Reporting by Tetsushi Kajimoto; Editing by Tom Hogue and Kim Coghill

Finance

Japan finance minister says currencies should be set by markets

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JRIVXLVQWVKIFIB6YFLVDIWMLE.jpg)

Banknotes of Japanese yen are seen in this illustration picture taken June 15, 2022. REUTERS/Florence Lo/Illustration/File Photo Acquire Licensing Rights

TOKYO, Sept 1 (Reuters) – Japanese Finance Minister Shunichi Suzuki said on Friday that currencies should be set by markets although sudden moves are undesirable, offering no clues on intervening in the market to stem the weak yen, which is driving up import bills.

“Currencies should reflect economic fundamentals,” Suzuki told reporters after a cabinet meeting. “We’re closely watching currency moves.”

Suzuki toed the official line on currencies, without raising the level of verbal warnings to say things like he is “deeply concerned” about a weak currency.

Late last month, the dollar hit 147.375 yen, the highest since Nov. 7. It was last at 145.50 at midday on Friday.

The yen has been on weak footing lately as investors raised bets that the U.S. Federal Reserve could continue hiking interest rates, or keep rates higher for longer as it tries to rein in inflation, while the Bank of Japan maintains its ultra-loose policy.

Traders are watching for any signs of intervention by Japanese officials to shore up the ailing currency.

However, Japanese officials have rarely escalated verbal warnings since the middle of last month against speculators trying to sell off the yen, which stood at levels where Japan conducted its first dollar-selling intervention in 24 years last September.

“There’s no change to my view on currencies since I stated previously (in mid-August). There’s nothing to add,” Suzuki said.

Back then, Suzuki said authorities were not targeting absolute currency levels when it comes to intervening in the market, as the dollar broke above 145 yen.

The weak yen has driven up import bills for fuel and foods, depriving households of purchasing power and prompting Prime Minister Fumio Kishida to scramble for measures to subsidise gasoline retail prices and to mitigate rises of utility bills.

The BOJ remains an outlier among global central banks with its loose monetary policy, even as it slowly shifts away from yield curve control.

Our Standards: The Thomson Reuters Trust Principles.

Finance

Financial Wellness Center aims to customize student support – @theU

The Financial Wellness Center— specialized in enhancing students’ understanding of the role of finance in their lives and assisting them in making smart, informed decisions about their money—aims to improve the way it supports students by providing the right information at the right time to the right students.

“Each student’s financial wellness journey is unique, shaped by their distinct needs, circumstances, goals, and aspirations,” explained Gabrielle Mcallaster, director of the Financial Wellness Center. “It is clear that a one-size-fits-all approach to financial counseling does not suffice, and our students require distinctive guidance and support tailored to their individual situations.”

To accomplish this and to prepare for an increasing student population, the center is evaluating its processes and exploring how technology can support staff in providing students with an experience tailored to their needs and interests.

The center is partnering with University Information Technology to pilot the use of Salesforce as a customer relationship management platform. The way the system is being configured, each student’s personalized journey will begin with their profile, which includes demographic information, eliminating the need to ask redundant questions during each visit. Student profiles also serve as a repository for staff to add case notes from one-on-one counseling sessions and view notes from previous sessions, ensuring a comprehensive understanding of each student’s progress over time at the university.

Additionally, staff can indicate students’ interests on their profile, such as investing, saving, or budgeting. The technology then uses this information to invite students to workshops related to their interests, enhancing engagement and support.

Moreover, with the platform, the center can send automated communications to students. For example, if a student misses their counseling session, they will receive an email asking them to reschedule. This feature enhances the center’s ability to maintain consistent communication with students and helps students stay informed and engaged.

While this initial effort is focused on updating the Financial Wellness Center’s case management processes and implementing customized and automated follow-up communications to help students work toward their financial goals, it also presents an opportunity to prepare for future expansion into other Student Affairs departments. Collaborating with various departments within UIT, Student Affairs will use this test case to learn and plan for how to create the most seamless experience for students.

“As we look to incorporate this into more departments, we envision curating a host of information, resources, invitations, follow-ups, and connections from a wide range of offices,” said Annalisa Purser, special assistant for strategic initiatives in Student Affairs. “We want to be proactive in providing students with personalized information and experiences to support their individual student journeys.”

Finance

Waaree Energies partners Ecofy for low-cost finance to rooftop solar customers

Waaree Energies Ltd, India’s largest solar PV module manufacturer, has partnered with Ecofy, a non-banking finance company backed by Eversource Capital, to provide low-cost, hassle-free finance to homeowners and MSMEs adopting rooftop solar systems.

Waaree Energies Ltd, India’s largest solar PV module manufacturer, has collaborated with Ecofy, a non-banking finance company backed by Eversource Capital, to provide low-cost, hassle-free finance to homeowners and MSMEs adopting rooftop solar systems. Ecofy has committed INR 100 crore into the partnership.

The partnership will leverage Waaree Energies’ solar expertise and Ecofy’s digital financing solutions to accelerate the solarisation of over 10,000 rooftops across households and MSMEs, contributing to the government’s target under PM Surya Ghar Yojana 2024.

Kailash Rathi, head of partnerships and co-lending at Ecofy, said, ” Over the past 15 months, Ecofy has empowered over 5000 rooftop solar customers. We have invested heavily in this segment enabling penetration through product innovation and instant approvals. As the country prepares for the peak solar season, the collaboration between Ecofy and Waaree is expected to act as a catalyst, and aid in accelerating solar adoption and penetration across diverse segments of society.”

Pankaj Vassal, president-sales at Waaree Energies, said, “By integrating our solar solutions with Ecofy’s financing platform, we are working towards removing barriers and aiding in accelerating the adoption of solar power across households and businesses. Ultimately, this is expected to empower more people to embrace the benefits of clean energy while collectively building a greener, more environmentally-conscious India.”

Waaree Energies had an installed PV module manufacturing capacity of 12 GW, as of June 30, 2023 (Source: CRISIL Report). It has four solar module manufacturing facilities in India, with international presence.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Finance

Global Finance Leaders Expect AI to Unlock Deeper, Faster Audits

Global companies increasingly use artificial intelligence to produce their financial statements and expect auditors to leverage the technology further to spot fraud and speed up their reviews, a new international survey shows.

The fast-evolving technology will help auditors predict trends and scan short-seller reports and consumer trends for market shifts and risks. “That’s where the additional rigor and the reliability and the quality is going to come in,” said Larry Bradley, global head of audit for KPMG International.

The Big Four firm released the results of its survey of 1,800 business leaders and corporate directors on …

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

-

Politics1 week ago

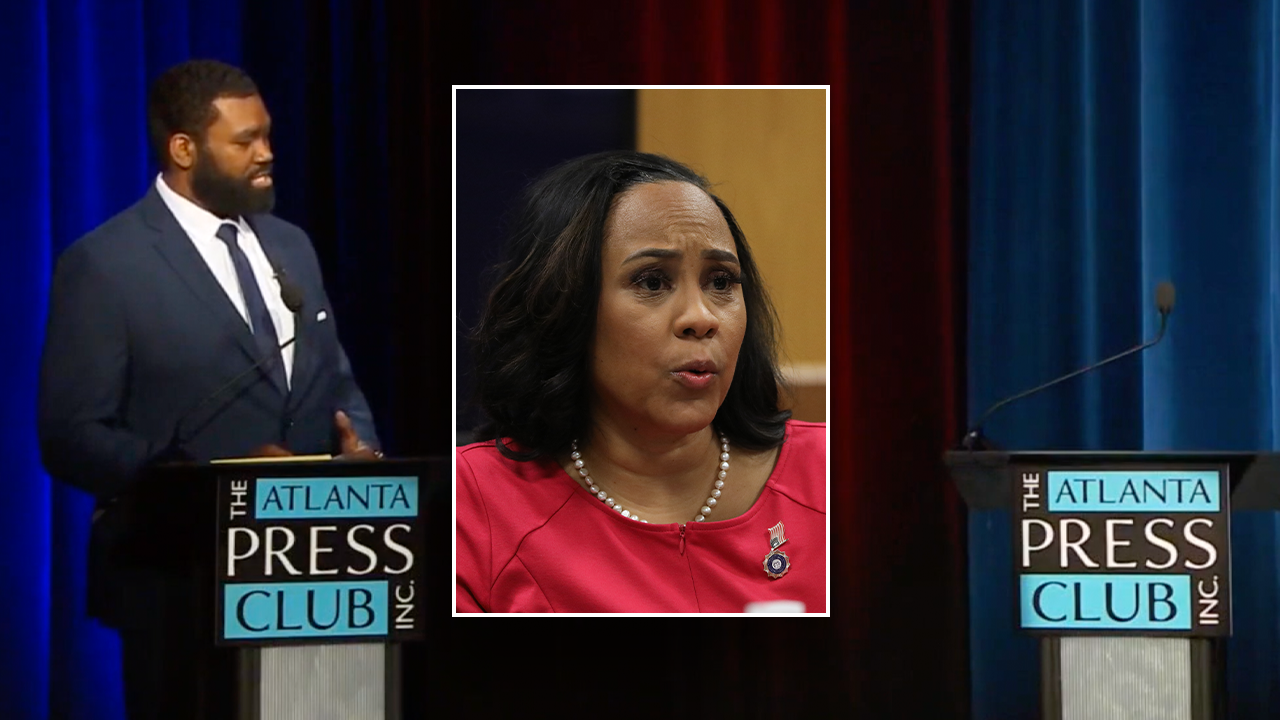

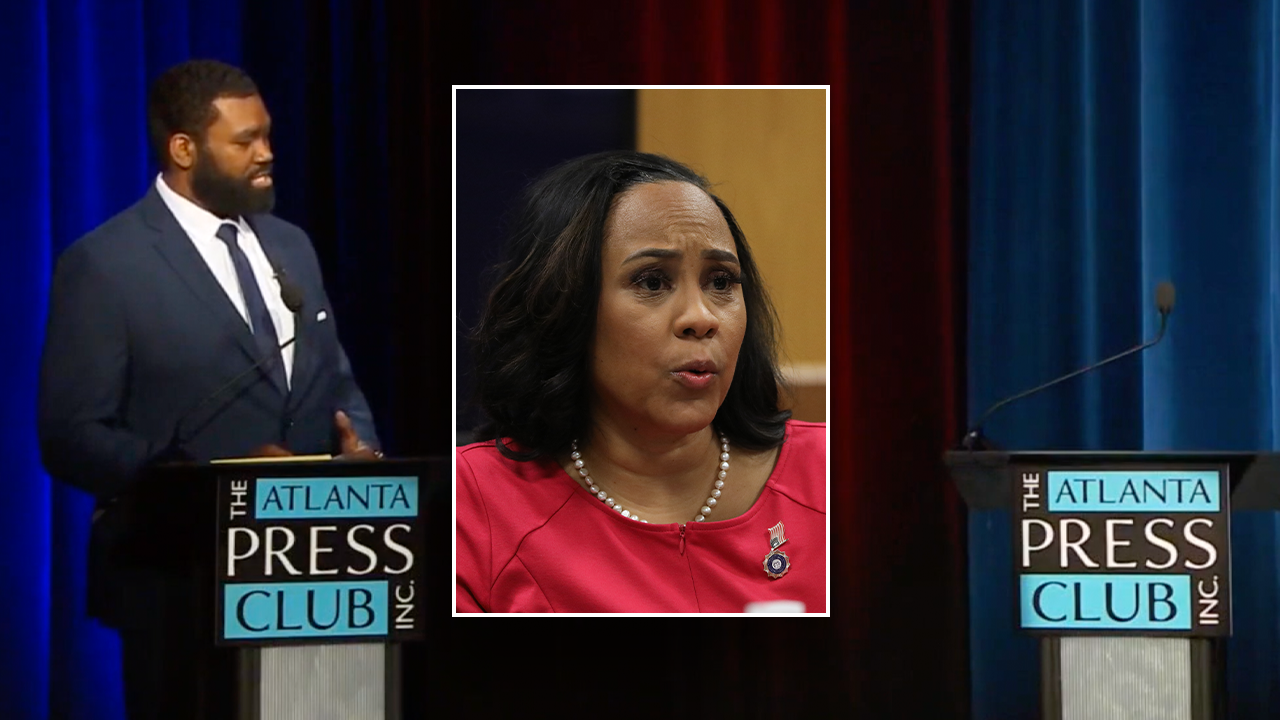

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

Politics7 days ago

Politics7 days agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

News1 week ago

News1 week agoAs student protesters get arrested, they risk being banned from campus too

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

World1 week ago

World1 week agoNine on trial in Germany over alleged far-right coup plot

/cdn.vox-cdn.com/uploads/chorus_asset/file/24416409/the_making_of_hi_fi_rush_7.jpeg)