Finance

FINANCE: USC’s divestment from fossil fuels prescribed key updates – Daily Trojan

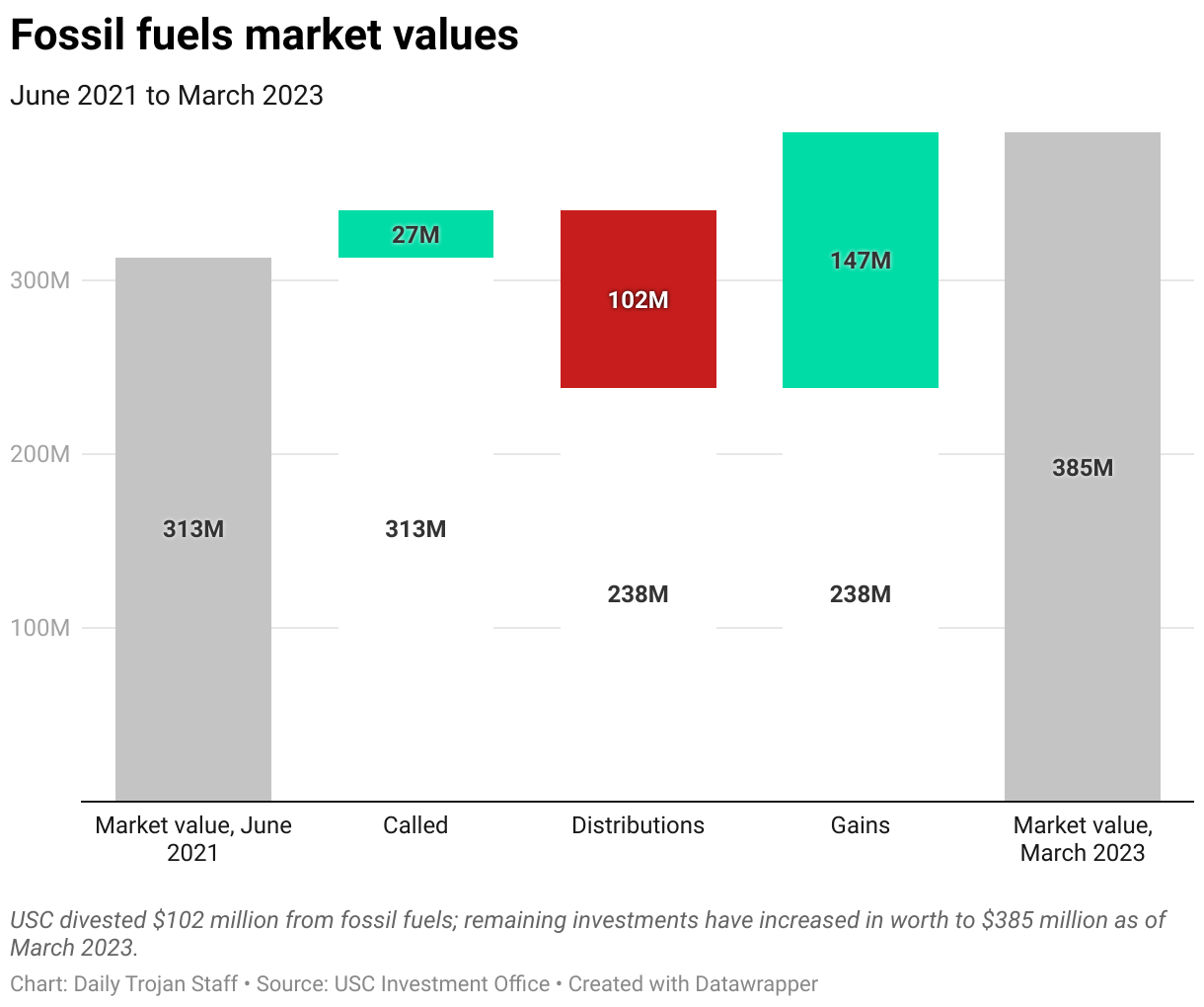

Within the first replace because it made public its dedication to fossil gas divestment two years in the past, USC divulged that it bought one-third of its divestment portfolio by withdrawing $102 million from investments that have been price $313 million in June 2021.

The worth of the remaining investments within the portfolio has appreciated to $385 million.

The funding workplace additionally gave updates on the timeline inside which it’s supposed to totally withdraw from these investments. In an interview with the Every day Trojan, Amy Diamond, USC’s chief funding officer, stated the College is trying to satisfy its dedication to divestment in a “prudently monetary method.”

“We’re very dedicated to liquidating this portfolio, however the essential side of it’s ensuring we achieve this by producing essentially the most quantity of proceeds we will, in order that we’re not hurting the endowment, since we’re accountable for rising the worth of the endowment,” Diamond stated.

Pre-existing name contracts triggered a further $27 million of funding on the unique $313 million pot earlier than a bulk of the investments was withdrawn. Regardless of the withdrawal, the worth of USC’s fossil gas holdings then elevated round 23% as of March 2023. Diamond stated macroeconomic traits and worth hikes associated to the pandemic and Russia’s struggle in Ukraine have been the explanation for this.

The College will proceed what it describes as a 10-year means of withdrawing from partnerships and funds which can be primarily invested in fossil fuels, together with oil and gasoline. William Higbie, a Pupil Sustainability Committee member, was amongst a number of college students who largely lauded a gathering between SSC members and the funding workplace for the transparency with which progress was mentioned.

Within the assembly, the College dedicated to collaborating with college students to offer a quarterly reality sheet about fossil gas divestment, in addition to publicly define its “Funding Stewardship Coverage” by selecting ESG funding requirements for the endowment. Higbie, a junior majoring in cinema and media research, stated the assembly was an “extraordinarily optimistic” signal.

“I walked in not understanding what to anticipate,” Higbie stated. “The very last thing frankly anybody had actually heard was that they have been going to decide to eradicating and transferring that $277 million in fossil gas [investments, back in February 2021].”

USC’s divestment efforts are half of a bigger development throughout increased establishments within the nation: Greater than 100 universities throughout the US have dedicated to comparable methods, together with Columbia College and Dartmouth College.

Nevertheless, not all establishments have been divesting on the similar tempo. The UC system totally divested all its fossil gas holdings virtually three years in the past following an effort that started six years sooner than USC. When requested why USC had selected a 10-year timeline, Diamond stated it could have been because of the differing non-public and public natures of the colleges’ investments.

“One query can be how a lot that they had within the public markets, which is clearly a lot simpler to divest from,” Diamond stated. “Now we have very restricted publicity to grease and gasoline corporations within the public markets.”

Jules Flores, a member of SSC, stated divesting away from fossil fuels is a pure monetary course of.

“We’ve seen that fossil gas funding is just not a sensible funding alternative,” stated Flores, a sophomore majoring in worldwide relations. “It’s going to maintain devaluing as different, newer applied sciences … come up.”

Critics of divestment as a sustainability technique have labeled it ineffective, stating that for an establishment to promote its investments in fossil fuels, one other celebration has to purchase them. Nonetheless, Flores, described the answer as “the very best that we’ve obtained,” and Higbie stated that, as half of a bigger divestment motion, USC’s efforts wouldn’t go to waste.

“It’s not like USC is divesting in a vacuum,” Higbie stated. “When you’ve gotten establishments like Harvard, and the Los Angeles pension fund, and numerous different giant establishments, eradicating their cash from soiled vitality, it has a really giant impact and it makes their inventory price much less, which creates uncertainty for his or her firm.”

The potential success of divestment is “a much bigger query of whether or not, collectively, institutional buyers could make a change in how the world will get its vitality,” Diamond stated, including that a lot of USC’s friends — together with universities like Harvard College which have additionally dedicated to divestment — have been now not all for investing in fossil fuels, scuppering demand and leading to worth reductions for these merchandise.

“That’s direct proof that the efforts that teams like the scholar group at USC which have actually pushed for fossil gas divestment, collectively, could make change on the planet,” Diamond stated.

Based on Flores, the moral argument for divestment is simply too sturdy to disregard.

“If we maintain doing that and funding issues which can be actively destroying our planet, it’s not only a fiduciary duty — it’s an moral and ethical one,” Flores stated.

Higbie stated that whereas this line of argument was a “good speaking level,” profitable mass adoption of sustainable alternate options to fossil fuels would solely occur if these choices have been economically viable.

“Persons are motivated by what’s extra economically viable,” he stated. “Folks aren’t going to purchase an electrical automobile if it’s cheaper to have a gasoline automobile.”

Based on Diamond, the College has made greater than $230 million of recent, further investments into environmentally-friendly alternatives throughout this time, together with initiatives associated to carbon seize and photo voltaic expertise.

“We’re above tempo relative to the distributions we’ve obtained from that portfolio,” Diamond stated. “We’re discovering extra enticing alternatives in areas comparable to carbon seize and photo voltaic and different types of infrastructure and investments. That helped for transitioning away from fossil fuels.”

Going ahead, Diamond stated she expects the overwhelming majority of the College’s portfolio in fossil fuels will likely be bought off in a a lot shorter interval than the 10-year goal the funding workplace has set itself.

“[Around] half of the portfolio is with two portfolio corporations, so the expectation is that after these are liquidated, the worth of the portfolio can be considerably under the place it’s in the present day,” Diamond stated. “We anticipate these to be liquidated inside three years and on the surface 5 years, so it’s going to be a portfolio that has some tail publicity that lasts for fairly a while.”

Higbie stated the targets the funding workplace must obtain usually are not simply associated to the portfolio figures.

“We’re on the lookout for accountability and transparency, together with urgency,” Higbie stated.

Finance

SRG Housing Finance Q4 Results Live : profit rise by 45.65% YOY

SRG Housing Finance Q4 Results Live : SRG Housing Finance announced their Q4 results on 23 May, 2024, showcasing a significant growth in their financial performance.

The company reported a 38.64% increase in revenue and a 45.65% rise in profit year-over-year.

Quarter-on-quarter comparison also revealed positive growth, with revenue growing by 13.89% and profit increasing by 14.46%.

However, the Selling, general & administrative expenses saw a noticeable increase, rising by 8.82% sequentially and 43.86% year-on-year.

Similarly, the operating income also showed a positive trend, with an 18.1% increase quarter-on-quarter and a 42.73% rise year-on-year.

The Earnings Per Share (EPS) for Q4 stood at ₹4.72, marking a 29.67% increase year-on-year.

In terms of market performance, SRG Housing Finance delivered a 2.84% return in the last week, 0.87% return in the last 6 months, and a 1.99% year-to-date return.

The company currently holds a market cap of ₹378.12 Cr, with a 52-week high/low of ₹336.75 and ₹230 respectively.

| Period | Q4 | Q3 | Q-o-Q Growth | Q4 | Y-o-Y Growth |

|---|---|---|---|---|---|

| Total Revenue | 36.15 | 31.74 | +13.89% | 26.07 | +38.64% |

| Selling/ General/ Admin Expenses Total | 7.64 | 7.02 | +8.82% | 5.31 | +43.86% |

| Depreciation/ Amortization | 1.71 | 1.58 | +7.86% | 0.97 | +76.31% |

| Total Operating Expense | 28.79 | 25.51 | +12.86% | 20.92 | +37.63% |

| Operating Income | 7.35 | 6.23 | +18.1% | 5.15 | +42.73% |

| Net Income Before Taxes | 7.61 | 6.7 | +13.64% | 5.37 | +41.65% |

| Net Income | 6.09 | 5.32 | +14.46% | 4.18 | +45.65% |

| Diluted Normalized EPS | 4.72 | 4.09 | +15.33% | 3.64 | +29.67% |

FAQs

Question : What is the Q4 profit/Loss as per company?

Ans : ₹6.09Cr

Question : What is Q4 revenue?

Ans : ₹36.15Cr

Stay updated on quarterly results with our results calendar

You are on Mint! India’s #1 news destination (Source: Press Gazette). To learn more about our business coverage and market insights Click Here!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 26 May 2024, 02:27 AM IST

Finance

G7 finance ministers back plan to use Russian assets for Ukraine funding – the FT

Stock photo: Getty Images

The G7 finance ministers supported the idea of providing Ukraine with a loan secured by profits from frozen Russian assets to ensure funding for Kyiv after 2024.

Source: Financial Times, citing the draft communiqué of the ministers’ meeting, as reported by European Pravda

The ministers’ discussions were based on a US proposal, which was circulated before the meeting in the Italian city of Stresa, to issue Ukraine a loan of about US$50 billion, to be repaid from the profits of the Russian central bank’s assets amounting to around €190 billion.

Advertisement:

The ministers stated that they were “making progress” in working out options to “bring forward” the profits, according to the draft communiqué. They added that options for structuring the loan would be presented to the G7 leaders before the June summit.

They also promised to continue pressuring China to reduce industrial subsidies that they believe are driving Western competitors out of business, and stated that implementing the most significant global tax agreement in more than a century is a “top priority”.

The G7, a group of advanced economies that includes all major Western allies of Ukraine, aims to ensure funding for Kyiv in the long term, even after this year when crucial elections will take place on both sides of the Atlantic.

According to people familiar with the negotiations, many details of the loan are yet to be agreed upon, including the amount, who will issue it, and how it will be guaranteed in case of Ukraine’s default or if the profits do not materialise.

One official mentioned that Europeans are particularly concerned about “fair-risk sharing”, fearing that Europe will bear the brunt of the financial and legal risks and potential retaliatory actions from Russia, as most of the assets are located on the continent.

This week, the EU officially approved a plan to use interest from frozen Russian assets, which, according to estimates, could bring up to three billion euros per year to Ukraine.

Background:

- In February, the United States argued that G7 countries should fully seize frozen assets, but later abandoned this idea due to concerns from allies that it could set a dangerous legal precedent and prompt retaliatory measures from Russia.

- Earlier, Minister of Foreign Affairs Dmytro Kuleba stated that Ukraine insists on the confiscation and transfer to Ukraine of all frozen assets of the Russian Federation held in the West.

Support UP or become our patron!

Finance

Big Players Maneuver In Global Finance And Industry

What’s going on here?

From hostile takeovers to strategic acquisitions, major financial and industrial players are making bold moves to bolster their market positions. Spanish bank BBVA, Swiss private bank Julius Baer, and British IT services group Redcentric are all in high-stakes negotiations for potential mergers.

What does this mean?

BBVA’s €12.23 billion hostile takeover bid for Sabadell marks a major potential consolidation in the Spanish banking sector, despite opposition from Madrid. Julius Baer’s talks with EFG International highlighted competition in Swiss private banking, though discussions have ceased. In IT services, Redcentric’s negotiations with Milan-listed Wiit SpA could lead to a substantial acquisition. Additionally, private equity firm Carlyle is preparing to sell aerospace manufacturer Forgital, signaling increased activity in the aerospace sector. Also, Deutsche Bahn is advancing in the bidding process for its logistics subsidiary Schenker, with four contenders still vying for it.

Why should I care?

For markets: Strategic consolidations and divestments.

These moves reflect broader trends of consolidation and strategic realignment across industries. BBVA’s bold bid for Sabadell and Criteria’s acquisition of a 9.4% stake in ACS for €983 million signify aggressive strategies to capitalize on market opportunities. Carlyle’s plan to sell Forgital and Saudi Aramco’s in Repsol’s renewable energy division highlight the growing focus on portfolio diversification and sustainability.

The bigger picture: Global shifts in financial and industrial landscapes.

These developments indicate profound changes in the global financial and industrial sectors. KKR’s likely approval to acquire Telecom Italia’s fixed-line network without EU antitrust conditions signals a favorable regulatory climate for strategic deals. On the flip side, the Italian government’s decree for state broadcaster RAI to possibly merge its tower unit, RaiWay, with EI Towers shows the fluidity of managing national strategic assets. Meanwhile, Coventry Building Society’s £780 million purchase of Co-operative Bank underscores ongoing consolidation in the British banking sector.

-

News1 week ago

News1 week agoHow a migrant aid group got caught up in a right-wing social media thread : Consider This from NPR

-

Movie Reviews1 week ago

Movie Reviews1 week agoIs Coppola’s $120M ‘Megalopolis’ ‘bafflingly shallow’ or ‘remarkably sincere’? Critics can’t tell

-

Movie Reviews1 week ago

Movie Reviews1 week agoGuruvayoor Ambalanadayil movie review: This Prithviraj Sukumaran, Basil Joseph-starrer is a total laugh riot

-

World1 week ago

World1 week agoTaiwan grapples with divisive history as new president prepares for power

-

Politics1 week ago

Politics1 week agoSouthern border migrant encounters decrease slightly but gotaways still surge under Biden

-

World1 week ago

World1 week agoSlovakia PM Robert Fico in ‘very serious’ condition after being shot

-

Crypto1 week ago

Crypto1 week agoVoice of Web3 by Coingape : Showcasing India’s Cryptocurrency Potential

-

News1 week ago

News1 week agoThe NFL responds after a player urges female college graduates to become homemakers