Legal and financial experts have revealed how couples who meet and remarry later in life can avoid nasty inheritance battles.

Americans 65 and older are increasingly getting remarried following the death of their spouse or a divorce, according to research from the National Center for Family and Marriage Research at Bowling Green State University.

But those finding love in their golden age may need to work out how they would split their assets – including real estate and retirement accounts.

They may also have disagreements over whose adult children inherits what.

To avoid these issues, Lee Meadowcroft, of Skinner Law in Portland, Oregon, told the New York Times he advises couples to simply keep their bank accounts separate – though he noted that it is difficult to maintain separate accounts.

‘Keeping everything separate seems to work the best, but it’s a rare couple who can actually do that for a long time,’ Meadowcroft admitted.

‘Although there are ways of protecting finances and keeping things very clear, practically, those things fall apart.’

In those cases, Meadowcroft suggested it may be better for older couples to simply stay together but not remarry.

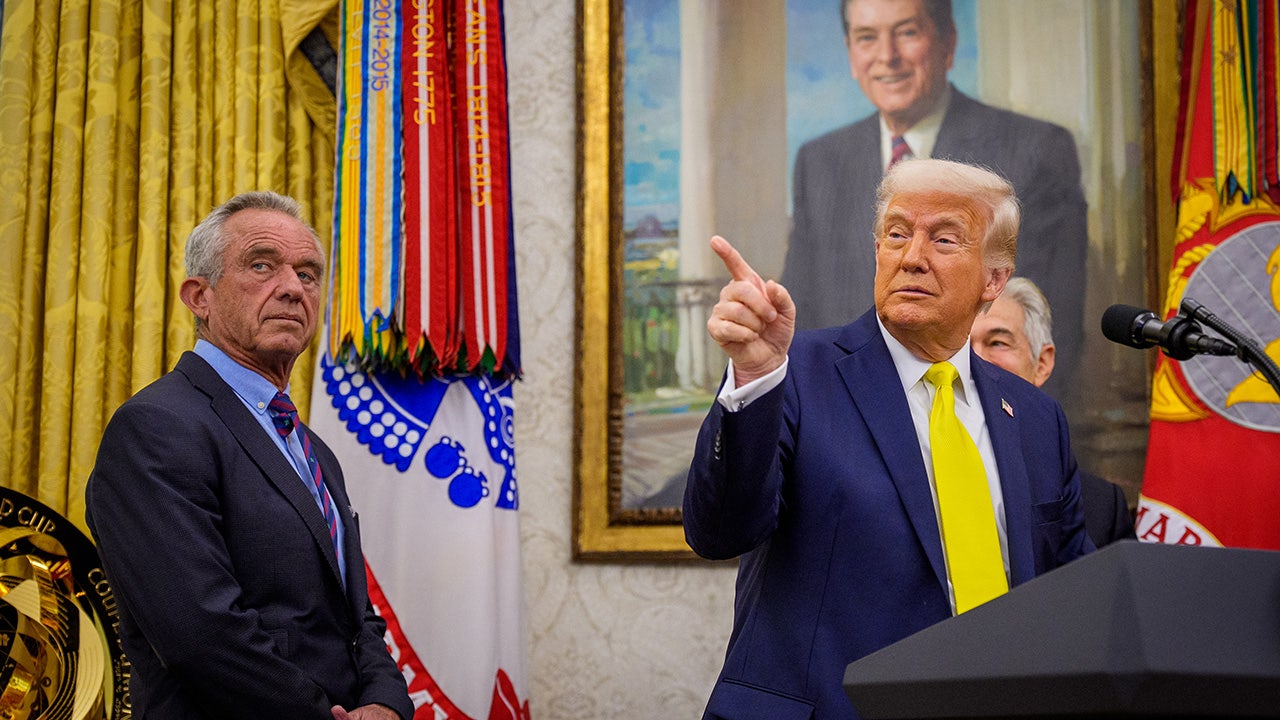

Lee Meadowcroft, of Skinner Law in Portland, Oregon suggested older couples keep their assets separate

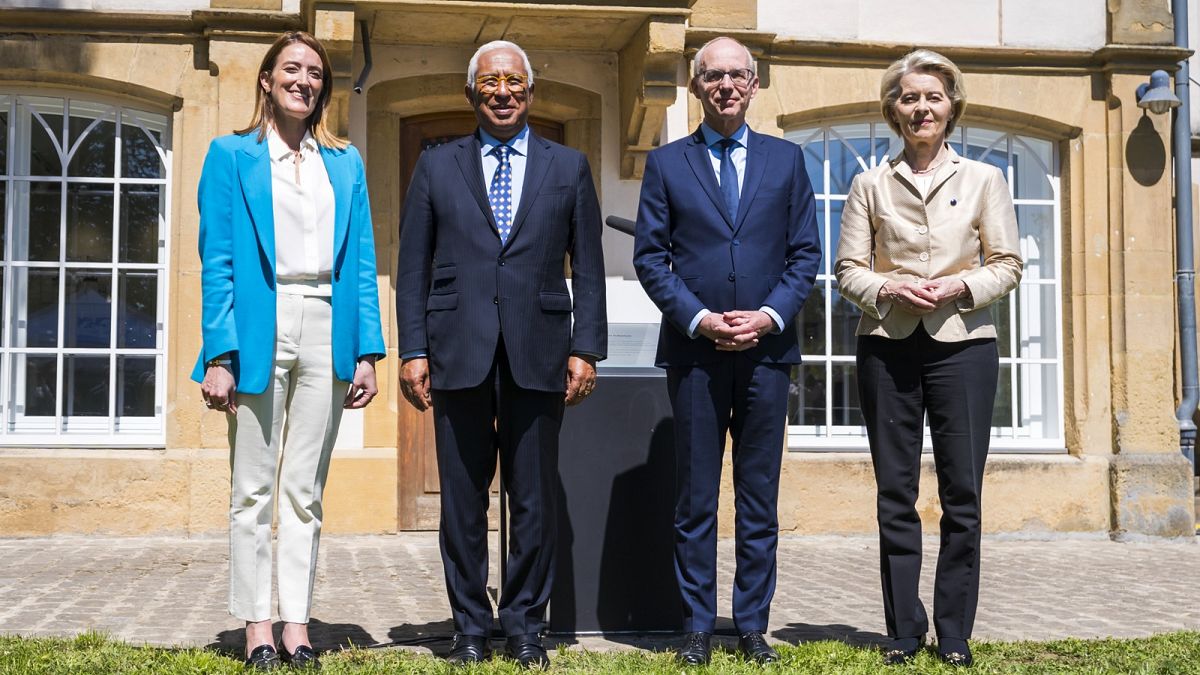

Americans 65 and older are increasingly getting remarried following the death of their spouse or a divorce

‘It can get so messy and it can cause so many problems,’ he said.

Michael Fiffik, a managing partner at Fiffik Law Group in Pittsburgh, Pennsylvania agreed – noting that marriage triggers inheritance rules for certain retirement assets.

If one spouse has a retirement account, for example, they may be required to name the other as a beneficiary.

But if the spouse with the account wanted to bequeath the asset to someone else – say a child – he or she would have to get their new spouse to legally cede their right to it.

For some widows and widowers, remarriage may also mean forfeiting pension or Social Security benefits.

To avoid these issues, Meadowcroft recommended what one of his client couples, who were both in their 80s did and have a ceremonial marriage – but never actually obtain a marriage license.

‘They said, in the eyes of God, they’re married,’ Meadowcroft recounted.

‘The state’s purpose for marriage doesn’t have anything to do with that. It’s simply who gets your stuff when you die.’

Sometimes it may make more sense for an older couple to not remarry

But for those who do decide to remarry, experts recommend taking a number of precautions – including getting a prenuptial agreement, life insurance and putting assets in a trust.

‘Having a prenup is important because it forces a conversation of what happens if this marriage ends because of death,’ Ginger Skinner, a colleague of Meadowcroft’s who works as a founder of an estate law practice in Portland, explained.

She noted that the discussion in itself can bring to light assumptions or differences between spouses, even if it is uncomfortable.

Life insurance, meanwhile, allows people to allocate assets intended to be inherited by spouses or children from previous relationships.

And for those who have significant assets, trusts can protect their financial legacy.