California

California might levy a new tax on oil companies. Here’s what to know

By Grace Gedye | CalMatters

Few issues agitate drivers — and make politicians sweat — like rising costs on the pump.

Fuel costs in California are persistently larger than the remainder of the nation, because of state taxes, a cleaner gas mix, an remoted gasoline refining market and extra. However in September, California costs jumped even larger and that hole grew wider.

Gov. Gavin Newsom pointed the finger on the gasoline business when he talked to reporters in early October, saying firms have been “fleecing” drivers and referred to as for a brand new “windfall revenue” tax on oil firms.

Valero, a global oil firm that owns refineries in California, noticed its earnings from July to September improve 500% over the identical interval final 12 months. And earnings on West Coast gasoline operations elevated dramatically in April via June, in comparison with the identical time final 12 months, at firms that personal among the state’s largest refineries, an evaluation by Shopper Watchdog discovered.

With Newsom planning to convene a particular legislative session in early December to deal with the brand new tax, CalMatters spoke to consultants about how the concept has labored within the U.S. and overseas.

This isn’t one thing states have achieved typically.

No state has achieved a windfall revenue tax earlier than, mentioned David Brunori, a visiting professor of public coverage at George Mason College and an knowledgeable on state-level tax coverage. The one debatable exception: In 2006, Alaska started taxing web revenues on oil manufacturing, with a tax price that elevated as the worth of a barrel of oil elevated. After some tweaks in 2007, the tax introduced in billions of {dollars} for the state, a few of which was used to difficulty $1,200 funds to residents to assist with excessive gasoline costs, in response to the Seattle Instances.

After the tax was imposed, nonetheless, drilling decreased and the quantity oil firms invested in growing new oil dropped, in response to the Alaska Journal of Commerce. However, Brunori mentioned, it wasn’t actually a windfall revenue tax as a result of it wasn’t a direct tax on earnings. It’s additionally not clear whether or not Newsom’s proposal will look something like Alaska’s tax.

A windfall tax isn’t prone to increase or decrease gasoline costs, says Severin Borenstein, an power economist at UC Berkeley, however it will be “very tough to really implement.”

Policymakers must determine precisely how a lot revenue constitutes a windfall. “Above what degree do we are saying, ‘That’s an excessive amount of revenue and we’re going to tax it away?’ ” he mentioned.

The US quickly embraced extra revenue taxes throughout World Battle I, World Battle II and the Korean Battle, with combined outcomes. When the U.S. authorities massively ramped up spending throughout WWI, some firms noticed their revenue margins balloon. So, the federal government started taxing all industries’ earnings above a sure return on funding, which wound up bringing in about 40% of the tax income raised for the struggle.

However, as a result of the taxes have been sophisticated, well-paid attorneys at massive firms might use “artistic gamesmanship” to cut back their employers’ tax invoice, whereas small firms with no phalanx of legal professionals shouldered extra of the burden, mentioned Joe Thorndike, director of the Tax Historical past Venture at Tax Analysts.

“These taxes, greater than most, actually are depending on an ethical argument, an ethical justification, to exist, and when that begins to get picked aside by these equity failures it actually makes it an issue,” Thorndike mentioned.

The concept was revived in 1980, because the federal authorities ready to chill out worth controls on oil produced within the U.S. That 12 months, Congress handed what it dubbed a windfall revenue tax, geared toward oil business earnings. The pondering, Thorndike mentioned, was that firms would revenue massively as crude oil rose to the market worth, and the method can be costly and painful for shoppers. The tax, nonetheless, was not a tax on earnings, however quite a system of excise taxes on oil, in response to a Congressional Analysis Service report.

It wasn’t a convincing success. In the course of the eight years it was in impact, it introduced in $80 billion — far decrease than the $393 billion it was projected to generate, in response to congressional researchers. As a result of the tax solely utilized to grease produced within the U.S., it probably decreased home manufacturing whereas growing the nation’s reliance on overseas oil, congressional researchers discovered. It was additionally tough for the Inside Income Service to manage, and tough for the oil business to adjust to. So, in 1988 it was repealed.

As power costs have spiked in Europe and the UK, leaders there have additionally turned to windfall taxes. Greece, Hungary, Italy, Romania, Spain and the U.Okay. have all applied their very own, and 6 different nations have proven intentions to impose related taxes, in response to a September evaluation by the Tax Basis. In late September, the European Union agreed to a windfall tax on oil and gasoline earnings.

As a result of these taxes in Europe are so current — and since they’re short-term — it’s laborious to inform what influence they are going to have, mentioned Sean Bray, the EU tax coverage analyst on the Tax Basis.

Right here in California, Borenstein, the power economist at Berkeley, hopes the Legislature will use the particular session to debate what he sees because the Golden State’s “elementary drawback” in terms of gasoline: determining learn how to keep enough provides whereas the state is utilizing its cleaner mix and is making an attempt to part out fossil gas utilization.

“We ignore this difficulty totally, till there’s an enormous worth spike,” Borenstein mentioned. “After which all people runs round yelling about how outrageous that is, as a substitute of truly having a critical coverage dialogue of what’s the precise approach to take care of this.”

Particulars are spare at this level. However the primary concept is that firms that extract, produce and refine oil would pay a better tax price on their earnings above a set quantity annually, a spokesperson for the governor mentioned. The cash raised by the tax can be despatched by way of refunds to “California taxpayers impacted by excessive gasoline costs,” mentioned a spokesperson in an e mail.

The logic behind windfall revenue taxes is to tax an organization at a better price when they’re making big earnings — a “windfall” — for some purpose not of their very own making.

Typically there’s an ethical dimension to the pondering as effectively, mentioned Kirk Stark, a tax regulation professor at UCLA. Theoretically, taxing further excessive earnings at an additional excessive price ought to make firms much less prone to capitalize on circumstances like struggle and pure disasters to jack up costs — like a shopkeeper who raises the worth of bottled water from $2 to $40 following a hurricane. “There’s virtually a sort of ethical judgment that, in some conditions, market costs will be immoral,” Stark mentioned.

Getting the incentives proper is difficult, Borenstein mentioned, as is stopping firms from evading the tax. If, for instance, the state taxes earnings at California refineries, these refineries — owned by firms together with Chevron and Valero — might begin shopping for oil from one other division of their mother or father firms at larger costs.

By doing that, they may scale back their revenue. And in the event that they’re not making massive earnings, their tax invoice would go down.

“The satan is within the particulars,” Borenstein mentioned.

California

Dickies to say goodbye to Texas, hello to Southern California

FORT WORTH, Texas — Dickies is leaving Cowtown for the California coast, according to a report from the Los Angeles Times.

The 102-year-old Texas workwear brand, which is owned by VF Corp., is making the move from Fort Worth to Costa Mesa in order to be closer to its sister brand, Vans.

Dickies was founded in Fort Worth in 1922 by E.E. “Colonel” Dickie. Today, Dickies Arena is the entertainment hub of the city and home of the Fort Worth Stock Show and Rodeo.

The company is expected to make the move by May. Approximately 120 employees will be affected, the report said.

By moving one of its offices closer to the other, VF Corp. says it can “consolidate its real estate portfolio,” as well as “create an even more vibrant campus,” Ashley McCormack, director of external communications at VF Corp. said in the report.

Dickies isn’t the only rugged brand owned by VF Corp. The company also has ownership of Timberland, The North Face and JanSport.

VF Corp. acquired Dickies in 2017 for $820 million.

“Their contributions to our city’s culture, economy and identity are immeasurable,” District 9 City Council member Elizabeth Beck, who represents the area of downtown Fort Worth where Dickies headquarters is currently located, said in a statement to the Fort Worth Report. “While we understand their business decision, it is bittersweet to see a company that started right here in Fort Worth take this next step. We are committed to supporting the employees who remain here and will work to honor the lasting imprint Dickies has left on our community.”

California

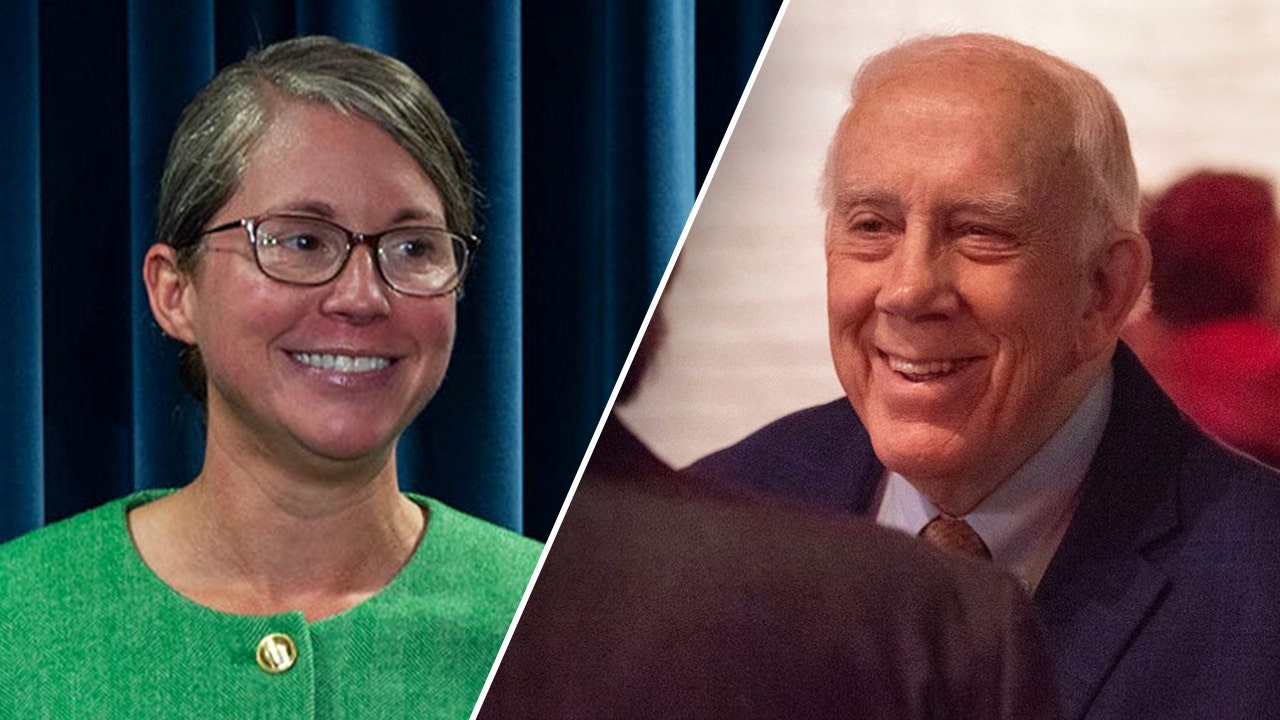

Caitlyn Jenner says she'd 'destroy' Kamala Harris in hypothetical race to be CA gov

Caitlyn Jenner considers another run to become California governor

Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

SAN FRANCISCO – Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

Jenner, who publicly came out as transgender nearly 10 years ago, made a foray into politics when she ran as a Republican during the recall election that attempted to unseat Gov. Gavin Newsom in 2021. Jenner only received one percent of the vote and was not considered a serious candidate.

Jenner posted this week on social media that she’s having conversations with “many people” and hopes to have an announcement soon about whether she will run.

Caitlyn Jenner speaks at the 4th annual Womens March LA: Women Rising at Pershing Square on January 18, 2020 in Los Angeles, California. (Photo by Chelsea Guglielmino/Getty Images)

She has also posted in Trumpian-style all caps: “MAKE CA GREAT AGAIN!”

As for VP Harris, she has not indicated any future plans for when she leaves office. However, a recent poll suggests Harris would have a sizable advantage should she decide to run in 2026. At that point, Newsom cannot run again because of term limits.

If Jenner decides to run and wins, it would mark the nation and state’s first transgender governor.

California

Northern California 6-year-old, parents hailed as heroes for saving woman who crashed into canal

LIVE OAK — A six-year-old and her parents are being called heroes by a Northern California community for jumping into a canal to save a 75-year-old woman who drove off the road.

It happened on Larkin Road near Paseo Avenue in the Sutter County community of Live Oak on Monday.

“I just about lost her, but I didn’t,” said Terry Carpenter, husband of the woman who was rescued. “We got more chances.”

Terry said his wife of 33 years, Robin Carpenter, is the love of his life and soulmate. He is grateful he has been granted more time to spend with her after she survived her car crashing off a two-lane road and overturning into a canal.

“She’s doing really well,” Terry said. “No broken bones, praise the Lord.”

It is what some call a miracle that could have had a much different outcome without a family of good Samaritans.

“Her lips were purple,” said Ashley Martin, who helped rescue the woman. “There wasn’t a breath at all. I was scared.”

Martin and her husband, Cyle Johnson, are being hailed heroes by the Live Oak community for jumping into the canal, cutting Robin out of her seat belt and pulling her head above water until first responders arrived.

“She was literally submerged underwater,” Martin said. “She had a back brace on. Apparently, she just had back surgery. So, I grabbed her brace from down below and I flipped her upward just in a quick motion to get her out of that water.”

The couple said the real hero was their six-year-old daughter, Cayleigh Johnson.

“It was scary,” Cayleigh said. “So the car was going like this, and it just went boom, right into the ditch.”

Cayleigh was playing outside and screamed for her parents who were inside the house near the canal.

I spoke with Robin from her hospital bed over the phone who told us she is in a lot of pain but grateful.

“The thing I can remember is I started falling asleep and then I was going over the bump and I went into the ditch and that’s all I remember,” Robin said.

It was a split-second decision for a family who firefighters said helped save a stranger’s life.

“It’s pretty unique that someone would jump in and help somebody that they don’t even know,” said Battalion Chief for Sutter County Fire Richard Epperson.

Robin is hopeful that she will be released from the hospital on Wednesday in time to be home for Thanksgiving.

“She gets Thanksgiving and Christmas now with her family and grandkids,” Martin said.

Terry and Robin are looking forward to eventually meeting the family who helped save Robin’s life. The family expressed the same feelings about meeting the woman they helped when she is out of the hospital.

“I can’t wait for my baby to get home,” Terry said.

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health2 days ago

Health2 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World