California

Prop 30: Following The Money On California’s Proposed Income Tax For Electric Vehicles

Propositions 26 and 27, the 2 sports activities betting measures, could be the most costly on California’s November poll.

Prop. 28, for arts and music training, might need probably the most celebrities on its endorsement record.

However Proposition 30, which might elevate taxes on the wealthy to help electrical automobile deployment and fight wildfires, takes the dignity of most confounding.

On the professional aspect is the California Democratic Celebration, on the opposite is its most notable member, Gov. Gavin Newsom.

Additionally on the sure aspect: Lyft, but additionally a number of the unions that vociferously opposed the rideshare big’s 2020 poll measure to rewrite state labor legislation. On the opposite: the California GOP and its longtime political nemesis, the California Academics Affiliation.

And relying on which marketing campaign you imagine, that is both a taxpayer-funded handout for a single company — or a climate-saving spending package deal opposed by billionaires who don’t need to pay greater taxes. Or neither.

In the event you’re nonetheless undecided on Prop. 30 — or simply interested by how it will work — we’ve boiled it down to fifteen key numbers.

Who pays the taxes?

35,000:

The approximate variety of Californians who earned greater than $2 million a 12 months in 2019 and would due to this fact should pay up if Prop. 30 passes finally rely, in line with the nonpartisan Legislative Analyst’s Workplace. Analysts say the quantity is now most likely better than 40,000. You’ve heard of “the 1%”? That is an much more rarified set than that: The 0.2%.

30%:

The tough share of the state’s private revenue tax income paid by these 0.2%-ers, in line with the latest numbers. Private revenue tax isn’t the one supply of state cash, but it surely’s by far the most important. Wanting on the complete pot of money that state lawmakers can draw on for discretionary spending, these choose hyper-rich taxpayers cough up about one-fifth.

That’s a promoting level for backers of Prop. 30. Except you’re wealthy sufficient to plausibly be available in the market for a personal airplane, this measure isn’t going to lift your taxes.

However for opponents, that slim supply of funding is precisely the issue. The very best earners are inclined to get the majority of their cash by way of their investments. As a result of the inventory market and different monetary markets soar to greater booms and sink to decrease busts than the financial system as a complete, the taxes these individuals pay are notoriously unstable. That, opponents argue, makes the tremendous wealthy a foul supply for an ongoing, long-term funding.

15.05%:

California’s new prime revenue tax charge, if Prop. 30 passes, for so long as 20 years.

That doesn’t imply the highest-earning 43,000 will probably be forking over greater than 15% of their complete princely incomes to the state. The brand new charge would apply solely to cash earned in extra of $2 million per 12 months.

Now, California’s prime charge, 13.3%, begins at $1 million of revenue, which itself was set by a 2004 poll measure taxing millionaires to fund psychological well being companies. That’s already the very best marginal tax charge of any state within the nation and much above the nationwide common of 5.5%, in line with the Tax Basis. Nevertheless it’s not essentially an apples-to-apples comparability. Hawaii, with the second highest prime charge of 11%, for instance, hits anybody with earnings above $200,000.

Opponents of the measure say such a excessive charge might chase California’s rich — and all their money — out of the state, which might pull the rug out from underneath the state price range. If that sounds acquainted, critics of excessive taxes on the wealthy have been predicting an exodus of the elite for greater than a decade. There’s by no means been a lot proof to again up that narrative.

However this new record-high charge would put us in uncharted fiscal waters, particularly now that federal legislation not permits taxpayers to put in writing off as a lot of their state tax funds.

The place is the marketing campaign cash coming from?

An indication inside a Lyft rideshare car.

(Scott Olson

/

Getty Photographs)

$0:

The quantity that the proposition earmarks for Lyft.

Perhaps you’ve heard that Prop. 30 is a “particular curiosity carve-out” for the San Francisco-based rideshare firm. That’s how Newsom, the measure’s most recognizable opponent, put it in an advert for the “no” marketing campaign.

Extra Voter Guides

consider judges

Head to LAist’s Voter Recreation Plan for guides to the remainder of your poll together with:

Strictly talking, that isn’t true. The textual content of the measure doesn’t point out Lyft, or any firm, by title. However Lyft stands to learn. State regulators are requiring all of California’s ridesharing firms to go solely emission-free by 2030, together with having 90% of their miles pushed in electrical automobiles. By making it cheaper and simpler to purchase electrical automobiles, Prop. 30 might assist Lyft meet that aim with out drawing from its personal company treasury to assist its drivers comply.

Therefore the following quantity.

95%:

The share of the “Sure on 30” fundraising that comes from Lyft ($45 million and counting out of $48 million to date).

That’s why opponents of the measure argue that it’s a company giveaway.

On Tuesday, the “No on 30” marketing campaign accused the proposition’s backers of attempting to cover the company big’s involvement by itemizing not “Lyft,” however “Raise” as its largest funder in a latest tv advert. Attorneys with the “No” marketing campaign say they wrote to station managers throughout the state demanding that they “cease airing the commercial with the unlawful disclaimer.”

Steve Maviglio, a spokesperson for the Sure on 30 marketing campaign, referred to as the misspelling a “typo” that was “instantly corrected.”

44:

The quantity of people that have given greater than $100,000 to the “No” marketing campaign to date. Their donations add as much as about two-thirds of the entire haul. The largest contributors embody a few of California’s highest earners, together with Netflix founder Reed Hastings, enterprise capitalist Michael Moritz and Catherine Dean, chief working officer of Govern For California, a corporation on the heart of an influential donor community. (Govern for California has supplied the trouble with $250,000 in workers time.)

Amongst these prime donors, a minimum of 10 of them are billionaires, in line with Forbes.

That’s why supporters of the measure describe the opposition as funded by the California elite.

The place does the cash go for electrical automobiles?

An indication for electrical car parking and charging in Millbrae.

(Martin do Nascimento

/

CalMatters)

80%:

That is the share of Prop. 30 revenues — estimated to whole $3.5 billion to $5 billion a 12 months — that’s put aside to beef up the state’s charging infrastructure and to offer subsidies for extra individuals to afford electrical automobiles. Half of that cash is put aside for low-income communities. The state has already devoted $10 billion over a five-year interval to those applications. California’s lately handed mandate to section out all new gross sales of gas-powered automobiles by 2035 requires huge investments in clear vitality.

Right here’s a breakdown of what that appears like:

- 35% of the entire Prop. 30 income would go in the direction of constructing charging stations in houses and flats. That cash would even be used for constructing fast-chargers in public areas and fueling infrastructure for medium and heavy-duty automobiles like vehicles, buses and off-road building tools.

- 45% of all funds would go in the direction of the state’s zero-emission subsidy applications meant to assist make electrical automobiles extra reasonably priced. At the moment, eligible residents can obtain as a lot as $7,000 or $9,500 in state subsidies, relying on this system. All applications have revenue limits. Prop. 30 would enhance state funding for zero emission subsidy applications by $1.6 billion to $2.25 billion per 12 months, in line with the Legislative Analyst’s Workplace. This pool of cash can also be meant to extend entry to different modes of fresh transportation that don’t require proudly owning a automobile, together with electrifying public transit, college buses and bikes.

$384 million:

The federal funding California is anticipated to obtain over the following 5 years, supplied by the Infrastructure Funding and Jobs Act of 2021, to assist speed up the transition to zero-emission automobiles. The cash will probably be used to put in charging stations statewide and builds on the state’s $10 billion local weather funding in electrical automobiles. The federal cash additionally consists of $68.2 million to exchange 177 college buses with electrical fashions.

Federal subsidies for electrical automobiles will probably be accessible by way of the Inflation Discount Act, the place candidates can anticipate to obtain a tax credit score of as much as $7,500 per car.

18%:

Thus far this 12 months, 17.7% of all new automobiles bought in California had been electrical, in line with the California Power Fee. All advised, greater than 1.3 million electrical automobiles have been bought within the state. Although California is residence to only 10% of all automobiles within the U.S., the state represents 42.6% of all new zero emission car gross sales bought nationally.

$66,000:

The common price ticket of a brand new electrical automobile is about $66,000, however can vary anyplace from about $28,000 to upwards of $160,000 for luxurious fashions.

The fee has steadily been reducing as extra fashions flood the market, however for most individuals, they’re nonetheless out of attain. There are greater than 115 electrical fashions accessible, with the Chevy Bolt EV, MINI Electrical and Nissan Leaf amongst a number of the most reasonably priced.

How a lot cash to forestall wildfires?

A U.S. Forestry firefighter prepares to tackle an out-of-control wildfire in Could 2013 in Camarillo, California.

(Kevork Djansezian

/

Getty Photographs)

$1 billion:

Efforts to deal with wildfires would obtain 20% of the funds raised through Prop. 30, however there’s loads of methods to spend the cash. The Legislative Analyst’s Workplace estimates that if accredited, the proposition will doubtless enhance wildfire response by $700 million, to about $1 billion a 12 months.

That’s on prime of the brand new state price range that gives a one-time allocation of practically $1 billion from the final fund for wildfire-related actions.

Residing with wildfires requires large cash in California: The state has spent as a lot as $4 billion a 12 months to battle wildfires, relying on the severity of the fireplace season. Most of that comes from the state’s emergency fund.

Vital to understanding how this new cash could be used is to clarify the excellence between two components of the proposition: allocating funds for “response” and funds for “prevention.”

$26 million:

The per-unit price of a brand new era of firefighting helicopters. Response typically means suppressing fires which have already ignited. In California, which means using the most important civilian fleet of water and retardant-dropping plane on the earth, spinning up choppers and calling in scores of bulldozers, water vehicles and practically 8,000 firefighters and help personnel.

State officers might select to allocate the brand new funds to buy extra tools that helps put out fires. Or Cal Hearth might rent extra personnel, an effort already underway. The state might additionally select to make use of a number of the cash to higher help Cal Hearth’s behavioral well being unit to deal with what hearth officers have referred to as a psychological well being disaster amongst hard-pressed first responders.

$582 million:

The present state price range allocates $582 million over three years for tasks that both search to forestall fires or increase the resiliency of forests to resist blazes.

It’s an enormous chunk of the prevention piece, the place researchers argue the majority of the brand new cash ought to go — doing what we will to forestall fires from beginning and minimizing the scale and harmful capability of those who do.

The final time period for this technique of fireside prevention is fuels therapy, and this method, too, is expensive and tough to handle. Usually, the cash may very well be spent eradicating issues that burn — bushes and brush. To make an impression, that must occur on a big scale. So-called mechanical thinning, eradicating vegetation by hand or with machines, is efficient, but additionally costly and time consuming.

Extra environment friendly and cost-effective are prescribed burns, fastidiously deliberate and executed small fires, whose low depth removes the extra flammable crops and small bushes, preserving massive bushes and leaving a more healthy and fewer weak panorama.

There are political, bureaucratic and societal causes that extra prescribed burns aren’t undertaken. And, as California stays within the grip of a devastating drought, there’s additionally an ever-narrowing window to securely set bushes on hearth.

For a wide range of causes, California isn’t emphasizing fuels-reduction actions. Cal Hearth has carried out fuels discount tasks on solely 4,000 acres since July, and cleared greater than 97,000 acres within the 2021-22 fiscal 12 months. It hasn’t come near reaching the aim of its much-touted settlement with the U.S. Forest Service to collectively deal with 1 million acres within the state by 2025.

Ought to Prop. 30 free-up surprising funds to deal with wildfires, it is going to be as much as Cal Hearth and state officers to find out how one can prioritize the spending. And the one certain factor to learn about hearth in California is that it gained’t be practically sufficient.

40%:

…give or take. That’s the share of the discretionary spending within the state price range that’s required by legislation to fund Okay-12 training. The precise quantity varies from 12 months to 12 months and is determined by a components that only a few Californians really perceive.

However the cash raised by Prop. 30 can be exempt from that requirement. That’s why the California Academics Affiliation, the state’s largest union of educators, opposes the measure, which it says would “set a harmful precedent.”

The place do the voters stand?

52%:

The share of doubtless voters who oppose the measure in a brand new statewide ballot launched Wednesday evening.

Solely 41% stated they help Prop. 30 within the Public Coverage Institute of California survey, carried out in mid-October. One other 7% stated they’re nonetheless undecided. (The margin of error on the pattern of 1,111 doubtless voters is plus or minus 5.1 share factors.)

That’s a dramatic reversal from polling in late September, which confirmed a 49% to 37% lead for the “Sure” aspect. That implies that the “No” marketing campaign — particularly its choice to trumpet the opposition of the state’s in style governor — is having its meant impact. Whereas most Democrats within the new ballot nonetheless again Prop. 30, most different voter teams at the moment are opposed.

Extra unhealthy information for supporters of the measure: As Election Day approaches, public help for propositions tends to say no as undecided — or confused — voters err on the aspect of “no.”

CalMatters information reporter Jeremia Kimelman contributed to this story.

What questions do you have got in regards to the Nov. 8 basic election?

Whether or not it is about how one can register to vote or making sense of a candidate’s platform, we’re right here that will help you get poll prepared.

California

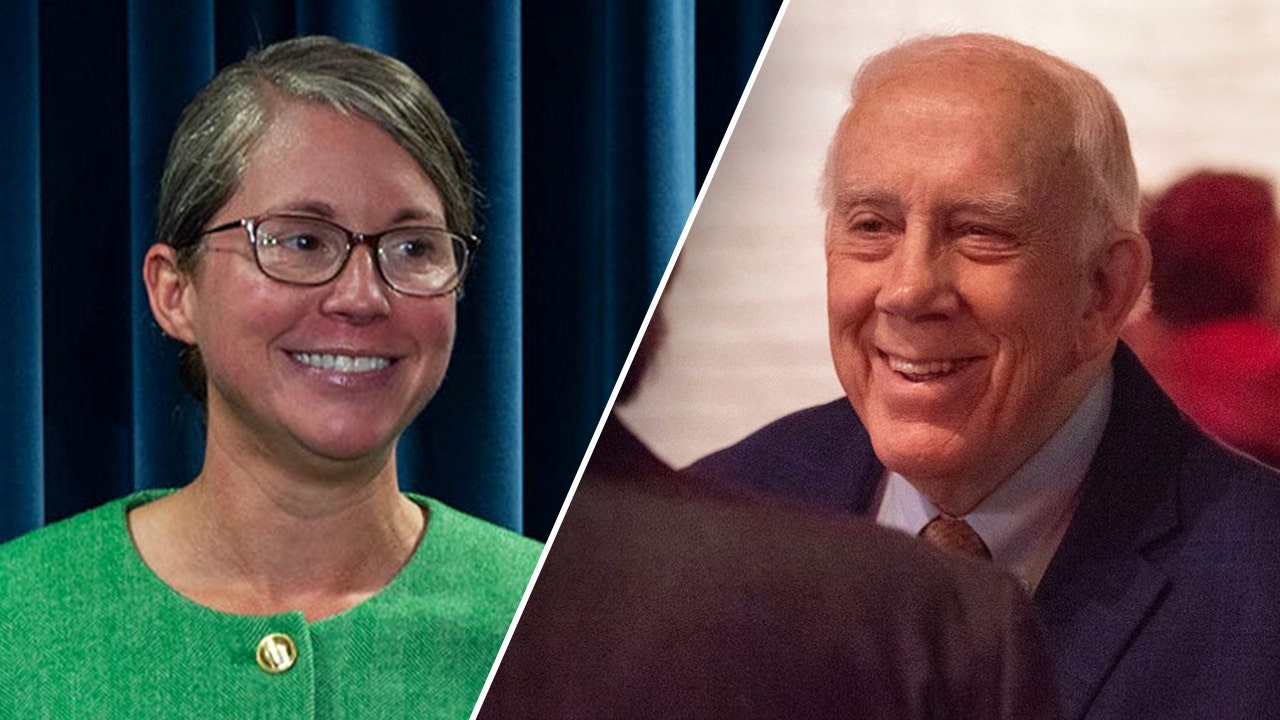

Caitlyn Jenner says she'd 'destroy' Kamala Harris in hypothetical race to be CA gov

Caitlyn Jenner considers another run to become California governor

Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

SAN FRANCISCO – Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

Jenner, who publicly came out as transgender nearly 10 years ago, made a foray into politics when she ran as a Republican during the recall election that attempted to unseat Gov. Gavin Newsom in 2021. Jenner only received one percent of the vote and was not considered a serious candidate.

Jenner posted this week on social media that she’s having conversations with “many people” and hopes to have an announcement soon about whether she will run.

Caitlyn Jenner speaks at the 4th annual Womens March LA: Women Rising at Pershing Square on January 18, 2020 in Los Angeles, California. (Photo by Chelsea Guglielmino/Getty Images)

She has also posted in Trumpian-style all caps: “MAKE CA GREAT AGAIN!”

As for VP Harris, she has not indicated any future plans for when she leaves office. However, a recent poll suggests Harris would have a sizable advantage should she decide to run in 2026. At that point, Newsom cannot run again because of term limits.

If Jenner decides to run and wins, it would mark the nation and state’s first transgender governor.

California

Northern California 6-year-old, parents hailed as heroes for saving woman who crashed into canal

LIVE OAK — A six-year-old and her parents are being called heroes by a Northern California community for jumping into a canal to save a 75-year-old woman who drove off the road.

It happened on Larkin Road near Paseo Avenue in the Sutter County community of Live Oak on Monday.

“I just about lost her, but I didn’t,” said Terry Carpenter, husband of the woman who was rescued. “We got more chances.”

Terry said his wife of 33 years, Robin Carpenter, is the love of his life and soulmate. He is grateful he has been granted more time to spend with her after she survived her car crashing off a two-lane road and overturning into a canal.

“She’s doing really well,” Terry said. “No broken bones, praise the Lord.”

It is what some call a miracle that could have had a much different outcome without a family of good Samaritans.

“Her lips were purple,” said Ashley Martin, who helped rescue the woman. “There wasn’t a breath at all. I was scared.”

Martin and her husband, Cyle Johnson, are being hailed heroes by the Live Oak community for jumping into the canal, cutting Robin out of her seat belt and pulling her head above water until first responders arrived.

“She was literally submerged underwater,” Martin said. “She had a back brace on. Apparently, she just had back surgery. So, I grabbed her brace from down below and I flipped her upward just in a quick motion to get her out of that water.”

The couple said the real hero was their six-year-old daughter, Cayleigh Johnson.

“It was scary,” Cayleigh said. “So the car was going like this, and it just went boom, right into the ditch.”

Cayleigh was playing outside and screamed for her parents who were inside the house near the canal.

I spoke with Robin from her hospital bed over the phone who told us she is in a lot of pain but grateful.

“The thing I can remember is I started falling asleep and then I was going over the bump and I went into the ditch and that’s all I remember,” Robin said.

It was a split-second decision for a family who firefighters said helped save a stranger’s life.

“It’s pretty unique that someone would jump in and help somebody that they don’t even know,” said Battalion Chief for Sutter County Fire Richard Epperson.

Robin is hopeful that she will be released from the hospital on Wednesday in time to be home for Thanksgiving.

“She gets Thanksgiving and Christmas now with her family and grandkids,” Martin said.

Terry and Robin are looking forward to eventually meeting the family who helped save Robin’s life. The family expressed the same feelings about meeting the woman they helped when she is out of the hospital.

“I can’t wait for my baby to get home,” Terry said.

More from CBS News

California

California may exclude Tesla from EV rebate program

Spear Invest founder and Chief Investment Officer Ivana Delevska discusses the value of A.I. data centers and the future of driverless cars on ‘Making Money.’

California Gov. Gavin Newsom may exclude Tesla and other automakers from an electric vehicle (EV) rebate program if the incoming Trump administration scraps a federal tax credit for electric car purchases.

Newsom proposed creating a new version of the state’s Clean Vehicle Rebate Program, which was phased out in 2023 after funding more than 594,000 vehicles and saving more than 456 million gallons of fuel, the governor’s office said in a news release on Monday.

“Consumers continue to prove the skeptics wrong – zero-emission vehicles are here to stay,” Newsom said in a statement. “We’re not turning back on a clean transportation future – we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The proposed rebates would be funded with money from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters under the state’s cap-and-trade program, the governor’s office said. Officials did not say how much the program would cost or save consumers.

NEBRASKA AG LAUNCHES ASSAULT AGAINST CALIFORNIA’S ELECTRIC VEHICLE PUSH

California Gov. Gavin Newsom on Monday proposed creating a new version of the state’s Clean Vehicle Rebate Program if the incoming Trump administration scraps a federal tax credit for electric car purchases. (Photo by Justin Sullivan/Getty Images, File / Getty Images)

They would also include changes to promote innovation and competition in the zero-emission vehicles market – changes that could prevent automakers like Tesla from qualifying for the rebates.

Tesla CEO Elon Musk, who relocated Tesla’s corporate headquarters from California to Texas in 2021, responded to the possibility of having Tesla EVs left out of the program.

Tesla and other automakers may not qualify for the proposed tax credits, according to the governor’s office. (Getty Images, File / Getty Images)

“Even though Tesla is the only company who manufactures their EVs in California! This is insane,” Musk wrote on X, which he also owns.

BENTLEY PUSHES BACK ALL-EV LINEUP TIMELINE TO 2035

Those buying or leasing Tesla vehicles accounted for about 42% of the state’s rebates, The Associated Press reported, citing data from the California Air Resources Board.

Newsom’s office told Fox Business Digital that the proposal is intended to foster market competition, and any potential market cap is subject to negotiation with the state Legislature.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 338.59 | -13.97 | -3.96% |

“Under a potential market cap, and depending on what the cap is, there’s a possibility that Tesla and other automakers could be excluded,” the governor’s office said. “But that’s again subject to negotiations with the legislature.”

Newsom’s office noted that such market caps have been part of rebate programs since George W. Bush’s administration in 2005.

Newsom has pushed Californians to replace gas-powered vehicles with zero-emission vehicles. (Chip Somodevilla/Getty Images / Getty Images)

Federal tax credits for EVs are currently worth up to $7,500 for new zero-emission vehicles. President-elect Trump has previously vowed to end the credit.

CLICK HERE TO GET THE FOX NEWS APP

California has surpassed 2 million zero-emission vehicles sold, according to the governor’s office. The state, however, could face a $2 billion budget deficit next year, Reuters reported, citing a non-partisan legislative estimate released last week.

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health2 days ago

Health2 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World