Finance

Rabo, others back Avanti Finance with $24 mn cheque

Know-how-led non-bank finance firm (NBFC) Avanti Finance raised $24 million (about ₹197 crore) in funding from Rabo Partnerships, a wholly-owned unit of the Rabobank Group, and IDH Farmfit Fund. Current buyers Oikocredit and NRJN Belief additionally joined the fundraise.

The Bengaluru-based firm mentioned it’s going to use the funds to reinforce its deeptech platform and broaden its partnerships, amongst different issues.

Avanti makes use of a digital supply mannequin primarily based on a paperless, presenceless and cashless method to lending, geared toward lowering prices and friction for unserved and underserved segments, particularly in rural India.

“This funding will help ongoing investments in our deeptech platform to develop match for objective hyperlocal credit score merchandise, automated knowledge and social indicators pushed underwriting for data-dark clients, amplify our partnership community and speed up co-lending applications with different monetary establishments for capital effectivity,” mentioned Rahul Gupta, chief govt workplace at Avanti Finance.

The corporate has a community of social enterprises, monetary establishments, enterprise correspondents, agritech companies and Farmer Producer Organisations (FPOs) throughout 300 districts in 24 states in India.

To date, the corporate has disbursed over ₹1300 crore of loans to about 275,000 households with none proprietary branches. Within the subsequent 24 months, it goals to broaden to 1.5 million households with ₹2,500 crore in belongings below administration.

The most recent fundraise comes about 18 months after Avanti mentioned it had raised $15 million as a part of its Sequence A prolonged spherical in October 2021. Backers included Oikocredit, Nomura, The Invoice & Melinda Gates Basis and Dr Okay R Shroff Basis.

For Rabo, the funding is in step with its “smallholder ecosystem” technique, which focuses on offering data-driven finance options to smallholder farmers by way of native cooperatives and repair suppliers.

“We consider in Avanti’s imaginative and prescient of economic inclusion, particularly for the agricultural sector, the place entry to applicable monetary providers stays a problem for a lot of,” mentioned Marianne Schoemaker, CEO, Rabo Partnerships.

“This funding helps our technique of selling finance options by way of native cooperatives and repair suppliers, which is near our roots as a cooperative financial institution,” she added.

Miguel Tamayo Maertens, Funding Director at IDH Farmfit Fund mentioned the partnership helps the fund’s technique of investing in revolutionary and impactful options which might be enabling the entry to finance and linked providers to smallholder farmers to enhance their livelihoods.

IDH Farmfit Fund is a €100 million affect funding fund facilitated by IDH, The Sustainable Commerce Initiative, and some banks.

Finance

Weekly Numerology Horoscope, Oct 27 – Nov 2: Luck, love & finance decoded

Number 1: (People born on 1, 10, 19, and 28 of any month)

Ganesha says to stay organized and maintain good communication with colleagues and customers to gain cooperation. Remember, calculated risks can improve your professional life. It is most important to manage your financial situation this week. Evaluate your current financial situation and establish clear goals for the short and long term. Create a reasonable budget that allows you to meet your essential expenses while saving for the future. Consider seeking expert financial advice or exploring investment opportunities to improve your financial portfolio. Be disciplined with your spending habits and remember that small changes can gradually lead to substantial financial growth. In matters of the heart, this week offers an opportunity to strengthen existing relationships and foster new ones.

Number 2: (People born on 2, 11, 20, and 29 of any month)

Ganesha says whether you’re starting a new project or trying to get better at your job, this is the perfect time to set clear goals and make a plan. It may also be a good idea for you to work well with your colleagues and talk to them effectively. Don’t be afraid of new challenges, meet new people in your professional network, and show that you are good at what you do. This week can provide immense potential for career growth and recognition. It’s a good idea to be careful with your money this week. Take a close look at how you’re spending and make some changes if necessary to stay on the right financial track. Look for opportunities to save your money and invest it wisely so you can achieve financial security in the long run.

Number 3: (People born on 3, 12, 21, and 30 of any month)

Ganesha says to keep your focus on personal and professional development, as expanding your skills can lead to long-term success. Have confidence in your abilities, and believe that your efforts will yield positive results. From a financial point of view, there is a need to make careful decisions this week. Assess your current financial situation, establish a budget, and prioritize your needs over wants. It is essential to take a more proactive approach towards your financial goals. Look for opportunities to cut down on unnecessary expenses and save for future endeavors. Keeping an eye on your financial situation will pave the way for stability and security in the long run. In terms of love, this week is going to be full of harmony and growth. If you are in a committed relationship, open communication and mutual understanding will be important.

Number 4: (People born on 4, 13, 22, and 31 of any month)

Ganesha says to stand out from the crowd and utilize career opportunities, it is important to be proactive and show leadership qualities. Working well with others and communicating effectively will help you achieve your goals and create a good work environment. Your financial situation looks stable this week, so it is a good time to make finance-related decisions. This is the right time to think about how you are spending your money. You need to create a budget that is in line with your long-term goals. By being careful with your finances and planning wisely, you can work on improving your financial situation. It can also be a good idea to take advantage of investment opportunities after doing proper research and taking advice from experts to improve your financial future.

Number 5: (People born on 5, 14, and 23 of any month)

Ganesha says it’s also important to think about your finances during the week. Look at what you’re spending and figure out where you can make changes for the better. Consider creating a budget or reviewing one that you can use wisely during the week. This week is a good time for love and strengthening your relationships. Whether you’re single or in a committed relationship, it’s important to focus on your emotional connections with the people you care about. Try to improve your communication and show your affection to those close to you. By embracing the changing nature of life, you will be well on your way to a fulfilling and successful week ahead.

Number 6: (People born on 6, 15, and 24 of any month)

Ganesha says you can also be more productive by organizing your work area, focusing on your tasks, and managing your time better. In terms of finances, it is important to keep a good balance this week. Think about your current financial situation and make clear goals to improve it. Create a budget that matches your goals, such as saving for a large purchase, paying off debt, or investing for the future. Find ways to cut down on unnecessary spending and be more careful with your money. This might include looking for better deals, cooking at home, or reconsidering subscription services. Focus on your relationships and matters of the heart. Love and relationships require your time, care, and open communication.

Number 7 (People born on 7, 16, and 25 of any month)

Ganesha says it is important to plan for various parameters of life in this combined week. This week will bring a variety of experiences that will impact your personal life, business, finance, and love life. Let’s take a closer look at each area and try to take away the main takeaways of the week. In this heavily raced world, it is important to make time for your personal life, which includes nurturing relationships and keeping your secrets. This week, set aside some time to stock up on good times and create lasting memories for your loved ones, be it family or friends. To strengthen your social integration, promote your universal well-being, and provide valuable support, especially during your cooperation time. This week has brought an opportunity for you to take a step forward in your professional journey. Focus on the goals of your venture, find a few, and make a plan, as well as create level steps to reach them. Be on the lookout for opportunities to collaborate with enterprises, starting with new skills training, mentorship, and making the most of growth opportunities within your organization.

Number 8: (People born on 8, 17, and 26 of any month)

Ganesha says at the beginning of the new week, you need to stock up and prepare. There may be changes in your personal life, business, finance, and love life during the week. So let us revive ourselves and get ready for the journey ahead. This week you may feel a sense of balance and peace in your personal life. You can focus more on yourself and your relationship. Take some time to think about your life and buy more things you like. Pay attention to your mental and physical health and deliver your presentation even if you don’t have everything you need. You work with people to lay the infrastructure and build a strong support system over time, which can bring you great joy. Your performance in professional life is likely to be good this week. If you are working on a project or looking for new opportunities, your hard work will bear fruit. Don’t be afraid of dissenting opinions and different thinking. Working well with documents and communicating effectively will help you reach your goals. This week is a chance to embrace your skills and knowledge, so be prepared for any opportunities that come your way.

Number 9: (People born on 9, 18, and 27 of any month)

Ganesha says this week will be full of stamina for you. Welcome all opportunities to feel balance and joy in your personal life, finances, finances, and balance. Devote your time and effort to each area, this way you can pave the way for an individual and successful week. Start each day with a clear plan and strong willpower. It is very important to focus on personal development to achieve complete success this week. This is a great time to meet new people, read, take online courses, or gain new skills. This week, maintaining achievable goals and keeping track of your progress will help keep you motivated and stable. If you’re willing to leave your comfort zone behind and embrace growth, you’ll learn more about yourself and change for the better during this period. Invest your time and efforts in your profession. Your hard work and sketch will bring you historically positive results. Also, focus on your growth as a person while making important decisions based on your principles.

– Ends

Finance

Shropshire Council asks for urgent government financial support

Shropshire Council has asked the government for urgent financial support to allow it to continue delivering services.

The authority said a detailed review of its budget is expected to reveal it could overspend by £50m if nothing is done and its savings of £34m would not be enough to meet the shortfall.

Unless more money can be found, the council said it would have to issue a Section 114 notice, making it effectively bankrupt.

The council declared a “financial emergency” last month and said it would be “making some difficult decisions over the next few weeks and months to save money and bring more in”.

The Liberal Democrat-run authority said the review, which is due to be published on 10 November, showed “the true scale of the financial challenge”.

If it has to issue a Section 114 notice, the government could then take action to reduce spending through the appointment of commissioners, as it has done in Birmingham.

The council said it had had several conversations with the government about the issue, which were initially focused on “longer-term funding the council needs over the next three years to enable it to invest in transformation, stabilise its budget and bring an end to its financial emergency”.

But the growing budget pressures have since forced the council to ask for emergency funding.

The authority was run by Conservatives until the Liberal Democrats took control in May.

Roger Evans, the councillor responsible for finance, said: “For a number of years now the council has been overspending its budget – a budget that was set by the previous administration.”

He said the council had been using reserves to meet the deficit and there was now “none left for us to use to help us meet this shortfall”.

Evans also said a shortage of government funding over the years had been “contributing hugely to our financial challenge”.

He thanked staff for their efforts to meet the budget shortfall and added: “Despite our challenges, I truly believe that together, we can make Shropshire Council sustainable.”

Finance

Finance Trailblazer Donna Gambrell Receives 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance

Opportunity Finance Network gives its highest honor to Gambrell for her career-long commitment to expanding economic opportunity in rural, urban, and Native communities through community development finance

WASHINGTON, Oct. 23, 2025 /PRNewswire/ — Last night, Opportunity Finance Network (OFN), the nation’s leading network and intermediary focused on community development investment, presented Donna Gambrell with the 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance during The Opportunity Honors: Award Ceremony and Reception. The Gramlich Award is the community development finance industry’s highest individual honor recognizing people of distinction and their impact on the community development financial institution (CDFI) industry.

Donna Gambrell receives the 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance during The Opportunity Honors in Washington, D.C.

As Director of the U.S. Department of the Treasury’s CDFI Fund (2007–2013), Gambrell helped double funding through the flagship Financial Assistance Awards program and launched cornerstone initiatives—including the Capital Magnet Fund, Healthy Food Financing Initiative, and the CDFI Bond Guarantee Program—that expanded the reach of CDFIs nationwide. Following federal service, she joined OFN’s Board of Directors in 2017 and served as Chair from 2020–2024, guiding the network through the COVID-19 response and sector stabilization.

“Donna Gambrell has dedicated her career to expanding economic opportunity for communities long excluded from traditional finance,” said Harold Pettigrew, President and CEO of OFN. “As a trailblazer and fierce advocate, Donna has grown and expanded the organizations she led, helping community development finance to reach more people and underinvested communities. Donna is a titan of the community development finance industry, and the impact of her work can be felt in almost every community across our nation.”

Today, as President & CEO of Appalachian Community Capital (ACC), Gambrell leads a membership network with more than 40 members managing $4 billion in assets and supporting 20,000 regional businesses. Under her leadership, ACC has advanced initiatives such as Opportunity Appalachia—helping 80+ communities raise over $160 million for priority projects—and launched the Green Bank for Rural America to catalyze climate-smart investment in rural markets.

“Local communities know what they need to best support themselves, and CDFIs put the power back in their hands,” said Gambrell. “That’s what first drew me to community development finance; watching communities thrive and people build generational wealth because of CDFIs is what continues to inspire me many years later. It is an honor to receive the Gramlich Award, and I am grateful to my peers for this recognition of my career.”

Gambrell was also the first African American woman to lead the CDFI Fund—an important accomplishment that underscores a career defined by durable institutional achievements and industry-wide impact.

“Not only is Donna Gambrell a tireless champion for equitable community and business development, but she is a mentor and role model to so many in the industry,” said Darrin Williams, CEO of Southern Bancorp, Inc. “Donna brings people together to help advance community development finance and bolster connections to support communities across all areas of the country. I am proud to call her a colleague, friend, and inspiration.”

About the Ned Gramlich Lifetime Achievement Award for Responsible Finance

Established in 2007, the Ned Gramlich Lifetime Achievement Award for Responsible Finance is the community development finance industry’s highest individual honor. It is awarded annually at OFN’s Annual Conference to individuals whose careers exemplify leadership, integrity, and a deep commitment to expanding economic opportunity.

The spirit of the award is to celebrate people of distinction who have produced a body of work that sets them apart within the CDFI industry. These individuals have shaped the field through innovation, institution-building, and a relentless focus on impact—leaving a legacy that continues to influence the sector and the communities it serves.

The award is named for Ned Gramlich, a staunch, longtime advocate for responsible finance. As the former Board of Governors’ primary liaison to the Federal Reserve’s Consumer Advisory Council, Gramlich advised on community development and consumer finance policy matters. He was an outspoken voice against predatory lending and a strong defender of the Community Reinvestment Act. He served on the OFN Board of Directors from October 2006 until his death in 2007.

About Opportunity Finance Network

Opportunity Finance Network (OFN) is the nation’s leading network and intermediary focused on community development investment, managing more than $1 billion in total assets and a membership of more than 490 community development financial institutions (CDFIs), which includes community development loan funds, credit unions, green banks, banks, minority depository institutions, and venture capital funds. Our network of CDFIs works to ensure communities left behind by mainstream finance have access to affordable, responsible financial products and services, with a deep focus on serving rural, urban, and Native communities across the United States. OFN is a trusted investment partner to the public, private, and philanthropic sectors – foundations, corporations, banks, government agencies, and others – and, for more than 40 years, has helped partners invest in communities to catalyze change and create economic opportunities for all.

Since its founding in 1986, OFN members have originated $124 billion in cumulative financing, helping to create or maintain nearly 3.4 million jobs, start or expand more than 1 million businesses and microenterprises, and support the development or rehabilitation of more than 3 million housing units and more than 15,000 community facility projects.

SOURCE Opportunity Finance Network

-

New York3 days ago

New York3 days agoVideo: How Mamdani Has Evolved in the Mayoral Race

-

World6 days ago

World6 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

News5 days ago

News5 days agoVideo: Federal Agents Detain Man During New York City Raid

-

News5 days ago

News5 days agoBooks about race and gender to be returned to school libraries on some military bases

-

Technology6 days ago

Technology6 days agoAI girlfriend apps leak millions of private chats

-

News6 days ago

News6 days agoTrump news at a glance: president can send national guard to Portland, for now

-

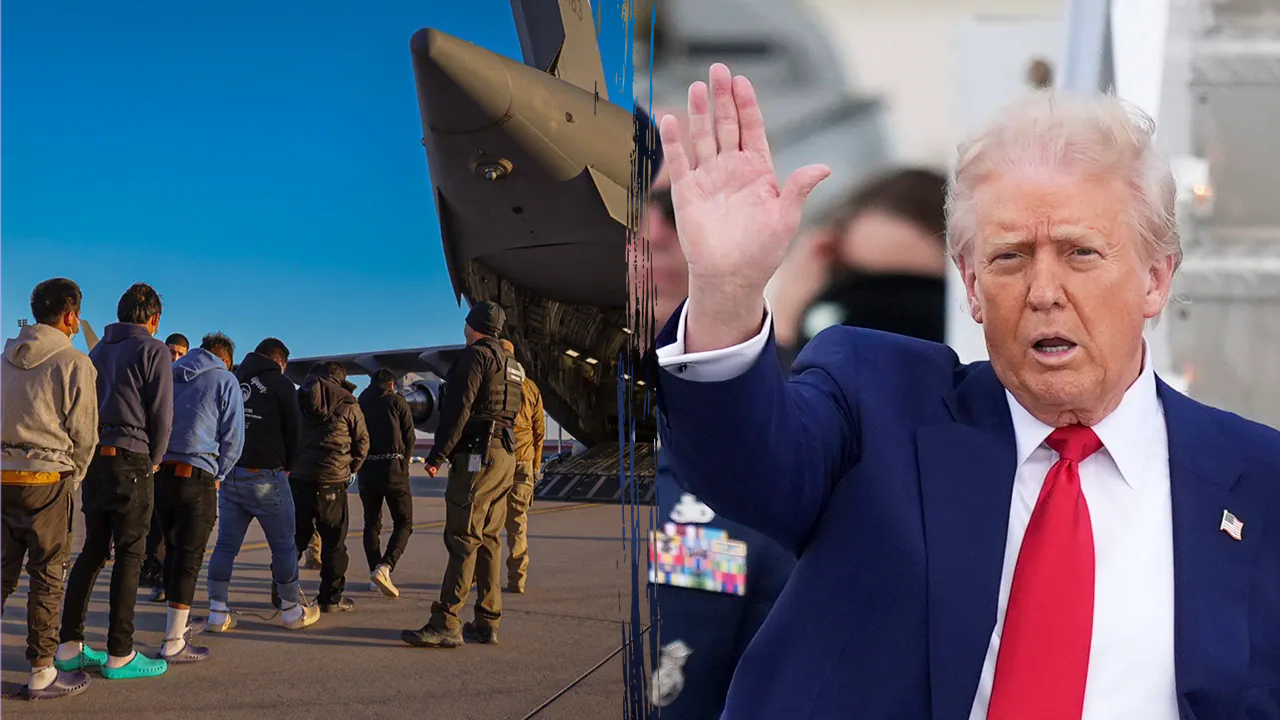

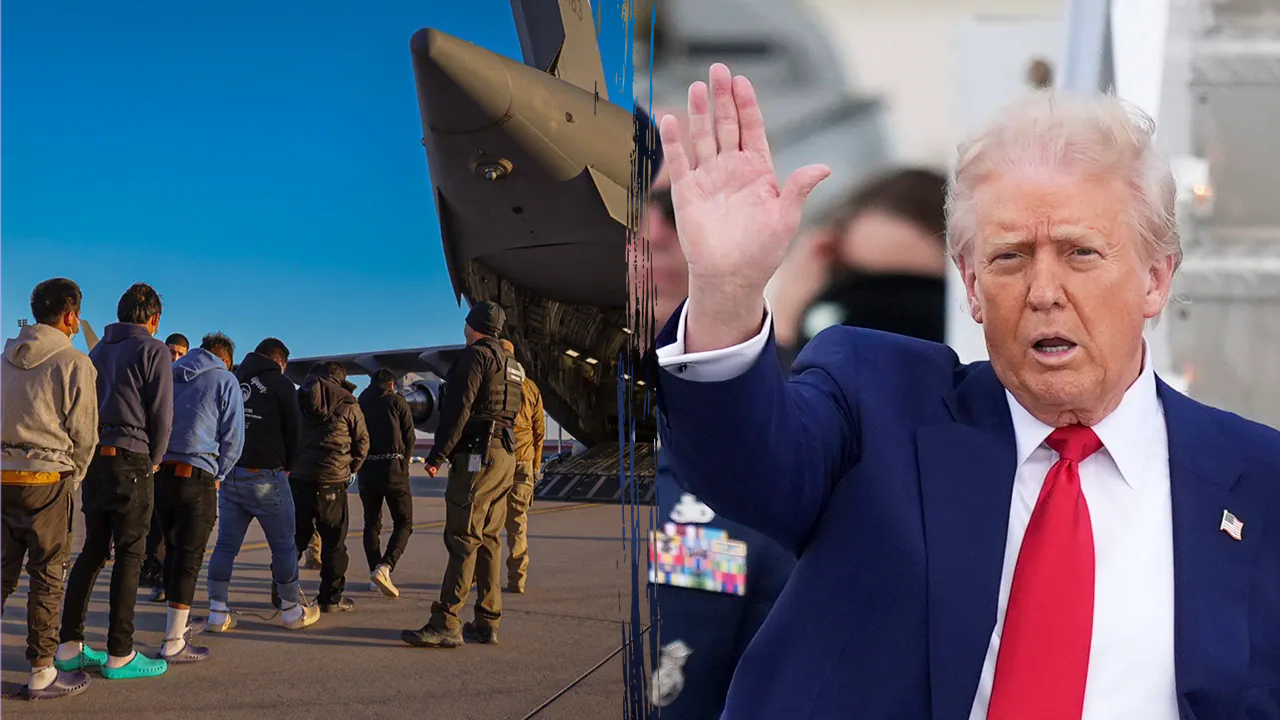

Politics6 days ago

Politics6 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

Business6 days ago

Business6 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’