Rhode Island

E-bike safety, Teen Dance and more reap benefits from Rhode Island Foundation grants

NEWPORT – Dozens of nonprofit organizations serving Newport County residents will share nearly $340,000 in grants from the Rhode Island Foundation. The funding will support work ranging from educational programs for school children and disaster recovery preparation to food pantries and arts activities.

“We are grateful to be able to help these organizations carry out their crucial work. We are fortunate to partner with passionate donors who make it possible for us to support nonprofits that are on the frontlines of serving the needs of their communities,” said David N. Cicilline, the Foundation’s president and CEO, in a statement.

Bike Newport, the Boys & Girls Clubs of Newport County, the Jamestown Community Food Pantry and the St. Lucy’s Conference of the St. Vincent de Paul Society in Middletown are among the organizations that received funding through the Foundation’s Newport County Fund.

Bike Newport received $5,000 to launch an e-bike safety training initiative. The program will train riders to safely use e-bikes. The organization expects 150-200 residents to participate in the full multi-session curriculum with on-bike training.

“The exploding popularity of e-bikes underscores the importance for communities everywhere to take timely and effective measures to promote their safe operation. Their increasing use is easy to observe on Aquidneck Island, and indeed everywhere. E-Bikes are dependable, comfortable, and easy to use. E-Bikes are prevalent, growing ever more so, and by all indications they are here to stay,” said Bari Freeman, executive director.

The Boys & Girls Clubs of Newport County received $3,000 to support its new Teen Dance Program, which was conceived by participants in the Club’s SMART Girls program to provide an alternative to wrestling, which is the only other organized physical activity.

“By providing participants with a physical activity in performance art, an opportunity to develop confidence and teamwork and the experience of giving back and supporting the community by performing at community events, we keep them returning to the Club to benefit not only from this program and our other activities will help keep them on the path to success and give them a safe place to go,” said Joe Pratt, executive director and CEO.

The Jamestown Community Food Pantry received $10,000 to support the increased costs of purchasing food and personal care and pet items. The organization provides clients with meat, fish, juice, cheese, yogurt, milk, fresh fruits and vegetables, in addition to non-perishables.

“People often think that a town like ours can’t possibly have a need for an emergency food pantry. We have witnessed the exact opposite of that. The beneficiaries of our program are those individuals and families in Jamestown who need emergency food help when their budgets are tight. Many of our clients are shut-ins, or without reliable transportation, and our services offer them what they need without having to travel across one of the bridges to get help,” said Deb Nordstrom, executive director.

The St. Lucy’s Conference of the St. Vincent de Paul Society in Middletown received $10,000 to provide emergency financial assistance to people facing eviction, utility shut-offs, prescription drugs and clothing among other needs. Last year, the organization helped 137 households with 157 adults and 167 children.

“In Newport County, there simply is not enough affordable housing to meet the demand. The populations in Newport County who benefit from our mission are the poor, the marginalized, children, the elderly and people who are disabled. The assistance we are able to provide varies according to circumstance and needs, but our most common outcome is keeping individuals or families sheltered in their homes with utilities,” said Judy Weston, president.

Aquidneck Community Table in Newport, the American Red Cross, Conexion Latina Newport, East Bay Community Action Program, FabNewport, Girl Scouts of Southeast New England, the Jamestown Arts Center, the Katie Brown Educational Program, the Little Compton Community Center, Live and Learn in Jamestown, Lucy’s Hearth in Middletown, the Dr. Martin Luther King Jr. Community Center in Newport, Meals on Wheels, Newport Contemporary Ballet, newportFILM, the Newport County YMCA, the Newport String Project, Rhode Island Black Storytellers, Rhode Island Slave History Medallions in Newport, Sail Newport, St. John’s Lodge Food Bank in Portsmouth, Turning Around Ministries in Newport and the Washington Square Services Corporation in Newport are among the nonprofits that also received grants.

The Newport County Fund awards grants of up $10,000 to strengthen or expand established programs, to support policy or advocacy efforts on behalf of community concerns, to fund new projects that focus on significant problems or opportunities, and to leverage strategic collaborations and partnerships.

In making the funding decisions, the Foundation worked with an advisory committee comprised of residents from every community in Newport County.

Established in 2002, the Fund has awarded more than $6 million in grants for programs and services for residents of Jamestown, Little Compton, Middletown, Newport, Portsmouth and Tiverton over the years.

It is just one of the grant programs that enable the Foundation to serve Newport County communities. Since 2022, the Foundation has awarded more than $10.9 million in grants to Newport County nonprofits.

Rhode Island

Attorney General Neronha endorses Democrat Helena Foulkes for Rhode Island Governor

(WJAR) — Rhode Island Attorney General Peter Neronha endorsed Democrat Helena Foulkes in her bid for Rhode Island Governor on Thursday.

Neronha spoke at a campaign event with Foulkes.

The term-limited Attorney General says he hadn’t been comfortable endorsing people because of his position.

Neronha said he had gotten to know Foulkes after she reached out to him about health care, an issue Neronha has been vocal about.

“I found Helena to be a great listener, a great thought partner, a person of integrity and character, and that is foremost why I’m endorsing her today,” he said.

“What Rhode Island needs today and into the future is strong capable leadership,” he said. “This is not a state that can afford to keep muddling around in the four, eight, ten, fifteen years.”

He said Foulkes could offer bold leadership.

Neronha has publicly admitted to having a strained relationship with Gov. Dan McKee.

JOIN THE CONVERSATION (1)

This story will be updated.

Rhode Island

RI Lottery Powerball, Numbers Midday winning numbers for March 4, 2026

The Rhode Island Lottery offers multiple draw games for those aiming to win big.

Here’s a look at March 4, 2026, results for each game:

Winning Powerball numbers from March 4 drawing

07-14-42-47-56, Powerball: 06, Power Play: 4

Check Powerball payouts and previous drawings here.

Winning Numbers numbers from March 4 drawing

Midday: 2-7-4-4

Evening: 7-6-0-2

Check Numbers payouts and previous drawings here.

Winning Wild Money numbers from March 4 drawing

08-11-12-18-24, Extra: 15

Check Wild Money payouts and previous drawings here.

Winning Millionaire for Life numbers from March 4 drawing

12-13-36-39-58, Bonus: 03

Check Millionaire for Life payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your prize

- Prizes less than $600 can be claimed at any Rhode Island Lottery Retailer. Prizes of $600 and above must be claimed at Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920.

- Mega Millions and Powerball jackpot winners can decide on cash or annuity payment within 60 days after becoming entitled to the prize. The annuitized prize shall be paid in 30 graduated annual installments.

- Winners of the Millionaire for Life top prize of $1,000,000 a year for life and second prize of $100,000 a year for life can decide to collect the prize for a minimum of 20 years or take a lump sum cash payment.

When are the Rhode Island Lottery drawings held?

- Powerball: 10:59 p.m. ET on Monday, Wednesday, and Saturday.

- Mega Millions: 11:00 p.m. ET on Tuesday and Friday.

- Lucky for Life: 10:30 p.m. ET daily.

- Millionaire for Life: 11:15 p.m. ET daily.

- Numbers (Midday): 1:30 p.m. ET daily.

- Numbers (Evening): 7:29 p.m. ET daily.

- Wild Money: 7:29 p.m. ET on Tuesday, Thursday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Rhode Island editor. You can send feedback using this form.

Rhode Island

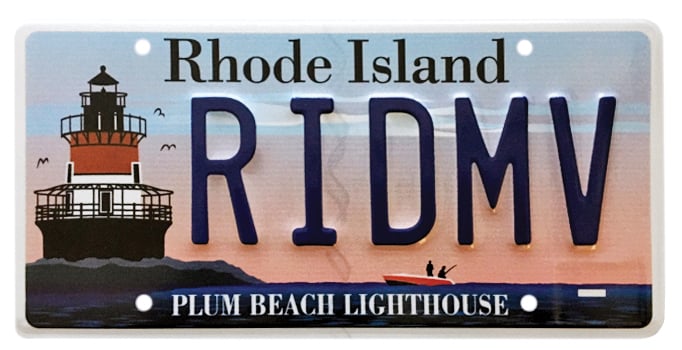

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin4 days ago

Wisconsin4 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling