California

Aaron Carter teased selling his California home days before death

Days earlier than Aaron Carter’s demise, he teased that his California dwelling, the place his physique was found on Saturday morning within the bathtub, was up on the market.

“Promoting my 2nd dwelling,’ Carter, 34, wrote in a tweet final Saturday, Oct. 29. “Actual property has been tremendous good to me. Prepared for a brand new chapter in my third dwelling which I plan on staying to make a phenomenal life for my household.”

“This 12 months has been tremendous powerful however I’ve discovered a lot,” he added. “Thanks for the assist everybody.”

Carter was engaged to Melanie Martin. The 2, who had an on-and-off once more dysfunctional relationship, had simply welcomed their first baby final November — a child boy named Prince Lyric Carter.

Nevertheless it seems like he by no means bought the prospect to purchase his third dwelling.

“Deputies responded to the block of Valley Vista Dr to Aaron Carter’s residence at 10:58 am [PST] this morning,” Los Angeles County Sheriff’s instructed The Submit in an announcement, including “they did find a deceased particular person.”

Lori Graf, supervisor of Aaron’s older brother, Nick Carter, instructed The Submit in an e-mail, “Aaron has handed.” TMZ reported that the troubled baby singer was found within the bathtub of the house.

A reason for demise has not but been launched.

Aaron, who has struggled with drug dependancy, had bought the seven-bedroom, four-bathroom Lancaster property in November 2020 for $620,000, information present.

He then listed the house on the market three months later. The residence has glided on and off the market since.

Aaron final put the house up on the market on Sept. 30 for $829,000, earlier than it acquired a $30,000 worth lower over every week in the past.

Based on the itemizing’s description, the house is surrounded by palm timber and contains a kitchen with a breakfast bar, granite counter tops, and a big walk-in pantry.

Facilities embrace a major suite with a sitting room and fireside, and a big out of doors patio, pool and spa.

“The inside of the house options a lot wanted Facilities corresponding to laminate flooring, upgraded lighting fixtures, recessed lighting, vaulted ceilings, massive image home windows, and customized inside paint,” the outline of the house states.

The itemizing stays energetic.

Christie M Limpus with Berkshire Hathaway Residence Companies holds the itemizing.

Carter began his profession opening for the Backstreet Boys, Nick’s band, on their 1997 tour.

At simply 9 years outdated, he launched his first self-titled debut album, which offered one million copies, that very same 12 months. He went on to open for different main acts together with Britney Spears.

Aaron rapidly shot to stardom within the late ’90s, promoting thousands and thousands of information with pop hits like “I’m All About You,” “I Need Sweet,” and “Aaron’s Social gathering (Come Get It).”

In July 2017, Carter was busted on DUI and marijuana prices in Georgia whereas in a automotive together with his then-girlfriend, Madison Parker.

A decide dismissed the case final 12 months, however he was positioned on probation for 12 months, needed to full 40 hours of group service, attend DUI threat discount courses and be subjected to a drug and alcohol analysis.

He was additionally made to pay roughly $1,500 in courtroom charges and fines.

California

Campaign manager charged with acting as Chinese agent in California election

Feds arrest, charge former aide to New York governor as Chinese agent

Linda Sun, New York Governor Kathy Hochul’s former Deputy Chief of staff, , was arrested and charged as an undisclosed Chinese agent.

A man was charged for allegedly acting as an illegal agent for the Chinese government while working as a campaign manager for a political candidate in Southern California who was elected in 2022 to the city council.

Yaoning “Mike” Sun, 64, was also accused of conspiring with another man — John Chen — who had been plotting to target U.S.-based practitioners of Falun Gong, a spiritual practice banned in China, according to a criminal complaint unsealed Thursday. Chen was sentenced last month to 20 months in prison for acting as an unregistered agent of the People’s Republic of China (PRC) and bribing an Internal Revenue Service agent.

Sun, a Chinese national who resided in Chino Hills, California, had served as the campaign manager and “close personal confidante” for a political candidate who ran for city council in Southern California in 2022, prosecutors said. According to the complaint, Sun communicated with Chen about his efforts to get the candidate elected.

“Chen allegedly discussed with Chinese government officials how the (People’s Republic of China) could ‘influence’ local politicians in the United States, particularly on the issue of Taiwan,” prosecutors said.

After the candidate was elected to office in November 2022, prosecutors alleged that Chen instructed Sun to submit reports on the election that could be sent to Chinese government officials. Chen remained in frequent contact with Sun and told him in early 2023 that the two men were “cultivating and assisting (politician’s) success,” according to the complaint.

In another exchange, prosecutors said Chen instructed Sun to refer to the politician as a “new political star” in a draft report. Chen also critiqued Sun’s draft report and suggested that he add information about their “past struggle fighting Taiwanese independence forces in a named California city over the years and fighting (Falun Gong) influences in that city,” according to the complaint.

The complaint added that in February 2023, Sun sent Chen a proposal to combat “anti-China forces” by participating in an Independence Day parade in Washington, D.C. Sun also requested that the Chinese government provide $80,000 to fund pro-PRC activities in the United States, the complaint states.

If convicted of all charges, Sun faces a maximum penalty of 15 years in prison, according to prosecutors.

Sun’s arrest comes just months after a former aide to New York Gov. Kathy Hochul and her predecessor Andrew Cuomo were charged with acting as an undisclosed agent of the Chinese government. Linda Sun, Hochul’s former deputy chief of staff, was arrested and pleaded not guilty in September.

U.S. Attorney Breon Peace said in a statement that Linda Sun had used her state government service “to further the interests of the Chinese government” and the Chinese Communist Party. “The illicit scheme enriched the defendant’s family to the tune of millions of dollars,” Peace added.

Contributing: Reuters

California

California political operative allegedly acted as illegal agent of China: DOJ

A Chino Hills, California man has been arrested for allegedly working as an illegal agent of the People’s Republic of China (PRC) while also serving as the campaign manager for a local politician who was elected to office in 2022.

The U.S. Department of Justice (DOJ) said 64-year-old Yaoning “Mike” Sun was arrested on Thursday and charged with acting as an illegal agent of China as well as conspiring with another man, Chen Jun, who was sentenced to prison in November for bribery and also acting as an illegal agent of the Chinese government.

According to a criminal complaint filed with the U.S. District Court for the Central District of California on Tuesday, Sun served as campaign manager for a Southern California politician who was not named and only identified as “Individual 1” in the complaint. Individual 1 was ultimately elected to a city council position in a city not named in the complaint, in 2022.

Sun and Chen communicated during the campaign to help get the individual elected.

2 NY RESIDENTS ALLEGEDLY RAN SECRET CHINESE POLICE STATION: ‘SIGNIFICANT NATIONAL SECURITY MATTER’

Chen Jun, who Yaoning “Mike” Sun allegedly conspired with, was sentenced to prison in November for bribery and acting as an illegal agent of the Chinese government. (Department of Justice)

The DOJ said Chen allegedly spoke with Chinese government officials about how China could “influence” local American politicians, especially on the topic of Taiwan.

Shortly after Individual 1 was elected to office in November 2022, Chen allegedly told Sun to prepare a report on the election. The report was sent to Chinese government officials, who the complaint says responded positively and expressed thanks.

Nearly a month after the individual was elected, Chen also set up a lunch with Sun and others at a Rowland Heights restaurant. The gathering was described to a PRC official by Chen as a “core member lunch,” the DOJ said. Individual 1 was not reportedly at the luncheon, though Chen told the Chinese government officials the individual was part of the “basic team dedicated for us.”

CALIFORNIA MAN SENTENCED FOR ‘BIRTH TOURISM’ SCHEME FOR AFFLUENT CHINESE WOMEN

Chen told the PRC official the lunch was “successful,” adding that attendees agreed to create a “US-China Friendship Promotional Association.”

In early 2023, Chen allegedly instructed Sun to compose another report for PRC officials about the two of them “cultivating and assisting” with Individual 1’s success.

As the second report was being finalized in February 2023, Sun sent Chen a proposal to combat “anti-China forces” by marching in a U.S. Independence Day parade in Washington, D.C., the complaint noted.

MAN ACCUSED OF RUNNING SECRET CHINESE GOV POLICE STATION IN NYC MAKES PLEA: US ATTORNEY

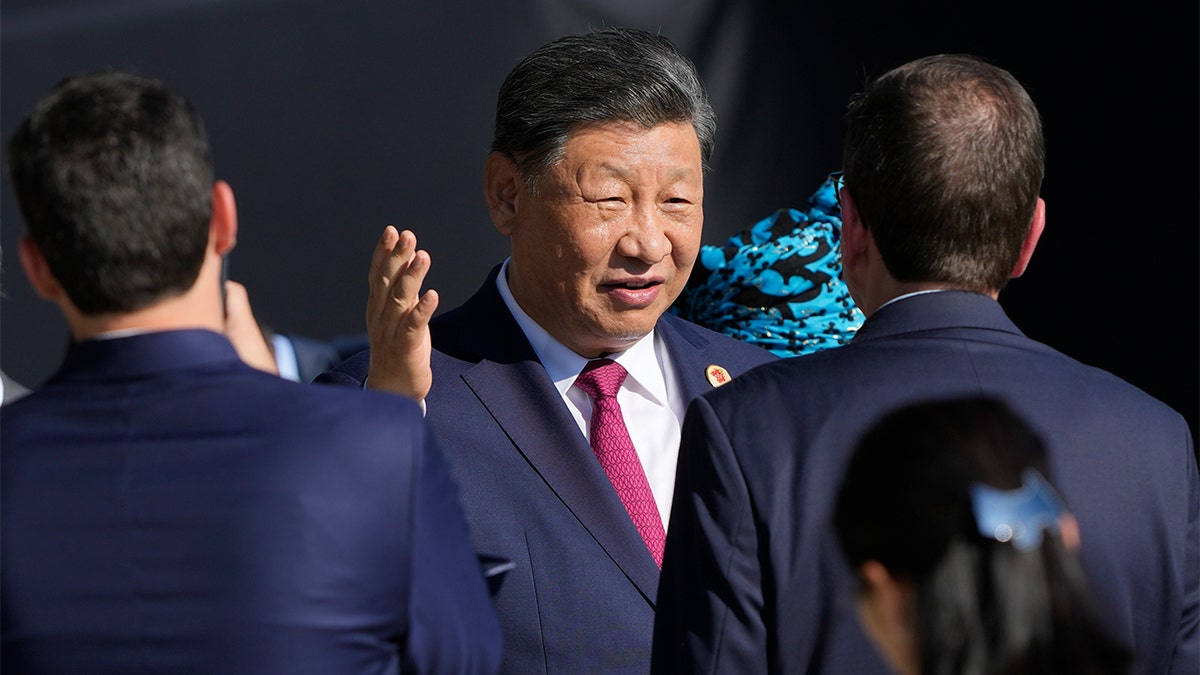

China’s President Xi Jinping talks after joining a group photo during the G20 Summit in Rio de Janeiro, Monday, Nov. 18, 2024. (AP Photo/Eraldo Peres)

While the two men continued their efforts in the U.S., Sun allegedly asked the PRC to provide them with a budget of $80,000.

The complaint alleges that Chen and Sun spoke about a planned trip to China to meet with “leadership.” It also claims Sun was directed by Chen to set up a meeting with the Chinese consul general in Los Angeles. In August 2023, Sun and Individual 1 eventually traveled to China, the complaint alleges.

Sun could face up to 10 years in prison for acting as an illegal agent of a foreign government if he is convicted.

CLICK HERE TO GET THE FOX NEWS APP

He also faces a maximum penalty of five years behind bars for conspiring to commit an offense against the U.S.

California

Whistleblower Seeks To Determine If Hunter Biden Paid California Taxes

Hunter Biden, son of US President Joe Biden, arrives at court for his trail on tax evasion in Los … [+]

Thanks to the presidential pardon from his father, Hunter Biden will no longer have to worry about the federal charges he was facing for failure to pay federal income tax on millions of dollars in earnings. President Joe Biden’s December 1 pardon does not, however, immunize his son from prosecution for failure to pay state income tax. Whether or not Hunter Biden fulfilled his state tax obligations to California is a question now being pursued by a public whistleblower.

Hunter Biden was a resident of California, home to the highest top marginal income tax rate in the country at 13.3%, during the years for which he has pled guilty to federal tax evasion. While media coverage has focused on unmet obligations to the IRS, the prospect of unpaid state tax liabilities is a topic that has never received much attention. In early December, James Lacy, president of the United States Justice Foundation, filed a public complaint (Case Number 12024-14638) with the California State Auditor calling for an investigation of the California Franchise Tax Board in order to determine whether Hunter Biden filed and paid state taxes for the years he has pled guilty to federal tax evasion.

Given the amount of income on which Hunter Biden failed to pay federal taxes, it’s a potentially large sum of money that he also might have neglected to pay to the government of California, a Democrat-run state where taxpayers are on the hook for an estimated trillion dollars-worth of unfunded public pension liabilities and where employers were recently hit with a payroll tax hike triggered by Governor Gavin Newsom’s (D-Calif.) decision to not repay unemployment insurance loans taken out from the federal government during the pandemic.

“Californians who file their tax returns and timely pay their taxes deserve to know whether or not Hunter Biden has received any special treatment from the Franchise Tax Board regarding his tax liability,” said Lacy. “I am hoping my Whistleblower Complaint will draw attention to this issue and bring some transparency to whether our state tax system has acted fairly.”

“If Hunter Biden failed to pay federal taxes, it’s reasonable to suspect he also failed to pay applicable state income taxes for those years,” says Ryan Ellis, an IRS-enrolled agent. Lacy also called on the Governor to act, saying “Newsom should also reveal to California taxpayers whether or not Hunter Biden was secretly ‘pardoned’ from state tax liability and enforcement as well.”

California Combines High Tax Rates With Muscular Collection

Aside from the nation’s highest state income tax rate, California has long been considered the most aggressive state in the nation when it comes to taxing foreign-sourced income. “Unfortunately for the President’s son, not only did he face the highest state income tax rate, he was also dealing with a state whose tax law has the longest and most aggressive arm,” Ellis said. “Comparatively speaking, California is the most litigious state I have seen in terms of chasing people down for money. Only New York rivals them.”

“It doesn’t matter if the income was coming from the former Mayor of Moscow, a Chinese private equity firm, or a Ukrainian gas company, California tax obligations are global and would’ve applied for the years in which Hunter Biden was a Golden State resident,” added Ellis, who runs his own tax preparation business and is president of the Center for a Free Economy.

The Department of Justice noted in a September 5 press release that “Hunter Biden engaged in a four-year scheme in which he chose not to pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019 and to evade the assessment of taxes for tax year 2018 when he filed false returns.” While Hunter Biden won’t face repercussions for skipping out on those federal tax obligations thanks to the pardon from his father, that doesn’t shield him from state level prosecution for failure to pay taxes to California.

Why would a person pay state taxes on income for which it’s known they did not pay federal taxes owed? That question and the desire to answer it is behind the complaint recently filed with the State Auditor. Fortunately for Hunter Biden, California tax authorities and the California press corps have thus far demonstrated little interest in answering that question.

Hunter Biden also doesn’t have to worry about the most recent state wealth tax proposal introduced Sacramento. That’s because Governor Newsom confirmed earlier this year that he opposes the latest wealth tax bill introduced by California legislators. That should be welcomed news for Hunter Biden, who purchased a $142,000 sports car with funds provided by a Kazakh businessman, and who received a 3.16 carat diamond from a Chinese businessman, both of which would be prime targets of the sort of wealth tax sought by some California lawmakers.

In his 2023 State of the Union Address, President Biden promoted his effort to make “the wealthiest and the biggest corporations begin to pay their fair share. That message was echoed throughout 2024 by Vice President Kamala Harris (D), Senator Chuck Schumer (D-N.Y.), and other prominent Democrats. Any politician who wants to continue calling for stricter gun control and higher tax burdens on the rich, however, will have a hard time doing so in the future if they declined to comment when the President’s son was let off the hook for failing to pay taxes on millions in income and violating of gun laws.

-

Politics7 days ago

Politics7 days agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside the launch — and future — of ChatGPT

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology6 days ago

Technology6 days agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics6 days ago

Politics6 days agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology6 days ago

Technology6 days agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Politics1 week ago

Politics1 week agoConservative group debuts major ad buy in key senators' states as 'soft appeal' for Hegseth, Gabbard, Patel

-

Business4 days ago

Business4 days agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology4 days ago

Technology4 days agoMeta’s Instagram boss: who posted something matters more in the AI age