Finance

How Republicans created – and now exploit – the debt crisis

It’s that time again. A Democrat is in the White House and Republicans control the House of Representatives. Sure enough, the GOP is once again engaging in dangerous political hostage-taking over America’s massive federal debt.

Republicans, in short, are demanding major concessions before agreeing to raise the debt limit. The irony is that the GOP is overwhelmingly responsible for the staggering accumulation of debt over the past four decades. In other words, Republicans are engaging in the political equivalent of starting a four-alarm blaze and refusing to allow firefighters to do their job until someone pays up.

Twice in recent history – in 1980 and 2000 – America was on track to eliminate the federal debt. In both instances, Democratic presidents passed the baton to Republicans who proceeded to balloon the debt, demolishing any hope of paring down America’s IOUs.

In 1981, Republicans (with a major assist from conservative Southern Democrats) passed the then-largest tax cut in history. In a striking abandonment of decades of sound tax policy, President Reagan’s cuts overwhelmingly benefitted the ultra-wealthy.

At the same time, the Reagan administration spent trillions on a massive – and thoroughly unnecessary – military buildup.

Despite negligible economic growth from Reagan’s massive tax cuts for the wealthy, the federal debt tripled. As one Reagan and Bush administration official put it, “In the Reagan years, more federal debt was added than in the entire prior history of the United States.”

Then, in 2000, President Bill Clinton left office with historic budget surpluses. The United States was on track to eliminate the entire national debt – yes, all of it – within a decade.

But just a few months before the Sept. 11, 2001, jihadist attacks, newly-elected Republican President George W. Bush slashed taxes on the ultra-wealthy. Any hope of reducing, let alone eliminating, the debt was shattered for decades to come.

Bush then launched a tragically unnecessary multi-trillion-dollar war of choice, swelling the debt even further.

Now, in the face of conservative historical revisionism, let’s be clear: Clinton’s record budget surpluses are a product of Democrats’ 1993 tax increase on the wealthy, coupled with the booming economy that followed. Republicans who claim that the 1997 passage of (yet more) GOP tax cuts for the wealthy led to the historic Clinton-era surpluses need to check the math.

As noted, the American economy, buoyed by the internet revolution, climbed to soaring heights in the years after Clinton and the Democrats raised taxes on the wealthy. This is a critical lesson that Reagan, Bush and Trump-style “supply-siders” apparently have yet to learn.

Indeed, the theory of “trickle down” economics – the raison d’être of the post-1980 GOP – has been exhaustively discredited. Reagan, Bush and Trump’s tax cuts for the wealthy resulted in no significant economic growth or wage benefits for workers, despite significant declines in revenue. Far worse, the cuts turbocharged inequality.

Ultimately, one does not need an accounting degree to see how massive decreases in revenue from Trump-style tax cuts for the ultra-wealthy, coupled with enormous increases in unnecessary defense spending, led to the explosion in debt that America grapples with today.

A remarkable graphic created by the U.S. Treasury Department drives this point home. Readers should digest how Trump, Reagan and Bush-style tax cuts for the wealthy led to a multi-trillion-dollar swing – from historic budget surpluses to massive debt – in just a few years.

Of note, Obama-era crisis spending (lauded by most economists) to shore up an economy hemorrhaging hundreds of thousands of jobs each month is a drop in the bucket compared to the trillions in revenue lost due to Trump, Bush and Reagan-style tax cuts for the ultra-wealthy.

But the broader implications of the debt are far more profound than the abstract metrics described above.

As trillions in government IOUs stacked up and the very wealthy became ultra-wealthy, the American middle class collapsed. From 1975 to 2018, extreme, Trump-style economic policies led to the transfer of a staggering $50 trillion in wealth from millions of hard-working Americans to the top 1 percent.

Those who lost the most over the past four decades – white, blue-collar Americans – now confront an epidemic of deaths of despair (deaths by alcohol, suicide, opioids and other drugs) unheard of elsewhere in the world. Since economic distress is closely correlated with the rise of extreme political ideologies, it should come as little surprise that this demographic makes up Trump’s base. (Case in point: Most of the individuals arrested following the Jan. 6, 2021, riot had significant financial problems.)

Make no mistake: The debt is a glaring symptom of the dangerous inequality at the root of the political, cultural and social schisms now dividing America. That Republicans continue to engage in political brinksmanship over the debt – a crisis overwhelmingly of their own making – is unconscionable.

Marik von Rennenkampff served as an analyst with the U.S. Department of State’s Bureau of International Security and Nonproliferation, as well as an Obama administration appointee at the U.S. Department of Defense. Follow him on Twitter @MvonRen.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Finance

Logan Ridge Finance Corporation Schedules Fourth Quarter and Full Year 2024 Earnings Release and Conference Call

Call Scheduled for 11:30 am ET on Friday, March 14, 2025

NEW YORK, Jan. 16, 2025 (GLOBE NEWSWIRE) — Logan Ridge Finance Corporation (Nasdaq: LRFC) (“LRFC,” “Logan Ridge” or the “Company”) to release its financial results for the fourth quarter and full year ended December 31, 2024, on Thursday, March 13, 2025, after market close. The Company will host a conference call on Friday, March 14, 2025, at 11:30 a.m. ET to discuss these results.

By Phone: To access the call, please dial (646) 968-2525 approximately 10 minutes prior to the start of the conference call and use the conference ID 1779602.

A replay of this conference call will be available shortly after the live call through March 21, 2025.

By Webcast: A live audio webcast of the conference call can be accessed via the Internet, on a listen-only basis at https://edge.media-server.com/mmc/p/h9fj5e3y. The online archive of the webcast will be available on the Company’s website shortly after the call at www.loganridgefinance.com in the Investor Resources section under Events and Presentations.

About Logan Ridge Finance Corporation

Logan Ridge Finance Corporation (Nasdaq: LRFC) is a publicly traded, externally managed investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. Logan Ridge invests primarily in first lien loans and, to a lesser extent, second lien loans and equity securities issued by lower middle market companies. Logan Ridge Finance Corporation is externally managed by Mount Logan Management, LLC, a wholly owned subsidiary of Mount Logan Capital Inc. Both Mount Logan Management, LLC and Mount Logan Capital Inc. are affiliates of BC Partners Advisors L.P.

Logan Ridge’s filings with the Securities and Exchange Commission (the “SEC”), earnings releases, press releases and other financial, operational and governance information are available on the Company’s website at loganridgefinance.com.

Contacts:

Logan Ridge Finance Corporation

650 Madison Avenue, 3rd floor

New York, NY 10022

Brandon Satoren

Chief Financial Officer

Brandon.Satoren@bcpartners.com

(212) 891-2880

The Equity Group Inc.

Lena Cati

lcati@equityny.com

(212) 836-9611

The Equity Group Inc.

Val Ferraro

vferraro@equityny.com

(212) 836-9633

Finance

The brave new world of Open Finance

Don Cardinal of Financial Data Exchange (FDX) explores how Open Finance extends beyond Open Banking, revolutionising financial data sharing.

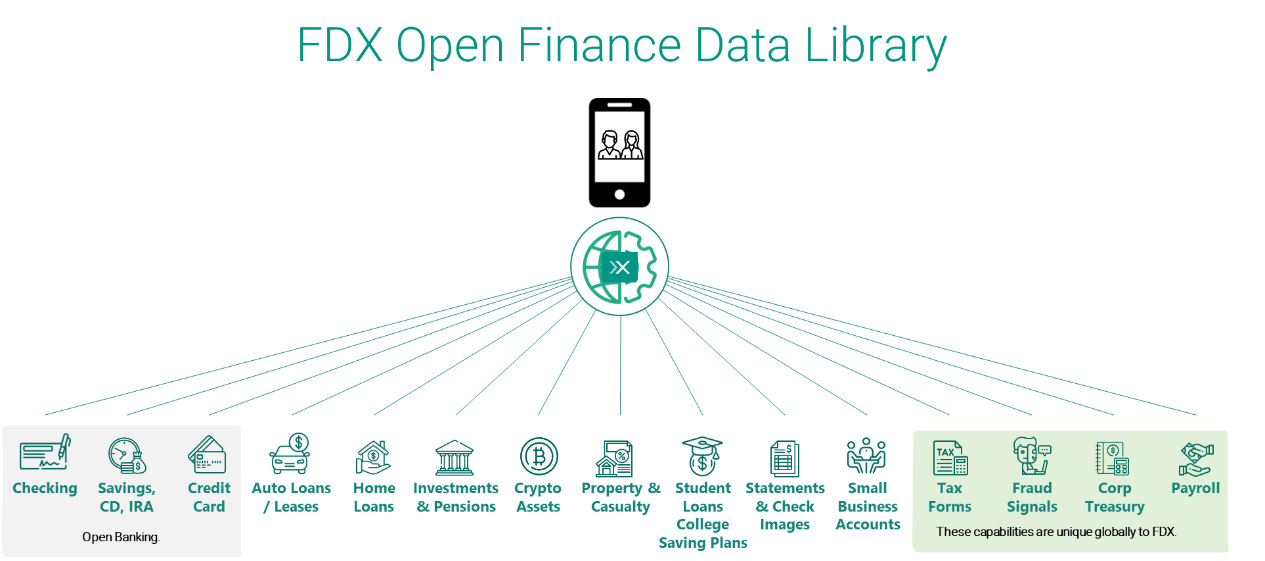

Much ink has been spilt on the topic of Open Banking, but I wanted to take a step today into a larger world of Open Finance. Whereas Open Banking is most commonly associated with current accounts (checking, savings, credit cards), Open Finance is concerned with the totality of your financial world.

While current accounts are important in the personal financial management use case, when you look at more sophisticated needs, liability accounts like auto loans, home loans, and student loans are required to help give context to a personal balance sheet. Finally, the addition of investment and retirement accounts gives the wealth management user a full 360-degree view of the consumer’s financial health.

Additional use cases – such as account and balance verification, bill payment, and payroll needs like verification of income/employment and pay stub retrieval – along with the ability to retrieve tax forms like W2, 1098, 1099, and capital gain statements for tax preparation, round out the most common consumer demands for linking accounts.

These are all important use cases for consumers and small businesses, but it is also important to address why data providers like banks, brokers, and others would benefit from data sharing.

We know that one in three digitally-enabled consumers has shared access to their financial data in the last year and similar polls of financial institutions tell us that at least one-third (if not more) of their online banking traffic was credential-based access (screen scraping) to power these use cases.

Imagine if a data provider could reduce one-third of its entire load on its online infrastructure in favour of a portal 100 times more efficient than screen scraping. The introduction of secure APIs does just that. Lowering costs of hardware overall.

One of the other uses by data providers is data-in, to pre-fill new account applications as well as provide strong signals for Know Your Customer (KYC), including account tenure at a predecessor institution. Better data means faster, more accurate decisions leading to fewer abandons or declines, meaning more revenue for the institution.

As a banker for a number of years, one of the biggest questions we had was ‘What was our share of a given customer’s wallet?’ We often had to try to infer based on monies in and out, but with Open Finance, you can link to other institutions and know in real time what your share of wallet is. This allows you to be almost surgical in your marketing and product offering.

All this is made possible by secure, permissioned data sharing via a common API standard.

Looking forward

Avoid FUD (fear, uncertainty, and doubt). Many jurisdictions have implemented Open Banking (the UK, EU, Australia, Brazil, among others) and there has yet to be a mass exodus of consumers in any of these nations. Why? If you are confident in your product, your pricing, and your service, making data available via an API does nothing to incent consumers to leave, rather the opposite. The largest credit union in Brazil said at the FDX Spring 2024 Summit that they saw a net increase in digital engagement and accounts per customer after Open Banking was introduced.

A last bit of advice: APIs are a net new channel and will be the third leg in the digital stool. Online, Mobile, and API will be the troika. APIs are much more efficient and can deliver data that cannot be displayed visually. As you make your plans for 2025 and 2026 for your digital roadmap, you would be remiss in not including Open Finance APIs in your product mix. Your competitors are.

This editorial piece was first published in The Paypers’ Open Finance Report 2024, the latest comprehensive market overview and analysis focusing on the key players and products within the Open Banking and Open Finance ecosystem. Download the full report to discover more insightful content.

About Don Cardinal

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

About FDX

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

Finance

Boost your finances in 2025: Experts share top New Year's money resolutions

Boost your finances: Experts share top 2025 money resolutions

With holiday credit card bills starting to roll in, you might want to shift your New Years resolution from your waistline to your wallet.

CHICAGO – With holiday credit card bills starting to roll in, you might want to shift your New Year’s resolution from your waistline to your wallet.

In a Fox 32 money saver special report, we asked the experts for a little help on how to boost your finances in 2025.

SMART MONEY MOVES

Why you should care:

“Some of the resolutions, some of the tips we would recommend for your New Year resolutions, financially, is to plan for retirement,” said Chip Lupo, a writer and analyst at WalletHub.

Lupo said it’s critically important that you begin to build an emergency fund to avoid relying on high-interest credit cards during life’s unexpected moments.

“We’re in a situation now where, because of the inflationary economy, people are now relying on credit cards for everyday expenses when the primary objective of a credit card for most people is to have basically an emergency fund,” Lupo said.

Lupo said that wages aren’t keeping up with the rate of inflation, and people are turning to credit cards for the essentials such as food and gas, which leads to significant debt by the end of the year.

“I think a big area that lot of consumers can agree on was the rising living costs,” said consumer finance expert Andrea Woroch. “Inflation impacting how much they’re spending on housing, transportation, groceries as well as even health care.”

MAKE A GAME PLAN

What you can do:

Woroch said you need to get back to the basics – set a budget this year and follow it.

“A lot of people think of a budget as being really restrictive and while it does cap you on spending in certain areas, a budget allows you to see where you are potentially wasting money on things you don’t need,” Woroch said.

If you think setting up a budget can be overwhelming, Woroch said going into debt and having no money in savings can be even worse.

Not to mention, there are digital tools and apps to help you set a budget, like the “You Need a Budget” app, or YNAB.

“Saying you are going to pay off debt is not enough. You have to be specific with how much debt you are going to pay off and set a realistic goal,” Woroch said.

When you take on this financial resolution, Woroch said it’s important to have a plan in place. Use a balance transfer credit card or pay off the smallest balance first.

If you don’t have a plan, Woroch said you will likely just continue your cycle of debt.

Another tip from our experts, they both recommended taking advantage of the high interest rates being offered with online bank accounts or CD’s.

The Source: For this story, the Fox 32 Chicago Special Projects team spoke with leading personal finance experts Chip Lupo from WalletHub and Andrea Woroch.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology1 week ago

Technology1 week agoMeta is highlighting a splintering global approach to online speech

-

Science5 days ago

Science5 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood

-

Business1 week ago

Business1 week agoMeta Drops Rules Protecting LGBTQ Community as Part of Content Moderation Overhaul

-

Education1 week ago

Education1 week agoFour Fraternity Members Charged After a Pledge Is Set on Fire

-

Politics1 week ago

Politics1 week agoTrump trolls Canada again, shares map with country as part of US: 'Oh Canada!'