Rio Tinto and Glencore held talks last year about combining part or all of their businesses, in an indication of how the push by mining companies to secure metals needed for the energy transition has focused executives on large-scale deals.

The London-listed companies engaged in early-stage talks as recently as October, according to people familiar with the matter, but the discussions did not progress to a deal.

A full-blown merger between Rio and Glencore — which have market capitalisations of $103bn and $55bn, respectively — would rank among the largest-ever transactions in the mining industry.

The talks between the two companies followed BHP’s failed £39bn bid for Anglo American last year, which prompted rivals to review strategic options.

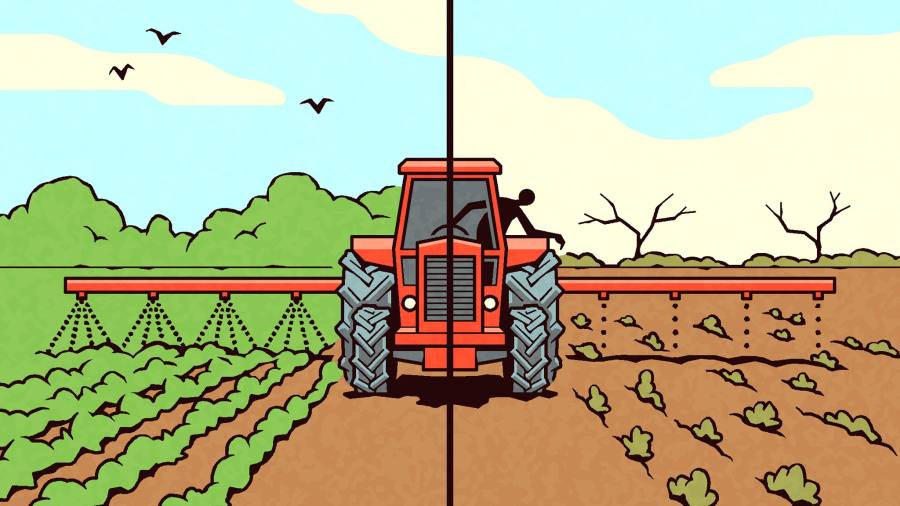

BHP was interested in Anglo’s copper mines, among other assets, because the metal is used in renewable energy projects and electric vehicles.

Glencore and Rio declined to comment. Bloomberg first reported the companies had discussed combining their businesses.

Rio has been looking to boost its exposure to commodities including lithium and copper to offset weakness in the iron ore market as demand from China slows.

Glencore owns stakes in two significant copper mines — Collahuasi in Chile and Antamina in Peru — that would boost its production of the metal by almost 1mn tonnes a year and offer substantial expansion capacity, according to analysts.

A potential deal with Glencore would be complicated by the Swiss-based company’s heavy exposure to thermal coal, a commodity Rio has abandoned in recent years.

Matthew Haupt, a portfolio manager at Wilson Asset Management, which owns shares in Rio, said the deal “didn’t make a lot of sense” given Rio’s efforts to get out of coal and invest in renewable energy to power its operations.

Glencore, which has a large commodity trading business and mining operations, has been debating the future of its coal business.

The company said in 2023 it would spin out its coal mines into a separate listed business but changed its mind last year and decided to retain them.

Glyn Lawcock, an analyst with investment bank Barrenjoey, said coal assets could be spun out as a separate company as part of any agreement. He added there was little overlap between the two companies, meaning there were few synergy benefits from a merger and a deal would need to be justified by asset diversification and creating more scale.

Ray David, a portfolio manager at Blackwattle Investment Partners, which owns Rio’s UK-listed shares, said Rio could fund an acquisition of Glencore by issuing shares in Australia, which would rebalance Rio’s share structure and close the value gap between its Australian and London listings.

Activist investors, including Blackwattle, have urged Rio to move its primary listing to Sydney — where its stock trades at a premium — to simplify share-based deals.

Rio’s Australia-quoted shares fell 1.8 per cent in early trading in Sydney on Friday, before climbing back to be down 0.5 per cent.

Demand for commodities required to decarbonise the global economy — such as copper, lithium and aluminium — has triggered a flurry of dealmaking activity in the mining industry over the past year.

Rio last year announced a $7bn deal to acquire Arcadium Lithium to increases its presence in metals used in batteries for electric vehicles. People close to the company said it was still digesting that transaction.

Rio previously rejected a takeover bid by Glencore in 2014.

Lawcock said the reaction from some Rio investors in Australia was one of unease given Glencore’s reputation for smart dealmaking.

“Shareholders have said I don’t want any of my companies sitting across the table from Glencore,” he said.

Blackwattle’s David said the fact talks had ended showed Rio remained cautious in a consolidating market.

“I suspect Glencore wants a high premium,” he said. “It is a positive sign [that talks ceased] as it shows Rio is being disciplined and aware of not destroying shareholder value. It would be easy to panic.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)