Finance

Runway Growth Finance Corp. (NASDAQ:RWAY) Short Interest Update

Runway Progress Finance Corp. (NASDAQ:RWAY – Get Score) noticed a major lower briefly curiosity in December. As of December fifteenth, there was brief curiosity totalling 107,600 shares, a lower of 34.4% from the November thirtieth complete of 164,100 shares. At present, 0.3% of the shares of the corporate are offered brief. Primarily based on a mean buying and selling quantity of 100,300 shares, the short-interest ratio is at the moment 1.1 days.

Insider Exercise

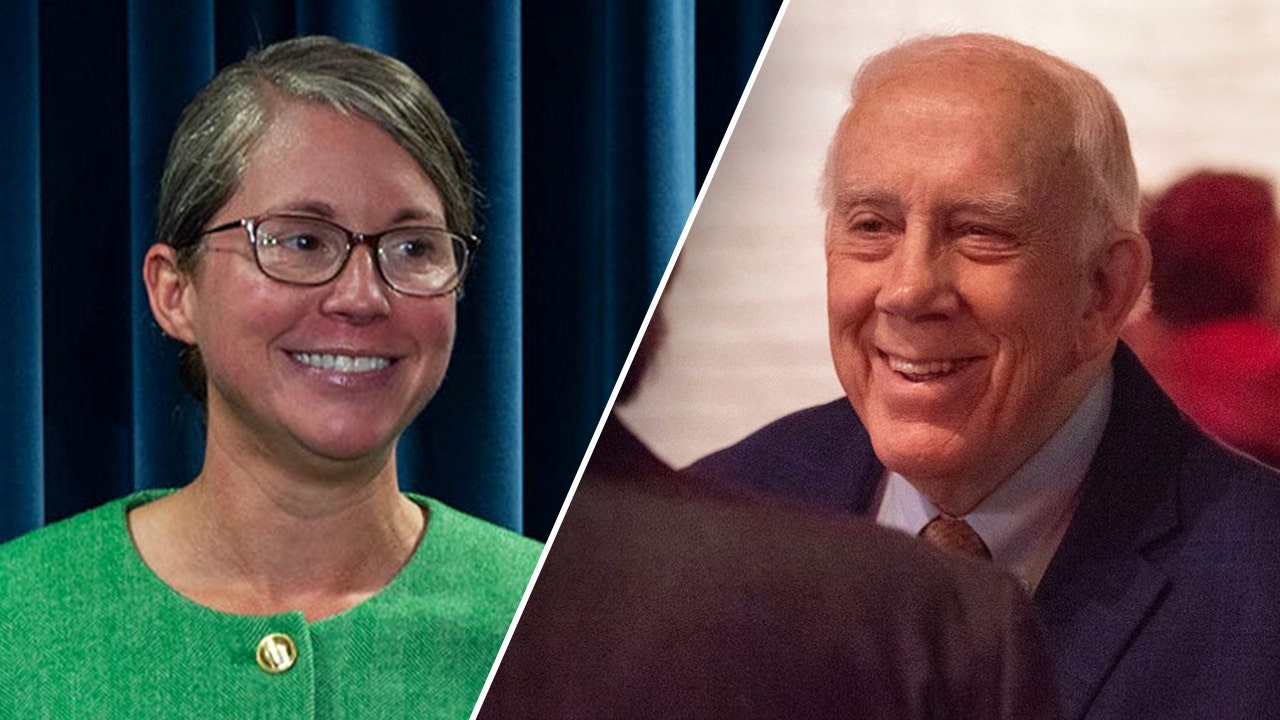

In different Runway Progress Finance information, CEO R David Spreng purchased 4,284 shares of Runway Progress Finance inventory in a transaction dated Friday, December sixteenth. The inventory was purchased at a mean value of $12.67 per share, with a complete worth of $54,278.28. Following the completion of the acquisition, the chief govt officer now straight owns 102,731 shares within the firm, valued at roughly $1,301,601.77. The transaction was disclosed in a submitting with the Securities & Alternate Fee, which is obtainable at this hyperlink. In different Runway Progress Finance information, insider Thomas B. Raterman purchased 6,700 shares of Runway Progress Finance inventory in a transaction dated Thursday, December fifteenth. The inventory was purchased at a mean value of $11.86 per share, with a complete worth of $79,462.00. Following the completion of the acquisition, the insider now straight owns 98,447 shares within the firm, valued at roughly $1,167,581.42. The transaction was disclosed in a submitting with the Securities & Alternate Fee, which is obtainable at this hyperlink. Additionally, CEO R David Spreng purchased 4,284 shares of Runway Progress Finance inventory in a transaction dated Friday, December sixteenth. The inventory was acquired at a mean value of $12.67 per share, with a complete worth of $54,278.28. Following the completion of the acquisition, the chief govt officer now owns 102,731 shares of the corporate’s inventory, valued at $1,301,601.77. The disclosure for this buy could be discovered right here. Insiders acquired a complete of 25,104 shares of firm inventory valued at $299,522 during the last three months. Company insiders personal 0.63% of the corporate’s inventory.

Institutional Inflows and Outflows

A number of institutional buyers have not too long ago made modifications to their positions within the firm. Tower Analysis Capital LLC TRC elevated its stake in Runway Progress Finance by 342.0% within the third quarter. Tower Analysis Capital LLC TRC now owns 3,960 shares of the corporate’s inventory valued at $45,000 after buying an extra 3,064 shares over the past quarter. Virtus ETF Advisers LLC purchased a brand new place in Runway Progress Finance within the third quarter valued at $134,000. Trexquant Funding LP purchased a brand new place in Runway Progress Finance within the third quarter valued at $173,000. B. Riley Wealth Advisors Inc. purchased a brand new place in Runway Progress Finance within the third quarter valued at $177,000. Lastly, Marshall Wace LLP purchased a brand new place in Runway Progress Finance within the third quarter valued at $197,000. Institutional buyers personal 61.46% of the corporate’s inventory.

Runway Progress Finance Value Efficiency

Shares of Runway Progress Finance inventory traded down $0.30 throughout buying and selling on Thursday, hitting $11.60. The inventory had a buying and selling quantity of 5,217 shares, in comparison with its common quantity of 184,077. The agency has a market cap of $470.03 million, a price-to-earnings ratio of 14.34 and a beta of 0.71. Runway Progress Finance has a 12 month low of $10.76 and a 12 month excessive of $14.92. The enterprise’s 50-day shifting common is $12.14 and its 200 day shifting common is $12.18. The corporate has a present ratio of 1.00, a fast ratio of 1.00 and a debt-to-equity ratio of 0.59.

Runway Progress Finance (NASDAQ:RWAY – Get Score) final launched its quarterly earnings outcomes on Thursday, November third. The corporate reported $0.36 earnings per share for the quarter, topping the consensus estimate of $0.35 by $0.01. The agency had income of $27.33 million for the quarter, in comparison with analysts’ expectations of $27.82 million. Runway Progress Finance had a web margin of 37.01% and a return on fairness of 8.89%. As a gaggle, sell-side analysts anticipate that Runway Progress Finance will put up 1.4 earnings per share for the present 12 months.

Runway Progress Finance Will increase Dividend

The corporate additionally not too long ago declared a quarterly dividend, which was paid on Tuesday, November twenty second. Stockholders of report on Tuesday, November eighth had been issued a $0.36 dividend. The ex-dividend date was Monday, November seventh. This represents a $1.44 annualized dividend and a dividend yield of 12.41%. This can be a increase from Runway Progress Finance’s earlier quarterly dividend of $0.33. Runway Progress Finance’s dividend payout ratio is presently 173.50%.

Wall Road Analyst Weigh In

A number of equities analysts not too long ago commented on the corporate. Wells Fargo & Firm upped their value goal on Runway Progress Finance from $13.50 to $14.00 and gave the corporate an “chubby” score in a analysis word on Monday, October twenty fourth. Hovde Group upped their value goal on Runway Progress Finance to $14.50 in a analysis word on Tuesday, November fifteenth. Lastly, B. Riley upped their value goal on Runway Progress Finance from $12.50 to $13.50 and gave the corporate a “purchase” score in a analysis word on Monday, October thirty first.

Runway Progress Finance Firm Profile

(Get Score)

Runway Progress Finance Corp. is a enterprise growth firm specializing investments in senior-secured loans to late stage and development firms. It prefers to make investments in firms engaged within the know-how, life sciences, healthcare and knowledge providers, enterprise providers and choose shopper providers and merchandise sectors.

Additional Studying

This immediate information alert was generated by narrative science know-how and monetary information from MarketBeat with a view to present readers with the quickest and most correct reporting. This story was reviewed by MarketBeat’s editorial group previous to publication. Please ship any questions or feedback about this story to contact@marketbeat.com.

Earlier than you contemplate Runway Progress Finance, you may wish to hear this.

MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they suggest to their shoppers each day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Runway Progress Finance wasn’t on the checklist.

Whereas Runway Progress Finance at the moment has a “Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

View The 5 Shares Right here

Finance

This personal finance educator says budgeting is ‘toxic’ — try ‘intuitive’ spending instead

Girl holding shopping bags and walking down the street

Pixelseffect | E+ | Getty Images

If you’re trying to stay on top of your spending, you might have logged your finances in a spreadsheet, tracked every dollar, and created a strict spending plan, but one expert says budgeting like this can be “toxic.”

Dana Miranda, a certified personal finance educator, is the author of “You Don’t Need a Budget,” a book that looks to liberate readers from the prevailing approach of managing their money.

“Budget culture is our dominant approach to money that relies on restriction, shame, and greed,” Miranda told CNBC Make It in an interview, likening it to diet culture.

“Research shows in budgeting, and we see the same thing with a much broader body of research in dieting, that that kind of restriction doesn’t work,” she said.

“People tend to fail at sticking to those rules, and so you are inevitably going to feel like a failure. You’re going to feel that shame because you’re not reaching those sorts of arbitrary goals that are being set.”

Not everyone agrees, and many financial planners say creating a budget is the single best thing you can do to improve your finances.

However, Miranda cited a 2018 study by researchers at the University of Minnesota who found little evidence that budgeting helps achieve long-term financial goals, adding that it can also increase anxiety.

Sheida Isabel Elmi, meanwhile, a research program manager at the Aspen Institute Financial Security Program, told CNBC Select that budgeting can be especially challenging for low and middle-income families. This is because they’re more likely to have volatile incomes and lower wages which can’t be easily managed by a strict, prescriptive budget.

Try ‘intuitive’ spending instead

According to Miranda, the toxicity of budgeting stems from a capitalistic culture geared toward making more money and accumulating assets, rather than focusing on the quality of life of individuals.

Instead of scrimping and saving your money, Miranda recommended “conscious spending,” as an alternative. “It’s like an intuitive or mindful approach to spending and using their money.”

“So instead of making a plan for your money on where every dollar is going to go and trying to stick to that and punishing yourself when you don’t, rewarding yourself when you do, take it more mindfully, moment by moment,” she said.

“So how does money serve you in this moment? How can money serve you in a broader way outside of the numbers and spreadsheets that we tend to put it in?”

Miranda acknowledged that it’s not easy to adopt this mindset, but said people need to start trusting themselves more.

When asked about the risk of overspending, Miranda said it’s okay to take on credit card debt. Although controversial, she said carrying debt isn’t always “ethically wrong” or as “destructive” as society would have you believe.

“I consider those as part of the resources available to you to spend,” she says. “As long as we understand how our debt products work and the consequences of different decisions that we make around debt.”

Not paying off your credit card every month can be costly, however, leading to additional debt, an increase in repayments, and damage to your credit score, CNBC Select reports.

Go on a ‘money date’

Another way to avoid reckless spending is to take yourself out on a “money date” every fortnight, Miranda said.

“It’s a way of automating your money management so that you don’t just constantly have this ticker of money stress running through your head,” she explained.

On the money date, you can check how your spending is affecting different areas of your life, and prioritize what’s important.

“So if I take this vacation that my friends are planning, how does that impact the money that I’m putting toward retirement savings next month? Or how does that impact what I’m spending in other areas? How does that impact how much I’m going to use on my credit card?” Miranda said.

You can also create a “money map” which helps organize your goals, the resources you have access to, and your financial commitments, she added — and this should be flexible.

For example, if you initially planned for 10% of your money to go into retirement savings every month, but then you realize you’d rather spend that money now, you can do that with a money map.

“You can sort of move it as it makes sense for you, but it helps you to see your financial situation so that you can understand the consequences of decisions you make,” she said.

“You can make sure that you always have this understanding of the lay of the land in your financial situation, so that it’s easier to make those conscious spending decisions as you go about your day-to-day.”

It’s important to note that budgeting is a standard financial planning method recommended by experts, however. Tania Brown, a CFP and former coach at SaverLife, a nonprofit focused on helping low-income Americans save, previously told CNBC Make It that budgeting is important regardless of income.

“A budget tells your money where to go and what to do so that you can have the life you want,” Brown said. “The less money you have then the more critical it is you prioritize where that money goes.”

Ready to boost your income and career? Don’t miss our special Black Friday offer: 55% off all Smarter by CNBC Make It online courses. Learn how to earn passive income online, master your money, ace your job interview and salary negotiations, and become an effective communicator. Use coupon code THANKS24 to get the best deal of the season—offer valid 11/25/24 through 12/2/24.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

Finance

Gartner Unveils CFO Conference 2025: Autonomous Finance & AI Transformation in Sydney | IT Stock News

Gartner (NYSE: IT) has announced its CFO & Finance Executive Conference 2025 scheduled for March 24-25, 2025, at the Hilton Sydney, Australia. The conference will focus on ‘Autonomous Finance: Driving Transformation, Productivity and Change‘ and address challenges like high interest rates, growth issues, labor scarcity, and AI implementation. The event features four specialized tracks covering CFO roles, FP&A, Controller functions, and Finance Transformation. Keynote speakers include Gartner analysts Mallory Bulman and Clement Christensen, alongside futurologist Magnus Lindkvist. Early-bird registration ends January 24, 2025.

Gartner (NYSE: IT) ha annunciato la sua Conference CFO & Finance Executive 2025, in programma per il 24-25 marzo 2025, presso l’Hilton di Sydney, Australia. La conferenza si concentrerà su ‘Finanza Autonoma: Guida alla Trasformazione, Produttività e Cambiamento‘ e affronterà sfide come i tassi di interesse elevati, problemi di crescita, scarsità di manodopera e implementazione dell’IA. L’evento presenta quattro percorsi specializzati che coprono i ruoli dei CFO, FP&A, funzioni di Controllo e Trasformazione Finanziaria. I relatori principali includono gli analisti di Gartner Mallory Bulman e Clement Christensen, insieme al futurologo Magnus Lindkvist. La registrazione anticipata termina il 24 gennaio 2025.

Gartner (NYSE: IT) ha anunciado su Conferencia CFO & Finance Executive 2025 programada para el 24-25 de marzo de 2025, en el Hilton de Sídney, Australia. La conferencia se centrará en ‘Finanzas Autónomas: Impulsando la Transformación, Productividad y Cambio‘ y abordará desafíos como las altas tasas de interés, problemas de crecimiento, escasez de mano de obra e implementación de IA. El evento contará con cuatro pistas especializadas que abarcan los roles de CFO, FP&A, funciones de Control y Transformación Financiera. Los oradores principales incluyen a los analistas de Gartner Mallory Bulman y Clement Christensen, junto con el futurologo Magnus Lindkvist. La inscripción anticipada finaliza el 24 de enero de 2025.

가트너(Gartner) (NYSE: IT)는 2025년 3월 24일~25일 호주 시드니 힐튼에서 열릴 CFO 및 재무 임원 회의 2025를 발표했습니다. 이번 회의는 ‘자율 재무: 변화, 생산성 및 변화를 이끄는 힘‘에 초점을 맞추고 있으며, 높은 이자율, 성장 문제, 노동력 부족, AI 구현과 같은 과제를 다룹니다. 이 행사는 CFO 역할, FP&A, 관리자 기능 및 재무 변혁을 다루는 네 개의 전문 트랙으로 구성됩니다. 주요 연사는 가트너 애널리스트인 말로리 불만(Mallory Bulman)과 클레멘트 크리스텐센(Clement Christensen), 미래학자 마그누스 린드크비스트(Magnus Lindkvist)가 포함됩니다. 조기 등록은 2025년 1월 24일에 마감됩니다.

Gartner (NYSE: IT) a annoncé sa Conférence CFO & Finance Executive 2025 prévue pour le 24 et 25 mars 2025 à l’Hilton Sydney, Australie. La conférence se concentrera sur ‘Finances Autonome : Stimuler la Transformation, la Productivité et le Changement‘ et abordera des défis tels que les taux d’intérêt élevés, les problèmes de croissance, la pénurie de main-d’œuvre et la mise en œuvre de l’IA. L’événement comporte quatre pistes spécialisées couvrant les rôles de CFO, FP&A, les fonctions de Contrôleur et la Transformation Financière. Les conférenciers principaux incluent les analystes de Gartner Mallory Bulman et Clement Christensen, ainsi que le futurologue Magnus Lindkvist. L’inscription précoce se termine le 24 janvier 2025.

Gartner (NYSE: IT) hat seine CFO & Finance Executive Conference 2025 angekündigt, die für den 24. und 25. März 2025 im Hilton Sydney, Australien, geplant ist. Die Konferenz wird sich auf ‘Autonome Finanzen: Transformation, Produktivität und Veränderung vorantreiben‘ konzentrieren und Herausforderungen wie hohe Zinssätze, Wachstumsprobleme, Arbeitskräftemangel und die Implementierung von KI ansprechen. Die Veranstaltung umfasst vier spezialisierte Tracks, die die Rollen des CFO, FP&A, Controller-Funktionen und Finanztransformation abdecken. Zu den Hauptrednern gehören die Gartner-Analysten Mallory Bulman und Clement Christensen sowie der Futurist Magnus Lindkvist. Die Frühbucherregistrierung endet am 24. Januar 2025.

Gartner, Inc. (NYSE: IT):

Details:

Gartner experts will explore the theme “Autonomous Finance: Driving Transformation, Productivity and Change” during the Gartner CFO & Finance Executive Conference 2025. Sessions will cover how organizations can navigate various issues – such as higher interest rates, challenged growth, scarce labor, cost pressure, security threats, and the scramble for AI use cases – by rapidly evolving, transforming, and redefining data, processes, technologies, staff capabilities and organizational models.

Audience and Topics:

The conference agenda covers the latest hot topics in finance including AI in finance and finance transformation. View the full agenda to learn more about the conference experience.

The conference agenda is split into four tracks:

- Track A: CFO: Improve the ROI of Finance and Enterprise Transformation

- Track B: FP&A: Modernize Data, Analytics and Planning

- Track C: Controller: Streamline, Simplify and Automate Workflows

- Track D: Finance Transformation: Revitalize and Accelerate Your Transformation Programs

Keynotes & Guest Speakers:

- Gartner Opening Keynote: “Finance’s New Identity as a Technology Function” with Mallory Bulman, Senior Director Analyst at Gartner, and Clement Christensen, Senior Director Analyst at Gartner

- Guest Keynote: “Crafting the Future: Transformative Moments in the Digital Age” with Magnus Lindkvist, Futurologist

Exhibitor Showcase

Attendees will get exclusive access to live demos and peers case studies from solution providers at the forefront of finance technology. They will have the opportunity to evaluate the solution providers and learn implementation best practices.

Registration

Early-bird registration expires on January 24, 2025. Additional details can be found on the registration page.

Members of the media can register for the conference by contacting Rob van der Meulen at rob.vandermeulen@gartner.com.

Social Media: Join the discussion on social media using #GartnerFinance.

About the Gartner Finance Practice

The Gartner Finance practice helps senior finance executives meet their top priorities. Gartner offers a unique breadth and depth of content to support clients’ individual success and deliver on key initiatives that cut across finance functions to drive business impact. Learn more at https://www.gartner.com/en/finance/finance-leaders. Follow Gartner for Finance on LinkedIn and X using #GartnerFinance to stay ahead of the latest expert insights and key trends shaping the Finance function. Visit the Gartner Finance Newsroom for more information and insights.

About Gartner

Gartner, Inc. (NYSE: IT) delivers actionable, objective insight that drives smarter decisions and stronger performance on an organization’s mission-critical priorities. To learn more, visit gartner.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241126702293/en/

Rob van der Meulen

Gartner

Tel +44 1784 267 892

rob.vandermeulen@gartner.com

Source: Gartner, Inc.

FAQ

When and where is the Gartner CFO & Finance Executive Conference 2025 taking place?

The conference will be held on March 24-25, 2025, at the Hilton Sydney, 488 George Street, Sydney, New South Wales, Australia.

What are the main tracks at Gartner’s 2025 CFO Conference?

The conference features four tracks: CFO (ROI of Finance and Enterprise Transformation), FP&A (Data, Analytics and Planning), Controller (Workflow Streamlining), and Finance Transformation Programs.

Who are the keynote speakers at Gartner’s 2025 Finance Conference?

The keynote speakers include Gartner analysts Mallory Bulman and Clement Christensen presenting ‘Finance’s New Identity as a Technology Function,’ and futurologist Magnus Lindkvist discussing ‘Crafting the Future: Transformative Moments in the Digital Age.’

When does the early-bird registration end for Gartner’s 2025 CFO Conference?

The early-bird registration expires on January 24, 2025.

Finance

Cash today, finance tomorrow: the trend fueling Miami's luxury market

A significant factor contributing to Miami’s allure, according to Krebs, is its expanding infrastructure, notably developments like 830 Brickell and new corporate residents like Microsoft and Citadel.

“Santander Bank…has basically become a huge financial hub,” he added, suggesting that these shifts draw not only affluent clients but also foreign nationals and investors who see Miami as a gateway to the US economy. Many of these clients, however, don’t fit traditional financing molds, necessitating tailored approaches.

“Some of those individuals fit the banking quadrant…others fit within non-QM,” Krebs said, explaining how his firm often meets the needs of clients with unconventional financial profiles.

Demand for non-conventional mortgage products

The demand for non-traditional mortgage products has surged following recent banking sector disruptions, such as the collapses of First Republic and Signature Bank in 2023.

“Just last month, we did a purchase on a non-warrantable condo for a borrower… at 75% financing,” Krebs said, illustrating the substantial value of loans still being issued under alternative programs. In this volatile environment, non-QM products and bridge loans have emerged as vital tools. Bridge loans, Krebs noted, now make up around “30-40% of our book,” appealing to buyers aiming for fast, low-paperwork transactions. Non-QM loans, which comprise about 50% of DAK’s portfolio, provide options for clients whose tax structures or income sources don’t align with conventional financing standards.

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health2 days ago

Health2 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World

/cdn.vox-cdn.com/uploads/chorus_asset/file/25330613/STK419_DEEPFAKE_CVIRGINIA_E.jpg)