Mississippi

Mississippi State Football Countdown: Nine Best Quotes by Head Coach Mike Leach During His Time with the Bulldogs

Mississippi State head coach Mike Leach has been identified for his quotes all through his profession, and that has solely change into extra true since he moved to the SEC.

Leach has mentioned almost every part in his decades-long teaching profession, starting from marriage to mascot battles. His witty one-liners and prolonged metaphors have stored the nation engaged and wanting to listen to his opinion on almost every part.

Listed here are a few of Leach’s most memorable quotes since being named the top coach of the Bulldogs in 2020.

1. “I imply, I utterly hate Sweet Corn.”

Leach was not shy about sharing his opinion on Halloween sweet following the staff’s rout of Vanderbilt final October. Most sweet appears to get his approval, however Sweet Corn is the exception. Truthfully, can anybody disagree?

2. “I’ve all the time appreciated Lane — and I do know you’re not supposed to love something from Ole Miss — however I’ve all the time appreciated him, sort of an entertaining man.”

In his first press convention after being employed as Mississippi State’s new head coach, Leach shared his opinion on Ole Miss coach Lane Kiffin. Regardless of being new to this system, he rapidly grasped simply how large the rivalry is for Bulldogs followers.

3. “Some participant comes frantically to the sideline, ‘Okay, they did this. Nicely, okay they did this. The cheerleader ran across the stadium 3 times after which the Shetland pony got here out and ate a sizzling canine on the 50-yard line, so now what do I do?’“

What did Leach imply when he used this metaphor after MSU’s loss to LSU final season? It seems like he’s emphasizing how his Bulldogs cannot get too frazzled or fall too far behind in a sport in the event that they need to win within the SEC. This was simply a way more colourful option to emphasize his level.

4. “I don’t know in regards to the math, most likely 4 factors price.”

Scroll to Proceed

After Mississippi State’s sport in opposition to Alabama, Leach was requested how a lot a discipline objective that got here after a missed landing alternative affected the result of the sport. He took it actually and did get the maths proper.

5. “They should let me deal with that. I’ll have that performed by lunch. I feel it could be good to let me deal with it.”

Leach is assured in his means to kind by means of the approaching SEC realignment that can come as Texas and Oklahoma be a part of the convention. Actually, the job nearly seems to be fairly straightforward for him.

6. “I imply, the 2 most japanese groups within the West are the 2 Alabama faculties, so ship them east, and we have now to play Texas and OU, and I most likely gained slightly on that.”

With Texas and Oklahoma becoming a member of the SEC, the divisions throughout the convention will change. Leach believes that taking part in the 2 newcomer faculties versus the powerhouses in Alabama may gain advantage Mississippi State in the long term.

7. “Any questions?”

Most SEC coaches gave an in-depth opening assertion at this yr’s SEC Media Days. Leach wanted simply two easy phrases to open up his time with the media.

8. “I’ll inform you what, that simply exhibits in the event you spend time with nice people who find themselves doing nice issues, a few of it’ll rub off on you. Trigger that was higher than I deserved as a result of lots of people would have eaten it in that state of affairs, however not me. I used to be blessed by the people who I get to cope with day-after-day.”

Leach almost tripped and fell off the stage on the 2021 C-Spire Conerly Trophy awards ceremony, however he caught himself. Moderately than preserving quiet about his tumble, he acknowledged that he was capable of keep his composure due to the influence his gamers have had on him.

9. “That’s the canine model of a leather-based jacket.”

Upon arriving in Starkville, Leach showered MSU’s dwell bulldog mascot, Jak, with reward. He is not flawed — Jak is such a great boy and beloved by all the fanbase!

Mississippi

Mississippi State researcher to play vital role in NASA artificial star mission – SuperTalk Mississippi

A Mississippi State University astrophysicist will lead a $19.5 million NASA space mission to put an artificial star in orbit around the Earth.

Angelle Tanner, an associate professor in the Department of Physics and Astronomy at Mississippi State, is serving as the principal investigator on the Landolt mission, part of the NASA Astrophysics Pioneers program. The program’s artificial star will allow scientists to calibrate telescopes and more accurately measure the brightness of stars ranging from those nearby to the distant explosions of supernovas in far-off galaxies.

By establishing absolute flux calibration, the mission will address several open challenges in astrophysics including the speed and acceleration of the universe expansion.

Tanner is managing a sub-grant of $300,000 for the project. Her work on the mission relies on cubesats, which are small satellites orbiting Earth. Each cubesat contains four lasers specially calibrated by the National Institute of Standards and Technology, an agency of the U.S. Department of Commerce.

“The program includes a cubesat and a set of ‘ground stations,’ which are telescopes. As the cubesat flies over a location, the ground stations will observe the cubesat in the same frame as their science target,” Tanner said.

“The point is to use the image of the laser to determine the amount of starlight being absorbed by the Earth’s atmosphere. This will reduce the uncertainties in the value of the brightness of the star from 10 percent to one percent. That makes a difference when propagated into the properties of exoplanets and, believe it or not, some of the parameters used to determine the structure of the universe.”

Working with the team at George Mason University in Virginia, the mission is named in honor of LSU Professor Arlo Landolt, who Tanner calls the “the father of photometry.” To follow the mission’s progress, click here.

Mississippi

Internal Revenue Service warns against scams targeting Mississippi seniors

From United States Department of Treasury

JACKSON, Miss. (WDAM) – The Internal Revenue Service Wednesday issued a warning about the rising threat of impersonation scams specifically targeting the senior community..

The scams are targeting older adults in Mississippi and elsewhere across the country by pretending to be government officials, aiming to steal sensitive personal information and money.

By posing as representatives from agencies such as the IRS, or other government agencies, these fraudsters use fear and deceit to exploit their victims.

“Scammers often target seniors, attempting to steal personal information through phone calls, emails or text messages by pretending to be from the IRS or other agencies or businesses,” said IRS Commissioner Danny Werfel. “Preventing these types of scams requires assistance from many different places.

“By partnering with other federal agencies and others in the tax community, we can reach more seniors and other taxpayers to help protect them against these terrible scams.”

The IRS speaking out on the scams is is part of a wider effort taking place this week leading up to World Elder Abuse Awareness Day on Saturday.

World Elder Abuse Awareness Day, observed since June 15, 2006, aims to foster a better understanding of the neglect and abuse faced by millions of older adults, focusing attention on the contributing cultural, social, economic and demographic factors.

The IRS also has been engaged in long-term efforts to protect against scams and other related schemes, including identity theft. This has been an ongoing focus of the Security Summit partnership between the IRS, state tax agencies and the nation’s tax professional community since 2015.

The IRS has identified a concerning trend where fraudulent actors are increasingly targeting unsuspecting individuals, particularly senior citizens, by masquerading as IRS agents.

Victims are pressured into making immediate payments through unorthodox methods such as gift cards or wire transfers under the pretense of resolving fictitious tax liabilities or securing false refunds.

These scammers deploy advanced techniques to fabricate a veneer of credibility, including the manipulation of caller IDs to appear legitimate. Here are just a few examples of their schemes:

- Impersonation of known entities: Fraudsters often pose as representatives from government agencies — including the IRS, Social Security Administration and Medicare — others in the tax community or familiar businesses and charities. By spoofing caller IDs, scammers can deceive victims into believing they are receiving legitimate communications

- Claims of problems or prizes: Scammers frequently fabricate urgent scenarios, such as outstanding debts or promises of significant prize winnings. Victims may be falsely informed that they owe the IRS money, are owed a tax refund, need to verify accounts or must pay fees to claim non-existent lottery winnings

- Pressure for immediate action: These deceitful actors create a sense of urgency, demanding that victims take immediate action without allowing time for reflection. Common tactics include threats of arrest, deportation, license suspension or computer viruses to coerce quick compliance

- Specified payment methods: To complicate traceability, scammers insist on unconventional payment methods, including cryptocurrency, wire transfers, payment apps or gift cards, and often require victims to provide sensitive information like gift card numbers.

If an individual receives an unexpected call from someone alleging to be from the IRS, but they have not been notified by mail about any issues with their IRS account, they should hang up immediately. The call is likely from a scammer.

Do not return the call using the number provided by the caller or the one displayed on their caller ID. If taxpayers are uncertain about the legitimacy of IRS communications, they can contact IRS customer service for verification at 1-800-829-1040, or for the hearing impaired, TTY/TDD 1-800-829-4059.

To view details about an individual’s tax account, they can set up or check their IRS individual online account on IRS.gov

Electronic scams are also on the rise, with scammers sending malicious emails and texts posing as IRS representatives to steal personal information. The IRS reminds taxpayers that it does not initiate contact via email, text, or social media regarding tax bills or refunds.

Report the call or electronic scam by visiting the Hotline page of the Treasury Inspector General for Tax Administration and using an IRS Impersonation Scam Reporting form or by calling 1-800-366-4484.

Forms to report different types of fraud are available on the Hotline page of Treasury Inspector General for Tax Administration website. Taxpayers can click the appropriate option under “IRS Scams and Fraud” and follow the instructions.

Individuals should understand how and when the IRS contacts taxpayers to help them verify whether any communication they receive is genuinely from an IRS employee.

Most IRS communications are initiated through regular mail delivered by the United States Postal Service. However, in certain situations, the IRS may make phone calls or visit homes or businesses. These situations include having an overdue tax bill, an unfiled tax return or missing employment tax deposit.

Additionally, an IRS employee might review assets or inspect a business as part of a collection investigation, audit or ongoing criminal investigation.

Remember the following:

- The IRS will never demand immediate payment via prepaid debit cards, gift cards or wire transfers. Typically, if taxes are owed, the IRS will send a bill by mail first

- The IRS will never threaten to involve local police or other law enforcement agencies

- The IRS will never demand payment without allowing opportunities to dispute or appeal the amount owed

- The IRS will never request credit, debit or gift card numbers over the phone.

The IRS and partnering federal agencies urge everyone to be cautious, especially when dealing with unsolicited communications concerning taxes.

In March 2020, the U.S. Department of Justice introduced the National Elder Fraud Hotline to address fraud targeting elderly Americans and support affected individuals. If an individual has fallen victim to elder fraud, they can contact the National Elder Fraud Hotline at 1-833-372-8311.

The hotline operates Monday through Friday, from 9 a.m. to 5 p.m., and services are available in English, Spanish and other languages.

Want more WDAM 7 news in your inbox? Click here to subscribe to our newsletter.

Copyright 2024 WDAM. All rights reserved.

Mississippi

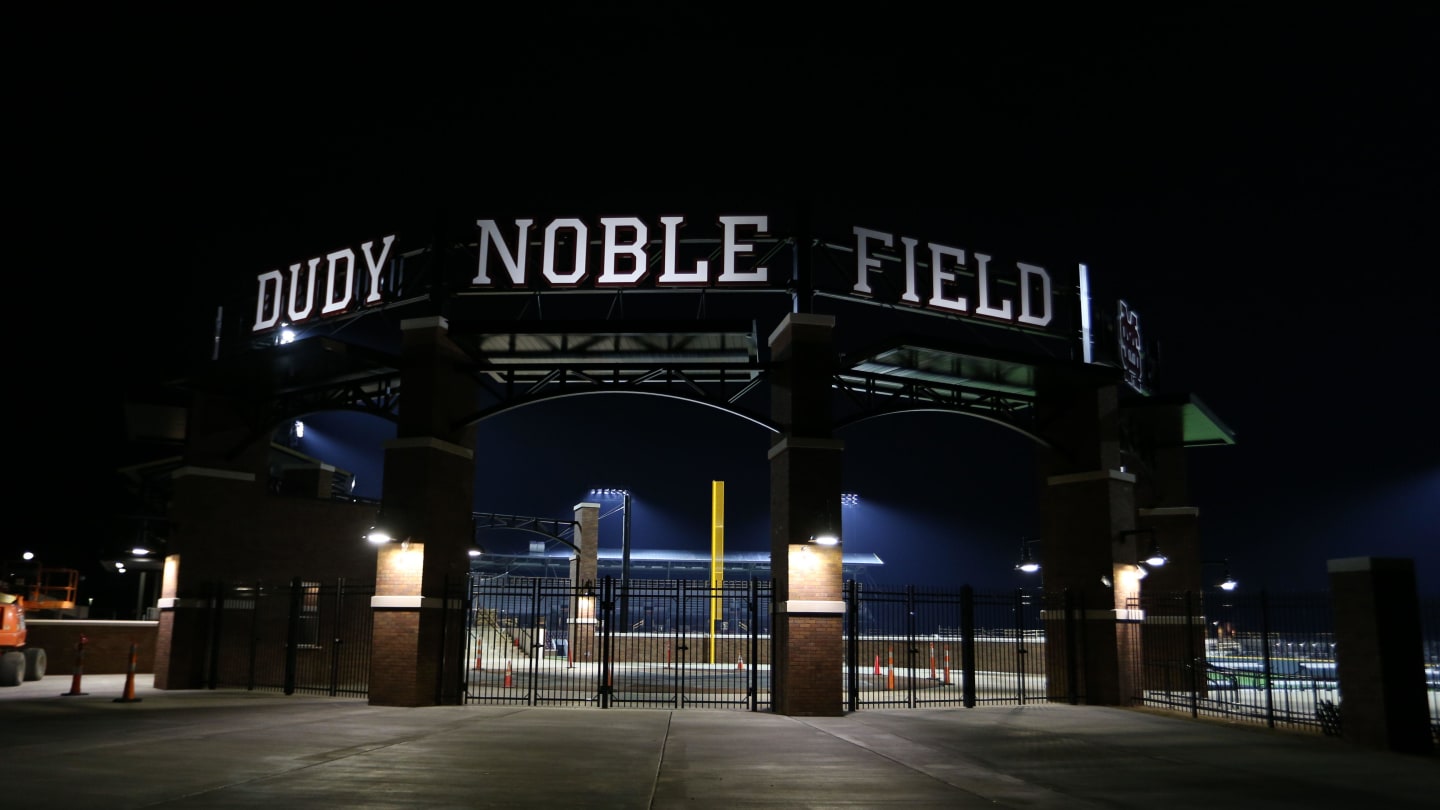

Mississippi State baseball lands mid-major shortstop from portal

Mississippi State baseball head coach Chris Lemonis has a major reload ahead of him this offseason. After a successful 2024 season that saw the Diamond Dawgs win 40 games, finish fifth in the SEC, and return to their first regional since 2021, the MSU roster is being overhauled.

Nearly every major contributor from this season will be gone in 2025, both at the plate and on the mound. And while young talent will always be present on the Mississippi State roster given they consistently recruit at a high level, in the transfer portal era, there’s no reason to only rely on those less experienced pieces.

Now, you turn to the portal to fill the holes on your team, and State has quite a few holes to fill. Over the weekend, they began the reload process with the addition of former North Alabama third-baseman Gehrig Frei. On Monday, they brought in another piece for the left side of the infield.

Shortstop Sawyer Reeves, formerly of The Citadel, is the second transfer pick-up for Mississippi State baseball this offseason.

I want to first give all the glory and praise to my Lord and Savior Jesus Christ, as these blessings are for His honor alone. I am excited to announce that I will be playing my graduate year of baseball at Mississippi State University! All glory to God and Hail State! pic.twitter.com/qiOi3NVXjv

— Sawyer Reeves (@swreeves4) June 11, 2024

Reeves batted .304 in 2024, the second-best in The Citadel’s lineup. He had 58 hits with 10 doubles and five home runs, and he was second on the team with 31 RBI. Reeves had a slugging percentage of .445 with an on base percentage of .377 for an OPS of .822. The most impressive statistic for Reeves at the plate is that he struck out just 22 times the entire season (a 10.2% K rate) while drawing 19 walks. He led The Citadel in stolen bases, going 10-11.

In 2023, Sawyer Reeves was named 2nd Team All-SoCon and was an All-Freshman selection in 2022.

If any coach should be well-informed about baseball at The Citadel, it’s Chris Lemonis. Lemonis played for The Citadel and spent over a decade as an assistant there. He was also college teammates with (now former) The Citadel head coach Tony Skole.

You can expect that Lemonis did his due diligence on scouting Sawyer Reeves and was able to get an evaluation he trusted on him.

-

Fitness1 week ago

Fitness1 week agoThe five simple exercises that are crucial in midlife

-

Politics1 week ago

Politics1 week ago5 things to know about Hunter Biden trial

-

World1 week ago

World1 week agoChina denies fuelling Russia-Ukraine war tensions, says it supports peace

-

World7 days ago

World7 days agoEconomy, migration: Voters' main concerns ahead of elections

-

News1 week ago

News1 week agoWhat is D-Day? How the Normandy landings led to Germany’s defeat in World War II | CNN

-

World1 week ago

World1 week agoWill liberals be biggest losers of EU election?

-

Politics1 week ago

Politics1 week agoHunter Biden trial enters 3rd day with cross-examination of FBI agent

-

Politics7 days ago

Politics7 days agoTrump campaign accelerates vetting of potential running mates