Science

Rising Home Insurance Premiums Are Eating Into Home Values in Disaster-Prone Areas

This Louisiana resident expects to pay 45 percent more for home insurance this year.

Similar increases are hitting homeowners across the state, where insurance costs have exploded over the past four years.

It’s part of a rapid shift that’s sending tremors through real estate markets across the country.

Even after she escaped rising floodwaters by wading away from her home in chest-deep water during Hurricane Rita in 2005, Sandra Rojas, now 69, stayed put. A fifth-generation resident of Lafitte, La., a small coastal community, she raised her home with stilts.

But this year, her annual home insurance premium increased to $8,312, more than doubling over the past four years.

She considered selling, but found herself in a dilemma. As insurance costs have risen, area home values have fallen, dropping by 38 percent since 2020. The roadsides around her house are dotted with for-sale signs.

“They won’t insure you,” Ms. Rojas said. “No one will buy from you. You’re kind of stuck where you are.”

New research shared with The New York Times estimates the extent to which rising home insurance premiums, driven higher by climate change, are cascading into the broader real estate market and eating into home values in the most disaster-prone areas.

The study, which analyzed tens of millions of housing payments through 2024 to understand where insurance costs have risen most, offers first-of-its-kind insight into the way rising insurance rates are affecting home values.

Since 2018, a financial shock in the home insurance market has meant that homes in the ZIP codes most exposed to hurricanes and wildfires would sell for an average of $43,900 less than they would otherwise, the research found. They include coastal towns in Louisiana and low-lying areas in Florida.

Changes in an under-the-radar part of the insurance market, known as reinsurance, have helped to drive this trend. Insurance companies purchase reinsurance to help limit their exposure when a catastrophe hits. Over the past several years, global reinsurance companies have had what the researchers call a “climate epiphany” and have roughly doubled the rates they charge home insurance providers.

Benjamin Keys at the Wharton School of the University of Pennsylvania and Philip Mulder of the University of Wisconsin-Madison, the authors of the study, which was published this week, have called these swift changes “a reinsurance shock.” For some Americans, these changes have made it unaffordable to remain in homes they have lived in for decades.

“Homeowners don’t appreciate or don’t understand that we are living in a much riskier world than we were 25 years ago,” Dr. Keys said. “And that risk? They have to pay for it.”

After analyzing 74 million home payments — which included mortgage, taxes and insurance and were made between 2014 and 2024 — the researchers found that a rapid repricing of disaster risk had been responsible for about a fifth of overall home insurance increases since 2017. Another third could be explained by rising construction costs.

The researchers estimated the effects of the reinsurance shock on home prices in the ZIP codes most vulnerable to catastrophes. They found that rising insurance premiums weighed down home values by about $20,500 in the top 25 percent of homes most exposed to catastrophic hurricanes and wildfires, and by $43,900 in the top 10 percent.

Buying a home has long been seen as a way to lock in predictable housing costs. But the fast-increasing burden of insurance is catching some homeowners by surprise.

Last year, Ms. Rojas’s brother-in-law, who lived down the road in Lafitte, decided to sell his home to escape the area’s rising premiums. It sold for $150,000, which is what it cost him to build it in 1984. He estimated he lost about $75,000 on the sale, after accounting for the cost of renovations.

In parts of the hail-prone Midwestern states, insurance now eats up more than a fifth of the average homeowner’s total housing payments, which include mortgage costs and property taxes. In Orleans Parish, La., that number is nearly 30 percent.

A hundred miles north of Lafitte, the small city of Bogalusa, La., lies further inland. Nevertheless, Cristal Holmes saw her insurance premium more than quadruple in 2022, to $500 per month, on top of her $700 monthly mortgage.

Ms. Holmes, a single mother who was working 56 hours a week at a warehouse, struggled to keep up with the higher bills. She fell behind on mortgage payments after her work hours were reduced to 35 per week. She worried she couldn’t stay in her home.

Similar stories are playing out all over town. Ms. Holmes’s real estate agent, Charlotte Johnson, said her office was getting phone calls every day from people who said they could no longer afford their rising insurance premiums. For many, dropping insurance is not an option, because banks refuse to offer or maintain mortgages for people without coverage.

That means owners are being forced to choose between accepting home insurance policies they can’t afford or risking foreclosure.

Buyers face their own obstacles. High insurance prices and interest rates are making it harder than ever for first-time buyers to purchase homes, said Nancy Galofaro-Cruse, a senior loan officer with CMG Home Loans who works with many of Ms. Johnson’s clients. She estimated that more than a third of would-be buyers in the area backed out of the market this year after insurance and interest rates pushed their total monthly housing costs out of reach.

It’s not just the hurricane-prone coasts that have been affected by the reinsurance shock. In Colorado, where wildfires and hail pose the biggest threats to homes, the average homeowner’s premium has more than doubled in the last decade and median premiums have increased 74 percent since 2020.

Steve Hakes, an insurance broker with Rocky Mountain Insurance Center in Lafayette, Colo., has seen clients consider homes in wildfire-prone areas, only to back out when they can’t find affordable insurance. High prices and limited availability have pushed him to advise buyers to look for insurance early in the homebuying process.

And in California, 13 percent of real estate agents surveyed by an industry trade association said they’d had deals fall through in 2024 after buyers couldn’t find affordable insurance coverage.

Colorado regulators are aware of the threats these dynamics pose to the real estate market and are exploring a wide range of fixes, said Michael Conway, the Colorado insurance commissioner.

“We don’t want a situation where the insurance market is effectively decimating the real estate market,” he said.

As insurance becomes more expensive, home values will need to adjust for potential buyers to afford their monthly costs, industry analysts say. And if home values fall, lower property tax revenue could mean less money for local governments to pay for essential services or affect the ability of those governments to borrow money.

Clarence Guidry reached a breaking point this year when he got a quote to insure his home in Lafitte, La. He’d pay a $20,000 annual premium but if a hurricane struck, he’d be on the hook for the first $50,000 in damage before the insurance company would pay out.

His lender wouldn’t let Mr. Guidry, who goes by Rosco, keep his mortgage without home insurance. But keeping his home insured against damage from hurricanes would mean stomaching monthly payments that are at least 40 percent higher than the rest of his monthly mortgage and property taxes combined.

Over the last decade, as the number of wildfires and storms has mounted, losses have exceeded the revenue insurance companies receive from home insurance policies across the United States. In Louisiana, 12 companies, including Mr. Guidry’s insurer, became insolvent after a wave of hurricanes between 2021 and 2023. (Most private insurers do not cover flood damage, which is handled separately under a federal program.)

Insurance companies’ own costs have climbed in recent years for a variety of reasons, including higher construction costs, higher interest rates and President Trump’s tariff policies.

But the changes in the insurance market have begun to put a higher price on risk. Reinsurers have been driving these effects, Dr. Mulder said.

“These reinsurers are looking at a lot of the same data as insurers, but at a much bigger scale and with more sophistication,” he said.

Politicians, homeowners, economists, state insurance commissioners and real estate agents have long worried that insurance costs will rise so much that they will begin to pull down home values.

According to the study by Dr. Keys and Dr. Mulder, which was published as a working paper in the National Bureau of Economic Research, this is already happening in some areas.

Jesse Keenan, an associate professor of sustainable real estate and urban planning at Tulane University, said the direct evidence of this phenomenon remained limited and there were factors beyond insurance that affected local home prices.

But there are increasingly troubling signs in some markets, he said.

“The New Orleans housing market is exhibiting signs of failure that are imposing stress on the financial system around it,” he said.

Overall, U.S. home prices have risen about 55 percent since 2018, but New Orleans prices have increased by only 14 percent, less than the rate of inflation over the same time period.

Even in states where heavy regulations have kept costs down, there are signs that home insurers will continue to raise premiums to align more closely with disaster risk. New rules in California allow insurance companies to pass rising reinsurance costs on to consumers. One consumer advocacy group, citing the effects of similar changes in other states, has estimated this provision could raise net premiums significantly for homeowners.

Back in Lafitte, Mr. Guidry was running the numbers for his own budget. Against the advice of his financial adviser, he took money out of his retirement account to pay off his home loan. The plan now is to self-insure for wind and hail damage. That means he and his wife will have to pay out of pocket to repair their home if another severe storm hits.

In forgoing coverage, the Guidrys join some 13 percent of U.S. homeowners who are uninsured, according to Census Bureau data. Insurers continue to drop people in many areas.

“Now, we’ve got to take the gamble,” Mr. Guidry said.

Methodology

Benjamin Keys and Philip Mulder calculated annual homeowners’ insurance costs by separating mortgage and tax payments from loan-level escrow data obtained from CoreLogic, a property and risk analytics firm. Households whose payments were captured by CoreLogic were not necessarily present in all years of data from 2014 to 2024.

The home insurance share of total home payments are based on mean values. Total home payments include insurance, property tax and mortgage principal and interest costs. Escrow payments typically do not include utilities, homeowners’ association fees.

Science

Diablo Canyon clears last California permit hurdle to keep running

Central Coast Water authorities approved waste discharge permits for Diablo Canyon nuclear plant Thursday, making it nearly certain it will remain running through 2030, and potentially through 2045.

The Pacific Gas & Electric-owned plant was originally supposed to shut down in 2025, but lawmakers extended that deadline by five years in 2022, fearing power shortages if a plant that provides about 9 percent the state’s electricity were to shut off.

In December, Diablo Canyon received a key permit from the California Coastal Commission through an agreement that involved PG&E giving up about 12,000 acres of nearby land for conservation in exchange for the loss of marine life caused by the plant’s operations.

Today’s 6-0 vote by the Central Coast Regional Water Board approved PG&E’s plans to limit discharges of pollutants into the water and continue to run its “once-through cooling system.” The cooling technology flushes ocean water through the plant to absorb heat and discharges it, killing what the Coastal Commission estimated to be two billion fish each year.

The board also granted the plant a certification under the Clean Water Act, the last state regulatory hurdle the facility needed to clear before the federal Nuclear Regulatory Commission (NRC) is allowed to renew its permit through 2045.

The new regional water board permit made several changes since the last one was issued in 1990. One was a first-time limit on the chemical tributyltin-10, a toxic, internationally-banned compound added to paint to prevent organisms from growing on ship hulls.

Additional changes stemmed from a 2025 Supreme Court ruling that said if pollutant permits like this one impose specific water quality requirements, they must also specify how to meet them.

The plant’s biggest water quality impact is the heated water it discharges into the ocean, and that part of the permit remains unchanged. Radioactive waste from the plant is regulated not by the state but by the NRC.

California state law only allows the plant to remain open to 2030, but some lawmakers and regulators have already expressed interest in another extension given growing electricity demand and the plant’s role in providing carbon-free power to the grid.

Some board members raised concerns about granting a certification that would allow the NRC to reauthorize the plant’s permits through 2045.

“There’s every reason to think the California entities responsible for making the decision about continuing operation, namely the California [Independent System Operator] and the Energy Commission, all of them are sort of leaning toward continuing to operate this facility,” said boardmember Dominic Roques. “I’d like us to be consistent with state law at least, and imply that we are consistent with ending operation at five years.”

Other board members noted that regulators could revisit the permits in five years or sooner if state and federal laws changes, and the board ultimately approved the permit.

Science

Deadly bird flu found in California elephant seals for the first time

The H5N1 bird flu virus that devastated South American elephant seal populations has been confirmed in seals at California’s Año Nuevo State Park, researchers from UC Davis and UC Santa Cruz announced Wednesday.

The virus has ravaged wild, commercial and domestic animals across the globe and was found last week in seven weaned pups. The confirmation came from the U.S. Department of Agriculture’s National Veterinary Services Laboratory in Ames, Iowa.

“This is exceptionally rapid detection of an outbreak in free-ranging marine mammals,” said Professor Christine Johnson, director of the Institute for Pandemic Insights at UC Davis’ Weill School of Veterinary Medicine. “We have most likely identified the very first cases here because of coordinated teams that have been on high alert with active surveillance for this disease for some time.”

Since last week, when researchers began noticing neurological and respoiratory signs of the disease in some animals, 30 seals have died, said Roxanne Beltran, a professor of ecology and evolutionary biology at UC Santa Cruz. Twenty-nine were weaned pups and the other was an adult male. The team has so far confirmed the virus in only seven of the dead pups.

Infected animals often have tremors convulsions, seizures and muscle weakness, Johnson said.

Beltran said teams from UC Santa Cruz, UC Davis and California State Parks monitor the animals 260 days of the year, “including every day from December 15 to March 1” when the animals typically come ashore to breed, give birth and nurse.

The concerning behavior and deaths were first noticed Feb. 19.

“This is one of the most well-studied elephant seal colonies on the planet,” she said. “We know the seals so well that it’s very obvious to us when something is abnormal. And so my team was out that morning and we observed abnormal behaviors in seals and increased mortality that we had not seen the day before in those exact same locations. So we were very confident that we caught the beginning of this outbreak.”

In late 2022, the virus decimated southern elephant seal populations in South America and several sub-Antarctic Islands. At some colonies in Argentina, 97% of pups died, while on South Georgia Island, researchers reported a 47% decline in breeding females between 2022 and 2024. Researchers believe tens of thousands of animals died.

More than 30,000 sea lions in Peru and Chile died between 2022 and 2024. In Argentina, roughly 1,300 sea lions and fur seals perished.

At the time, researchers were not sure why northern Pacific populations were not infected, but suspected previous or milder strains of the virus conferred some immunity.

The virus is better known in the U.S. for sweeping through the nation’s dairy herds, where it infected dozens of dairy workers, millions of cows and thousands of wild, feral and domestic mammals. It’s also been found in wild birds and killed millions of commercial chickens, geese and ducks.

Two Americans have died from the virus since 2024, and 71 have been infected. The vast majority were dairy or commercial poultry workers. One death was that of a Louisiana man who had underlying conditions and was believed to have been exposed via backyard poultry or wild birds.

Scientists at UC Santa Cruz and UC Davis increased their surveillance of the elephant seals in Año Nuevo in recent years. The catastrophic effect of the disease prompted worry that it would spread to California elephant seals, said Beltran, whose lab leads UC Santa Cruz’s northern elephant seal research program at Año Nuevo.

Johnson, the UC Davis researcher, said the team has been working with stranding networks across the Pacific region for several years — sampling the tissue of birds, elephant seals and other marine mammals. They have not seen the virus in other California marine mammals. Two previous outbreaks of bird flu in U.S. marine mammals occurred in Maine in 2022 and Washington in 2023, affecting gray and harbor seals.

The virus in the animals has not yet been fully sequenced, so it’s unclear how the animals were exposed.

“We think the transmission is actually from dead and dying sea birds” living among the sea lions, Johnson said. “But we’ll certainly be investigating if there’s any mammal-to-mammal transmission.”

Genetic sequencing from southern elephant seal populations in Argentina suggested that version of the virus had acquired mutations that allowed it to pass between mammals.

The H5N1 virus was first detected in geese in China in 1996. Since then it has spread across the globe, reaching North America in 2021. The only continent where it has not been detected is Oceania.

Año Nuevo State Park, just north of Santa Cruz, is home to a colony of some 5,000 elephant seals during the winter breeding season. About 1,350 seals were on the beach when the outbreak began. Other large California colonies are located at Piedras Blancas and Point Reyes National Sea Shore. Most of those animals — roughly 900 — are weaned pups.

It’s “important to keep this in context. So far, avian influenza has affected only a small proportion of the weaned at this time, and there are still thousands of apparently healthy animals in the population,” Beltran said in a press conference.

Public access to the park has been closed and guided elephant seal tours canceled.

Health and wildlife officials urge beachgoers to keep a safe distance from wildlife and keep dogs leashed because the virus is contagious.

Science

When slowing down can save a life: Training L.A. law enforcement to understand autism

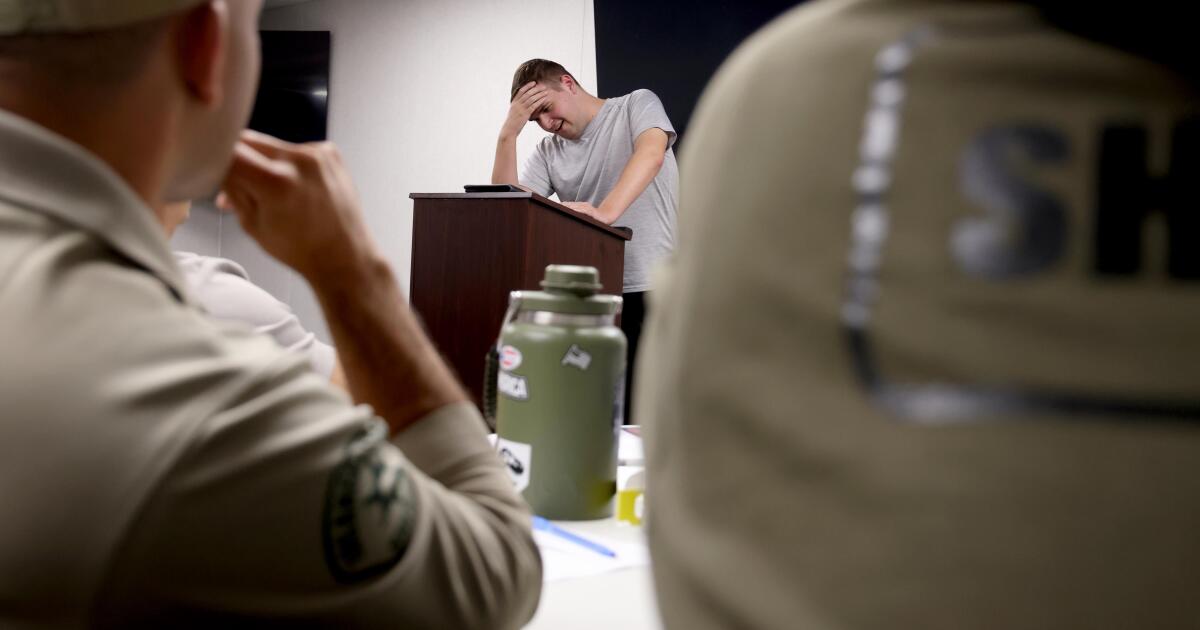

Kate Movius moved among a roomful of Los Angeles County sheriff’s deputies, passing out a pop trivia quiz and paper prism glasses.

She told them to put on the vision-distorting glasses, and to write with their nondominant hand. As they filled out the tests, Movius moved about the City of Industry classroom pounding abruptly on tables. Then came the cowbell. An aide flashed the overhead lights on and off at random. The goal was to help the deputies understand the feeling of sensory overwhelm, which many autistic people experience when incoming stimulation exceeds their capacity to process.

“So what can you do to assist somebody, or de-escalate somebody, or get information from someone who suffers from a sensory disorder?” Movius asked the rattled crowd afterward. “We can minimize sensory input. … That might be the difference between them being able to stay calm and them taking off.”

Movius, founder of the consultancy Autism Interaction Solutions, is one of a growing number of people around the U.S. working to teach law enforcement agencies to recognize autistic behaviors and ensure that encounters between neurodevelopmentally disabled people and law enforcement end safely.

She and City of Industry Mayor Cory Moss later passed out bags filled with tools donated by the city to aid interactions: a pair of noise-damping headphones to decrease auditory input, a whiteboard, a set of communication cards with words and images to point to, fidget toys to calm and distract.

“The thing about autistic behavior when it comes to law enforcement is a lot of it may look suspicious, and a lot of it may feel very disrespectful,” said Movius, who is also the parent of an autistic 25-year-old man. Responding officers, she said, “are not coming in thinking, ‘Could this be a developmentally disabled person?’ I would love for them to have that in the back of their minds.”

A sheriff’s deputy reads a pamphlet on autism during the training program.

(Genaro Molina / Los Angeles Times)

Autism spectrum disorder is a developmental condition that manifests differently in nearly every person who has it. Symptoms cluster around difficulties in communication, social interaction and sensory processing.

An autistic person stopped by police might hold the officer’s gaze intensely or not look at them at all. They may repeat a phrase from a movie, repeat the officer’s question or temporarily lose their ability to speak. They might flee.

All are common involuntary responses for an autistic person in a stressful situation, which a sudden encounter with law enforcement almost invariably is. To someone unfamiliar with the condition, all could be mistaken for intoxication, defiance or guilt.

Autism rates in the U.S. have increased nearly fivefold since the Centers for Disease Control began tracking diagnoses in 2000, a rise experts attribute to broadening diagnostic criteria and better efforts to identify children who have the condition.

The CDC now estimates that 1 in 31 U.S. 8-year-olds is autistic. In California, the rate is closer to 1 in 22 children.

As diverse as the autistic population is, people across the spectrum are more likely to be stopped by law enforcement than neurotypical peers.

About 15% of all people in the U.S. ages 18 to 24 have been stopped by police at some point in their lives, according to federal data. While the government doesn’t track encounters for disabled people specifically, a separate study found that 20% of autistic people ages 21 to 25 have been stopped, often after a report or officer observation of a person behaving unusually.

Some of these encounters have ended in tragedy.

In 2021, Los Angeles County sheriff’s deputies shot and permanently paralyzed a deaf autistic man after family members called 911 for help getting him to a hospital.

Isaias Cervantes, 25, had become distressed about a shopping trip and started pushing his mother, his family’s attorney said at the time. He resisted as two deputies attempted to handcuff him and one of the deputies shot him, according to a county report.

In 2024, Ryan Gainer’s family called 911 for support when the 15-year-old became agitated. Responding San Bernardino County sheriff‘s deputies shot and killed him outside his Apple Valley home.

Last year, police in Pocatello, Idaho, shot Victor Perez, 17, through a chain-link fence after the nonspeaking teenager did not heed their shouted commands. He died from his injuries in April.

Sheriff’s deputies take a trivia quiz using their non-writing hands, while wearing vision-distorting glasses, as Kate Movius, standing left, and Industry Mayor Cory Moss, right, ring cowbells. The idea was to help them understand the sensory overwhelm some autistic people experience.

(Genaro Molina / Los Angeles Times)

As early as 2001, the FBI published a bulletin on police officers’ need to adjust their approach when interacting with autistic people.

“Officers should not interpret an autistic individual’s failure to respond to orders or questions as a lack of cooperation or as a reason for increased force,” the bulletin stated. “They also need to recognize that individuals with autism often confess to crimes that they did not commit or may respond to the last choice in a sequence presented in a question.”

But a review of multiple studies last year by Chapman University researchers found that while up to 60% of officers have been on a call involving an autistic person, only 5% to 40% had received any training on autism.

In response, universities, nonprofits and private consultants across the U.S. have developed curricula for law enforcement on how to recognize autistic behaviors and adapt accordingly.

The primary goal, Movius told deputies at November’s training session, is to slow interactions down to the greatest extent possible. Many autistic people require additional time to process auditory input and verbal responses, particularly in unfamiliar circumstances.

If at all possible, Movius said, wait 20 seconds for a response after asking a question. It may feel unnaturally long, she acknowledged. But every additional question or instruction fired in that time — what’s your name? Did you hear me? Look at me. What’s your name? — just decreases the likelihood that a person struggling to process will be able to respond at all.

Moss’ son, Brayden, then 17, was one of several teenagers and young adults with autism who spoke or wrote statements to be read to the deputies. The diversity of their speech patterns and physical mannerisms showed the breadth of the spectrum. Some were fluently verbal, while others communicated through signs and notes.

“This population is so diverse. It is so complicated. But if there’s anything that we can show [deputies] in here that will make them stop and think, ‘Hey, what if this is autism?’ … it is saving lives,” Moss said.

Mayor Cory Moss, left, and Kate Movius hug at the end of the training program last November. Movius started Autism Interaction Solutions after her son was born with profound autism.

(Genaro Molina / Los Angeles Times)

Some disability advocates cautioned that it takes more than isolated training sessions to ensure encounters end safely.

Judy Mark, co-founder and president of the nonprofit Disability Voices United, says she trained thousands of officers on safe autism interactions but stopped after Cervantes’ shooting. She now urges families concerned about an autistic child’s safety to call an ambulance rather than law enforcement.

“I have significant concern about these training sessions,” Mark said. “People get comfort from it, and the Sheriff’s Department can check the box.”

While not a panacea, supporters argue that a brief course is better than no preparation at all. Some years ago, Movius received a letter from a man whose profoundly autistic son slipped away as the family loaded their car at the beach. He opened the unlocked door of a police vehicle, climbed into the back and began to flail in distress.

Though surprised, the officer seated at the wheel de-escalated the situation and helped the young man find his family, the father wrote to Movius. He had just been to her training.

-

World2 days ago

World2 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts2 days ago

Massachusetts2 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Louisiana5 days ago

Louisiana5 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Oklahoma1 week ago

Oklahoma1 week agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Denver, CO2 days ago

Denver, CO2 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology7 days ago

Technology7 days agoYouTube TV billing scam emails are hitting inboxes

-

Technology7 days ago

Technology7 days agoStellantis is in a crisis of its own making