Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Everyone is buzzing about SunZia, the massive, sprawling wind power and transmission project taking shape in New Mexico and Arizona. The project is launching into full construction mode on the heels of a newly signed financing package worth an impressive $11 billion, but the size of the deal is not the whole story. The project developer anticipates that SunZia will serve as a model for financing other, similarly ambitious renewable energy projects under the umbrella of the Green Loan Principles.

What Are These Green Loan Principles Of Which You Speak?

If the Green Loan Principles sound like something that fossil energy stakeholders should be pushing back against, they are.

The Green Loan Principles are a set of voluntary, environment-oriented guidelines that build on the more familiar Green Bond Principles, which were established through the International Capital Market Association back in 2018 (see more of CleanTechnica’s green bond news here).

“The Green Bond Principles…seek to support issuers in financing environmentally sound and sustainable projects that foster a net-zero emissions economy and protect the environment,” ICMA explains.

Similarly, the Green Loan Principles were launched in 2018 to “provide a framework for what is recognized as an increasingly important area of finance,” as described by the international organization Loan Syndications and Trading Association.

“The green loan market aims to facilitate and support environmentally sustainable economic activity,” LSTA emphasizes.

The Green Loan Principles also share qualities with responsible investing guidance, which has been formalized under the banner of ESG (environment, social, governance) principles.

That’s why we’re guessing that the Green Loan Principles will become a target for pushback. ESG guidelines have already come under a torrent of criticism from Republican office holders in 20 or so states. The Green Loan Principles could face a similar fate, though based on the track record of the anti-ESG movement, it’s likely that the opposition will be ineffectual.

Anti-ESG officials have generated a lot of noise, but so far they have had little direct impact other than encouraging money managers to stop using “ESG” in a sentence.

Adding insult to injury, many of the 20 or so states that have formally joined the anti-ESG movement are also happily playing host to clean energy innovators and manufacturers, helping to accelerate the energy transition within their own borders and far beyond.

Massive US Wind Power Project Qualifies For Green Loans

As for what types of projects qualify for green loans, that’s subject to interpretation. The Green Loan Principles are voluntary guidelines “to be applied by market participants on a deal-by-deal basis depending on the underlying characteristics of the transaction, that seek to promote integrity in the development of the green loan market by clarifying the instances in which a loan may be categorised as ‘green,’” LSTA explains.

Clearly, there has been widespread agreement on the eligibility of the SunZia wind power project for a green loan.

“The financings are structured as green loan facilities in alignment with the Green Loan Principles,” Pattern Energy emphasized in its press release of December 27. Pattern listed BNP Paribas, Crédit Agricole Corporate and Investment Bank, Desjardins Group, ING Capital LLC, Intesa Sanpaolo S.p.A, New York Branch, National Bank of Canada, Natixis Corporate & Investment Banking, Societe Generale, Sumitomo Mitsui Banking Corporation, and Wells Fargo Securities, LLC as holding the roles of Co-Green Loan Structuring Agents.

Follow The Money

In its press release, Pattern also emphasized that the financing arrangement for the SunZia wind power project provides a model for other supersized renewable energy projects. Hunter Armistead, Pattern’s CEO, chipped in his own two cents.

“Our hope is this successful financing of the largest clean energy infrastructure project in American history serves as an example for other ambitious renewable infrastructure initiatives that are needed to accelerate our transition to a carbon free future,” he stated.

“The size and scale of both the SunZia project and this multifaceted financing show that the renewable energy space can secure attractive capital at levels previously only seen in traditional generation,” added Pattern EVP Daniel Elkort for good measure.

In addition to featuring Green Loan Principles front and center, the SunZia financing package consists of several moving parts, described by Pattern as “an integrated construction loan and letter of credit facility, two separate term facilities, an operating phase letter of credit facility, an innovative tax equity term loan facility and a holding company loan facility.”

The Long Road To SunZia Is Shorter Than Keystone’s

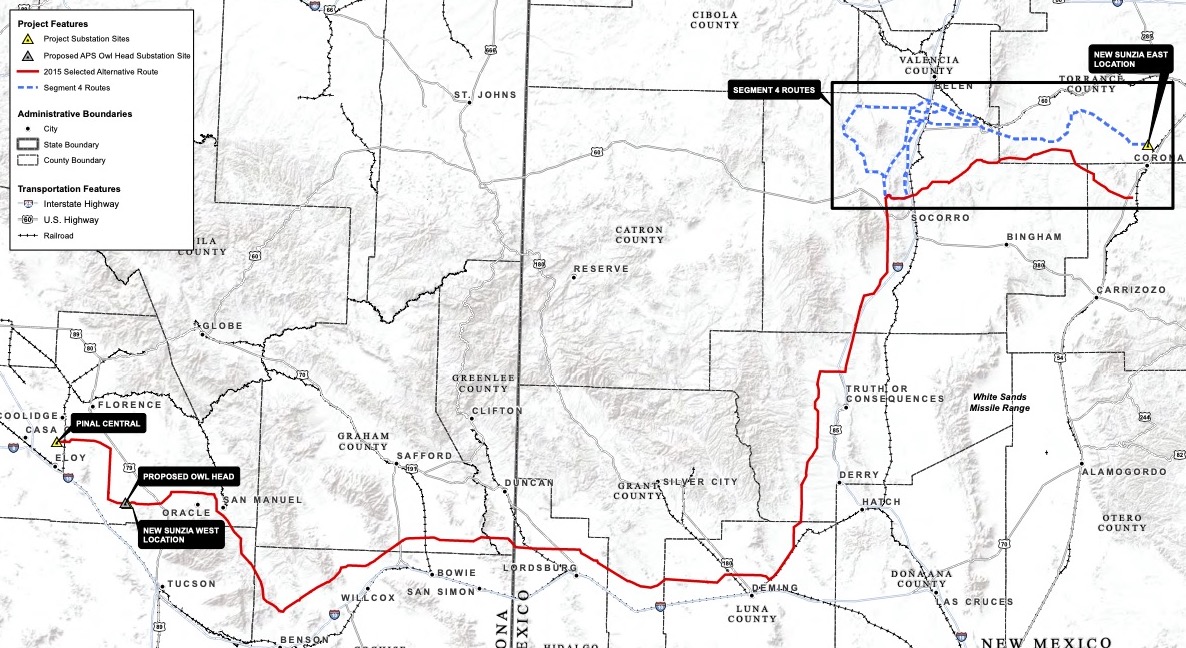

The $11 billion financing package marks the start of full construction for SunZia, and it’s been a long time coming. The wind power project began taking shape back in 2009, when Pattern won initial approval for a new 550-mile transmission line connecting the massive 3.5-gigawatt SunZia wind farm in New Mexico with Arizona and points west (see more SunZia coverage here).

Now that full construction is under way, completion and commissioning are on track for 2026.

Persistence is also paying off for the on-again, off-again Grain Belt Express wind power transmission project. The $7 billion, 800-mile interstate project got the approval process rolling in 2009, only to stall under opposition in Missouri back in 2015. That’s water under the bridge now. The project’s current owner, Invenergy, finally won Missouri over in October and they expect construction to be in full swing in 2025.

The persistence of the SunZia wind project, and the Grain Belt Express, is a stark contrast with the fate of that other high profile US energy infrastructure project, the proposed Keystone XL tar sands oil pipeline. After the proposal failed to win approval during the Obama administration, the fossil-friendly Trump administration held out hope, but the developer ultimately terminated the project in 2021.

Other notorious fossil energy transmission projects are faring somewhat better. As of this November, environmental groups and local tribes are still battling the Dakota Access oil pipeline, though they only seem to have one last card to play. Similarly, opposition to the Mountain Valley gas pipeline played out after the project was fast-tracked by Congress.

Still, as the pace of wind power transmission picks up, fossil energy projects like these could be assigned to the dust bin of history sooner rather than later.

For more activity on the scale of SunZia and Grain Belt, keep an eye on the grid operator MISO. They have a $10.3 billion, 18-project transmission initiative in the works for the midsection of the US. If all goes according to plan, the initiative will bring a total of 53 gigawatts in wind power, solar power, and standalone energy storage to Michigan, Indiana, Illinois, Missouri, Iowa, Minnesota, and North and South Dakota.

Connecting the nation’s growing portfolio of offshore wind farms to the grid is another factor to watch. In September, the Biden-Harris administration announced the launch of the new Atlantic Offshore Wind Transmission Action Plan, aimed at coordinating grid connections and additions to transmission infrastructure throughout the region.

Follow me @tinamcasey on Bluesky, Threads, Post, and LinkedIn.

Image: SunZia wind power and transmission map courtesy of Pattern Energy.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

https://www.youtube.com/watch?v=videoseries

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Like other media companies, we need reader support! If you support us, please chip in a bit monthly to help our team write, edit, and publish 15 cleantech stories a day!

Thank you!

Advertisement

CleanTechnica uses affiliate links. See our policy here.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)