about resilience and resources.

Ethereum’s “grizzled veteran” reputation today stems from surviving numerous shifts in user demand patterns while maintaining a large on-chain capital pool and growing it all the while. Its success or failure in any given crypto market segment is not guaranteed, nor was it in the past, but its constant evolution has ensured that failures are not fatal, and also that missed opportunities aren’t very damaging overall.

XRP, on the other hand, is only just starting to scale up its on-chain capital base; it has only $418 million in stablecoins. Furthermore, while it has succeeded in attracting some financial institutions to its chain, the truth is that its growth trajectory has not yet been seriously tested, and is still finding an appropriate product-market fit. Its real competitive challenges have only just begun.

So if you want a coin to buy with $5,000 and hold forever, pick the asset that can win without needing to be perfect: Ethereum. XRP is still a decent long-term hold, assuming it’s part of a diversified crypto portfolio, but it’s riskier.