Finance

Investing in equities is key to financial freedom for women, says Shibani Kurien

Women should consider diversified investment portfolios to mitigate risks and optimize returns over the long term keeping in mind their investment objectives, says Shibani Kurian, Senior Executive Vice President, Fund Manager & Head – Equity Research, Kotak Mahindra Asset Management.

In an interview with MintGenie, Kurian said that tailored investment education programs, mentorship opportunities, and success stories of women investors can inspire and build confidence.

Edited Excerpts:

What according to you should be done to attract more women to invest in equities?

Financial freedom is of utmost importance for women helping them take control of their destinies and lead lives of empowerment and independence. Financial freedom is not possible without investing in the future. Hence, there is a growing need for women to understand asset allocation including investing in equities. Investing in equities is often considered alien to women. However, to the contrary, women naturally embody the very characteristics needed to be successful equity investors.

To encourage more women to invest in equities, there is a need for a focused effort on financial education that is accessible and relatable. Tailored investment education programs, mentorship opportunities, and success stories of women investors can inspire and build confidence. Creating platforms that offer supportive communities for women to share experiences and learnings can significantly impact their investment journey.

What is your take on the role of mutual funds in building financial knowledge and securing a stable financial future for women?

Mutual funds are pivotal in building financial knowledge and securing a stable financial future for women. They offer a simplified entry point into the investing world, allowing women to benefit from professionally managed portfolios. Mutual funds also provide educational resources that can help demystify the investing process, making it more approachable for beginners.

How does one benefit from investing through SIPs?

Investing through systematic investment plans (SIPs) benefits investors by instilling discipline, offering the advantage of rupee cost averaging, and allowing the flexibility to start with small amounts. SIPs make it easier to commit to long-term financial goals and can be particularly advantageous in building wealth gradually without the pressure of timing the market.

Why and how should women opt for a diversified investment portfolio?

Women should consider diversified investment portfolios to mitigate risks and optimize returns over the long term keeping in mind their investment objectives. Diversification across asset classes, geographies, and sectors can help cushion against market volatility. This approach aligns with the principle of not putting all eggs in one basket, thereby, securing investments against unforeseen market downturns.

There is an increasing presence of women in the financial industry. Do you think it has brought the necessary impact in shaping investment strategies?

The increasing presence of women in the financial industry has indeed made a significant impact. Women supporting women creates a much larger impact encouraging other’s to join the path to financial freedom. Women often bring diverse perspectives and innovation to investment strategies, contributing to more holistic and balanced decision-making. Their growing influence also promotes gender diversity and inclusivity, which can lead to more tailored financial products and services that cater to a broader range of investors.

How can women work towards building a robust retirement portfolio?

Women can work towards building a robust retirement portfolio by starting early, making informed investment choices, and consistently reviewing and adjusting their portfolios to align with changing financial goals and market conditions. Emphasizing investments in a mix of equities, fixed income, and other asset classes, depending on risk tolerance and time horizon, is key to building a retirement corpus that can withstand inflation and provide stability in the golden years.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 08 Mar 2024, 09:12 AM IST

Finance

Strong Hong Kong dollar weighing on tourist spending: finance chief Paul Chan

“But the external environment remains complicated and there are a lot of uncertainties,” Chan said in his weekly blog. “The US Federal Reserve last week held interest rates steady. Coupled with stubborn inflation, the market expectation for a rate cut has weakened compared with earlier this year.”

He said the conditions could “bring adverse impacts to global economic recovery, Hong Kong’s exports, as well as the sentiment of local investment and capital markets”.

The Fed announced last week it was holding its benchmark lending rate steady in the 5.25 per cent to 5.5 per cent range as core inflation remained above the target of 2 per cent.

Chan said the city’s tourism sector was one of the key drivers of the economy in the first quarter, but warned of the drawbacks of a strengthening Hong Kong dollar, which is pegged to the US dollar.

The number of arrivals for the first three days of the Labour Day “golden week” holiday reached nearly 650,000, up by 25 per cent against last year’s figures, he said.

The break runs from May 1 to 5 on the mainland.

He said “changing consumption patterns among locals and tourists”, coupled with the strong Hong Kong dollar, could hit the retailing and catering sectors in particular.

Chan urged companies to develop new products and to embrace technology.

“New products can not only meet the changing needs of consumers, but also create demand and thus boost sales,” he said. “As for new ways of management, companies can lower costs and enhance efficiency by adopting more digital solutions.”

Chan was attending the annual meeting of the board of governors of the Asian Development Bank in Tbilisi, Georgia, which is themed “From Billions to Trillions – Promoting Private Sector Development for Climate Change”.

He said many participants were interested in the development of Hong Kong’s digital economy, as well as the innovation and technology sector.

Chan said at the plenary session a huge funding gap of trillions of US dollars existed for climate and transition investments, as well as in helping developed and developing economies in climate financing.

He urged members to work together to mobilise private sector resources and channel funds to support green and climate transition projects through innovative financial products and services.

In his weekly blog post, Chan also noted Hong Kong’s gross domestic product had increased for five consecutive quarters, expanding 2.7 per cent year-on-year in the first three months of the year.

The city’s benchmark Hang Seng Index also gained almost 14 per cent recently, while the property market had become more active after authorities scrapped cooling measures in February.

Finance

M&M Finance’s Q4 Results: Net profit declines; ₹6.30 per share dividend declared

Mahindra Finance reported a total income of ₹3,706 crores, marking a 21 per cent increase year-over-year (YoY), for the quarter ending March 31, 2024, on May 4. However, the Profit After Tax (PAT) experienced a slight downturn by 10 per cent YoY, settling at ₹619 crores, attributed to a 14% increase in Net Interest Income (NII) which stood at ₹1,971 crores. The Net Interest Margin (NIM) remained fairly stable at 7.1%. The reported disbursements for the quarter saw an 11% rise, totalling ₹15,292 crores, and the Gross Loan Book grew by an impressive 24% YoY to ₹1,02,597 crores.

Also Read | Pakistan coach Gary Kirstein gets brutally trolled after meeting with team online, ‘Is this cricket or…?’

The company also showed marked improvement in asset quality, with a significant reduction in Stage 3 assets to 3.4%, down from 4.0% in December 2023. Credit costs for the year were maintained within the targeted range of 1.5% – 1.7%, indicative of effective risk management strategies.

Also Read | Justin Trudeau says ‘rule-of-law’ after 3 arrested for Nijjar killing, Jaishankar says ‘internal politics’

In its consolidated results, the company posted a total income of ₹4,333 crores for the fourth quarter, up by 23% YoY, and a marginal decrease in PAT by 1%, amounting to ₹671 crores. The consolidated disbursements also noted an increase of 11% YoY, reaching ₹16,174 crores.

Also Read | No Dunki route to London anymore: Why is Rishi Sunak deporting UK’s illegal immigrants to Rwanda? An explainer

The company’s strategic initiatives included bolstering its presence in vehicle finance, particularly in pre-owned vehicle finance, which grew by 18% during FY24. Moreover, Mahindra Finance announced plans to enhance its services in the non-vehicle finance segment, aiming to expand its Asset Under Management (AUM) to 15% over the medium term. This includes increasing investments in sectors such as Small and Medium Enterprises (SME) lending, Lease and Purchase (LAP), and leasing through its Quiklyz platform.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 09:46 AM IST

Finance

Transwarranty Finance Q4 results : profit at ₹2.73Cr, Revenue increased by 166.66% YoY

Transwarranty Finance Q4 Results Live : Transwarranty Finance declared their Q4 results on 02 May, 2024. The topline increased by 166.66% & the profit came at ₹2.73cr.

It is noteworthy that Transwarranty Finance had declared a loss of ₹6cr in the previous fiscal year in the same period.

As compared to the previous quarter, the revenue grew by 68.98%.

The Selling, general & administrative expenses rose by 12.53% q-o-q & increased by 13.69% Y-o-Y.

The operating income was up by 7726.27% q-o-q & increased by 154.53% Y-o-Y.

The EPS is ₹0.98 for Q4, which increased by 148.87% Y-o-Y.

Transwarranty Finance has delivered 0% return in the last 1 week, 24.19% return in the last 6 months, and -6.85% YTD return.

Currently, Transwarranty Finance has a market cap of ₹56.46 Cr and 52wk high/low of ₹15.5 & ₹8.25 respectively.

| Period | Q4 | Q3 | Q-o-Q Growth | Q4 | Y-o-Y Growth |

|---|---|---|---|---|---|

| Total Revenue | 5.12 | 3.03 | +68.98% | 1.92 | +166.66% |

| Selling/ General/ Admin Expenses Total | 1.16 | 1.03 | +12.53% | 1.02 | +13.69% |

| Depreciation/ Amortization | 0.13 | 0.12 | +9.2% | 0.12 | +1.13% |

| Total Operating Expense | 2.42 | 3.07 | -21% | 6.87 | -64.74% |

| Operating Income | 2.7 | -0.04 | +7726.27% | -4.95 | +154.53% |

| Net Income Before Taxes | 2.73 | -0.36 | +862.66% | -6.01 | +145.33% |

| Net Income | 2.73 | -0.36 | +863.53% | -6 | +145.44% |

| Diluted Normalized EPS | 0.98 | -0.07 | +1500% | -2.01 | +148.87% |

FAQs

Question : What is the Q4 profit/Loss as per company?

Ans : ₹2.73Cr

Question : What is Q4 revenue?

Ans : ₹5.12Cr

Stay updated on quarterly results with our results calendar

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 02:36 AM IST

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

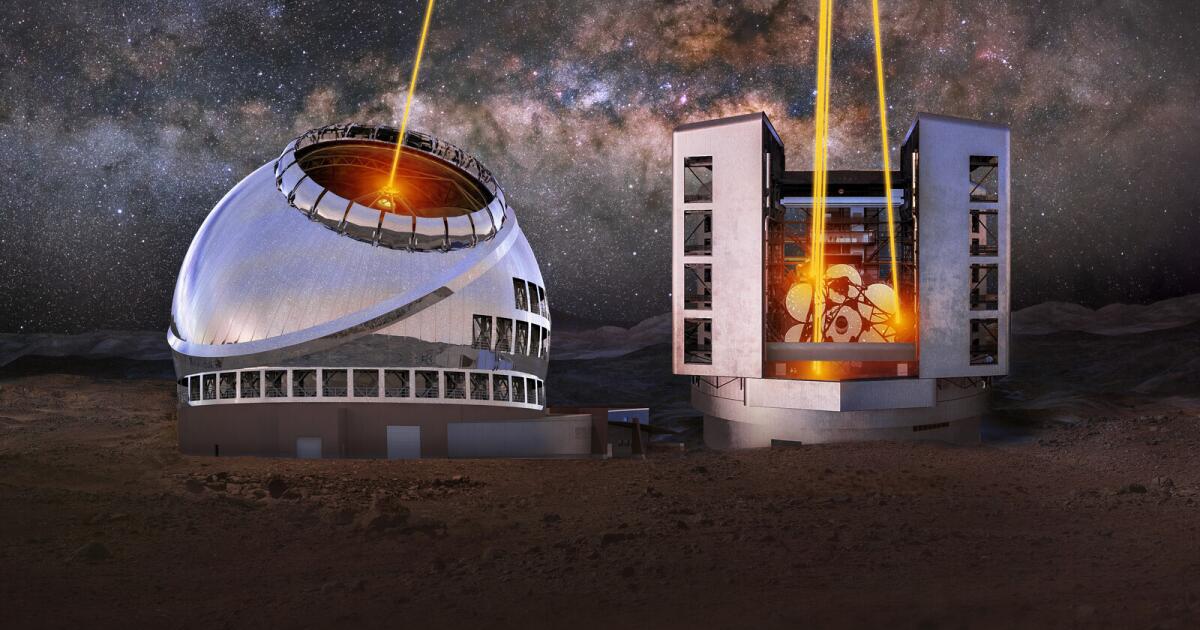

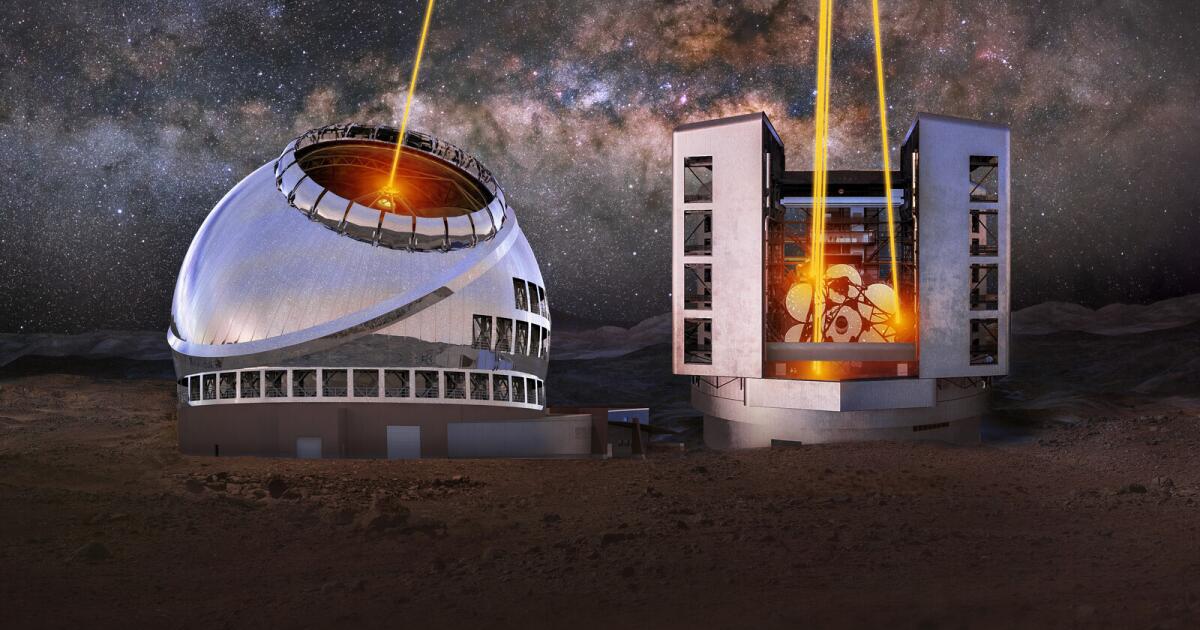

Science1 week ago

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire