Hong Kong

CNN

—

Hong Kong’s Covid-hit economic system will return to progress this yr and increase by between 3.5% and 5.5%, as the town opens up and China’s financial outlook improves, Hong Kong’s monetary secretary stated on Wednesday.

The Asian monetary hub suffered a 3.5% contraction final yr, as strict Covid restrictions and weakening international demand damage spending and exports. It was the third contraction in 4 years for the town of seven million folks.

After Hong Kong considerably relaxed its Covid curbs final month, it’s trying to revive the economic system by a raft of measures, together with providing money handouts to residents and chopping salaries tax to spice up spending. It’s additionally stepping up a drive to draw employees and investments amid rising competitors from Singapore.

On Wednesday, Hong Kong’s monetary secretary Paul Chan stated the economic system will stage a big rebound this yr, with actual GDP progress hitting 3.5% to five.5%.

“Hong Kong’s exports of products will nonetheless face extreme challenges this yr. Nevertheless, the accelerated progress of the [Chinese] mainland economic system coupled with the lifting of restrictions on cross-boundary truck actions ought to alleviate a part of the stress,” Chan stated in a speech outlining the town’s funds for the 2023 to 2024 fiscal yr.

The variety of guests can be anticipated to see “a robust rebound” after Hong Kong eliminated quarantine necessities for inbound vacationers.

“As general financial sentiment improves, non-public consumption will enhance,” he added.

Beforehand, analysts had broadly raised their forecasts for Hong Kong’s financial progress to a spread between 3% and 6.5%.

“We elevate our GDP forecast to mirror accelerated post-Covid reopening and improved China prospects,” analysts from Customary Chartered Financial institution stated in a latest analysis report, including that they count on Hong Kong’s GDP to increase by 3.2% in 2023 and three.6% in 2024.

Industries like tourism, commerce, and actual property, are set to “experience the crest of Hong Kong’s reopening wave,” they stated.

To spur the economic system, the Hong Kong authorities will give out additional cash handouts to all adults this yr, with every eligible resident resulting from obtain HK$5,000 ($637) in spending vouchers, Chan stated on Wednesday. Nonetheless, that’s solely half of final yr’s quantity of HK$10,000, as the town’s fiscal deficit has ballooned.

The federal government may even cut back the salaries tax with a cap of HK$6,000, which ought to profit 1.9 million tax payers, Chan stated.

Different measures to help restoration embrace vitality and transportation subsidies to residents, a brand new capital funding entrant program (which is aimed toward attracting abroad investments), extra efforts to construct a inexperienced tech monetary market in Hong Kong, and contemplating permitting inventory buying and selling throughout extreme climate. Presently, buying and selling in Hong Kong’s monetary market could be suspended underneath excessive climate, reminiscent of a hurricane.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

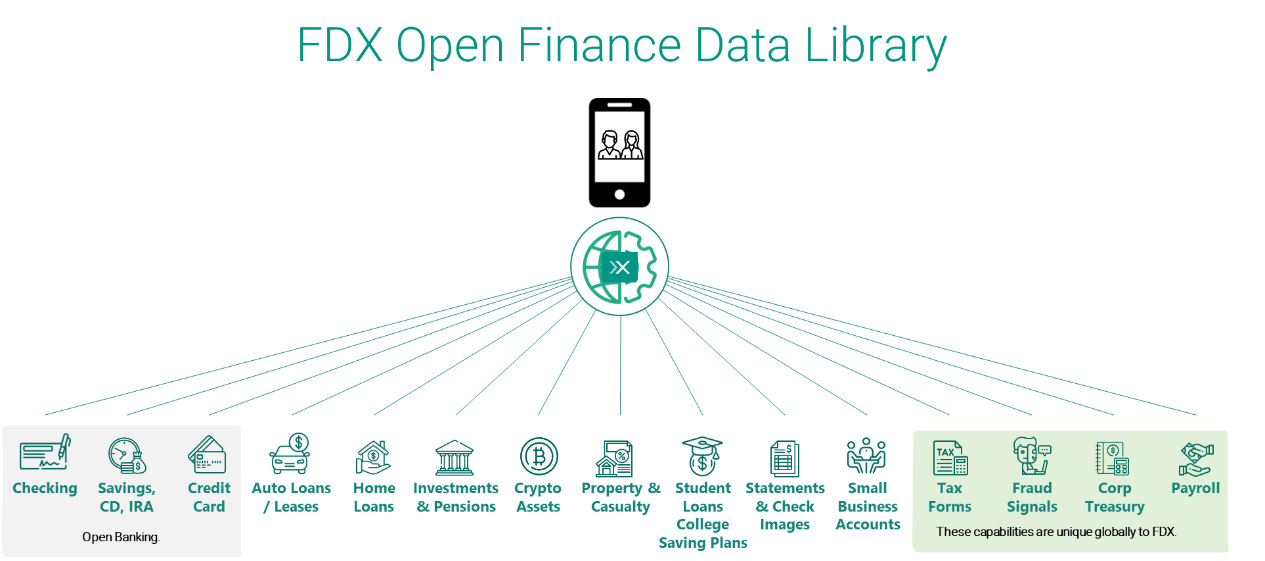

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)