California

How are students doing? New California School Dashboard is out

(CALMATTERS) – In the first glimpse of California’s K-12 schools’ year-over-year progress since the pandemic, graduation rates hit some of their highest levels ever, absenteeism dropped significantly, and hundreds of districts showed academic improvements.

But despite a few bright spots, most of the 13 measurements that California uses to gauge student achievement remained flat in the 2023 School Dashboard, which the California Department of Education released today.

Returning to the color-coded system the state used prior to the pandemic, the new dashboard graded many categories as “yellow,” or mid-way between high and low. In assigning one of five colors, the state combines data about schools’ current performance and progress from previous years, which it says creates a more nuanced picture of achievement. Districts that score red — the lowest grade — for more than one category qualify for extra assistance to make improvements.

During the pandemic, the state didn’t update the dashboard for two years, and then last year didn’t use the color-coding system because there was no previous data to compare it to. This is the first year since 2019 that the dashboard contains full information about test scores and other metrics.

First released in 2018, the dashboard is meant to give the public a fuller view of school performance, beyond just test scores. The dashboard looks at detailed data such as suspension rates, progress of English learners and career readiness, broken down by race and ethnicity and whether students are low-income, in foster care, are homeless or have disabilities.

“In no way, shape or form is yellow a good thing,” said Kimberly Mundhenk, education research and evaluation administrator for the Department of Education. “But it could mean that there’s improvements. … Not all yellows are created equal.”

The number of students who graduated within five years climbed to 88.7%, the highest rate since the state started tracking that data in 2018. More than half of those students qualified for California’s public universities, also the highest rate in years.

Chronic absenteeism, which hit record levels during the pandemic, dropped to 24.3%, down more than 5 percentage points from last year but still more than double the pre-pandemic level.

“I’m glad to see that we’re starting to turn things around, and that districts that had intentional strategies saw big improvements,” said Hedy Chang, executive director of Attendance Works, which researches the topic. “But we still have a significant challenge before us.”

Los Angeles Unified and Monterey County both doubled down on attendance efforts last year, she said, by examining data, working directly with families to address the barriers to attendance, investing in after-school and summer programs and taking other steps to get students back in the classroom after the height of the pandemic. A comprehensive, data-focused strategy clearly works, Chang said, and the state should encourage all districts to adopt such an approach.

Heather Hough, executive director of Policy Analysis for California Education, said that the state needs to take dramatic steps to jolt schools toward better results. She and her PACE colleagues recently released a study showing that collaboration among teachers, data analysis and extra help for struggling students can have “measurable impacts on student achievement.”

“There isn’t a simple solution, because the problem is that our schools (currently) aren’t organized in a way that supports and empowers educators to make sure every student learns,” she said. “The dashboard release will bring new attention to the issue, and will raise again questions about what, exactly, we need to do.”

“I’m glad to see that we’re starting to turn things around, and that districts that had intentional strategies saw big improvements. But we still have a significant challenge before us.”HEDY CHANG, EXECUTIVE DIRECTOR OF ATTENDANCE WORKS

The number of school districts that qualified for what the state calls “differentiated assistance” — extra help based on poor achievement in at least two categories — fell dramatically, from 617 last year to 466 in 2023, primarily because of improvements in attendance, according to the state.

Smarter Balanced test scores were released in October and incorporated into the new dashboard. Mostly unchanged from last year, the dashboard shows English language arts and math both in “orange,” or below average. In English language arts, students scored an average of 13.6 points below the state benchmark on a 200-point scale, and 49.1 points below the standard in math.

Among English learners, the dashboard assigned “yellow” statewide, based on 48.7% of students advancing in their language skills. But Martha Hernandez, executive director of Californians Together, an English learner advocacy group, said the state should have higher standards for its students.

“We’re happy the state has returned to the color-coded indicators, but we’re very concerned that 48.7% is considered yellow,” Hernandez said. “We’d like to see more aspirational goals, like 80%. … We know that there’s a persistent achievement gap for English learners, but California is giving itself a yellow as if there’s no sense of urgency.”

Students who don’t become proficient in English are more likely to struggle academically and miss out on opportunities to succeed in college and career, she said.

“This is important,” she said. “I think we need to have higher expectations.”

Related

California

California political operative allegedly acted as illegal agent of China: DOJ

A Chino Hills, California man has been arrested for allegedly working as an illegal agent of the People’s Republic of China (PRC) while also serving as the campaign manager for a local politician who was elected to office in 2022.

The U.S. Department of Justice (DOJ) said 64-year-old Yaoning “Mike” Sun was arrested on Thursday and charged with acting as an illegal agent of China as well as conspiring with another man, Chen Jun, who was sentenced to prison in November for bribery and also acting as an illegal agent of the Chinese government.

According to a criminal complaint filed with the U.S. District Court for the Central District of California on Tuesday, Sun served as campaign manager for a Southern California politician who was not named and only identified as “Individual 1” in the complaint. Individual 1 was ultimately elected to a city council position in a city not named in the complaint, in 2022.

Sun and Chen communicated during the campaign to help get the individual elected.

2 NY RESIDENTS ALLEGEDLY RAN SECRET CHINESE POLICE STATION: ‘SIGNIFICANT NATIONAL SECURITY MATTER’

Chen Jun, who Yaoning “Mike” Sun allegedly conspired with, was sentenced to prison in November for bribery and acting as an illegal agent of the Chinese government. (Department of Justice)

The DOJ said Chen allegedly spoke with Chinese government officials about how China could “influence” local American politicians, especially on the topic of Taiwan.

Shortly after Individual 1 was elected to office in November 2022, Chen allegedly told Sun to prepare a report on the election. The report was sent to Chinese government officials, who the complaint says responded positively and expressed thanks.

Nearly a month after the individual was elected, Chen also set up a lunch with Sun and others at a Rowland Heights restaurant. The gathering was described to a PRC official by Chen as a “core member lunch,” the DOJ said. Individual 1 was not reportedly at the luncheon, though Chen told the Chinese government officials the individual was part of the “basic team dedicated for us.”

CALIFORNIA MAN SENTENCED FOR ‘BIRTH TOURISM’ SCHEME FOR AFFLUENT CHINESE WOMEN

Chen told the PRC official the lunch was “successful,” adding that attendees agreed to create a “US-China Friendship Promotional Association.”

In early 2023, Chen allegedly instructed Sun to compose another report for PRC officials about the two of them “cultivating and assisting” with Individual 1’s success.

As the second report was being finalized in February 2023, Sun sent Chen a proposal to combat “anti-China forces” by marching in a U.S. Independence Day parade in Washington, D.C., the complaint noted.

MAN ACCUSED OF RUNNING SECRET CHINESE GOV POLICE STATION IN NYC MAKES PLEA: US ATTORNEY

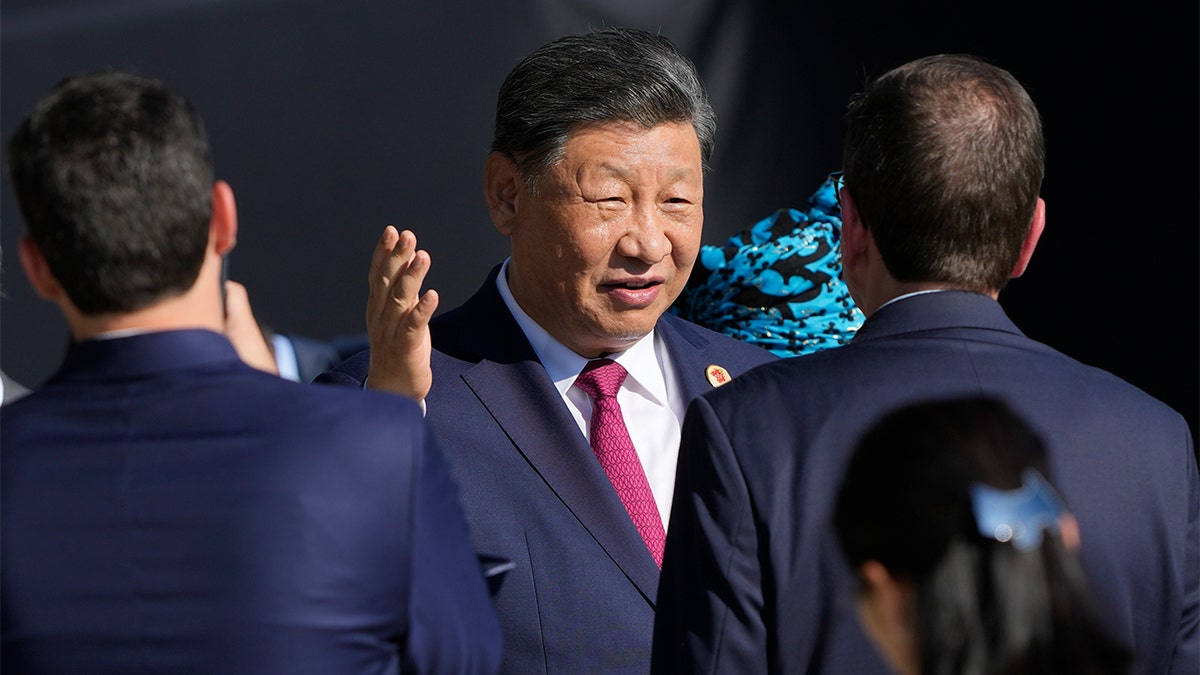

China’s President Xi Jinping talks after joining a group photo during the G20 Summit in Rio de Janeiro, Monday, Nov. 18, 2024. (AP Photo/Eraldo Peres)

While the two men continued their efforts in the U.S., Sun allegedly asked the PRC to provide them with a budget of $80,000.

The complaint alleges that Chen and Sun spoke about a planned trip to China to meet with “leadership.” It also claims Sun was directed by Chen to set up a meeting with the Chinese consul general in Los Angeles. In August 2023, Sun and Individual 1 eventually traveled to China, the complaint alleges.

Sun could face up to 10 years in prison for acting as an illegal agent of a foreign government if he is convicted.

CLICK HERE TO GET THE FOX NEWS APP

He also faces a maximum penalty of five years behind bars for conspiring to commit an offense against the U.S.

California

Whistleblower Seeks To Determine If Hunter Biden Paid California Taxes

Hunter Biden, son of US President Joe Biden, arrives at court for his trail on tax evasion in Los … [+]

Thanks to the presidential pardon from his father, Hunter Biden will no longer have to worry about the federal charges he was facing for failure to pay federal income tax on millions of dollars in earnings. President Joe Biden’s December 1 pardon does not, however, immunize his son from prosecution for failure to pay state income tax. Whether or not Hunter Biden fulfilled his state tax obligations to California is a question now being pursued by a public whistleblower.

Hunter Biden was a resident of California, home to the highest top marginal income tax rate in the country at 13.3%, during the years for which he has pled guilty to federal tax evasion. While media coverage has focused on unmet obligations to the IRS, the prospect of unpaid state tax liabilities is a topic that has never received much attention. In early December, James Lacy, president of the United States Justice Foundation, filed a public complaint (Case Number 12024-14638) with the California State Auditor calling for an investigation of the California Franchise Tax Board in order to determine whether Hunter Biden filed and paid state taxes for the years he has pled guilty to federal tax evasion.

Given the amount of income on which Hunter Biden failed to pay federal taxes, it’s a potentially large sum of money that he also might have neglected to pay to the government of California, a Democrat-run state where taxpayers are on the hook for an estimated trillion dollars-worth of unfunded public pension liabilities and where employers were recently hit with a payroll tax hike triggered by Governor Gavin Newsom’s (D-Calif.) decision to not repay unemployment insurance loans taken out from the federal government during the pandemic.

“Californians who file their tax returns and timely pay their taxes deserve to know whether or not Hunter Biden has received any special treatment from the Franchise Tax Board regarding his tax liability,” said Lacy. “I am hoping my Whistleblower Complaint will draw attention to this issue and bring some transparency to whether our state tax system has acted fairly.”

“If Hunter Biden failed to pay federal taxes, it’s reasonable to suspect he also failed to pay applicable state income taxes for those years,” says Ryan Ellis, an IRS-enrolled agent. Lacy also called on the Governor to act, saying “Newsom should also reveal to California taxpayers whether or not Hunter Biden was secretly ‘pardoned’ from state tax liability and enforcement as well.”

California Combines High Tax Rates With Muscular Collection

Aside from the nation’s highest state income tax rate, California has long been considered the most aggressive state in the nation when it comes to taxing foreign-sourced income. “Unfortunately for the President’s son, not only did he face the highest state income tax rate, he was also dealing with a state whose tax law has the longest and most aggressive arm,” Ellis said. “Comparatively speaking, California is the most litigious state I have seen in terms of chasing people down for money. Only New York rivals them.”

“It doesn’t matter if the income was coming from the former Mayor of Moscow, a Chinese private equity firm, or a Ukrainian gas company, California tax obligations are global and would’ve applied for the years in which Hunter Biden was a Golden State resident,” added Ellis, who runs his own tax preparation business and is president of the Center for a Free Economy.

The Department of Justice noted in a September 5 press release that “Hunter Biden engaged in a four-year scheme in which he chose not to pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019 and to evade the assessment of taxes for tax year 2018 when he filed false returns.” While Hunter Biden won’t face repercussions for skipping out on those federal tax obligations thanks to the pardon from his father, that doesn’t shield him from state level prosecution for failure to pay taxes to California.

Why would a person pay state taxes on income for which it’s known they did not pay federal taxes owed? That question and the desire to answer it is behind the complaint recently filed with the State Auditor. Fortunately for Hunter Biden, California tax authorities and the California press corps have thus far demonstrated little interest in answering that question.

Hunter Biden also doesn’t have to worry about the most recent state wealth tax proposal introduced Sacramento. That’s because Governor Newsom confirmed earlier this year that he opposes the latest wealth tax bill introduced by California legislators. That should be welcomed news for Hunter Biden, who purchased a $142,000 sports car with funds provided by a Kazakh businessman, and who received a 3.16 carat diamond from a Chinese businessman, both of which would be prime targets of the sort of wealth tax sought by some California lawmakers.

In his 2023 State of the Union Address, President Biden promoted his effort to make “the wealthiest and the biggest corporations begin to pay their fair share. That message was echoed throughout 2024 by Vice President Kamala Harris (D), Senator Chuck Schumer (D-N.Y.), and other prominent Democrats. Any politician who wants to continue calling for stricter gun control and higher tax burdens on the rich, however, will have a hard time doing so in the future if they declined to comment when the President’s son was let off the hook for failing to pay taxes on millions in income and violating of gun laws.

California

California man told Wisconsin shooting suspect about plan to attack a government building, gun order says

A California man was detained by the FBI and ordered to have his guns temporarily seized after he allegedly communicated with the 15-year-old shooter who killed two people at her Wisconsin school, documents show.

The gun violence emergency protective order was served to a 20-year-old in Carlsbad in San Diego County on Tuesday, according to the order, which was obtained by NBC San Diego.

The narrative of the order says the California man had communicated with Natalie “Samantha” Rupnow, who police say opened fire Monday at Abundant Life Christian School in Madison, Wisconsin, which she attended, killing two people before she killed herself.

The FBI detained the man “after he was discovered plotting a mass shooting with the Madison Wisconsin shooter,” a Carlsbad police officer wrote in the gun order.

The man “admitted to the FBI agents that he told Rupnow that he would arm himself with explosives and a gun and that he would target a government building,” the Carlsbad officer wrote.

The FBI saw messages between him and Rupnow, the order says. It does not go into further detail about the communication or the alleged plans.

The order was approved by a San Diego County judge and served at the Carlsbad home just before 9 p.m. Tuesday, it shows. A court hearing about the order is set for Jan. 3, the document reads.

The order says guns were reported and searched for, but it does not say police seized any. The order requires someone to turn over firearms and not to possess any guns while it is in effect.

A spokesperson for the FBI’s San Diego field office declined to comment Wednesday evening.

Carlsbad police said the investigation is being led by Madison police. A Madison police spokesperson referred questions to the FBI.

It’s not clear whether there are any criminal charges in the matter. None of the agencies mentioned criminal charges, and a spokesperson for the San Diego County District Attorney’s Office did not immediately respond to a request for comment.

No cases with the man’s name appeared in an online search of criminal cases in the county Wednesday night.

A phone number for the man or his family could not immediately be found in public records Wednesday.

“There is no threat to the Carlsbad community at this time,” Carlsbad police said in a statement.

Investigators in Madison are working to determine a motive in the shooting Monday morning.

Rupnow, a freshman, opened fire at a study hall that had mixed grades, Madison police said.

A staff member, Erin West, 42, and a student, Rubi Vergara, 14, were killed, the Dane County Medical Examiner’s Office said, and other people were injured.

Rubi was in the ninth grade, and “her gentle, loving, and kind heart was reflected in her smile,” the school said in a statement Wednesday after their names were released. “Often seen with a book in hand, she had a gift for art and music,” it said.

West was a substitute teacher who became a full-time staff member. “ALCS is a better school for the work of Erin West,” the school said.

Two students sustained life-threatening injuries, and they remained hospitalized Wednesday, police said. Four other people with minor injuries have been discharged.

Two guns were found at the school, only one of which was used in the shooting, police said in a statement Wednesday. Madison Police Chief Shon Barnes has said the gun that was used was a handgun.

The federal Bureau of Alcohol, Tobacco, Firearms and Explosives has completed its data trace of the guns, but police said more information about the weapons was not being released Wednesday.

Police are looking at Rupnow’s social media accounts as part of the investigation, the police department said.

“Our team is looking to connect to anyone who may have interacted with Natalie Rupnow in the days and weeks leading up to the shooting,” Madison police said in Wednesday’s statement.

-

Politics7 days ago

Politics7 days agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside the launch — and future — of ChatGPT

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology6 days ago

Technology6 days agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics6 days ago

Politics6 days agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology6 days ago

Technology6 days agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Politics1 week ago

Politics1 week agoConservative group debuts major ad buy in key senators' states as 'soft appeal' for Hegseth, Gabbard, Patel

-

Business4 days ago

Business4 days agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology4 days ago

Technology4 days agoMeta’s Instagram boss: who posted something matters more in the AI age

/cloudfront-us-east-1.images.arcpublishing.com/gray/4NQC3PC7U5A4TLB4VHBWYFK5YM.jpg)