Wisconsin

Wisconsin borrower risks; high-interest installment loans

Wisconsin borrower dangers; high-interest installment loans

A decade in the past, when debtors wanted fast money in Wisconsin, they have been extra more likely to get a short-term payday mortgage with a excessive rate of interest. Now, likelihood is greater they’ll get a special sort of mortgage that comes with its personal dangers.

MILWAUKEE – A decade in the past, when debtors wanted fast money in Wisconsin, they have been extra more likely to get a short-term payday mortgage with a excessive rate of interest. Now, likelihood is greater they’ll get a special sort of mortgage that comes with its personal dangers.

As guidelines round payday loans have tightened across the nation, the variety of storefront lenders providing payday loans in Wisconsin has steadily declined. A lot of those self same lenders are actually providing longer-term installment loans.

In April 2021, Michael Coloso says he was homeless when he walked right into a Examine n’ Go retailer on S. Layton Avenue in Milwaukee to ask for a mortgage.

“So, I may have someplace to remain, like a resort,” mentioned Coloso.

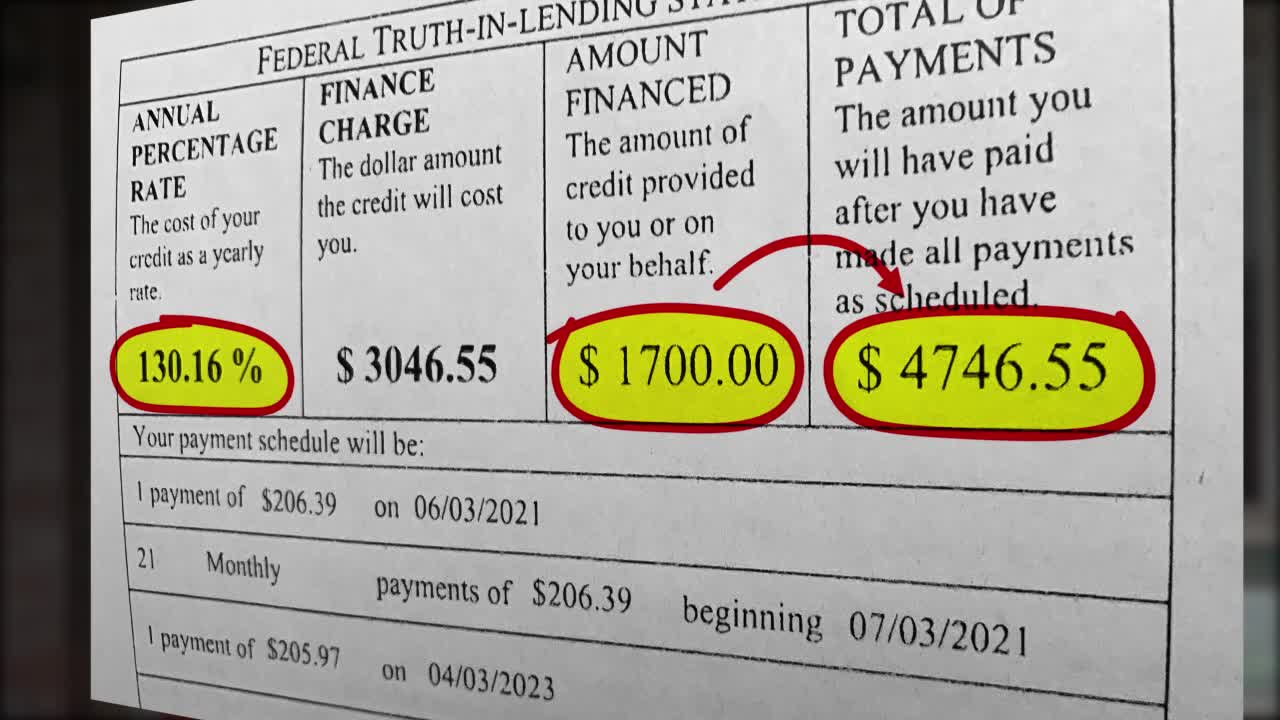

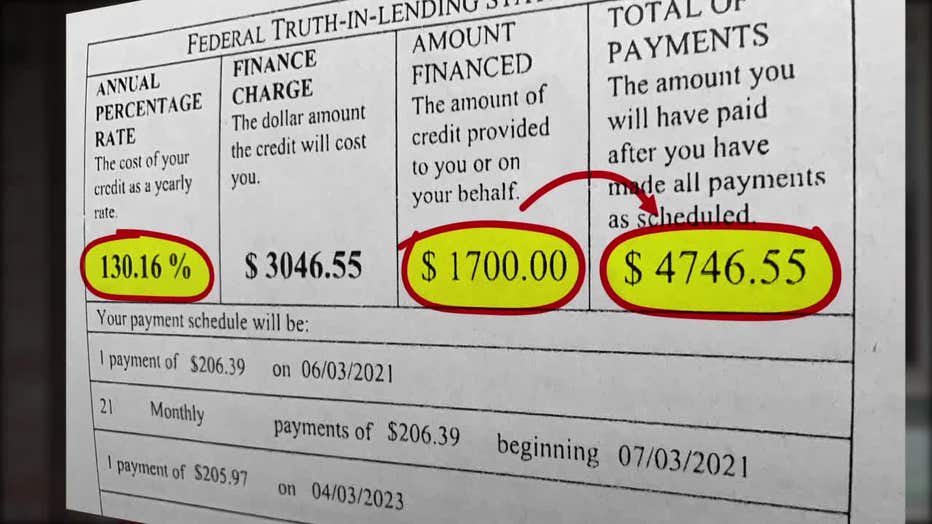

Coloso obtained a $1,700 mortgage. His contract is for 21 month-to-month funds at an APR of 130%. By the point all funds are made, Coloso may have paid again $4,746.55.

Coloso says he didn’t perceive the phrases of the mortgage when he signed the settlement. Examine n’ Go disagrees.

“I do imagine that, , that they … make the most of seniors. If they’ll’t actually perceive what’s happening,” Coloso informed Contact 6.

SIGN UP TODAY: Get each day headlines, breaking information emails from FOX6 Information

Coloso obtained one thing referred to as an installment mortgage. It’s nothing new, besides that it’s grow to be a extra widespread choice at storefront lenders. When not issued by a standard financial institution or credit score union, an installment mortgage will be like a payday mortgage in that it’s fast money and the rate of interest will be excessive.

Payday loans and installment loans are sometimes confused with each other in dialogue. In Wisconsin, a payday mortgage is a smaller, short-term mortgage with a 90-day-limit, capped at $1,500 or 35% of a buyer’s earnings. Loans that take longer to pay-off are typically installment loans.

Storefront lenders who challenge installment loans are usually not topic to the identical degree of scrutiny or oversight as conventional monetary establishments in Wisconsin, and don’t should observe the identical disclosure guidelines.

“They actually do cater to people who could have some credit score points up to now. Or, could not have any collateral,” mentioned Constance Alberts, director of Financial institution On Higher Milwaukee.

Financial institution On Higher Milwaukee is a non-profit that helps with private funds. Alberts says she’s listening to from extra individuals turning to high-interest installment loans.

“After we are in an emergency, worrying, dire scenario, we normally will pull on whoever goes to present [the loan] first,” Alberts informed Contact 6.

Contact 6 reached out to Examine n’ Go about Coloso’s mortgage. It referred Contact 6 to its web site, which says installment loans are a substitute for making use of for a bank card or taking out a payday mortgage.

“They’ve longer phrases and better mortgage quantities and are designed that will help you take management of issues in a means that works greatest for you,” the web site states.

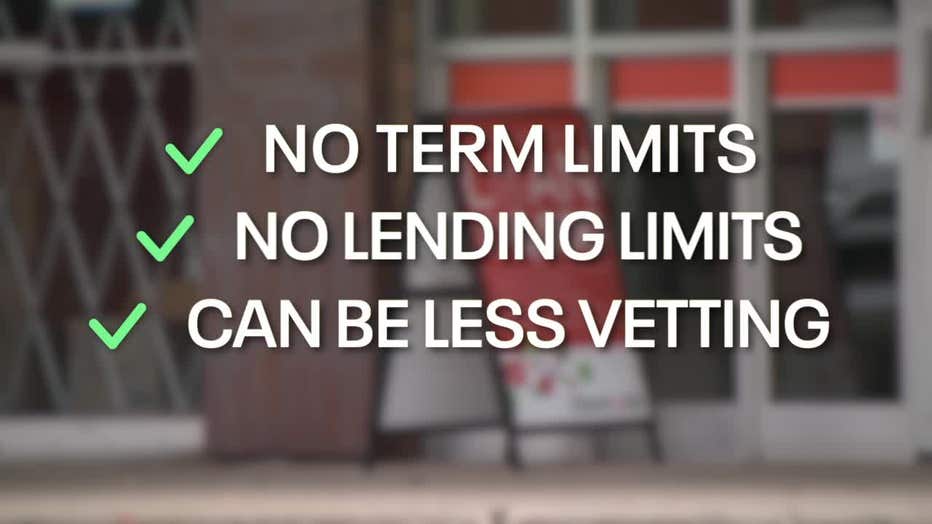

Michael Lawton on the Wisconsin Division of Monetary Establishments says in contrast to payday loans, installment loans at storefront lenders haven’t any time period limits, nor lending limits. In comparison with conventional banks, they’ve much less vetting of the borrower.

FREE DOWNLOAD: Get breaking information alerts within the FOX6 Information app for iOS or Android

“The installment loans don’t have the identical restrictions,” mentioned Lawton. “Many of the [storefront] lenders have restructured their product to be extra the installment mortgage, versus the payday.”

DFI knowledge exhibits 31 mortgage corporations in Milwaukee are licensed by the state to offer installment loans, in comparison with 8 payday lenders who can lengthen each payday and installment loans. The DFI knowledge doesn’t embrace licensed on-line lenders who can even lend to Milwaukee residents.

Wisconsin doesn’t cap the quantity of curiosity a storefront lender can cost, although lawmakers have tried placing ahead resolutions.

Sheila Stevens is a non-public investigator in Oak Creek whom Coloso trusts. She wrote to FOX6 in regards to the installment mortgage on his behalf.

“He mainly had are available as a result of he had paid extra money than lent, and he didn’t perceive why,” mentioned Stevens. “I do know you’ve helped individuals up to now.”

Contact 6 organized a gathering between Coloso, Financial institution on Higher Milwaukee and the Riverworks Monetary Clinic. The Riverworks clinic gives one-on-one monetary teaching.

“Did you assume you have been simply paying the $1,700 again?” Alberts requested Coloso.

“Yeah,” Coloso responded.

Alberts instructed Coloso to file a shopper criticism with the state, stating he didn’t perceive the transaction. Coloso filed the criticism on-line with Stevens’ assist.

Examine n’ Go responded to the criticism and mentioned “.. Notes taken on the time … point out this fee was confirmed with Mr. Coloso.”

The letter goes on to say, “Mr. Coloso has been using CNG’s mortgage providers intermittently … CNG respectfully disagrees Mr. Coloso didn’t perceive the transaction or was taken benefit of.”

Riverworks Monetary Clinic remains to be working with Coloso towards a “wholesome monetary consequence.”

Rose Oswald Poels, President of the Wisconsin Bankers Affiliation, tells Contact 6:

“There’s excessive demand for small-dollar credit score, which 4 in 10 People not with the ability to cowl an emergency expense that prices $400 with out promoting a possession or borrowing cash. [Storefront lenders] have quick phrases and egregious rates of interest, so the price of borrowing may be very excessive…

“… shoppers are inspired to work with their native financial institution as a trusted and accountable supply of choices. Financial institution present honest, handy, and sustainable loans which are higher for assembly the short-term credit score wants of shoppers.”

Lawton says if debtors want a fast mortgage and a storefront lender is their most suitable choice, it recommends purchasing round to get the very best fee.

Wisconsin

Wisconsin man, 56, dies in U.P. snowmobile crash

ONTONAGON COUNTY, MI – A 56-year-old Wisconsin man is dead after a snowmobile crash on Tuesday in Michigan’s Upper Peninsula, WLUC reports.

An Ontonagon County Sheriff’s deputy responded around 12:24 p.m. Tuesday to the crash on Trail No. 1 in Bergland, the report said. The man was found dead at the scene.

The crash is under investigation, the report said. Neither the victim’s identity nor the cause of the crash have been released.

Other agencies assisted at the scene, the report said.

Wisconsin

Wisconsin launches first EV charging stations in statewide network

GREEN BAY, Wis. (WBAY) – The first federally-funded electric vehicle charging stations in Wisconsin are now online.

Gov. Tony Evers’ office says fast-charging stations opened at a Kwik Trip in Ashland (Ashland County), Menomonie (Dunn County) and Chippewa Falls (Chippewa County).

More stations are set to open across the state in the coming months in a growing EV charging network at gas stations, hotels, supermarkets and other locations.

There are 12 federally-funded EV charging station sites planned in Northeast Wisconsin, including Oneida Casino; a Festival Foods on Green Bay’s east side; Kwik Trips in Green Bay, Bonduel, Marinette, Oshkosh and Fond du Lac; a BP station in Neenah; and Sleep Inn & Suites in Sheboygan.

Wisconsin received $78 million from National Electric Vehicle Infrastructure program, which was part of the Bipartisan Infrastructure Law signed by President Biden. So far the state has released $23 million to support 53 projects.

There are currently 29,000 electric vehicles registered in Wisconsin, according to the state Department of Transportation.

Copyright 2025 WBAY. All rights reserved.

Wisconsin

Wisconsin Lottery Mega Millions, Pick 3 results for Jan. 7, 2025

Manuel Franco claims his $768 million Powerball jackpot

Manuel Franco, 24, of West Allis was revealed Tuesday as the winner of the $768.4 million Powerball jackpot.

Mark Hoffman, Milwaukee Journal Sentinel

The Wisconsin Lottery offers multiple draw games for those aiming to win big. Here’s a look at Jan. 7, 2025, results for each game:

Winning Mega Millions numbers from Jan. 7 drawing

20-24-33-39-48, Mega Ball: 18, Megaplier: 2

Check Mega Millions payouts and previous drawings here.

Winning Pick 3 numbers from Jan. 7 drawing

Midday: 9-2-5

Evening: 7-8-8

Check Pick 3 payouts and previous drawings here.

Winning Pick 4 numbers from Jan. 7 drawing

Midday: 3-5-2-2

Evening: 8-5-7-6

Check Pick 4 payouts and previous drawings here.

Winning All or Nothing numbers from Jan. 7 drawing

Midday: 04-05-06-07-11-12-14-16-17-21-22

Evening: 05-08-09-10-13-16-17-18-19-20-21

Check All or Nothing payouts and previous drawings here.

Winning Badger 5 numbers from Jan. 7 drawing

02-06-18-22-28

Check Badger 5 payouts and previous drawings here.

Winning SuperCash numbers from Jan. 7 drawing

12-14-16-30-33-34, Doubler: N

Check SuperCash payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your lottery prize

- Prizes up to $599: Can be claimed at any Wisconsin Lottery retailer.

- Prizes from $600 to $199,999: Can be claimed in person at a Lottery Office. By mail, send the signed ticket and a completed claim form available on the Wisconsin Lottery claim page to: Prizes, PO Box 777 Madison, WI 53774.

- Prizes of $200,000 or more: Must be claimed in person at the Madison Lottery office. Call the Lottery office prior to your visit: 608-261-4916.

Can Wisconsin lottery winners remain anonymous?

No, according to the Wisconsin Lottery. Due to the state’s open records laws, the lottery must, upon request, release the name and city of the winner. Other information about the winner is released only with the winner’s consent.

When are the Wisconsin Lottery drawings held?

- Powerball: 9:59 p.m. CT on Monday, Wednesday, and Saturday.

- Mega Millions: 10:00 p.m. CT on Tuesday and Friday.

- Super Cash: 9:00 p.m. CT daily.

- Pick 3 (Day): 1:30 p.m. CT daily.

- Pick 3 (Evening): 9:00 p.m. CT daily.

- Pick 4 (Day): 1:30 p.m. CT daily.

- Pick 4 (Evening): 9:00 p.m. CT daily.

- All or Nothing (Day): 1:30 p.m. CT daily.

- All or Nothing (Evening): 9 p.m. CT daily.

- Megabucks: 9:00 p.m. CT on Wednesday and Saturday.

- Badger 5: 9:00 p.m. CT daily.

Missed a draw? Peek at the past week’s winning numbers.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Wisconsin editor. You can send feedback using this form.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics6 days ago

Politics6 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics6 days ago

Politics6 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics4 days ago

Politics4 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health3 days ago

Health3 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades