Rhode Island

Hasbro HQ vs. RIPTA funding: What’s at stake under a potential tax on R.I.’s top earners • Rhode Island Current

While Gov. Dan McKee pledged to not raise taxes during his 2025 State of the State address, a crowd of progressive advocates gathered a floor below him rallied for higher taxes on the state’s top earners.

The perennial push to bring a millionaire’s tax to Rhode Island got off to an earlier and more fiery beginning than usual this year. Not surprising, given what’s at stake on both sides of the debate.

To proponents, the tax policy offers a crucial way to boost state revenues, staving off cuts to social services, public transit and health care amid projections of a $223 million structural deficit for the fiscal year that starts July 1. Legislation proposing an extra tax on the top 1% of state earners is slated to be introduced in both chambers this week.

Equally stalwart in their opposition, naysayers insist the tax will cause employers and wealthy residents to seek tax-friendlier pastures.

Including Hasbro Inc. The Pawtucket-based toy and gaming empire is considering a move to Massachusetts, citing the stronger talent pool and access to amenities that Rhode Island lacks.

The absence of a millionaire’s tax, though, is one way the Ocean State can still compete against its northern neighbor, which began a 4% surtax on income over $1 million in 2023.

“It’s a competitive advantage,” House Speaker K. Joseph Shekarchi said, speaking to reporters after Gov. Dan McKee’s State of the State address on Jan. 14. “I think the governor is using that to keep Hasbro and the Hasbro workers in Rhode Island.”

Hasbro did not return multiple inquiries for comment. Company executives have never mentioned state income taxes in publicly released emails or investors’ calls regarding potential relocation plans.

But it’s clear to Laurie White that the company’s calculus on whether to stay or go hinges on costs associated with doing business — including income taxes.

“It’s about two things: access to talent and the cost structure,” White, president of the Greater Providence Chamber of Commerce, said in an interview. “We can’t compete 1-to-1 with Massachusetts on the talent basis. But on taxes, that’s a consideration.”

Rhode Island lacks the appeal of states like New Hampshire or Florida, which don’t tax personal income at all. But it managed to edge out Massachusetts for the first time in a decade last year, in a ranking of state business tax climates by the Tax Foundation.

Rhode Island ranked 41st among states with the most business-friendly tax policies, while Massachusetts fell to 46th. The report cited Massachusetts’ millionaire’s tax as a key reason for its lower ranking compared with past years.

“We do not want to lose that momentum,” Olivia DaRocha, a spokesperson for McKee, said in an email. She also raised an oft-cited argument among opponents of wealth taxes: that states that raise taxes see their top-earners move elsewhere.

A separate Jan. 7 analysis by the Tax Foundation linked lower state income taxes to where people moved within the United States in fiscal year 2024.

The Commonwealth saw the sixth-largest net loss in residents in fiscal 2024, losing .39% of its population, based on an analysis of U.S. Census Bureau data. Rhode Island’s population shrank ever-so-slightly, down .03%, according to the report.

“Rhode Island should learn a lesson from its neighbor to the north about targeting residents’ incomes,” Katherine Loughead, senior policy analyst and research manager for the Tax Foundation, said in an interview. “Rhode Island is already trending in the wrong direction. Outbound migration could be expected to get considerably worse if Rhode Island was to adopt a significant tax increase.”

Not so, according to Alan Krinsky, director of research and fiscal policy for The Economic Progress Institute, which has supported a Rhode Island millionaire’s tax. Ahead of a forthcoming Institute research paper on the “tax migration myth,” Krinsky poked holes in the Tax Foundation’s analysis.

For one thing, Massachusetts was already losing residents at a similar clip even before voters approved the millionaire’s tax. Also noteworthy to Krinsky are the sizes of population swings, which range from .65% loss in Hawaii to 1.26% gain in South Carolina.

“That’s hardly a mass exodus,” Krinsky said.

Meanwhile, other studies suggest taxes hold little sway over where people move. New York saw the number of millionaire households increase by 17,500 from 2020 to 2022, despite imposing a higher tax on income over $1.1 million during that time period, according to a December 2023 report by the Fiscal Policy Institute. Residents who earned over $850,000 a year were less likely to move out of state than people in lower-income brackets, the report found.

Loughead acknowledged that taxes are just one factor in a complex decision of where to move: cost-of-living, particularly housing costs, also plays an important role. New England overall has seen its population decline because of a higher median age and migration to southern states.

Fiscal and policy experts largely agree it’s too early to draw conclusions from Massachusetts’ tax on millionaires. Initial state estimates predicted a $2.2 billion revenue boost from the surtax in fiscal 2024. The Massachusetts Department of Revenue projected $2.4 billion revenue from the tax in fiscal 2026 budget projections, according to news reports.

Less abstract than future forecasts about revenue and population are the financial woes facing the Rhode Island Public Transit Authority, hospitals, and social services. All the more reason, Krinsky said, to consider a surtax on top earners.

Rep. Karen Alzate, a Pawtucket Democrat, plans to introduce legislation this week calling for a 3% surtax on the top 1% of state earners. Preliminary number-crunching suggests that, if approved, the tax would bring in $190 million in revenue per year, affecting residents with net taxable income of $650,000 or more.

Alzate, who introduced similar, though not identical legislation last year, hoped the looming budget deficit might make previous critics take a fresh look at her proposal.

“This is the year to do it,” she said. “We are facing a real deficit and we cannot afford to cut social services and education.”

McKee’s initial fiscal 2026 spending plan did not include higher taxes on top earners. Senate President Dominick Ruggerio has already signaled his opposition. Shekarchi pledged to remain open to all ideas.

GET THE MORNING HEADLINES.

Rhode Island

RI Lottery Powerball, Numbers Midday winning numbers for March 4, 2026

The Rhode Island Lottery offers multiple draw games for those aiming to win big.

Here’s a look at March 4, 2026, results for each game:

Winning Powerball numbers from March 4 drawing

07-14-42-47-56, Powerball: 06, Power Play: 4

Check Powerball payouts and previous drawings here.

Winning Numbers numbers from March 4 drawing

Midday: 2-7-4-4

Evening: 7-6-0-2

Check Numbers payouts and previous drawings here.

Winning Wild Money numbers from March 4 drawing

08-11-12-18-24, Extra: 15

Check Wild Money payouts and previous drawings here.

Winning Millionaire for Life numbers from March 4 drawing

12-13-36-39-58, Bonus: 03

Check Millionaire for Life payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your prize

- Prizes less than $600 can be claimed at any Rhode Island Lottery Retailer. Prizes of $600 and above must be claimed at Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920.

- Mega Millions and Powerball jackpot winners can decide on cash or annuity payment within 60 days after becoming entitled to the prize. The annuitized prize shall be paid in 30 graduated annual installments.

- Winners of the Millionaire for Life top prize of $1,000,000 a year for life and second prize of $100,000 a year for life can decide to collect the prize for a minimum of 20 years or take a lump sum cash payment.

When are the Rhode Island Lottery drawings held?

- Powerball: 10:59 p.m. ET on Monday, Wednesday, and Saturday.

- Mega Millions: 11:00 p.m. ET on Tuesday and Friday.

- Lucky for Life: 10:30 p.m. ET daily.

- Millionaire for Life: 11:15 p.m. ET daily.

- Numbers (Midday): 1:30 p.m. ET daily.

- Numbers (Evening): 7:29 p.m. ET daily.

- Wild Money: 7:29 p.m. ET on Tuesday, Thursday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Rhode Island editor. You can send feedback using this form.

Rhode Island

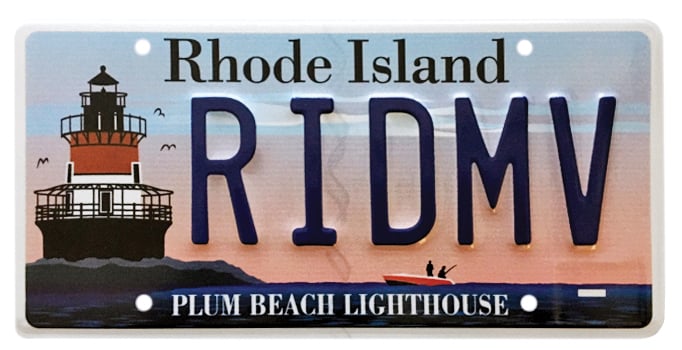

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

Rhode Island

Rhode Island AG to unveil long-awaited report on Diocese of Providence clergy abuse

PROVIDENCE, R.I. — Rhode Island Attorney General Peter Neronha will release on Wednesday findings from a multiyear investigation into child sexual abuse in the Diocese of Providence.

According to the attorney general’s office, the report will detail the diocese’s handling of clergy abuse over decades.

While the smallest state in the U.S., Rhode Island is home to the country’s largest Catholic population per capita, with nearly 40% of the state identifying as Catholic, according to the Pew Research Center.

Neronha first launched the investigation in 2019, nearly a year after a Pennsylvania grand jury report found more than 1,000 children had been abused by an estimated 300 priests in that state since the 1940s. The 2018 report is considered one of the broadest inquiries into child sexual abuse in U.S. history.

Neronha’s investigation involved entering into an agreement with the Diocese of Providence to gain access to all complaints and allegations of child sexual abuse by clergy dating back to 1950. Neronha’s office said in 2019 that the goal of the report was to determine how the diocese responded to past reports of child sexual abuse, identify any prosecutable cases, and ensure that no credibly accused clergy were in active ministry.

Rhode Island State Police also helped with the investigation.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin4 days ago

Wisconsin4 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling