Business

Why This Is No Madoff Moment for FTX Creditors

Why getting again cash from FTX will probably be so laborious

The legion of collectors who misplaced billions in final month’s collapse of the crypto trade FTX simply obtained a tiny piece of excellent information: Numerous events that obtained funds and political contributions from the corporate; its jailed founder, Sam Bankman-Fried; and his associates have expressed a willingness to return the cash, FTX stated in an announcement Monday night time.

Politicians have been among the many largest benefactors. Mr. Bankman-Fried; Ryan Salame, the previous co-C.E.O. of FTX; and Nishad Singh, a former head of engineering on the firm, have donated a complete of $84.3 million to Democrats, Republicans and political motion committees since 2019, in accordance with information collected by OpenSecrets.org and shared with DealBook. Some politicians, together with Hakeem Jeffries, the incoming Democratic chief within the Home, and Consultant-elect Aaron Bean, a Republican from Florida, have returned donations or given the cash to charity since FTX fell into scandal.

Clawing again sufficient to make collectors complete will probably be tough. FTX went bankrupt final month owing greater than $3 billion to its prime 50 collectors and having racked up losses that exceeded $8 billion.

Many commentators have pointed to the case of Bernie Madoff, the poster youngster for Ponzi schemers, as a mannequin for the way FTX’s new C.E.O., John Ray III, and a chapter court docket would possibly gather property to repay depositors. In that case, judges dominated {that a} court-appointed trustee, Irving Picard, was allowed to claw again funds from anybody who pulled out extra money than they put in.

Mr. Madoff, although, could also be an imperfect mannequin for FTX. Right here’s why: Mr. Madoff claimed he was investing his shoppers’ funds, however there was no proof of that. He seems as an alternative to have stored their cash in money. FTX’s consumer funds, in contrast, have been nearly actually transformed into some cryptocurrency that traded on exchanges. In that case, specialists say shoppers of FTX might declare that they have been entitled to positive factors — and in the event that they have been fortunate sufficient to get their cash out earlier, they might in all probability hold them.

Traders are specializing in Binance. The world’s largest crypto trade, and an early FTX investor, has tried to reassure markets about its personal monetary well being since FTX’s chapter. It’s rapidly gone from being considered because the strongest participant in crypto to trying weak, with the worth of its in-house digital forex, BNB, falling practically $10 billion previously week. (It has recovered considerably, buying and selling flat over the previous 24 hours.)

The massive query rattling Binance: Will collectors be capable to claw again the $2.1 billion that Binance pocketed in 2019 when it bought again its stake in FTX to the corporate? Binance has stated that cash it cashed out of FTX got here from promoting plenty of digital tokens. Since these tokens had traded, it’s possible that Binance can be allowed to maintain its positive factors.

There’s an enormous catch. If Binance or its executives knew that FTX or its executives have been committing fraud, then a clawback may be allowed. However even that will be tough to show.

Right here’s what else is occurring in crypto:

-

Following a chaotic day in court docket, Bankman-Fried on Monday agreed to be extradited to the U.S., the place he faces a number of federal fraud fees. His protection lawyer within the Bahamas stated he strongly suggested his consumer towards the transfer.

-

Binance’s U.S. arm purchased the property and buyer deposits of Voyager Digital, the bankrupt crypto trade, in a deal valued at $1 billion.

-

The crypto conglomerate Digital Foreign money Group is trying to increase capital for its troubled subsidiary, Genesis, whose collectors embrace Todd Boehly, the U.S. financier and co-owner of the Chelsea soccer membership.

HERE’S WHAT’S HAPPENING

The Home Jan. 6 panel refers Donald Trump for felony prosecution. Lawmakers accused the previous president of inciting riot, conspiring to defraud the nation and different fees, and advisable the Justice Division prosecute him. It’s unclear whether or not federal prosecutors will, however the fees are the newest blow to Trump as he prepares to run once more for president.

What to Know About the Collapse of FTX

What’s FTX? FTX is a now bankrupt firm that was one of many world’s largest cryptocurrency exchanges. It enabled prospects to commerce digital currencies for different digital currencies or conventional cash; it additionally had a local cryptocurrency referred to as FTT. The corporate, primarily based within the Bahamas, constructed its enterprise on dangerous buying and selling choices that aren’t authorized in the US.

Epic Video games can pay $520 million to settle an F.T.C. investigation. The maker of Fortnite was accused of illegally amassing youngsters’s private data, matching them with strangers whereas enabling reside communications and utilizing “darkish patterns” to trick children into paying for in-game gadgets. The high quality simply set a report for youngster privateness violations.

E.U. nations agree on a worth cap for pure gasoline. Vitality ministers agreed to impose a restrict if month-ahead costs stay above 180 euros, or about $191, per megawatt-hour for 3 consecutive buying and selling days. However merchants fear that the cap, which may be utilized starting Feb. 15 and would have an effect on sure pure gasoline contracts, could distort markets somewhat than restrict costs.

Harvey Weinstein is convicted once more of intercourse crimes. A Los Angeles jury discovered the disgraced film producer responsible of raping and sexually assaulting an actress in 2013, however acquitted him on one other cost and couldn’t agree on three others. The responsible verdict will in all probability hold Weinstein in jail, at the same time as New York State’s highest court docket opinions his conviction there.

Elon Musk stays quiet on ballot about his standing as Twitter C.E.O. The billionaire hasn’t commented on the survey, during which a majority of respondents stated he ought to step down; he had promised to abide by the outcomes. However Musk has commented on Senator Elizabeth Warren prodding Tesla’s board about his work at Twitter, tweeting, “The US has positively been harmed by having her as a senator lol.”

Financial institution of Japan’s shock transfer ruffles world markets

There’s little or no vacation cheer to be discovered within the markets. Shares in Asia and Europe dropped on Tuesday morning, and U.S. futures have been pinging between positive factors and losses. World bond traders, in the meantime, have been in a promoting temper.

A shock transfer by the Financial institution of Japan pushes many traders to promote. The dovish central financial institution eased its bond-yield coverage — it should permit 10-year bonds yield to fluctuate by 0.5 % somewhat than 0.25 % — and traders consider the B.O.J. will be part of its world friends in elevating rates of interest (they remained at minus 0.1 % in a single day). On cue, Japanese shares and bonds sank, and the safe-haven yen jumped.

“It’s essential to not underestimate the impression this might have, as a result of tighter B.O.J. coverage would take away one of many final world anchors that’s helped to maintain borrowing prices at low ranges extra broadly,” Jim Reid, head of world basic credit score technique at Deutsche Financial institution, wrote in an investor word this morning.

Hopes of a “Santa rally” are fading. Most years at this level within the calendar, market commentators talk about the likelihood of whether or not traders will sink a part of their year-end financial savings into shares and different dangerous property within the hope that they are going to reap greater future positive factors. Not everyone seems to be a believer within the so-called “Santa rally,” which is extensively outlined because the seven buying and selling days following Christmas. However in accordance with LPL Monetary, the return on the benchmark S&P 500 is effectively above the median for many who make investments at the moment of yr.

The buying and selling equal of a stocking stuffed with coal is trying extra possible. For the reason that intraday excessive reached final Tuesday — the identical day traders obtained some excellent news on slowing U.S. inflation — the S&P 500 has fallen practically 7 %, as considerations about progress and rising borrowing prices push traders right into a bearish mind-set. The index is down 19.9 % this yr.

The malaise will dampen the temper within the new yr. Forecasts for 2023 are trying more and more bearish, as traders develop into involved about company earnings. Wall Road analysts now predict that the S&P 500 will shut out 2023 at 4,009, implying that shares will climb again roughly to the place they have been final Tuesday.

The Aftermath of FTX’s Downfall

The sudden collapse of the crypto trade has left the trade shocked.

“It’s nearly comical to see the home worth progress forecasts. It’s both 3 % progress or double-digit declines, with nearly nothing in between.”

— Igor Popov, chief economist at House Record, on the nice disparity in outlooks for the U.S. actual property market subsequent yr.

Invoice Gates’s cautious optimism for 2023

In his newest year-end letter, Invoice Gates walks readers via his philanthropic achievements for 2022, together with efforts to double the Gates Basis’s spending and its work on decreasing poverty and sickness.

He additionally has some powerful assessments for the way the world is doing on essential points like local weather change — but in addition causes for hope. (He additionally discloses a private motivation for optimism: He’s set to develop into a grandfather subsequent yr.) Listed below are some highlights from his letter:

Local weather-change work is progressing however is seeing short-term setbacks. “Sadly, on near-term targets, we’re falling quick,” Mr. Gates warns. “Between 2021 and 2022, world emissions truly rose from 51 billion tons of carbon equivalents to 52 billion tons.”

However he provides that public funding for climate-related R.&D. has grown practically a 3rd for the reason that 2015 Paris accords. Personal capital has elevated as effectively, with $70 billion spent over the previous two years. And new applied sciences to deal with local weather points are persevering with to emerge.

That doesn’t imply the long run is assured. “Attending to zero would be the hardest factor people have ever carried out,” he writes.

There are huge breakthroughs in preventing AIDS. “I believe there’s a great likelihood {that a} treatment for HIV will probably be obtainable in 10 to fifteen years,” Mr. Gates writes.

One cause is advances in gene remedy which might be making it simpler and cheaper to deal with affected folks. The stakes are excessive, he says: “A great HIV treatment will free all of them from taking these medicine and save the world tens of millions of {dollars} a yr in remedy prices. It can additionally imply that tens of millions of individuals by no means have to fret about getting HIV sooner or later.”

The Gates Basis is elevating its spending. Mr. Gates notes that this previous summer time, the nonprofit stated it could deploy $9 billion a yr by 2026, a pledge that prompted him to switch $20 billion to its endowment.

Additionally serving to in that objective is a collection of donations by Mr. Gates’s shut pal Warren Buffett, which have totaled $45 billion since 2006. “I consider that is the most important reward ever given, and eager about it fills me with awe and gratitude and a way of duty to ensure it’s spent effectively,” Mr. Gates writes.

THE SPEED READ

Offers

-

The electrical car maker Lucid closed a $1.5 billion fund-raising spherical, led by Saudi Arabia’s sovereign wealth fund. (CNBC)

-

Mondelez will promote its gum enterprise within the U.S., Canada and Europe to an Italian rival, Perfetti, for $1.35 billion. (Bloomberg)

-

Silicon Valley start-ups are turning to debt financing to lift cash with out taking big cuts to their valuation. (FT)

Coverage

-

The U.S. authorities’s determination to dump a few of its strategic oil reserves has netted it a cool $4 billion revenue. (WSJ)

-

Scores of countries have agreed to chop a complete of $500 billion in environmentally dangerous subsidies by 2030 as a part of a pact to guard marine and land habitats. (Politico)

Better of the remaining

We’d like your suggestions! Please electronic mail ideas and solutions to dealbook@nytimes.com.

Business

Dozens of shuttered 99 Cents Only stores could reopen under a familiar name: Dollar Tree

Dozens of recently closed 99 Cents Only stores across the Southland could reopen with another bargain retailer’s logo outside: Dollar Tree.

The Chesapeake, Va.-based company, which operates hundreds of Dollar Tree and Family Dollar stores in California, reportedly made a bid on about 100 recently shuttered locations of 99 Cents Only, which announced last month that it was going out of business, according to a LinkedIn post from Bill Read, executive vice president of the real estate firm Retail Specialists.

The development, first reported by the Orange County Register, involves a handful of stores in Arizona, Nevada and Texas, but the vast majority are in Southern California, including in Lancaster, North Hollywood, Burbank, Long Beach and Riverside, according to Read’s post.

Dollar Tree did not immediately respond to requests for comment. A representative for 99 Cents Only could not be reached.

The 99 Cents Only chain — a longtime icon of L.A.’s discount retail world — started in 1982 with a single store on La Tijera Boulevard and expanded rapidly.

Before the City of Commerce company abruptly announced its closure in April — citing several factors, including shifting consumer demands and inflation — the chain had 371 locations.

But shelves quickly emptied out during liquidation sales, and several of the locations today are covered in graffiti.

Dollar Tree has faced financial turmoil of its own.

In 2014, Dollar Tree Inc. announced a plan to buy its big rival Family Dollar Stores Inc. for more than $8 billion — an acquisition that, according to the company’s website, brought its total to 15,000 stores. But this year, Dollar Tree announced a plan to close nearly 1,000 locations, including about 600 Family Dollar stores, in the first half of 2024, as well as several other Dollar Tree stores in the years ahead.

The Associated Press contributed to this report.

Business

OpenAI forms safety and security committee as concerns mount about AI

ChatGPT creator OpenAI on Tuesday said it formed a safety and security committee to evaluate the company’s processes and safeguards as concerns mount over the use of rapidly developing artificial intelligence technology.

The committee is expected to take 90 days to finish its evaluation. After that, it will present the company’s full board with recommendations on critical safety and security decisions for OpenAI projects and operations, the firm said in a blog post.

The announcement comes after two high-level leaders, co-founder Ilya Sutskever and fellow executive Jan Leike, resigned from the company. Their departures raised concerns about the company’s priorities, because both had been focused on the importance of ensuring a safe future for humanity amid the rise of AI.

Sutskever and Leike led OpenAI’s so-called superalignment team, which was meant to create systems to curb the tech’s longterm risks. The group was tasked with “scientific and technical breakthroughs to steer and control AI systems much smarter than us.” Upon his departure, Leike said OpenAI’s “safety culture and processes have taken a backseat to shiny products.”

OpenAI’s new safety and security committee is led by board chair Bret Taylor, directors Adam D’Angelo and Nicole Seligman and Chief Executive Sam Altman. Multiple OpenAI technical and policy leaders are on the committee as well. OpenAI said that it will “retain and consult with other safety, security and technical experts to support this work.”

The committee’s formation arrives as the company begins work on training what it calls its “next frontier model” for artificial intelligence.

“While we are proud to build and release models that are industry-leading on both capabilities and safety, we welcome a robust debate at this important moment,” OpenAI said in its blog post.

Controversies about use of AI have dogged the San Francisco-based company, including in the entertainment business, which is worried about the technology’s implications for intellectual property and the potential displacement of jobs.

Actor Scarlett Johansson criticized the company last week over its handling of a ChatGPT voice feature that she and others said sounded eerily like her. Johansson, who voiced an AI program in the Oscar-winning Spike Jonze movie “Her,” said she was approached by Altman with a request to provide her voice, but she declined, only to later hear what sounded like her voice in an OpenAI demo.

OpenAI said that the voice featured in the demo was not Johansson’s, but another actor’s. After Johansson raised the alarm, OpenAI put a pause on its voice option, “Sky,” one of many human voices available on the app. An OpenAI spokesperson said the formation of the safety committee was not related to the issues involving Johansson.

OpenAI is best known for ChatGPT and Sora, a text to video tool that has major potential ramifications for filmmakers and studios.

OpenAI and other tech companies have been holding discussions with Hollywood, as the entertainment industry grapples with the long-term effects of AI on employment and creativity.

Some film and TV directors have said AI allows them to think more boldly, testing ideas without having the constraints of limited visual effects and travel budgets. Others worry that increased efficiency through AI tools could whittle away jobs in areas like makeup, production and animation.

As it faced safety questions, OpenAI’s business, which is backed by Microsoft, also must deal with competition from other companies that are building their own artificial intelligence tools and funding.

San Francisco-based Anthropic has received billions of dollars from Amazon and Google. On Sunday, xAI, which is led by Elon Musk, announced it closed on a $6-billion funding round that goes toward research and development, building its infrastructure and bringing its first products to market.

Business

California is making restaurants tell the truth about prices. Will it give you sticker shock?

California restaurants finally have their answer: They, too, must comply with a new state law that bans unadvertised fees, surcharges and other costs tacked onto the end of the bill.

Starting July 1, restaurants will join thousands of other California businesses, including event ticket sellers, short-term rental apps, hotels and food delivery services, that are required to include all mandatory fees and charges in the prices they display or advertise.

The state attorney general’s office gave conflicting statements in the weeks after Gov. Gavin Newsom signed the measure into law last year, telling some news outlets that restaurants could continue to keep their current prices while listing any surcharges on their menus, and others that the surcharges had to be included in the prices themselves.

On Wednesday Atty. Gen. Rob Bonta’s office released a set of guidelines to clarify that issue and answer other questions about how businesses must comply with the new law. Bonta sponsored the measure, Senate Bill 478, along with its co-authors, state Sens. Bill Dodd (D-Napa) and Nancy Skinner (D-Berkeley).

For restaurants, that means it will no longer be enough to just list service charges and surcharges on a bill or a menu’s fine print. Instead, these charges must be included in the prices printed on the menu.

For example, a $20 mole enchilada at a restaurant that levies a 5% fee to cover employee health costs will have to be listed on the menu as a $21 mole enchilada. And a flier advertising a $10 lunch buffet at a restaurant that adds a mandatory 10% “service charge” will have to refer to the offer as an $11 lunch buffet.

In a statement, the Golden Gate Restaurant Assn. said Bonta’s guidelines “will create significant challenges for the restaurant industry moving forward.”

The association, which advocates for the restaurant industry, argues that by prohibiting the longtime practice of using service charges to increase staff pay or cover the cost of local ordinances — such as San Francisco’s requirement that businesses spend at least a minimum amount on healthcare services — the law will compound the problems faced by an already struggling industry.

“Diners will not pay less, instead they will see significant menu price increases, which we believe will further cause them to pull back on dining out,” the statement said. “Not only will restaurants struggle, but workers will lose hours and jobs.”

With few exceptions, businesses of all sorts across California will not be able to advertise, display or offer a price for their goods or services that does not include all of the “mandatory fees or charges” other than government-imposed taxes or fees or reasonable shipping costs, according to the measure’s authors.

“Put simply, the price a Californian sees should be the price they pay,” Bonta’s office said in a news release.

The new law doesn’t dictate what companies charge for their goods or services. Businesses will still be able to set prices, but the posted price will need to match the full amount a customer will see on their final bill.

Though businesses can exclude taxes and shipping charges, handling fees must be included. In other words, actual postage or delivery charges can be excluded, while the cost of pulling an item off a shelf and taking it to a shipping company has to be included in its advertised price.

Separate fees for optional services or features do not need to be advertised. This could extend to a bevy of industries and services — for example, the amount an airline charges for a seat upgrade or checked bags.

What about late fees or extra charges for customers who smoke in a hotel room? Because those charges can be avoided, they do not have to be advertised, according to the guidelines from Bonta’s office.

Businesses will not be allowed to skirt the law by advertising one price and then letting customers know that additional fees might be added later. A business can, however, list the full price of its product and provide customers a breakdown of all the fees that are included.

Bonta also offered some guidance for businesses that say they do not know up front what the final cost will be once their work is done. Such businesses “should wait to display a price until they know how much they will charge,” the guidelines say.

This could affect how live music fans interact with ticket sellers for concerts and other live events. The nonprofit watchdog Consumer Reports noted that hidden fees can increase the price of live-event tickets by 30% to 40%.

Live Nation Entertainment, parent company of ticketing giant Ticketmaster, said in a statement that it supported SB 478 and has already offered all-in pricing at some venues and festivals across the country. “Unfortunately, we routinely see resellers defy state laws requiring all-in pricing which confuses and harms fans, so we strongly encourage regulatory scrutiny to ensure compliance across the industry,” the company said.

The Virginia-based Travel Technology Assn., a global network of online travel agents, said it views transparency as a top priority but opposed SB 478 and would rather see a uniform national standard for regulations on lodging prices.

“We take this position to create uniformity and certainty for lodging operators, travel technology companies, and most of all, travelers, who will have a better understanding of what is included in advertised prices for trips both in and out of their home state,” President and Chief Executive Laura Chadwick said in a statement.

The online travel company Expedia opposed the bill for similar reasons.

In response to the argument, Bonta said that California does not need to wait for federal action to ensure transparency for consumers. The practice of hiding mandatory charges, he said in a statement, “is deceptive and unfair to consumers wherever it occurs — not just in certain industries.”

-

Movie Reviews1 week ago

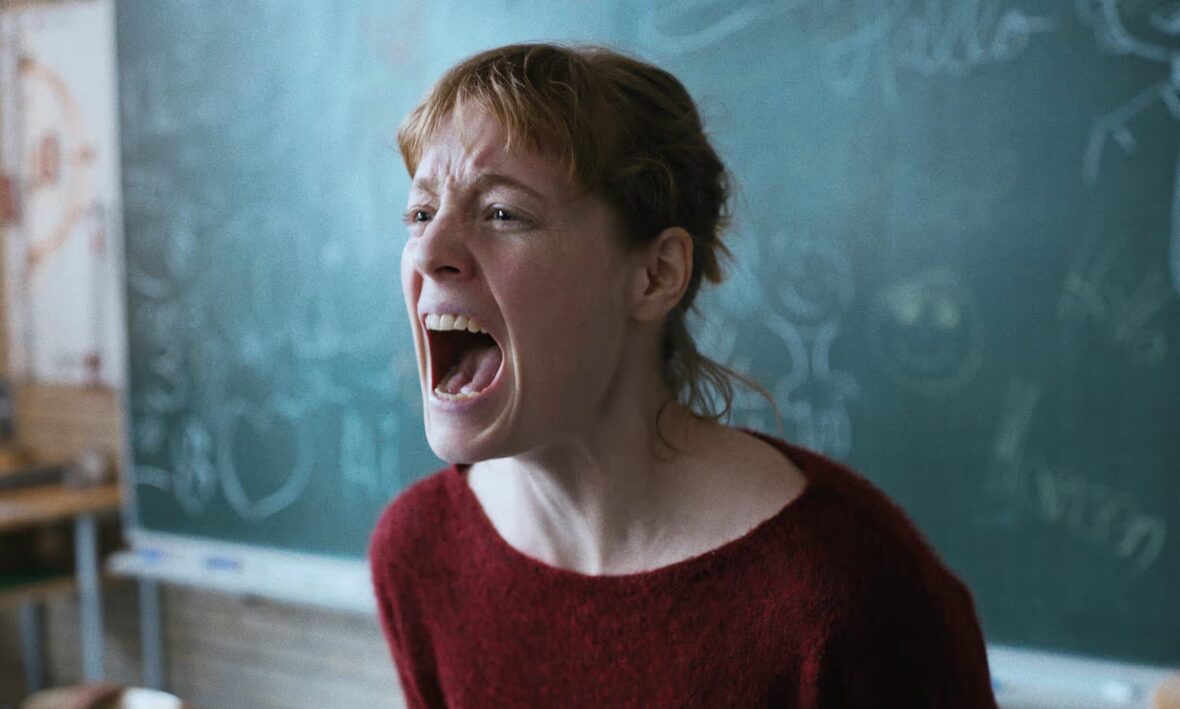

Movie Reviews1 week ago‘The Substance’ Review: An Excellent Demi Moore Helps Sustain Coralie Fargeat’s Stylish but Redundant Body Horror

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Rumours’ Review: Cate Blanchett and Alicia Vikander Play Clueless World Leaders in Guy Maddin’s Very Funny, Truly Silly Dark Comedy

-

Culture1 week ago

Culture1 week agoFrom Dairy Daddies to Trash Pandas: How branding creates fans for lower-league baseball teams

-

News1 week ago

News1 week agoVideo: A Student Protester Facing Disciplinary Action Has ‘No Regrets’

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Blue Sun Palace’ Review: An Intimate, Affecting and Dogma-Free Portrait of Chinese Immigrants in Working-Class New York

-

World1 week ago

World1 week agoPanic in Bishkek: Why were Pakistani students attacked in Kyrgyzstan?

-

Politics1 week ago

Politics1 week agoAnti-Israel agitators interrupt Blinken Senate testimony, hauled out by Capitol police

-

Politics7 days ago

Politics7 days agoMichael Cohen swore he had nothing derogatory on Trump, his ex-lawyer says – another lie – as testimony ends