Montana

‘Uncomfortable’ position: How, why Marshals held out versus Billings

RAPID CITY, S.D. (KOTA) – Roughly half of the Rapid City Marshals roster left the team on Friday, Co-Owner Wes Johnson tells KOTA News.

Team ownership notified players this week that moving forward they will only get paid $250 per game – that’s the 25% agreed upon in the contract between the team and the Arena Football League. As a result, nearly a dozen players quit.

Wages have been the primary concern from players all season, not only in Rapid City but across the country. It’s what ultimately led to last Saturday’s game, May 11, against the Billings Outlaws to be forfeited.

CONTEXT: Marshals players ‘refuse’ to come out of locker room

On Monday of this week, KOTA News heard from former players Tim Lukas and Brian Villanueva on what made them hold out against Billings, and do it the way they did.

”We’ll do anything to play this game, and we’ll believe anyone that tells us really good things,” Lukas said. “The more that we started seeing cracks in the walls and some of the things that seemed like they were getting ignored by a lot of people, the more it became apparent that we had to act on it.”

Marshals players started brainstorming how they wanted to send a message several days before last Saturday’s game. While it remains unclear what exactly those conversations looked like between players in private, it’s known that the timing of their actions were deliberate.

“Things were getting dragged out in previous weeks and we wanted to make sure that you know decisions were made you know quicker, and that was part of the strategy,” Villanueva said. “If it was truly about making sure that we were taking care of the players than I felt like there would have been a game played, honestly.”

READ: Hear from Marshals ownership as AFL receives backlash

Players whole-heartedly believed that the team ownership would meet their requests and pay them in full before kickoff against the Outlaws. That did not happen.

The Marshals wanted to make a statement, loud and clear, and the end result was felt by their peers across the league.

“A lot of the guys were proud that we stepped up and that we stuck together as a team to write a message to the entire league,” Lukas said.

“Had we not done it in that way, I don’t think it would have been felt as strong,” Villanueva continued.

Although players thought that not playing was the right move, ownership believed otherwise. Forfeiting the game against Billings put the franchise in a “really uncomfortable” financial position, according to Marshals Co-Owner Wes Johnson.

“Wes usually tells us how much time he spends with this organization, and knowing that there’s not a lot of personnel or resources in the building, I know that they both (Wes and Rebecca) are working extremely hard on it,” Lukas said.

Looking back on all of this, Lukas is happy he came to South Dakota, but thinks that if he would have done more research, some of these issues wouldn’t have come as a surprise.

“I wish I would have dug a little bit further into some of the people who are at the very top, running the AFL, just for my own peace of mind,” Lukas said. “But as far as having regrets, I don’t have any regrets.”

On Tuesday of this week, league owners unanimously voted to appoint Jeff Fisher to AFL interim commissioner. Fisher is a former NFL head coach and serves as the president of operations for the Nashville Kats. This move pushes out former league commissioner Lee Hutton.

MORE: Jeff Fisher named interim commissioner of AFL

In addition to league front office changes, many teams have undergone schedule reconstruction to help with scheduling logistics among the teams left in the league. This will take several weeks to finalize, according to Chris Chetty of G6 Sports Group.

See a spelling or grammatical error in our story? Please click here to report it.

Do you have a photo or video of a breaking news story? Send it to us here with a brief description.

Copyright 2024 KOTA. All rights reserved.

Montana

Missoula and Western Montana neighbors: Obituaries for March 11

Montana

Montana AG letter alleges Helena violates law banning ‘sanctuary cities’

HELENA — On Monday, Montana Attorney General Austin Knudsen sent a letter to the City of Helena claiming the municipality is not in compliance with the state’s law banning “sanctuary cities.” The letter comes just under a month after the State of Montana launched an investigation into a city resolution on Helena Police policy and Helena’s involvement in federal immigration enforcement.

In the letter, Knudsen laid out the ways he believes the city’s resolution violated state law. The attorney general gave Helena 15 days to respond or reverse the policy. If the city does not comply, his office will pursue legal action.

“Helena’s resolution appears to contain blatant violations of this law,” wrote Knudsen.

MTN News

On January 26, 2026, the City of Helena adopted a resolution clarifying when and how the Helena Police Department will cooperate with federal immigration officials. The vote was 4 to 1. The Helena commission seats and the mayor are elected in non-partisan races.

In the letter, Knudsen alleges the resolution established “a broad sanctuary city policy” that seeks to protect every illegal immigrant, regardless of whether the individual had committed a serious crime or not. The state further claims the resolution gives illegal immigrants “special privileges” in plea deals and establishes a “free-for-all policy” where a police officer can request the unmasking of Department of Homeland Security and ICE officers.

Knudsen has requested that the City of Helena, in their response, specifically describe in detail how the resolution complies with Montana law, provide emails and correspondence from city staff and the commission regarding the resolution.

Helena City manager Alana Lake told MTN in a statement: “The City of Helena is aware of the issues being raised by the Attorney General’s Office and is reviewing the matter. While we cannot discuss the details of a potential legal issue, the City is committed to transparency and compliance with the law. The City takes these matters seriously and will continue to cooperate with the appropriate authorities while remaining focused on serving our community.”

MTN News

Passed in 2021, Montana House Bill 200 prohibits a state agency or local government from implementing any policy that prevents employees or departments from communicating with federal agencies regarding immigration or citizenship status for lawful purposes. It also states governments must comply with immigration detainer requests if they are lawfully made.

HB 200 was backed by Republicans and passed with only Republican votes. Gov. Greg Gianforte signed the legislation into law on March 31, 2021.

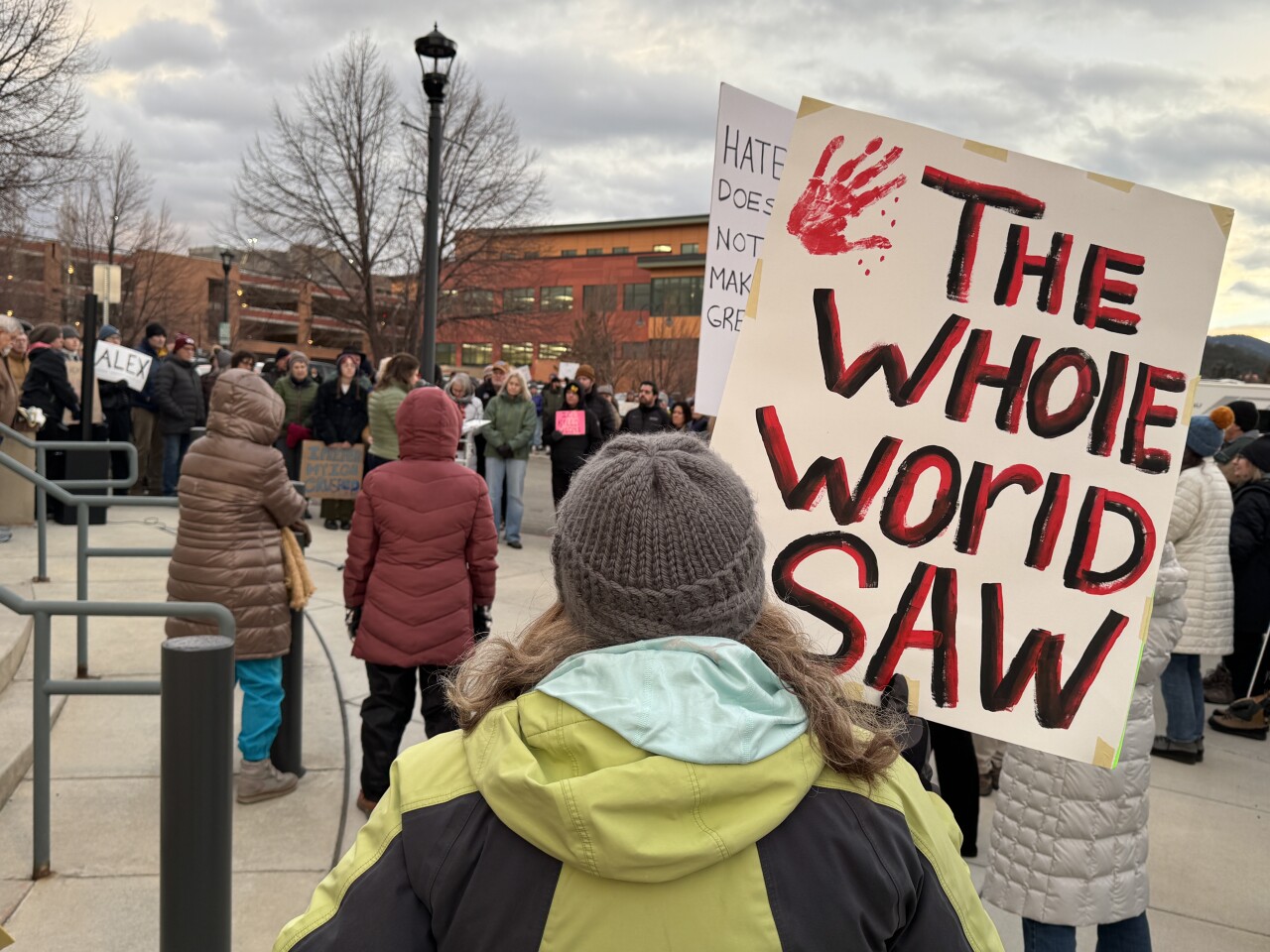

Passage of the resolution by the Helena City Commission has drawn ire from conservative voices in Montana politics and on the national level.

MTN News

The resolution said the commission supported the Helena Police Department avoiding “committing its resources to federal action for which it has no authority,” such as entering into an agreement with the federal government to directly enforce immigration laws. Under federal law, immigration enforcement is conducted by federal agencies under the Department of Homeland Security. However, under the Immigration and Nationality Act, state and local governments can voluntarily enter into 287 (g) agreements with the federal government that allow them to enforce immigration laws.

The commission further supported HPD’s policy not to stop, detain, or arrest a person solely on suspected violations of immigration law, including assisting other agencies in an arrest based solely on immigration law.

DEEPER LOOK: Helena has seen a growing debate over ICE and local police involvement

In the resolution, the commission also supported an HPD officer, using their own discretion, requesting the identification and unmasking of a Department of Homeland Security Officer if the HPD officer “feels it will not be interfering with the actions of federal officers exercising their jurisdiction.”

“This adversarial relationship by local law enforcement toward federal officers itself undermines public safety and forces immigration officers to fear for their safety when they are simply carrying out their lawful duties,” wrote Knudsen.

The resolution further supports the City of Helena’s policy not to consider immigration consequences in a plea agreement with a defendant.

Mack Carmack, MTN News

The commission also supports the City of Helena not disclosing any sensitive information about any person – including immigration status, sexual orientation, or social security number – except as required by law.

“This is a restriction that directly conflicts with Montana’s prohibition on sanctuary jurisdictions, specifically ‘sending to, receiving from, exchanging with, or maintaining for a federal, state, or local government entity information regarding a person’s citizenship or immigration status for a lawful purpose,’” the attorney general wrote.

If a government is found to be violating Montana’s law banning “sanctuary cities”, the state could fine them $10,000 every five days, prevent them from receiving new grants from the state, and have their projects with the state re-prioritized. A government in violation can avoid penalties by becoming compliant with the law within 14 days of being notified of the violation.

Read the full letter from the Montana Attorney General to the City of Helena:

Montana

Dispatches from the Wild: Montana’s wild inheritance at risk | Explore Big Sky

Steve Pearce and the future of the BLM

By Benjamin Alva Polley EBS COLUMNIST

If you care about hunting elk in crisp October air, floating a clear-running river for cutthroat trout, or simply taking your kids camping beneath a sky unspoiled by drill rigs, you should be outraged that Steve Pearce was ever considered to run the Bureau of Land Management.

The BLM is the largest landlord in the West. It oversees nearly 245 million acres of public land—millions of those acres in and around Montana’s most cherished places. This land is the backbone of our elk and mule deer herds, our sage grouse leks, our pronghorn migration routes and our blue-ribbon trout streams. It’s also the stage on which Montana’s hunting, fishing and outdoor recreation economy plays out.

Putting someone with Steve Pearce’s environmental record in charge of that land is like handing your cabin keys to the arsonist who’s always hated it. In the four months since Pearce was first nominated, it emerged that, if confirmed, he and his wife would divest from more than 1,000 oil and gas leases in Oklahoma to address potential conflicts of interest. While some senators strongly support his “active forest management” approach, he still faces opposition from groups alarmed by his record on public land transfers. On March 4, the Senate Energy and Natural Resources Committee voted 11-9 to advance his nomination, despite concerns from conservation groups.

Pearce’s track record is no mystery. He has consistently sided with extractive industries at the expense of wildlife, habitat and public access. He has supported opening more public lands to oil and gas drilling, weakening bedrock environmental safeguards and undermining science-based management. His votes and public statements have signaled again and again that he sees wild country as an obstacle to be overcome, not a legacy to be stewarded.

For Montana, that posture is an existential threat. Our big-game herds rely on intact winter range and unfragmented migration corridors across BLM lands. Aggressive drilling, poorly planned roads and relaxed reclamation standards shred those habitats. Once you carve up a landscape with pads, pipelines and traffic, you don’t get solitude—or mature bull elk—back with the stroke of a pen.

Anglers should be just as alarmed. Headwater streams and riparian corridors on BLM ground are the life support system for native bull trout, cutthroat and wild trout. A BLM director hostile to environmental safeguards is far more likely to greenlight development that increases sediment, degrades water quality and depletes the cold, clean flows our rivers depend on.

If Pearce takes office, outdoor recreation—and the rural economies built around it—will not be spared. In Montana, hunting, fishing and outdoor recreation pump billions of dollars into local businesses, guiding operations, gear shops and main-street cafes. People travel here precisely because of the open space, healthy herds and functioning ecosystems that BLM lands help sustain. When those landscapes are sacrificed to short-term profit, we don’t just lose scenery; we lose jobs, identity and a way of life.

This is not a partisan issue, especially in Montana. Public lands are one of the few things we truly share: ranchers who graze allotments, tribal communities with cultural ties to these places, hunters and anglers who’ve long defended habitat, and families who just want a place to pitch a tent. A BLM director should be a careful, science-driven steward accountable to all Americans—not a politician with a history of dismissing environmental protections as red tape.

Montanans know what’s at stake. We’ve fought bad ideas before—land transfers, giveaway leases, rollbacks to bedrock conservation laws—and we’ve won when we stood together. Steve Pearce’s nomination should have been dead on arrival. The fact that he was even on the list tells us how vigilant we must remain.

Our outrage must translate into action: calling elected officials, packing public hearings, writing letters and voting as if our public lands are on the line. Truly, they are. The BLM needs a director who sees these landscapes the way Montanans do: as sacred ground, not a balance sheet.

Anything less is a betrayal of the wild inheritance we’re supposed to pass on.

Benjamin Alva Polley is a place-based storyteller. His words have been published in Rolling Stone, Esquire, Field & Stream, The Guardian, Men’s Journal, Outside, Popular Science, Sierra, and WWF, among other notable outlets, and are available on his website.

-

Wisconsin1 week ago

Wisconsin1 week agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts1 week ago

Massachusetts1 week agoMassachusetts man awaits word from family in Iran after attacks

-

Detroit, MI5 days ago

Detroit, MI5 days agoU.S. Postal Service could run out of money within a year

-

Pennsylvania6 days ago

Pennsylvania6 days agoPa. man found guilty of raping teen girl who he took to Mexico

-

Miami, FL7 days ago

Miami, FL7 days agoCity of Miami celebrates reopening of Flagler Street as part of beautification project

-

Sports7 days ago

Sports7 days agoKeith Olbermann under fire for calling Lou Holtz a ‘scumbag’ after legendary coach’s death

-

Virginia7 days ago

Virginia7 days agoGiants will hold 2026 training camp in West Virginia

-

Culture1 week ago

Culture1 week agoTry This Quiz on the Real Locations in These Magical and Mysterious Novels