California

California mortgage-making takes record 63% dive

“Crash, correction or chill” appears to be like at financial and actual property developments that supply hints in regards to the depth of housing’s troubles.

Buzz: California mortgage-making took a file tumble this summer season as hovering rates of interest made most loans unaffordable.

Source: My trusty spreadsheet analyzed third-quarter mortgage lending developments compiled by Attom. These stats, relationship to 2000, have a look at loan-making in 210 metro areas nationwide – together with 19 areas in California.

Topline

Californians in 19 metro areas took out 177,566 mortgages from July by means of September.

That’s the second-slowest slowest three months of the century. It’s additionally a shocking 63% nosedive from the year-ago interval, making this the largest 12-month drop on file.

Sure, this home-loan crater is deeper than something we witnessed in the course of the bubble-bursting housing meltdown of the mid-2000s.

How did this occur?

The Federal Reserve ballooned charges to battle surging inflation. Up to now 12 months, the typical 30-year mortgage jumped to six.9% from 3.1%, in response to Freddie Mac.

Skyrocketing charges slashed a home hunter’s potential “borrowing” energy by 35% in a yr and topped the 33% decline of 1980, one other excessive inflation period when charges went to 16.3% from 10.5%.

So this summer season, mortgages made to purchase a house fell by 53% from a yr in the past. And householders refinanced 82% fewer loans.

Strikingly, house owners did take out 74% extra house fairness loans. This tactic has turn into the popular solution to pull money from a home with out dropping the good charges on an older mortgage.

By the best way, this isn’t some California-only pattern. Each U.S. metro tracked by Attom noticed fewer mortgage offers reduce previously yr.

The nation, minus the California metros, had 1.8 million mortgages made this summer season – a 44% drop over 12 months, additionally the biggest decline on file. There have been 30% fewer buy loans, and 66% fewer refis however 45% extra house fairness loans.

Crash, correction or chill?

Crash: If you happen to make mortgages for a dwelling, it is a large catastrophe. No loans. No paychecks.

Mortgage dealer Jeff Lazerson, a Southern California Information Group contributor, lately wrote he laid off two-thirds of his workers: “Enterprise has all however stopped for mortgage lenders. And, sure, it’s a lot worse than the mortgage quantity collapse I bear in mind from the Nice Recession.”

Correction: For the broad housing market, it’s a part of a return to normalcy from a increase fueled by the Fed’s low cost cash insurance policies of the early pandemic period. This yr’s price surge is designed to sluggish the general economic system in addition to housing.

Chill: Chatting with the massive image, this dramatically slowed lending is a comparatively minor annoyance.

The lack of house gross sales is an financial minus. However, bear in mind, due to 30-year, fixed-rate mortgages, the Fed’s reward to any proprietor who refinanced lately stays in place.

That additional money from shrunken mortgage funds continues to be being spent. It’s one slice of the overheated, inflation-filled economic system. And the improved family money movement generally is a monetary cushion in opposition to any important downturn.

The unknown

Lenders have been very conservative about who will get mortgages on this cycle. So it’s an affordable wager the surge in home-equity lending is being performed prudently. (Fingers crossed!)

But when the uptick in home-equity loans is because of the monetary pressure of debtors, that’s a worrisome sample for the broad financial image.

Particulars

How mortgage-making slows in a few of California’s largest housing markets, ranked by the dimensions of the one-year drop in lending by means of the summer season …

San Jose: 8,114 mortgages made within the third quarter, down 71% (the No. 1 dip amongst all U.S. metros). That got here from 60% fewer buy loans closed, 89% fewer refinance offers, however 46% extra home-equity loans.

San Francisco: 22,048 mortgages, down 67% (No. 5 of the 210) – 56% fewer buy loans, 86% much less refis, however 35% extra fairness loans.

Ventura County: 4,212 mortgages, down 65% (No. 8) – 54% fewer buy loans, 86% fewer refis, however 85% extra fairness loans.

San Diego: 16,835 mortgages, down 65% (No. 9) – 56% fewer buy loans, 84% fewer refis, however 79% extra fairness loans.

Los Angeles-Orange County: 51,431 mortgages, down 64% (No. 12) – 55% fewer buy loans, 83% fewer refis, however 82% extra fairness loans.

Sacramento: 15,422 mortgages, down 62% (No. 18) – 49% fewer buy loans, 83% fewer refis, however 94% extra fairness loans.

Inland Empire: 28,247 mortgages, down 60% (No. 22) – 49% fewer buy loans, 78% fewer refis, however 127% extra fairness loans.

Jonathan Lansner is the enterprise columnist for the Southern California Information Group. He will be reached at jlansner@scng.com

California

Dickies to say goodbye to Texas, hello to Southern California

FORT WORTH, Texas — Dickies is leaving Cowtown for the California coast, according to a report from the Los Angeles Times.

The 102-year-old Texas workwear brand, which is owned by VF Corp., is making the move from Fort Worth to Costa Mesa in order to be closer to its sister brand, Vans.

Dickies was founded in Fort Worth in 1922 by E.E. “Colonel” Dickie. Today, Dickies Arena is the entertainment hub of the city and home of the Fort Worth Stock Show and Rodeo.

The company is expected to make the move by May. Approximately 120 employees will be affected, the report said.

By moving one of its offices closer to the other, VF Corp. says it can “consolidate its real estate portfolio,” as well as “create an even more vibrant campus,” Ashley McCormack, director of external communications at VF Corp. said in the report.

Dickies isn’t the only rugged brand owned by VF Corp. The company also has ownership of Timberland, The North Face and JanSport.

VF Corp. acquired Dickies in 2017 for $820 million.

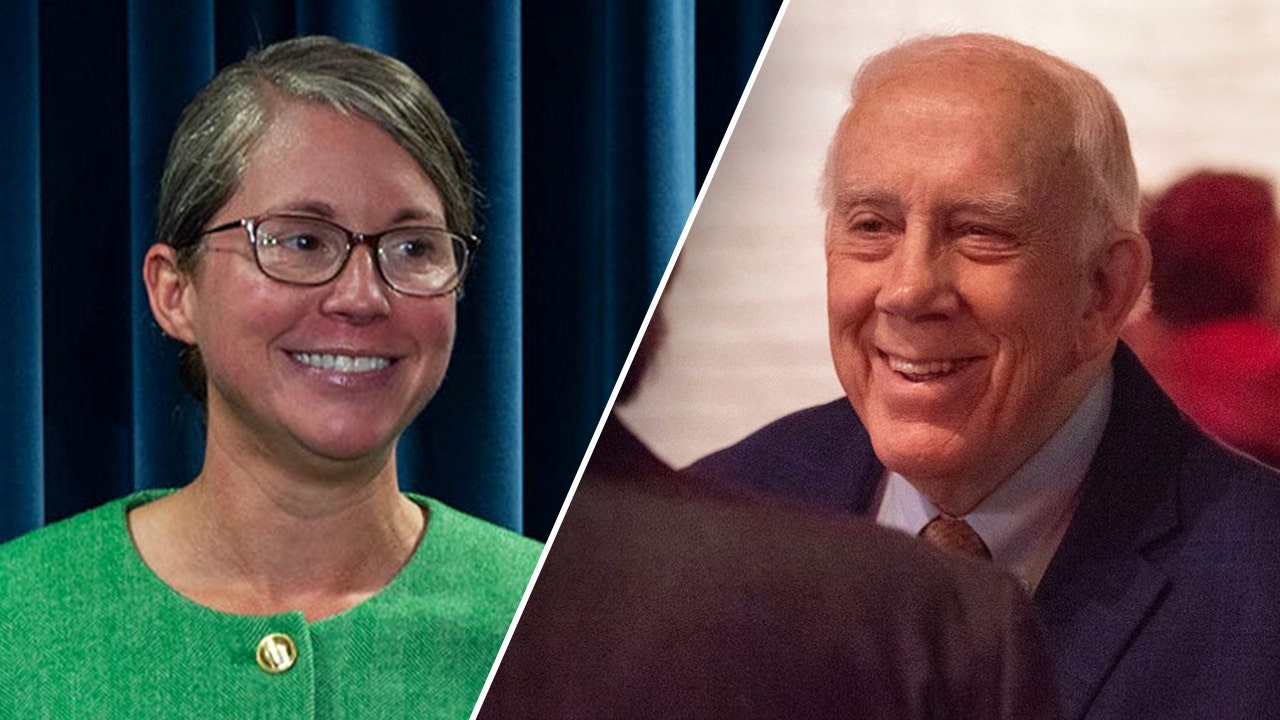

“Their contributions to our city’s culture, economy and identity are immeasurable,” District 9 City Council member Elizabeth Beck, who represents the area of downtown Fort Worth where Dickies headquarters is currently located, said in a statement to the Fort Worth Report. “While we understand their business decision, it is bittersweet to see a company that started right here in Fort Worth take this next step. We are committed to supporting the employees who remain here and will work to honor the lasting imprint Dickies has left on our community.”

California

Caitlyn Jenner says she'd 'destroy' Kamala Harris in hypothetical race to be CA gov

Caitlyn Jenner considers another run to become California governor

Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

SAN FRANCISCO – Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

Jenner, who publicly came out as transgender nearly 10 years ago, made a foray into politics when she ran as a Republican during the recall election that attempted to unseat Gov. Gavin Newsom in 2021. Jenner only received one percent of the vote and was not considered a serious candidate.

Jenner posted this week on social media that she’s having conversations with “many people” and hopes to have an announcement soon about whether she will run.

Caitlyn Jenner speaks at the 4th annual Womens March LA: Women Rising at Pershing Square on January 18, 2020 in Los Angeles, California. (Photo by Chelsea Guglielmino/Getty Images)

She has also posted in Trumpian-style all caps: “MAKE CA GREAT AGAIN!”

As for VP Harris, she has not indicated any future plans for when she leaves office. However, a recent poll suggests Harris would have a sizable advantage should she decide to run in 2026. At that point, Newsom cannot run again because of term limits.

If Jenner decides to run and wins, it would mark the nation and state’s first transgender governor.

California

Northern California 6-year-old, parents hailed as heroes for saving woman who crashed into canal

LIVE OAK — A six-year-old and her parents are being called heroes by a Northern California community for jumping into a canal to save a 75-year-old woman who drove off the road.

It happened on Larkin Road near Paseo Avenue in the Sutter County community of Live Oak on Monday.

“I just about lost her, but I didn’t,” said Terry Carpenter, husband of the woman who was rescued. “We got more chances.”

Terry said his wife of 33 years, Robin Carpenter, is the love of his life and soulmate. He is grateful he has been granted more time to spend with her after she survived her car crashing off a two-lane road and overturning into a canal.

“She’s doing really well,” Terry said. “No broken bones, praise the Lord.”

It is what some call a miracle that could have had a much different outcome without a family of good Samaritans.

“Her lips were purple,” said Ashley Martin, who helped rescue the woman. “There wasn’t a breath at all. I was scared.”

Martin and her husband, Cyle Johnson, are being hailed heroes by the Live Oak community for jumping into the canal, cutting Robin out of her seat belt and pulling her head above water until first responders arrived.

“She was literally submerged underwater,” Martin said. “She had a back brace on. Apparently, she just had back surgery. So, I grabbed her brace from down below and I flipped her upward just in a quick motion to get her out of that water.”

The couple said the real hero was their six-year-old daughter, Cayleigh Johnson.

“It was scary,” Cayleigh said. “So the car was going like this, and it just went boom, right into the ditch.”

Cayleigh was playing outside and screamed for her parents who were inside the house near the canal.

I spoke with Robin from her hospital bed over the phone who told us she is in a lot of pain but grateful.

“The thing I can remember is I started falling asleep and then I was going over the bump and I went into the ditch and that’s all I remember,” Robin said.

It was a split-second decision for a family who firefighters said helped save a stranger’s life.

“It’s pretty unique that someone would jump in and help somebody that they don’t even know,” said Battalion Chief for Sutter County Fire Richard Epperson.

Robin is hopeful that she will be released from the hospital on Wednesday in time to be home for Thanksgiving.

“She gets Thanksgiving and Christmas now with her family and grandkids,” Martin said.

Terry and Robin are looking forward to eventually meeting the family who helped save Robin’s life. The family expressed the same feelings about meeting the woman they helped when she is out of the hospital.

“I can’t wait for my baby to get home,” Terry said.

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health2 days ago

Health2 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World