South Dakota

South Dakota State to host first state high school esports tourney this weekend

Jeff Evenson didn’t know much about esports when he first heard that the South Dakota High School Activities Association (SDHSAA) was considering sanctioning it.

“I kind of thought it was just a bunch of kids playing video games, and I was thinking, ‘Come on, get outside and go do something,’” he said.

But when Evenson began to learn more about esports through his job as a sales and marketing manager at Northern Valley Communications/James Valley Telecommunications and through his son’s interest in video games, his opinion started to change.

“I learned quickly it was about connecting kids who have like interests,” he said. “It’s learning teamwork and communicating with each other on a team in pursuit of a common end goal. To me, that is a life skill you will need in the workforce someday.”

That future workforce includes NVC/JVT and other SDN Communications member companies in the telecommunications industry across South Dakota. Several of the companies, including NVC/JVT, are contributing money and behind-the-scenes support to schools in their coverage area.

For NVC/JVT, that means a one-time donation of $2,000 for Aberdeen Central, Northwestern and Warner high schools for the 2023-24 pilot season as well as a commitment to other schools that might sign up when the sport is sanctioned by the SDHSAA in the fall. The funds can be used for whatever the schools want, as long as it’s connected to their esports program. Aberdeen used the funds to help pay for professional coaching, while Northwestern and Warner are using it to offset students’ entry fees, Evenson said.

“We knew we wanted to be a part of it,” Evenson said. “This is not a traditional sport, but it is a sport that is near and dear to our hearts and our industry. These might be our customers and our employees someday, so we are embracing it.”

‘What we do complements what esports is doing’

SDN Communications, a business connectivity provider in South Dakota and southwestern Minnesota, is owned by 17 telecommunications member companies. Those companies cover more than 80% of the state and hundreds of communities.

Several members are supporting their local schools’ esports program as the SDHSAA prepares to sanction the sport for the 2024-25 school year. More than a dozen schools will compete in the pilot season’s state tournament March 22-23 at South Dakota State University in Brookings, and many of them are being supported by SDN member companies.

Interstate Telecommunications Cooperative (ITC), based in Clear Lake, provides Internet and TV service to more than 10 eastern South Dakota counties. It’s supporting Deuel’s esports team and will contribute to other schools if they sign on.

ITC gave $3,000 to Deuel’s team, which includes player jerseys with ITC’s logo. Since Deuel already had an established program and equipment, the team used the funds for trophies, end-of-year awards, a pizza party and game-specific training, coach Michael Gohring said.

The partnership was a natural fit, ITC CEO Tracy Bandemer said.

“You need a good internet connection for esports, and you aren’t going to find anything better than the fiber internet we offer,” she said. “What we do complements what esports is doing. And then who knows? They might be our next employees. We are looking out in the future — that is just a good place to be.”

Deuel has been participating in esports for five years; Gohring said the school was one of the first in the state to start a program. Students built the team’s computers, teaching them valuable tech skills in addition to their participation.

“It’s nice to have (ITC’s) support,” Gohring said. “They are a pillar in our community – literally a block away from our school.”

SDN member companies all in on esports

Like ITC and NVC/JVT, Midstate Communications reached out to all its schools in its coverage area to offer up a partnership, General Manager and CEO Chad Mutziger said.

Midstate, which is based in Kimball, will contribute $3,000 over three years to schools that start an esports team. Mutziger said five have signed up to start a program, including Platte-Geddes, which received a $5,000 grant, including $500 from Midstate, to help kickstart its team.

Mutziger cited the workforce development aspect as well as the fiber internet connection as to why Midstate is getting involved, but he also said the company is happy to support a program that offers an extracurricular activity to some students who sometimes get overlooked.

“Esports might reach out to kids who maybe weren’t involved in other extracurricular activities in the schools,” Mutziger said. “And it gives them an opportunity to be part of a team or be a part of their school.”

At NVC/JVT, Evenson said they reached out to nine schools in their coverage area to offer support for an esports program. Meanwhile, the three schools that are participating in the pilot season are doing so in different ways. Aberdeen Central has a state-of-the art computer lab, while Warner’s team is competing and practicing from home. Northwestern has a combination of at-home and in-school practices.

SDN member companies have connected South Dakota communities with the world for decades. Now they’re helping connect students in schools through esports.

“This sport is flexible for schools,” Evenson said. “It’s going to help connect kids. … It’s absolutely paramount and crucial that (SDN member companies) are involved in this. These are our kids that are in these schools, and this is part of why it has been so important for all of us to get fiber to these rural communities. Not just for gaming, but you are not going to have a successful esports team if you don’t have fast, reliable broadband.”

-30-

South Dakota

Gov. Noem requests presidential disaster declaration for June flooding in South Dakota

Gov. Kristi Noem formally requested Friday a major disaster declaration from the Biden administration for 25 counties due to the severe flooding that occurred in eastern South Dakota between June 16 and July 8.

Noem signed an executive order declaring a disaster exists in the following South Dakota counties: Aurora, Bennett, Bon Homme, Brule, Buffalo, Charles Mix, Clay, Davison, Douglas, Gregory, Hand, Hanson, Hutchinson, Jackson, Lake, Lincoln, McCook, Miner, Minnehaha, Moody, Sanborn, Tripp, Turner, Union, and Yankton.

According to the National Weather Service, the rain event that created this flooding was a 1,000-year event.

“Today, we are submitting our request for a presidential disaster declaration to address the damage from a historic 1,000-year flood that impacted South Dakota,” Noem wrote in a Friday press release. “We have been working with families, local governments and officials, and FEMA for weeks to assess the damage. I am so proud of what South Dakotans have been able to do to start piecing our communities back together.”

A presidential disaster declaration provides a wide range of federal assistance programs for individuals and public infrastructure, including funds for both emergency and permanent work.

The recent flooding inundated communities and damaged infrastructure across eastern South Dakota. The McCook Lake community in North Sioux City was hit by floodwaters diverted from the Big Sioux River on July 23, destroying about 30 homes and eroding roads.

A BNSF railroad bridge used to transport goods over the South Dakota-Iowa border in North Sioux City also collapsed July 23 due to the flooding.

Some parts of Canton also received more than a foot of rain between June 20 and June 22, almost exactly a decade after the 2014 flood that struck the area.

One person died as a result of the flooding. The state Department of Public Safety confirmed the death involved 87-year-old Merlyn Rennich, of Harrisburg, who crashed a UTV on a closed road near Lake Alvin, 5 miles east of Harrisburg. The road was damaged by the floodwaters, and the man died after reversing into the road’s washed-out shoulder while attempting to turn around.

More: DPS confirms fatal crash near Lake Alvin was flood-related

The release from Noem’s Office states that teams from the Office of Emergency Management and the Federal Emergency Management Agency have been on the ground conducting thorough damage assessments across the impacted areas, working closely to assess the extent of the damage and coordinate the necessary response efforts.

“This thorough damage assessment was normal protocol for a presidential disaster declaration, and it’s an important part of the process to make sure all eligible counties and citizens are included,” said Kristi Turman, Director of the Division of Emergency Services at the South Dakota Department of Public Safety.

At least 11 river gauges hit new preliminary record-high levels, according to the Governor’s Office. The Big Sioux River at Sioux City crested nearly eight feet higher than previous records. New record crests were set at the following locations:

- Big Sioux River at Canton, Hawarden, Akron, Richland, Jefferson, and Sioux City;

- Vermillion River at Davis, Wakonda, and Vermillion;

- West Fork Vermillion River at Parker; and

- Turkey Ridge Creek at Centerville.

South Dakota

Suspected pedophile kills himself when confronted by predator hunter at his South Dakota home

A suspected pedophile killed himself moments after he admitted to watching child pornography to a predator hunter outside his South Dakota home.

Donald Letcher, 60, described the graphic detail of the disturbing videos that featured children as young as infants to Predator Poachers founder Alex Rosen, according to footage shared by the “Breanna Morello Show” podcast.

Letcher described his atrocious viewing pleasures, which featured males holding down babies as they “ejaculated” on them.

After hearing enough evidence, Rosen called in a police officer and got Letcher to admit his heinous act to the cop.

As the officer called his supervisor, Letcher walked inside and a “pop” was heard.

The crew outside say they didn’t think much of it because it “wasn’t a loud shot,” but it was later revealed that Letcher shot himself in the head with a .22 bullet.

“The cop breaks the door down and then one of my camera guys goes around the window and sees him (Letcher) on the ground with a hole in his head bleeding out of it,” Rosen said.

Letcher was airlifted to a hospital, where he was pronounced dead, according to Rosen.

The pedophile had reached out to Rosen’s team, who were posing as a preteen girl, and asked for “nudes.”

“This guy messaged us first in April, and all the messages he was pretty sexual, asking us for nudes thinking we were a 12-year-old girl,” Rosen said.

The predator hunter said he had Letcher graphically describe the videos to ensure the creep admitted to the crimes for video evidence.

“When they describe basically everything they see, it leaves no doubt they’re guilty of watching and possessing that stuff,” he added.

Letcher reportedly molested a 9-year-old girl in 1996, a fact unknown to Rosen at the time of his conversation, but the case was overturned by the South Dakota Supreme Court.

“The justice system never held him accountable,” Rosen said.

Letcher was also hit with DUI and hit-and-run charges after he ran over a 6-year-old girl in a “non-pedophile” incident in 2022.

South Dakota

Red Flag Warning Indicates Extreme Fire Danger across Western South Dakota Thursday

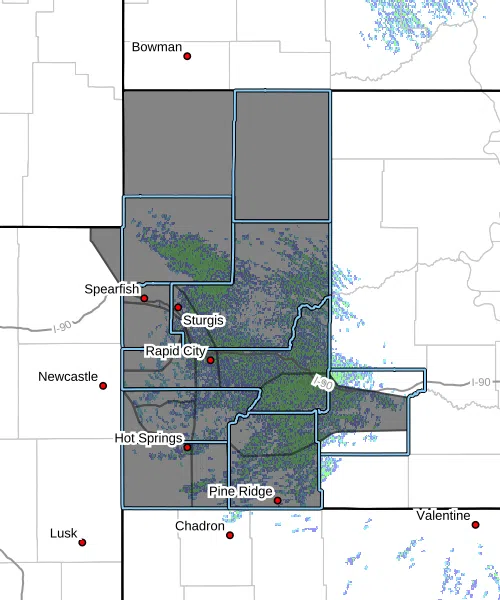

The National Weather Service has issued a RED FLAG WARNING for western South Dakota from Noon to 11 p.m. local time, Thursday, July 25. A Red Flag Warning means that critical fire weather conditions are either occurring now or will shortly. A combination of strong winds, low relative humidity, and warm temperatures can contribute to extreme fire behavior creating ideal conditions for wildland fires to start easily and spread quickly.

Counties within the Red Flag Warning area include Butte, Custer, Fall River, Harding, Jackson, Lawrence, Meade, Oglala Lakota, Pennington, and Perkins counties.

South Dakota Wildland Fire advises extreme caution with any potential fire ignition sources today. Please avoid any outdoor burning during this time, using tools that generate sparks, dragging chains from trailers, throwing cigarette butts out a car window, and parking in tall, dry grass.

If you see a wildland fire call 911 immediately. Be aware that in conditions like these, fires may spread quickly.

For more information about fire prevention visit https://wildlandfire.sd.gov/.

SDWF is an agency of the South Dakota Department of Public Safety.

-

World1 week ago

World1 week agoOne dead after car crashes into restaurant in Paris

-

Midwest1 week ago

Midwest1 week agoMichigan rep posts video response to Stephen Colbert's joke about his RNC speech: 'Touché'

-

News1 week ago

News1 week agoVideo: Young Republicans on Why Their Party Isn’t Reaching Gen Z (And What They Can Do About It)

-

News1 week ago

News1 week agoIn Milwaukee, Black Voters Struggle to Find a Home With Either Party

-

Politics1 week ago

Politics1 week agoFox News Politics: The Call is Coming from Inside the House

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: A new generation drives into the storm in rousing ‘Twisters’

-

News1 week ago

News1 week agoVideo: J.D. Vance Accepts Vice-Presidential Nomination

-

World1 week ago

World1 week agoTrump to take RNC stage for first speech since assassination attempt