Colorado

Democrats laud coming impact Inflation Reduction Act will have on Colorado

DENVER — President Joe Biden and Democrats, together with Colorado Sens. Michael Bennet and John Hickenlooper, are touting a string of wins in Congress that they’re hoping will provide a lift within the midterm election.

Together with passing a gun reform legislation, one other to extend American semiconductor chip manufacturing, one to help the NATO membership of Finland and Sweden, a invoice to supply extra assist to veterans who have been uncovered to toxins like Agent Orange or burn pits, on Sunday the U.S. Senate additionally handed the Inflation Discount Act on a party-line vote. No Republicans voted within the measure’s favor and Vice President Kamala Harris broke the 50-50 tie to maneuver the invoice ahead to the Home.

The invoice accommodates $430 billion in investments and addresses the whole lot from prescription medicines to local weather change to taxes.

On the well being care facet of issues, the largest change the invoice offers is permitting Medicare to barter the costs of 10 high-cost medication beginning in 2026. It could then regularly enhance to permit Medicare to barter on 20 high-cost medication by 2029.

The invoice additionally requires a cap on insulin of $35 for Medicare recipients and for a cap on out-of -pocket prescription drug bills at $2,000 for those self same recipients beginning in 2025.

Colorado already has a $100 a month cap for insulin that applies to all residents beginning this 12 months.

For these utilizing the Reasonably priced Care Act for insurance coverage, premium help will even be prolonged for 3 years.

On the local weather facet of issues, the invoice requires a tax credit score of as much as $7,500 for average revenue households who buy a brand new electrical car and a $4,000 tax credit score for many who purchase a used electrical car.

Nevertheless, one stipulation for the tax credit is that a part of the car’s batteries should be manufactured within the U.S. and among the battery’s minerals should be mined within the U.S. as properly.

“I feel it is actually essential to know that that is going to be a phasing. It isn’t all going to occur directly however it is going to be actually good for our manufacturing sector,” Sen. Bennet mentioned.

Sen. Hickenlooper, in the meantime, mentioned he believes the made-and-mined-in-America stipulations will assist incentivize corporations to spend money on U.S. corporations as a substitute of outsourcing the manufacturing.

Tax credit are additionally being prolonged for rooftop photo voltaic and low power warmth pumps on properties.

For companies, the tax credit would assist with power effectivity in industrial buildings, clear power manufacturing and improvement, manufacturing of metals within the U.S. and extra.

It additionally helps put the U.S. on a path to cut back greenhouse fuel emissions by 2030.

“We are going to get 80% of the best way in direction of President Biden’s dedication of decreasing local weather emissions by 50% by 2030, and that’s one thing folks did not suppose we might presumably get to,” mentioned U.S. Sen. John Hickenlooper.

One other portion of the invoice requires $4 billion to be spent on drought resiliency within the west and alongside the Colorado River Basin.

To pay for these applications, the invoice calls for no less than a 15% tax on firms making $1 billion or extra. Bennet identified throughout a Tuesday press convention that college lecturers pay greater than a 15% tax.

“Frankly, there’s extra I want we’d have executed I want that we had reversed the Trump tax giveaways for the richest folks. I want that we had prolonged my tax cuts,” he mentioned.

Bennet and two different Western Democratic senators – Catherine Cortez Masto of Nevada and Mark Kelly of Arizona – introduced final week that they had negotiated together with $4 billion in Bureau of Reclamation funding to assist battle the Western megadrought within the invoice.

The Bureau of Reclamation mentioned earlier this summer time that the seven states within the Colorado River Basin should in the reduction of on the usage of 2 million to 4 million acre-feet of water subsequent 12 months so Lake Powell and Lake Mead can proceed producing electrical energy and the Decrease Basin States can have water, and the funding goals to assist help these cuts and the choices governments and landowners must make to make the cuts.

The Decrease Basin States are anticipated to hold the biggest burden in reducing water use, however the Higher Basin States together with Colorado.

“The Western United States is experiencing an unprecedented drought, and it’s important that now we have the assets we have to help our states’ efforts to fight local weather change, preserve water assets, and defend the Colorado River Basin,” the three mentioned in a joint assertion final Friday forward of the Senate vote. “This funding within the Inflation Discount Act will function an essential assets for Nevada, Arizona, and Colorado, and the work we’ve executed to incorporate it would assist safe the West’s water future.”

The invoice’s drought response part contains the next:

- $4 billion by September 2026 for grants, contracts, or monetary help for drought mitigation – with precedence given to the Colorado River Basin – for reductions in water diversion or use; conservation initiatives that cut back the use or demand for water provides within the Colorado’s river’s Decrease and Higher basins; ecosystem restoration initiatives in areas affected by drought.

- $550 million by September 2031 for grants, contracts, or monetary help agreements for deprived communities to plan, design, or assemble water initiatives for households in areas that don’t have dependable entry to home water provides.

- $25 million by September 2031 for the design, research, and implementation of initiatives to cowl water conveyance services with photo voltaic panels or different photo voltaic initiatives that enhance water effectivity.

The invoice additionally contains $5 billion that might go towards defending communities from wildfire by forest conservation and funding for firefighters, one other $2 billion for Nationwide Labs to hurry up local weather and power analysis, and $250 million for wildlife restoration and habitat restoration affected by local weather change.

The measure is anticipated to cut back the deficit by not less than $300 billion as a result of it’s anticipated to boost practically $740 billion in income, in response to Democratic sponsors.

The measure additionally requires round $80 million to be devoted to the IRS to rent 87,000 extra brokers to conduct extra audits on high-income Individuals.

“The overwhelming majority of that cash goes to return from folks that make properly over $400,000 a 12 months, and so they do not pay taxes. They’re discovering each little loophole, the whole lot they might even fake as a reputable loophole,” Hickenlooper mentioned.

Colorado Republicans and Bennet’s November opponent, nevertheless, are lambasting the invoice as extra authorities spending throughout a time when the nation is going through excessive inflation.

“We do not should be spending more cash after which gathering it from working Individuals right here in Colorado. So it is a tax,” mentioned Joe O’Dea, the Republican candidate difficult Bennet for his seat in November.

O’Dea says the invoice will equate to a tax on fuel and manufacturing that may solely damage working class households in the long run. He additionally questioned whether or not the funding for the IRS would really damage middle-income residents, saying he believes nearly all of the cash will come from folks incomes lower than $100,000 a 12 months.

“I do not know why they’re calling it an inflation Discount Act. Bernie Sanders has already come out and mentioned it would not have an effect on inflation in any respect. It is a tax,” O’Dea mentioned.

Bennet, nevertheless, rejected the claims that it is a tax, saying it’s an abject lie from the Republicans.

For now, Democrats are touting the huge invoice as a hit, admitting there’s extra work to be executed however hoping it would assist them within the November election.

The Home of Representatives is anticipated to vote on the measure on Friday.

Denver7’s Blair Miller contributed to this report.

Colorado

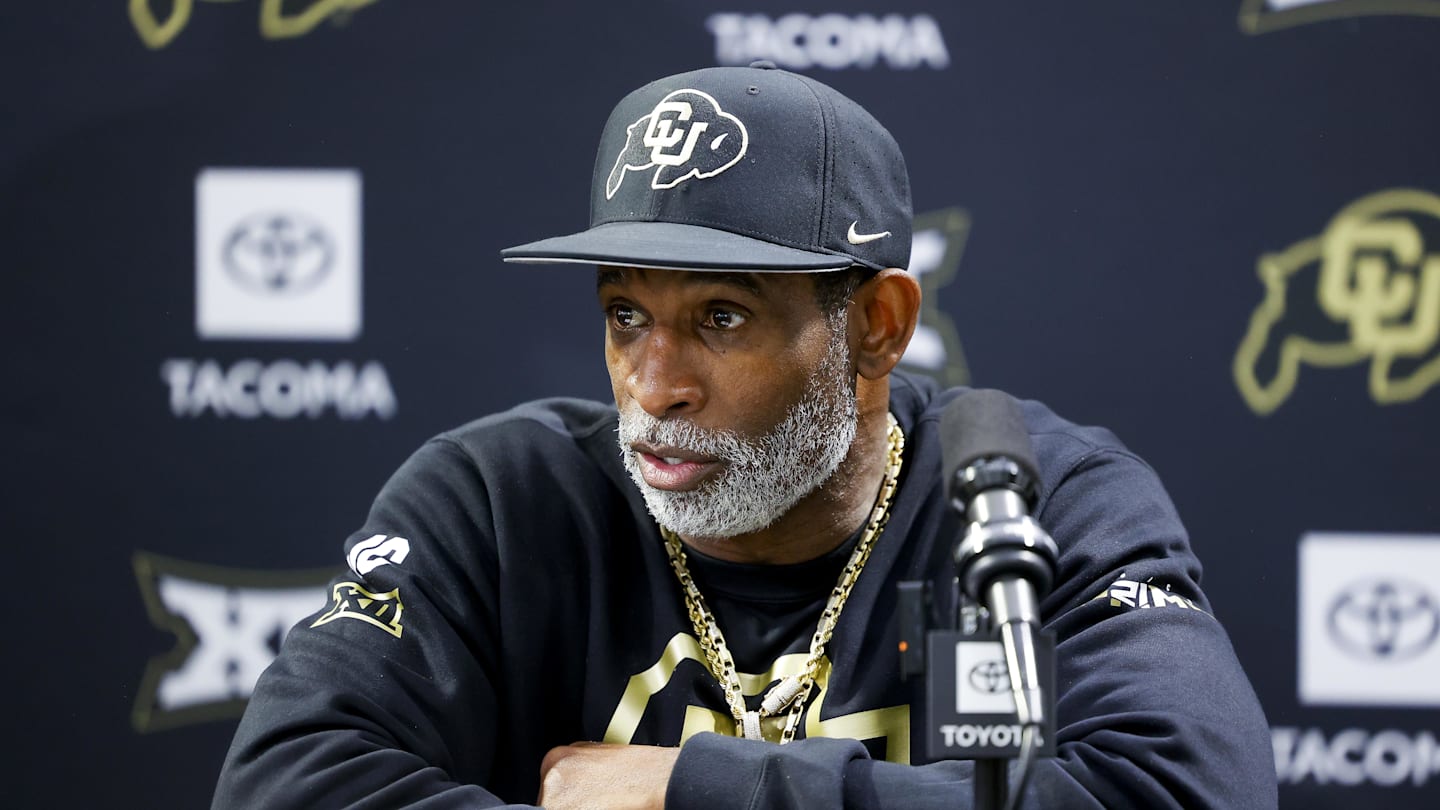

Deion Sanders Sends Reminder To Colorado Buffaloes Players, Staff Amid Memorial Day Weekend

Compared to most other Power Four college football programs, the Colorado Buffaloes haven’t had many players make headlines for negative off-field incidents since coach Deion Sanders took the helm in 2022. Still, a gentle reminder now and then can help keep it that way, especially as many attend social events over Memorial Day weekend.

On Sunday, “Coach Prime” posted a message on X encouraging his players and staff members to stay out of trouble. As Sanders noted, even one mistake can hurt one’s goal of playing football at the next level.

“All my PLAYERS & STAFF. I love u @ I miss u,” Sanders wrote. “Please be safe & don’t do anything to jeopardize your opportunity to be a Professional. Be careful out there because everyone around u ain’t really down for u and everybody else is just there.”

Sanders typically send out a daily piece of advice each morning on social media, and at least one Colorado player is taking Sunday’s message to heart. About 15 minutes after Sanders posted his plea to stay safe, freshman defensive end Brandon Davis-Swain commented “yes sir.” Davis-Swain totaled two tackles in two games last season but will likely take on a bigger role during his upcoming second season with the Buffs.

A few current Colorado players were in Tennessee on Saturday for Travis Hunter’s wedding, including linebacker Jeremiah Brown and cornerback DJ McKinney. Offensive analyst Rashad Davis was also in attendance, along with former Colorado wide receivers Jimmy Horn Jr. and Xavier Weaver.

Meanwhile, incoming freshman linebacker Mantrez Walker was in Georgia on Saturday for his Buford High School graduation. Walker enrolled early this past semester and played in Colorado’s spring football game last month. Fellow incoming freshman Julian “JuJu” Lewis, who’s competing with Liberty transfer Kaidon Salter for Colorado’s starting quarterback job, attended his own Georgia high school graduation earlier this month.

MORE: Drew Bledsoe Explains Why Cleveland Browns Quarterback Shedeur Sanders Will Succeed In NFL

MORE: Jacksonville Jaguars’ Travis Hunter Blowing Past Front Office Expectations As Rookie

MORE: New York Giants Quarterback Jaxson Dart Takes Subtle Shot At Shedeur Sanders?

While Colorado has been a disciplined team off the field over the past two-plus years, “Coach Prime” is looking for that to translate into game action next season.

“We’re so darn disciplined around here, I don’t know why we don’t take the disciplinary things on the field, so we’re going to fix that,” Sanders said after Colorado’s spring game. “We got to fix that. We have officials at practice, so we call it then, and they have disciplinary actions when they’re offsides or do something stupid to cause us a penalty. But we got to be better with that. We would not be the most penalized team in the Big 12 again this season. I’m putting my name on that.”

The Buffs will reconvene in Boulder later this summer for offseason workouts and preseason camp. They’ll begin the 2025 season at home against the Georgia Tech Yellow Jackets on Aug. 29.

Colorado

NWS: Friday’s storm produced 3 tornadoes in Colorado, including an EF-2

DENVER — Less than a week after four tornadoes hit Colorado’s eastern plains, three more touched down — including one EF-2 and one EF-1 — in Logan and Washington counties on Friday, causing damage but no reported injuries.

On Saturday, the National Weather Service issued its preliminary report on the supercell that produced the three tornadoes that snapped power lines and damaged several properties in the two northeastern Colorado counties.

Denver7 | Weather

Tornadoes sighted in NE Colorado Friday as Denver sees severe weather chance Sat

The first tornado rated an EF-1 was reported around 5:09 p.m. Friday near Messex in Logan County. According to the NWS report, it had estimated peak winds of 100 mph and stayed on the ground for more than 10 miles, ending in Washington County.

The NWS survey summary is as follows:

“The formation of this tornado was captured well by storm chaser video. The tornado did not have a coherent damage path. There was sporadic damage south of the South Platte River, primarily to a trio of grain silos. Two silos had their tops removed, one was shifted off the pad, another was destroyed. One off duty NWS employee confirmed the location of the tornado as it crossed Logan County Road R just south of County Road 59. The tornado dissipated just southwest of the Prewitt Reservoir with no evidence it crossed I-76.”

The second tornado, rated an EF-2, was reported around 5:37 p.m. Friday in rural Washington County. According to the NWS report, it had estimated peak winds of 118 mph and stayed on the ground for more than 8 miles, ending near Fremont Butte in Washington County.

The NWS survey summary is as follows:

“Well documented tornado that moved south parallel to CO-63, remaining generally in open areas 2-3 miles west of CO-63. We obtained the width (400 yds) of the tornado based on power poles snapped along County Road 50. One single family residence was struck with EF-1 damage to the house, along with EF-1 damage to all outbuildings and trees on the property. Debris from the property was carried approximately one mile to the south- southwest. Further south of the damaged property, power poles were snapped and thrown a considerable distance (~25 yds), consistent with EF-2 intensity. The power poles were on the west side of County Road AA, just north of County Road 48. Video evidence and the results of the storm survey suggest that the tornado dissipated just before 6 PM MDT.”

The third tornado rated an EFU, was reported around 6:10 p.m. Friday near Akron. It was a short-lived tornado and stayed on the ground for less than a mile.

According to the National Oceanic and Atmospheric Administration, Colorado sees an average of 27 tornadoes during May and June, with June being the busiest month with an average of 17 tornadoes. More than 2,100 tornado events have been recorded in Colorado since 1950, and at least five deaths have been related to twisters.

Weld County is the most tornado-prone county in Colorado—and the entire country—and has seen more than 268 tornadoes since 1950. The city and county of Denver have seen 16 tornadoes in the same period.

Coloradans making a difference | Denver7 featured videos

Denver7 is committed to making a difference in our community by standing up for what’s right, listening, lending a helping hand and following through on promises. See that work in action, in the videos above.

Colorado

What’s Working: Colorado restaurant owners spoke out to change state policy this year. It worked, sorta.

Quick links: No tax on tips | Minimum wage by state | Denver budget woes | 16th Street update | Colorado Springs adds chipmaker

Kinda win some, sorta lose some, but get a lot of attention while doing it may best describe 2025’s lawmaking session for the Colorado restaurant industry, or at least for the Colorado Restaurant Association.

“This was one of the most challenging legislative sessions in my decade with the CRA, but we feel that we made some good progress on behalf of the restaurant industry,” said Sonia Riggs, the organization’s president and CEO.

Years of rising food, labor and operational costs have dismayed independent restaurants, already operating on low margins. While new eateries still open regularly, the demise of some well-known Denver-area restaurants in the past year and ongoing struggles of nearly all, spurred action by the organization that represents 5,000 food businesses around the state.

Even though a bill to end credit card fees on tax and tips failed, the restaurant association was “grateful and relieved” when Gov. Jared Polis vetoed a bill that would have made it easier for workers to unionize under the state’s unique Labor Peace Act.

One of the more heated bills attracted dozens of restaurant owners who showed up at the statehouse to testify in support of the so-called Restaurant Relief Act, aka House Bill 1208.

The bill proposed increasing the amount employers could offset hourly pay to tipped workers, whose own tips would cover the difference. It only applied to areas where the local wage was higher than the state’s, such as in Denver, where tipped servers make $15.78 an hour, or $4 more than the state’s tipped minimum.

Worker advocates fought back because it meant a pay cut for the lowest-paid workers. And not all restaurant owners were in support of the initial plan, including Holly Adinoff, owner and general manager of Sullivan Scrap Kitchen in Denver.

“It was heartbreaking to think that the only way that restaurants could succeed is by cutting wages 25% for people who are barely making it,” said Adinoff, also a member of the policy team at Good Business Colorado, a grassroots business organization that advocates for equitable communities. “It just doesn’t seem right to hurt the people that make our restaurant possible.”

Others, like advocates at the national One Fair Wage, wanted to eliminate the tipped credit so all workers are paid full minimum wage — and keep their tips.

After a massive overhaul, the bill passed but left the decision on whether to change the tipped credit to the local municipality. Polis hasn’t signed the bill into law yet, but Riggs called it “a big win” and said the governor is expected to sign it.

Even though no immediate relief is expected, all the attention to the plight of restaurants was appreciated by local owners, like Alec Schuler, chef-owner of the three Tangerine breakfast spots in Boulder, Lafayette and Longmont.

“I like the direction things are going. They’re trying to lower credit-card fees. They’re trying not to tax tips. There are things that are supporting restaurants that are generally better for me,” said Schuler, who supported changing tipped minimum wages even if only the Boulder location could benefit. “It’s minimal … but 80-cents an hour still adds up to a chunk of money.”

Still on the way: No tax on tips

On Tuesday, the U.S. Senate unanimously approved the No Tax on Tips Act, an issue that both presidential candidates supported during the election season.

If it becomes law as is, tipped workers — including restaurant servers, bartenders, baristas, food-delivery drivers and those at beauty salons or barber shops — won’t have to pay federal taxes on tips as they must today. The benefit, however, has limits including a deduction of up to $25,000 and only for tipped workers who earn $160,000 or less in 2025. The amount will adjust to annual inflation, according to a New York Times analysis.

There’s a similar measure that’s part of Trump’s big budget bill that would also exempt overtime pay from federal taxes.

CRA hasn’t taken a side on the policy, but other restaurant owners say it would be helpful because it allows tipped workers to save a little bit more of their earnings.

“Any way that we can get more money into our people’s hands is great,” said Adinoff, with Sullivan Scrap Kitchen. “I’m interested to see where it goes.”

Meanwhile, worker advocates at One Fair Wage, which took a hard stance against Colorado’s tipped-wages bill, said the No Tax on Tips Act won’t help two-thirds of workers out there who don’t even earn enough to pay federal taxes. It “completely ignores the core crisis facing millions of workers in the service sector: poverty wages,” the organization said in a statement.

According to the Internal Revenue Service, individuals who earn less than $14,600 a year don’t have to pay federal income taxes. That amounts to about $7 an hour if the person works a 40-hour workweek all year.

That’s well below Colorado’s current minimum wage of $14.81 and tipped minimum wage of $11.79. But 20 states pay the federal minimum of $7.25 and a tipped minimum of $2.13 an hour. Those states haven’t raised their minimum wage since the federal government required them to in 2009.

Sun economy stories you may have missed

➔ Front Range cities step up opposition to $99 million Colorado River water rights purchase. Western Slope communities, led by the Colorado River District, want to buy the historic Shoshone Power Plant water rights to support their economies. >> Read story

➔ A new art center debuts in an old Denver fortune cookie factory. The privately funded Cookie Factory opens May 24 and will focus on showing new work by two contemporary artists per year >> Read story

➔ Running a food truck in Denver (and the rest of Colorado) is about to get simpler. A bill signed into law Tuesday by Gov. Jared Polis will allow food truck operators to get a single license to operate in different parts of the state >> Read story

➔ How Trump’s “big, beautiful bill” would impact Medicaid in Colorado. Work requirements could increase the number of people without health insurance in Colorado, but other provisions may not cut as deep as earlier feared >> Read story

➔ AT&T buying Lumen’s home fiber business, including Colorado market, for $5.75 billion. Coloradans may be more familiar with Lumen’s old moniker, CenturyLink. >> Read story

➔ Colorado cities sue Jared Polis, state over housing policies. A lawsuit filed Monday argues the state is violating the right of local governments to shape how they grow and develop >> Read story

How Colorado is getting older

The Colorado Sun launched a new series of stories earlier this week to take a deeper look into what it’s like to get older in Colorado. Here are the first two stories:

💼📢 The Colorado Sun is hiring a Chief Operating Officer. We’re seeking a strategic, collaborative and operations-minded leader to join our team in a crucial role that will help shape The Sun’s next chapter. Applications close June 15. Apply now

Other working bits

➔ City of Denver warns of layoffs. Mayor Mike Johnston announced Thursday that the city is expecting $50 million less in revenue this year and anticipates a $200 million deficit next year due to the nation’s economic downturn that has consumers spending less. According to a presentation, he also shared that expenses outpaced revenue since 2023. The city immediately put a freeze on hiring and will make most employees take two to seven days of furloughs this year. In a news release, city officials also warned of possible layoffs in 2026. >> See the mayor’s presentation

➔ At least Denver’s 16th Street Mall is nearly done. But its name has changed. It’s now just called 16th Street. Construction has taken more than three years and is expected to be done by the fall. Denverite reported that the branding and renaming campaign cost $100,000.

➔ Colorado Springs attracts another chipmaker. Okika Devices, which rebranded itself in January as it shifted from analog design to products, picked the Springs for its new headquarters and research and development center. Based in Carlsbad, California, Okika currently employs six people and plans to add 20 in Colorado with an average annual wage of $104,250. The company is eligible for up to $402,532 in state income tax credits from Pikes Peak Enterprise Zone.

➔ Upcoming job fair for 9-1-1 call takers. What’s it like to be the person answering 9-1-1 calls? You can now find out — and apply for a job — during the Colorado 9-1-1 Resource Center’s virtual job fair on June 3. Two sessions, one at 2 p.m. and the other at 6 p.m., will share what training it takes and stories from working emergency communication specialists. RSVP if you’re interested in attending. >> Sign up

Got some economic news or business bits Coloradans should know? Tell us: cosun.co/heyww

Have a nice Memorial Day weekend! As always, share your 2 cents on how the economy is keeping you down or helping you up at cosun.co/heyww. ~ tamara

Miss a column? Catch up:

What’s Working is a Colorado Sun column about surviving in today’s economy. Email tamara@coloradosun.com with stories, tips or questions. Read the archive, ask a question at cosun.co/heyww and don’t miss the next one by signing up at coloradosun.com/getww.

Support this free newsletter and become a Colorado Sun member: coloradosun.com/join

Corrections & Clarifications

Notice something wrong? The Colorado Sun has an ethical responsibility to fix all factual errors. Request a correction by emailing corrections@coloradosun.com.

-

Technology1 week ago

Technology1 week agoMeta asks judge to throw out antitrust case mid-trial

-

World1 week ago

World1 week agoCommissioner Hansen presents plan to cut farming bureaucracy in EU

-

News1 week ago

News1 week agoVideo: Doctors Heal Infant Using First Customized-Gene Editing Treatment

-

News1 week ago

News1 week agoNew Orleans jailbreak: 10 inmates dug a hole, wrote ‘to easy’ before fleeing; escape plan found

-

Movie Reviews1 week ago

Movie Reviews1 week agoDevil’s Double Next Level Movie Review: Trapped in a punchline purgatory

-

Business1 week ago

Business1 week agoVideo: How Staffing Shortages Have Plagued Newark Airport

-

Business1 week ago

Business1 week agoConsumers Show Signs of Strain Amid Trump's Tariff Rollout

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Nouvelle Vague’ Review: Richard Linklater’s Movie About the Making of Godard’s ‘Breathless’ Is an Enchanting Ode to the Rapture of Cinema