The Baltimore Banner thanks its sponsors. Become one.

Maryland

No. 7 Maryland women’s basketball narrowly escapes No. 16 Ohio State, 76-74, in regular-season finale

With 4.7 seconds remaining within the fourth quarter and No. 7 Maryland girls’s basketball main 76-74, No. 16 Ohio State acquired the ball at mid court docket with an opportunity to tie the sport or take the lead.

Ohio State guard Taylor Thierry launched an off-balance jumpshot that air balled. Freshman guard Cotie McMahon tried a putback, however the clock struck zero earlier than the ball went by means of the online.

The Terps escaped with a 76-74 victory on Friday to finish the common season at 24-5 and 15-3 in Massive Ten play. Maryland can be both the 2 or three seed within the Massive Ten Event beginning on March 1.

Maryland senior guard Abby Meyers led all scorers with 24 factors and made a number of essential buckets in its highway triumph.

Maryland and Ohio State began sluggish, as each groups appeared to dictate tempo from the opening tip.

Maryland senior guard Abby Meyers scored the primary factors on a pump faux and dribble drive to the rim.

With each groups even at 4 halfway by means of the primary quarter, Maryland star guard Diamond Miller slashed to the lane for a simple take a look at the rim.

The Terps went on a 6-0 run after a pair of Abby Meyers’ layups and Miller’s aggressive assault to the rim in transition.

Maryland’s 12-6 lead pressured a fast Ohio State timeout.

With beneath 10 seconds within the opening quarter and trailing 15-14, Ohio State guard Taylor Mikesell dribbled laborious to her proper earlier than abruptly stopping for her jumpshot.

Mikesell’s shot bounced in to offer the Buckeyes a 16-15 lead following the primary 10 minutes of motion.

Maryland went 7-for-16 from the sphere, whereas it’s counterparts went 8-of-15 within the opening interval. The Terps scored 4 factors on 5 Ohio State turnovers within the first 10 minutes.

Maryland began the second quarter quick, as Miller scored a layup in beneath 15 seconds on a powerful drive to the rim.

McMahon continued her sizzling begin within the second interval, however this time from three-point vary.

Ohio State junior guard Ricki Harris pushed the tempo in transition, as she discovered McMahon on the left wing. McMahon wasted little movement, as she drained her first 3-pointer of the sport.

Alexander, a 44.3% three-point shooter, continued to make the protection pay from distance.

With beneath eight minutes till intermission, Alexander knocked down her second three of the half to increase the Terps result in 24-19.

A number of possessions later, Mikesell transformed a 3-pointer to chop into Maryland’s lead.

On the Terps’ subsequent possession, Alexander stored the recent streak going, as she pale away from a display screen and sunk her third 3-pointer of the primary half. Alexander’s triple gave Maryland a 30-25 lead. The Vanderbilt switch had 11 factors after the primary 20 minutes of play.

After a pair of missed Ohio State free throws, Alexander pushed the tempo in transition earlier than delivering a bounce move to senior guard Elisa Pinzan for a layup.

On Ohio State’s subsequent two possessions, the Buckeyes appeared to ascertain the inside presence of six foot 4 senior ahead Rebeka Mikulasikova.

Mikulasikova effortlessly scored on a pair of layups within the paint to trim Maryland’s result in 36-31.

With beneath 20 seconds till intermission, Meyers pivoted and completed with a left hand floater to offer the Terps a 38-33 lead on the half.

After shedding the rebounding margin by 4 within the first quarter, Maryland responded with a 10-6 benefit within the second quarter.

Ohio State started the second half trying to get proper again into the sport.

On the very first possession within the third quarter, Mikulasikova displayed her dynamic presence, this time, swishing in a 3 pointer to trim Ohio State’s deficit to 38-36.

On Maryland’s subsequent two possessions, Miller and Meyers maneuvered their approach into the paint for layups to increase its result in 42-36.

After a layup by senior ahead Religion Masonius, Ohio State marched down the ground trying to make Maryland pay in transition.

The back-and-forth affair continued all through the third interval.

With beneath two minutes remaining within the third quarter, Ohio State secured its tenth offensive rebound. Mikesell, standing on the high of the important thing, stepped into the shot and drilled one other three to offer the Buckeyes a 63-58 lead heading to the fourth quarter.

Ohio State outscored Maryland 30-20 and made 5-of-8 pictures from distance within the third interval.

Maryland started the ultimate quarter with an emphasis to get again into the sport.

With beneath a minute expired within the fourth quarter, Meyers scored a 3 pointer and on the next possession raced down the court docket for a layup after a steal. Meyers’ personal 5-0 run evened the sport at 63 with over 9 minutes in regulation.

After Mikesell’s free throws pushed the result in 65-63, Thierry led a one-woman quick break to stretch their lead.

Maryland trailed Ohio State 69-67 with beneath six minutes to play.

The Terps went on a 8-0 run to reclaim a 73-69 lead with beneath 5 minutes left in regulation.

A basic Massive Ten battle ensued down the stretch with each groups in search of any edge to shut out the common season with a win.

Ultimately, Maryland narrowly got here out on high on the highway.

Three issues to know

- The Terps full the season sweep of Ohio State to finish the common season. Maryland had one of many hardest three-game stretches within the nation to finish the common season. The Terps confronted Michigan State, No. 6 Iowa, and No. 16 Iowa; with two of three being on the highway. Maryland swept its three sport slate and prolonged their win streak to 6 with a slim 76-74 victory over Ohio State. When was the final time Maryland had two or extra victories over Ohio State? It was the 2019-20 season when the Terps defeated their Massive Ten counterparts 3 times en path to its newest Massive Ten Event Championship.

- Abby Meyers’ clutch efficiency saved the day. When the Terps go to opposing arenas, discovering a method to comprise senior guard Diamond Miller ought to be on the forefront of sport plans. On Friday, Miller sat for a protracted interval after selecting up her fourth foul within the third quarter. However Maryland relied on the scoring of senior guard Abby Meyers to will it to victory.

- The Massive Ten Event is subsequent. With the common season within the rearview, Maryland can set its sights on the Massive Ten Event, starting on March 1 on the Goal Heart in Minneapolis. The end result of Sunday’s tilt between No. 2 Indiana and No. 6 Iowa will decide whether or not Maryland is the 2 or three seed.

Continue Reading

Maryland

Getting to know Michigan State football’s Week 2 opponent: Maryland

Game two is coming up for Michigan State football as the Spartans hit the road for an early season Big Ten matchup against Maryland. The Terps have had MSU’s number in recent years, but the Spartans’ new-look team is ready to change that narrative this weekend.

Jonathan Smith and his staff have a lot to work on this week after a lackluster 16-10 win over Florida Atlantic, but we’ve become more than used to slow starts for MSU in their first game so it’s not time to panic just yet.

While the team wraps up their preparations for Maryland, let’s take a quick look at the Terps and see what we can learn about them before the big game on Saturday.

Maryland is off and running in their 2024 campaign and had an absolutely dominant week one performance. The Terps took on UConn at home and came away with an impressive 50-7 win. Sure UConn is an awful football program, but we saw how poorly Michigan State just did against a similar opponent.

Not only was the final score lopsided, but ever major statistical category was as well. Maryland doubled UConn in first downs and rushing yards, threw for nearly 400 passing yards and even won the turnover battle 3-0. The Terps also only had five penalties for 45 yards which is significantly better than MSU’s 12 for 140 yards against FAU.

Sure all of this took place against UConn, but it appears that Maryland is in a very good spot heading into this big week two matchup.

One thing that I thought would be a positive for Michigan State in this game is that Maryland is breaking in a new quarterback as well. The Terps’ quarterback, Billy Edwards Jr., went off against UConn and completed 20-of-27 passes for 311 yards and two touchdowns. He also is a capable runner and added 39 yards on the ground, so Michigan State will have its hands full on Saturday slowing him down.

The Terps don’t have one standout running back in the backfield, so that does benefit MSU. They do however have two solid backs in Roman Hemby and Nolan Ray who both ran for over 60 yards and one score each.

The one player however that Michigan State needs to pay the most attention to is wide receiver Tai Felton. He had one of the best Week 1 performances in the country as he recorded seven receptions for 178 yards and two touchdowns. Thankfully MSU’s defense and secondary looked much improved against FAU, so hopefully that carries over into this weekend’s matchup.

The opportunity in front of MSU on Saturday is massive. The Spartans are big underdogs in this matchup which they probably deserve, but a win would do wonders not just for the overall perception of the team but for their confidence moving forward.

I’ve got a strange feeling that we’re going to be very happy around 7 p.m. ET Saturday night.

Maryland

Maryland makes filing taxes online free for some

More than 700,000 Marylanders should be able to file their state and federal income tax returns online for free next year, saving residents hours of work and hundreds of dollars on tax software and prep services.

Maryland joined dozens of states Wednesday in a voluntary federal program called Direct File after a test run received positive reviews and showed possible cost savings. Filing paper returns by mail will still be an option.

“It’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns,” Maryland Comptroller Brooke Lierman said at a news conference in Annapolis.

The first-term Democrat called the program a game changer for Maryland taxpayers that will modernize her agency. It targets low-to-moderate earners with relatively simple tax returns, and is expected to expand over time.

Lierman’s office will partner with the nonprofit Code for America to integrate the Maryland tax filing system into Direct File. Eligibility requirements will be announced in January, the comptroller’s office said.

Gov. Wes Moore, State Treasurer Dereck E. Davis, members of Maryland’s congressional delegation, U.S. Deputy Secretary of the Treasury Wally Adeyemo and nonprofit partners joined Lierman for the announcement.

Funds from the Inflation Reduction Act of 2022 helped build and test the system. The IRS and Treasury Department then invited states to participate.

The IRS has been considering a free e-filing option for low-income American taxpayers for decades, according to the Congressional Research Service. When tax prep companies pushed back, the federal government agreed not to compete with them if they provided free help and e-filing to low-earning taxpayers.

However, many qualified taxpayers were pushed toward paid services, according to an investigation by nonprofit news outlet ProPublica.

The IRS piloted Direct File in 12 states this year. Filers used a laptop, tablet, cellphone or other device to submit income returns and request certain tax credits offered to low-earning individuals and families.

In a survey, nine out of 10 Direct File users ranked their experience as “Excellent” or “Above Average.”

U.S. Rep Steny Hoyer, a Democrat representing Maryland’s 5th District, called paying taxes the “price of our democracy.”

“We ought to make it as easy as possible for people to comply with a legal obligation that they have to support their country, their state and their communities,” he said. “And this system of Direct File does that.”

Robin McKinney, CEO and co-founder of CASH Campaign of Maryland, said easy, free online filing makes the government work more efficiently for citizens and should deliver refunds and credits to taxpayers faster.

McKinney’s nonprofit promotes economic advancement for low- to moderate-income Marylanders and provides free tax help, among other services.

Economic Security Project, a nonprofit that advocates for guaranteed income and economic equity for working families, found that adopting Direct File could mean $355 million in costs and time saved for Maryland’s low- to moderate-earners.

Maryland recently has expanded tax credits for working families, but about $152 million goes unclaimed each year, according to the Security Project’s analysis.

They also estimated that about $148 million could be saved in filing fees and $56 million could be saved in time spent filing taxes.

That money could have gone into Marylanders’ pockets, CASH Campaign’s McKinney said, and it could have gone back into the state’s economy.

Maryland

Maryland joins IRS Direct File program, offering free tax filing for up to 700,000 taxpayers – Maryland Matters

Some Maryland taxpayers will be able to use a free electronic filing tool for their federal taxes rather than having to pay a tax preparer or buy tax-filing software next year, when Maryland will offer the IRS’s new Direct File service.

The service was tested in 12 states this year, where 140,803 people filed with Direct File, saving an estimated $5.6 million in tax preparation fees. Maryland Comptroller Brooke Lierman (D) estimated Wednesday that as many as 700,000 Maryland taxpayers could be eligible for the program when it debuts in the state next year.

“While we value our relationship with tax preparers and CPAs (certified public accountants), it’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns,” Lierman said at a news conference announcing the program.

The IRS and the U.S. Treasury still have to finalize eligibility rules for the program this fall, but Lierman said it will be a “game changer” for those families who do qualify, which could be as much as 20% of individual taxpayers in the state.

“Taxes are a part of the glue that keeps our state and our nation together, functioning, producing, protecting and thriving,” Lierman said. “Yet in America, we make it uniquely challenging to pay those taxes and file a return — until now.”

According to the Treasury, taxpayers spend “approximately 13 hours and $270 preparing their taxes each year.” Many Americans use tax filing services or software, such as TurboTax and H&R Block, to ensure that their taxes are filed correctly, despite most of the information being readily available state and federal tax collection agencies.

It’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns.

– Comptroller Brooke Lierman

Direct File launched this year in 12 states for people to file their 2023 federal returns — Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Treasury Deputy Secretary Wally Adeyemo said the program is aimed at helping middle-income tax filers with “relatively simple” filings.

“What I can tell you is our goal for us is to build a system that’s going to work for working class and middle class Americans. So you get a W-2, and you’re somebody who’s a teacher, you’re a fireman, you’re a doctor who’s earning most of your money from a W-2, we want to make sure we’re building a system that potentially works for you,” said Adeyemo, who was in Annapolis for the announcement.

“The thing we’re not going to do is build a system that works for big corporations or wealthy individuals. Next year we’re going to expand the system so that more Americans are able to participate in it,” Adeyemo said.

The Biden administration invited all 50 states and the District of Columbia to join the program next year, when people will be filing their 2024 taxes. The Treasury said that Maryland joins Oregon, New Jersey, Pennsylvania, New Mexico, Connecticut, North Carolina, Wisconsin, and Maine in taking up Direct File.

“I know to some, this announcement may seem inconsequential — and I know how exciting tax announcements are,” Gov. Wes Moore (D) joked at the announcement. “But the details matter. They matter to the families who are impacted by this work. They’re going to matter to the families, who … dread tax season because it feels complicated. Who dread tax season because it seems expensive, or oftentimes have to deal with the consequences of getting something wrong.”

The Direct File program came out of the Inflation Reduction Act signed in 2022, which also secured additional funding to help the IRS modernize and provide better services to Americans.

But Sen. Chris Van Hollen (D-Md.), who chairs a Senate Appropriations Subcommittee on Financial Services and General Government Appropriations Subcommittee, said Direct File program and other services under the Inflation Reduction Act could be “under threat.” While his subcommittee wants to fully fund the IRS and keep Direct File going, House leaders want to cut funding for both.

He also said that the industry is lobbying against the free tax filing system.

“There are people who didn’t want us to do this, including a lot of the middlemen” who currently profit from tax preparation, Van Hollen said. “They’re lobbying against this kind of thing.”

In addition to Van Hollen, Moore, Lierman and Adeyemo, Wednesday’s event drew a number of Maryland Democratic heavyweights: U.S. Sen. Ben Cardin, U.S. Reps. Steny Hoyer John Sarbanes and State Treasurer Dereck Davis.

Hoyer put it simply: “Nobody likes taxes.”

“We don’t really get excited about paying our taxes. But we know that it is the price of our democracy,” Hoyer said. “We ought to make it as easy as possible for people to comply with a legal obligation that they have to support their country, their state and their communities.”

-

World1 week ago

World1 week agoSwiss court convicts two executives of embezzling $1.8bn from 1MDB

-

Movie Reviews1 week ago

Movie Reviews1 week agoSlingshot (2024) – Movie Review

-

World1 week ago

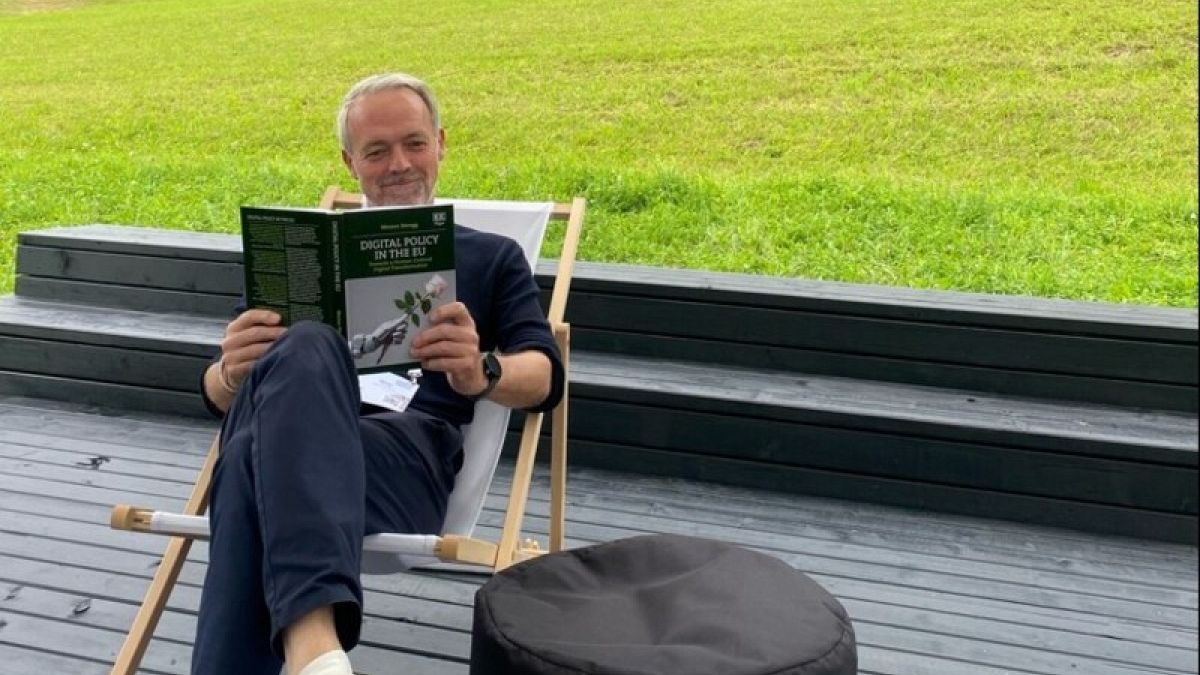

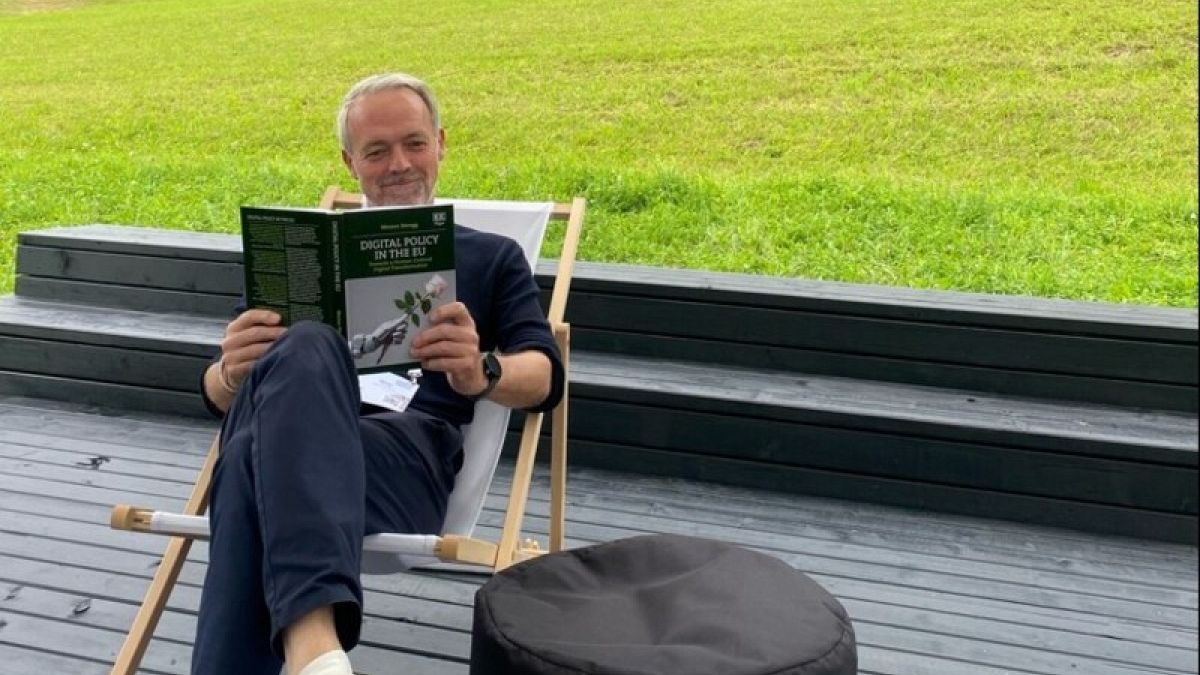

World1 week agoCommission mandarin flags convergence of digital with industry

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 915

-

News1 week ago

News1 week agoTrump Vs Harris: The Battle Over Hot Mics Heats Up Ahead Of Key Debate

-

News1 week ago

News1 week agoAfter months on the run, a murder suspect falls through the ceiling and into custody

-

News1 week ago

News1 week agoThe rise of the Pumpkin Spice Latte : It's Been a Minute

-

World1 week ago

World1 week agoEconomic portfolios are key in talks to chose new EU commissioners