The Baltimore Banner thanks its sponsors. Become one.

Maryland

Maryland church celebrates heritage on ‘Caribbean Sabbath’

As worshippers entered the sanctuary of Metropolitan Seventh-day Adventist Church, doorman Percy Joseph greeted them with “Completely happy Sabbath,” his shiny crimson Trinidad and Tobago T-shirt displaying beneath his lengthy black coat.

Inside, visitor metal drum gamers started to play “Elevate Each Voice and Sing,” giving the tune often called the Black nationwide anthem a gentle beat harking back to the homelands of many congregants.

Then, marching and dancing flag bearers processed down the primary aisle, first with the American flag, after which with banners of these lands, from Barbados to the Dominican Republic to Trinidad and Tobago.

On the third Saturday of Black Historical past Month, at this church close to Maryland’s border with the District of Columbia, it was “Caribbean Sabbath.”

Pastor Trevor Kinlock saved up the enthusiastic taste of the service as he greeted the congregation earlier than his sermon.

“Come on, increase your flag and characterize,” Kinlock mentioned to these fellow congregants who, like him, had Jamaican roots, earlier than turning to a extra international celebration. “We’ve come to rejoice him and we thank God for the great thing about our range as a individuals.”

Kinlock used his time on the lectern to emphasise why Black church buildings want to recollect the historical past of Black individuals, together with Individuals like “Sister Harriet Tubman and Mom Sojourner Fact,” the latter who had ties to Adventism.

However he shortly added others past the North American mainland, akin to Jamaican hero “Queen Nanny,” the religious and army chief of previously enslaved African individuals referred to as Maroons, who used guerrilla warfare in opposition to British troops, and Jean-Jacques Dessalines, who led the Haitian Revolution that overthrew French troopers, making the island the primary nation within the Americas to finish slavery.

“You ought to offer God a reward — thank God for the instance of our Haitian brothers and sisters,” he mentioned. “Caribbean folks know how one can act up.”

Preaching on the Hebrew Bible textual content in regards to the Prophet Elijah, Kinlock mentioned, “We’d like the novel spirit of Elijah that resists and challenges the social evils of our day.” He cited the disproportionate numbers of individuals of colour who’re incarcerated, circumstances the place “brown immigrant youngsters are ripped from their dad and mom on the border and housed in detention camps” and the killings of Black individuals by the hands of law enforcement officials.

“We have to name down the hearth on international company energy that also exploits the individuals and assets within the Caribbean and in Africa, extracting their wealth and leaving our individuals in poverty,” he mentioned to cheers in settlement. “We can’t hold silent however we’ve obtained to talk out.”

Seventh-day Adventists, recognized for his or her observance of the Sabbath on Saturdays, have topped the Pew Analysis Heart’s checklist of essentially the most racially various spiritual teams within the U.S.

“’Caribbean Sabbath’ is just not an official occasion throughout the North American Division territory of the Seventh-Day Adventist Church,” mentioned Julio C. Muñoz, a spokesperson for that division of the church. However “there are church buildings with a wealthy Caribbean background that observe and rejoice their heritage at completely different occasions all year long, together with Black Historical past Month.”

At Metropolitan, which has marked its members’ Caribbean tradition for greater than a decade, some have been celebrating not only one nation however the cultural range inside their very own households.

United Kingdom-born Claudette Smith is the daughter of a Barbadian mom and Jamaican father and he or she married a person from Trinidad.

“Illustration issues and never too many church buildings within the space take time to rejoice their members, the variety of their members,” she mentioned. “We have now individuals from in every single place that come right here to this church. And it’s good that we get a day the place we will act silly in Jesus’ identify.”

Requested in regards to the Metropolitan service, Monika Gosin, affiliate professor of sociology on the Faculty of William & Mary, mentioned it exemplifies the newest juncture within the progress of U.S. Black immigrant populations, who’ve lengthy been part of the Black neighborhood and its church buildings. Pew experiences that just about half of the nation’s foreign-born Black inhabitants — 46% — was birthed within the Caribbean.

“The best way that we even conceptualize the Black church is altering,” she mentioned. “This specific church service actually displays that, the way in which that Black individuals in United States are grappling with and embracing this specific range that they’ve.”

For many years, Caribbean communities in cities akin to Washington, Atlanta and New York have acknowledged Black Historical past Month, mentioned Noel Erskine, an knowledgeable on Caribbean theologies at Emory College’s Candler College of Theology. Usually, a neighborhood celebration can be held in a church as a result of such a constructing might present a big and free house for gathering.

“The half that’s new is the theological piece,” he mentioned, “to say this can be a Sabbath.”

In an interview, Kinlock mentioned the service, which attracts lots of to the sanctuary and an overflow room, is greater than the Easter, Christmas or revival providers at his church. Many exchange the same old swimsuit and tie or costume with cultural outfits that mirror their nation — with T-shirts and, in a single case, a skirt resembling the flag of St. Kitts and Nevis.

“It’s an area the place our members and their household and pals can really feel celebrated, can really feel affirmed, so that’s one thing that brings them out after which it’s good music and also you get to precise your self in your genuine cultural voice and in your individual method,” he mentioned of his church, whose different Sabbaths in February celebrated African Individuals and Africans, with a plan to finish the month with a global meals pageant. “That’s refreshing as a result of there will not be many areas that they will simply be themselves.”

Different Adventist church buildings have spotlighted their Caribbean members in providers throughout Black Historical past Month, from a church in Orlando, Florida, earlier this month to at least one in Mount Vernon, New York, final yr.

Philip James, wearing shiny inexperienced and yellow colours representing his native Jamaica —and a small embossed flag on his chest identical to his pastor at Metropolitan SDA — mentioned he appreciated the big day.

“It brings again reminiscences,” he mentioned, carrying a hefty Bible and hymnal beneath one arm. “And typically you miss it.”

Though most of the individuals waving flags, cheering and dancing have been enthusiastic about overseas nations, there have been a few American flags in view.

“For me it’s particular as a result of it signifies unity and neighborhood,” mentioned Nikita Thompson, who has attended the church for eight years. “I’m not from the Caribbean however I really feel linked and I be taught from them and their heritage.”

Ursula Roberts-Allen, carrying a skirt with the crimson and white colours of the flag of St. Croix, U.S. Virgin Islands, additionally affirmed the service’s instructional emphasis.

“It brings me again house — it does — and helps me to show my son what the Caribbean is about,” mentioned the 36-year member, “and passing on our heritage to the following era is important.”

Olive Sterling, who described herself as “from a little bit place in Jamaica referred to as Redberry,” additionally loved the celebration, 50 years after she had joined the Washington-area church.

“It simply highlights my heritage,” she mentioned. “It does my spirit good.”

Continue Reading

Maryland

Getting to know Michigan State football’s Week 2 opponent: Maryland

Game two is coming up for Michigan State football as the Spartans hit the road for an early season Big Ten matchup against Maryland. The Terps have had MSU’s number in recent years, but the Spartans’ new-look team is ready to change that narrative this weekend.

Jonathan Smith and his staff have a lot to work on this week after a lackluster 16-10 win over Florida Atlantic, but we’ve become more than used to slow starts for MSU in their first game so it’s not time to panic just yet.

While the team wraps up their preparations for Maryland, let’s take a quick look at the Terps and see what we can learn about them before the big game on Saturday.

Maryland is off and running in their 2024 campaign and had an absolutely dominant week one performance. The Terps took on UConn at home and came away with an impressive 50-7 win. Sure UConn is an awful football program, but we saw how poorly Michigan State just did against a similar opponent.

Not only was the final score lopsided, but ever major statistical category was as well. Maryland doubled UConn in first downs and rushing yards, threw for nearly 400 passing yards and even won the turnover battle 3-0. The Terps also only had five penalties for 45 yards which is significantly better than MSU’s 12 for 140 yards against FAU.

Sure all of this took place against UConn, but it appears that Maryland is in a very good spot heading into this big week two matchup.

One thing that I thought would be a positive for Michigan State in this game is that Maryland is breaking in a new quarterback as well. The Terps’ quarterback, Billy Edwards Jr., went off against UConn and completed 20-of-27 passes for 311 yards and two touchdowns. He also is a capable runner and added 39 yards on the ground, so Michigan State will have its hands full on Saturday slowing him down.

The Terps don’t have one standout running back in the backfield, so that does benefit MSU. They do however have two solid backs in Roman Hemby and Nolan Ray who both ran for over 60 yards and one score each.

The one player however that Michigan State needs to pay the most attention to is wide receiver Tai Felton. He had one of the best Week 1 performances in the country as he recorded seven receptions for 178 yards and two touchdowns. Thankfully MSU’s defense and secondary looked much improved against FAU, so hopefully that carries over into this weekend’s matchup.

The opportunity in front of MSU on Saturday is massive. The Spartans are big underdogs in this matchup which they probably deserve, but a win would do wonders not just for the overall perception of the team but for their confidence moving forward.

I’ve got a strange feeling that we’re going to be very happy around 7 p.m. ET Saturday night.

Maryland

Maryland makes filing taxes online free for some

More than 700,000 Marylanders should be able to file their state and federal income tax returns online for free next year, saving residents hours of work and hundreds of dollars on tax software and prep services.

Maryland joined dozens of states Wednesday in a voluntary federal program called Direct File after a test run received positive reviews and showed possible cost savings. Filing paper returns by mail will still be an option.

“It’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns,” Maryland Comptroller Brooke Lierman said at a news conference in Annapolis.

The first-term Democrat called the program a game changer for Maryland taxpayers that will modernize her agency. It targets low-to-moderate earners with relatively simple tax returns, and is expected to expand over time.

Lierman’s office will partner with the nonprofit Code for America to integrate the Maryland tax filing system into Direct File. Eligibility requirements will be announced in January, the comptroller’s office said.

Gov. Wes Moore, State Treasurer Dereck E. Davis, members of Maryland’s congressional delegation, U.S. Deputy Secretary of the Treasury Wally Adeyemo and nonprofit partners joined Lierman for the announcement.

Funds from the Inflation Reduction Act of 2022 helped build and test the system. The IRS and Treasury Department then invited states to participate.

The IRS has been considering a free e-filing option for low-income American taxpayers for decades, according to the Congressional Research Service. When tax prep companies pushed back, the federal government agreed not to compete with them if they provided free help and e-filing to low-earning taxpayers.

However, many qualified taxpayers were pushed toward paid services, according to an investigation by nonprofit news outlet ProPublica.

The IRS piloted Direct File in 12 states this year. Filers used a laptop, tablet, cellphone or other device to submit income returns and request certain tax credits offered to low-earning individuals and families.

In a survey, nine out of 10 Direct File users ranked their experience as “Excellent” or “Above Average.”

U.S. Rep Steny Hoyer, a Democrat representing Maryland’s 5th District, called paying taxes the “price of our democracy.”

“We ought to make it as easy as possible for people to comply with a legal obligation that they have to support their country, their state and their communities,” he said. “And this system of Direct File does that.”

Robin McKinney, CEO and co-founder of CASH Campaign of Maryland, said easy, free online filing makes the government work more efficiently for citizens and should deliver refunds and credits to taxpayers faster.

McKinney’s nonprofit promotes economic advancement for low- to moderate-income Marylanders and provides free tax help, among other services.

Economic Security Project, a nonprofit that advocates for guaranteed income and economic equity for working families, found that adopting Direct File could mean $355 million in costs and time saved for Maryland’s low- to moderate-earners.

Maryland recently has expanded tax credits for working families, but about $152 million goes unclaimed each year, according to the Security Project’s analysis.

They also estimated that about $148 million could be saved in filing fees and $56 million could be saved in time spent filing taxes.

That money could have gone into Marylanders’ pockets, CASH Campaign’s McKinney said, and it could have gone back into the state’s economy.

Maryland

Maryland joins IRS Direct File program, offering free tax filing for up to 700,000 taxpayers – Maryland Matters

Some Maryland taxpayers will be able to use a free electronic filing tool for their federal taxes rather than having to pay a tax preparer or buy tax-filing software next year, when Maryland will offer the IRS’s new Direct File service.

The service was tested in 12 states this year, where 140,803 people filed with Direct File, saving an estimated $5.6 million in tax preparation fees. Maryland Comptroller Brooke Lierman (D) estimated Wednesday that as many as 700,000 Maryland taxpayers could be eligible for the program when it debuts in the state next year.

“While we value our relationship with tax preparers and CPAs (certified public accountants), it’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns,” Lierman said at a news conference announcing the program.

The IRS and the U.S. Treasury still have to finalize eligibility rules for the program this fall, but Lierman said it will be a “game changer” for those families who do qualify, which could be as much as 20% of individual taxpayers in the state.

“Taxes are a part of the glue that keeps our state and our nation together, functioning, producing, protecting and thriving,” Lierman said. “Yet in America, we make it uniquely challenging to pay those taxes and file a return — until now.”

According to the Treasury, taxpayers spend “approximately 13 hours and $270 preparing their taxes each year.” Many Americans use tax filing services or software, such as TurboTax and H&R Block, to ensure that their taxes are filed correctly, despite most of the information being readily available state and federal tax collection agencies.

It’s unacceptable that Marylanders should have to pay any portion whatsoever of their refund or paycheck to fulfill a mandatory requirement like filing tax returns.

– Comptroller Brooke Lierman

Direct File launched this year in 12 states for people to file their 2023 federal returns — Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Treasury Deputy Secretary Wally Adeyemo said the program is aimed at helping middle-income tax filers with “relatively simple” filings.

“What I can tell you is our goal for us is to build a system that’s going to work for working class and middle class Americans. So you get a W-2, and you’re somebody who’s a teacher, you’re a fireman, you’re a doctor who’s earning most of your money from a W-2, we want to make sure we’re building a system that potentially works for you,” said Adeyemo, who was in Annapolis for the announcement.

“The thing we’re not going to do is build a system that works for big corporations or wealthy individuals. Next year we’re going to expand the system so that more Americans are able to participate in it,” Adeyemo said.

The Biden administration invited all 50 states and the District of Columbia to join the program next year, when people will be filing their 2024 taxes. The Treasury said that Maryland joins Oregon, New Jersey, Pennsylvania, New Mexico, Connecticut, North Carolina, Wisconsin, and Maine in taking up Direct File.

“I know to some, this announcement may seem inconsequential — and I know how exciting tax announcements are,” Gov. Wes Moore (D) joked at the announcement. “But the details matter. They matter to the families who are impacted by this work. They’re going to matter to the families, who … dread tax season because it feels complicated. Who dread tax season because it seems expensive, or oftentimes have to deal with the consequences of getting something wrong.”

The Direct File program came out of the Inflation Reduction Act signed in 2022, which also secured additional funding to help the IRS modernize and provide better services to Americans.

But Sen. Chris Van Hollen (D-Md.), who chairs a Senate Appropriations Subcommittee on Financial Services and General Government Appropriations Subcommittee, said Direct File program and other services under the Inflation Reduction Act could be “under threat.” While his subcommittee wants to fully fund the IRS and keep Direct File going, House leaders want to cut funding for both.

He also said that the industry is lobbying against the free tax filing system.

“There are people who didn’t want us to do this, including a lot of the middlemen” who currently profit from tax preparation, Van Hollen said. “They’re lobbying against this kind of thing.”

In addition to Van Hollen, Moore, Lierman and Adeyemo, Wednesday’s event drew a number of Maryland Democratic heavyweights: U.S. Sen. Ben Cardin, U.S. Reps. Steny Hoyer John Sarbanes and State Treasurer Dereck Davis.

Hoyer put it simply: “Nobody likes taxes.”

“We don’t really get excited about paying our taxes. But we know that it is the price of our democracy,” Hoyer said. “We ought to make it as easy as possible for people to comply with a legal obligation that they have to support their country, their state and their communities.”

-

World1 week ago

World1 week agoSwiss court convicts two executives of embezzling $1.8bn from 1MDB

-

Movie Reviews1 week ago

Movie Reviews1 week agoSlingshot (2024) – Movie Review

-

World1 week ago

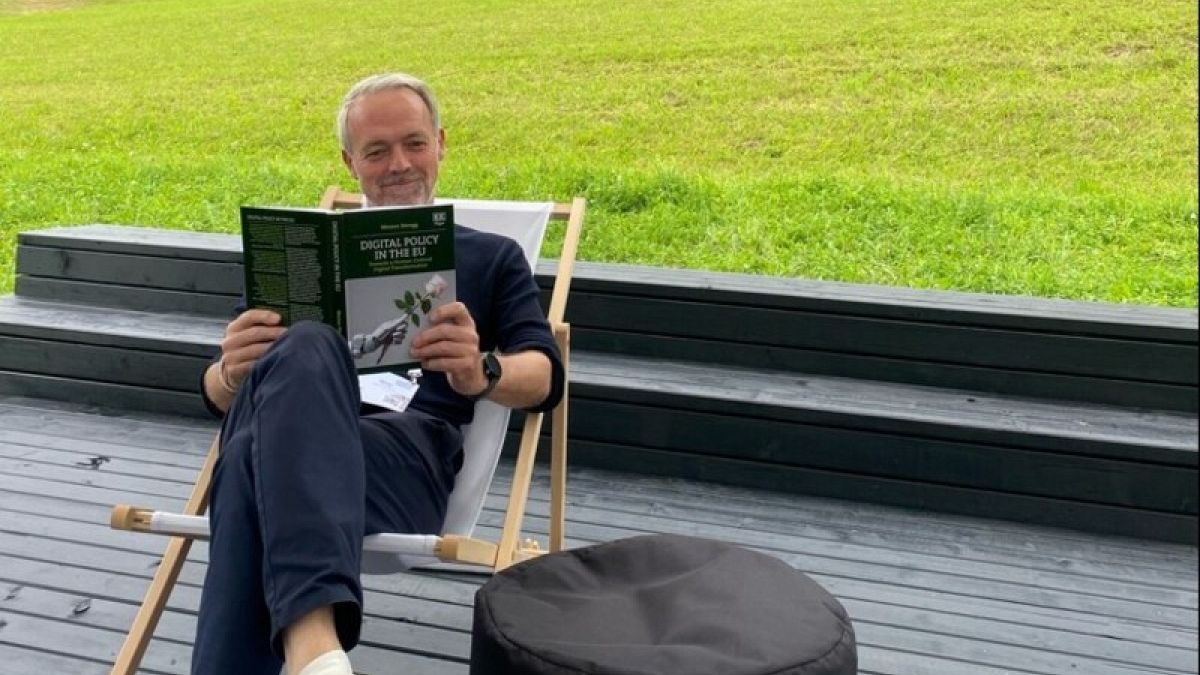

World1 week agoCommission mandarin flags convergence of digital with industry

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 915

-

News1 week ago

News1 week agoTrump Vs Harris: The Battle Over Hot Mics Heats Up Ahead Of Key Debate

-

News1 week ago

News1 week agoAfter months on the run, a murder suspect falls through the ceiling and into custody

-

News1 week ago

News1 week agoThe rise of the Pumpkin Spice Latte : It's Been a Minute

-

World1 week ago

World1 week agoEconomic portfolios are key in talks to chose new EU commissioners