Finance

Defiance and resilience: Ukraine’s financial sector

There’s one sound that Anastatasiya Shevchenko thinks of when speaking about Kyiv.

It is a low, virtually fixed buzz that flows by means of the streets. It has grow to be as a lot part of city life for town of about 2.8 million individuals — roughly the scale of Chicago — because the cacophony of distant honking horns. But it surely’s an uncommon noise, not one an individual would possible come throughout within the Windy Metropolis or one other city middle.

And in contrast to the piercing rackets of missiles and exploding bombs Ukraine’s capital has endured over the previous 12 months, this new sound is welcome to Shevchenko. To Shevchenko and plenty of others, it’s what hope appears like. It is what a metropolis getting again to enterprise appears like. It is what courageous individuals making an attempt to shake off the fixed risk of violence and conflict appears like.

“If you happen to exit within the streets, you may hear the pleased noise of mills,” stated Shevchenko, a normal accomplice at Lugera, a Kyiv-based human sources and recruitment firm that serves monetary establishments.

“The mills are everywhere in the metropolis. that you’ll have your life again if you hear them,” she added, noting that the mills aren’t affected by assaults on the principle energy grid and are used to maintain all types of companies needed for every day life working, together with {hardware} shops, faculties, hospitals and financial institution workplaces. “Enterprise is working, it is in a survival mode.”

To say Ukraine has been by means of hell prior to now 12 months can be to understate the horror its individuals have suffered. Kyiv and plenty of different cities have been savaged by Russian President Vladimir Putin’s conquest.

Greater than 8,000 non-combatants have died in Ukraine, in accordance with the United Nations, whereas tens of millions of others have been displaced and lots of the nation’s cities and communities lay in smash. Air raid sirens, missiles and bombings are nonetheless a frequent incidence and a driving issue within the rise of using mills.

Shevchenko, who travels backwards and forwards between Bucharest, the capital of Romania, and Kyiv, is among the many hundreds of staff in banking, know-how and monetary companies who’ve had their lives turned the other way up because the invasion started on Feb. 24, 2022.

A variety of these people spoke with American Banker about their experiences. They mentioned not simply how they’ve responded to the invasion, but in addition how they’ve managed to proceed doing their jobs in financial institution innovation, staffing, programming and funds and the way that is serving to Ukraine get again on its toes.

“We’re undoubtedly making ready for the time after the conflict,” Shevchenko stated, including her agency is anticipating investing in Ukraine as the corporate reconstructs its banking and industrial infrastructure. That can create potential demand for monetary service employees.

“There’s numerous building that may have to be completed to rebuild these cities, and that may require finance,” she stated.

Oleksander Gimanov/Photographer: Oleksander Gimanov

‘We’ve grow to be extra resilient’

Ukraine’s rebuilding ought to entice funding much like what occurred beneath the Marshall Plan, the post-World Warfare II effort that led to billions being invested in Europe’s restoration and that created markets for American items and merchandise.

The price to rebuild Ukraine’s infrastructure will rely upon the size and severity of the battle, however early estimates are about $750 billion, in accordance with The New York Occasions. That can require financing and funding, creating a possibility for buyers, banks, building corporations and different events.

In February, executives from JPMorgan Chase met with Ukrainian President Voldymry Zelensky to seek the advice of with Ukraine’s authorities on rebuilding. The Ukrainian authorities and the financial institution signed a memorandum of understanding beneath which the New York-based establishment will advise on points equivalent to monetary stabilization, reconstruction and constructing financial ties to Europe, in accordance with Zelensky’s workplace.

The February assembly constructed on the financial institution’s prior counsel relating to debt capital markets. JPMorgan Chase led Ukraine’s $20 billion debt restructuring in 2022, and the financial institution additionally dedicated greater than $10 million in humanitarian reduction and momentary housing assist in Poland for refugees.

The financial institution moreover employed 50 Ukrainian refugees in its Warsaw workplace, and positioned them in a coaching program for individuals displaced by the conflict. JPMorgan Chase didn’t present remark for this text.

It is possible that war-torn Ukraine will want vital assist from international banks in its restoration. Ukrainian financial institution earnings plunged 68% in 2022, in accordance with S&P International Market Intelligence, which attributed the decline to provisioning for incurred and anticipated losses because of the conflict. In distinction, U.S. banks’ publicity to the realm affected by the conflict is comparatively restricted, since many of those establishments moved belongings out of the area following Russia’s annexation of Crimea in 2014, in accordance with Reuters.

Amongst U.S. cost corporations, Visa disclosed in a Securities and Trade Fee submitting that it earned about 4% of its pre-war income from Russia and 1% from Ukraine. The corporate reported it could be capable of make up for the loss by development in different markets in a couple of 12 months, in accordance with The Wall Avenue Journal.

Anastatasiya Shevchenko

Mastercard acknowledged that it earned 4% of its pre-war income from Russia and a pair of% from Ukraine, in accordance with an SEC submitting. Administration stated it could lose about $37 million as a result of its departure from Russia, in accordance with Interfax. Mastercard’s 2022 world internet revenue was about $2.3 billion.

Nonetheless, regardless of the previous 12 months’s monetary losses, the banking ecosystem in Ukraine has proven resilience. Early within the invasion, Ukrainians flocked to withdraw cash from ATMs, and there have been lengthy strains at financial institution branches, in accordance with Shevchenko.

However fears of financial institution runs haven’t materialized, Shevchenko stated, including the power of most corporations to just accept contactless funds has been useful in constructing confidence amongst companies and customers.

The Lithuanian cost fintech Paysera, which labored to evacuate its employees from Ukraine because the invasion commenced, has spent the previous few months increasing its presence in Kyiv.

“As soon as we came upon that the Ukrainians had defended Kyiv, we had extra certainty and readability. We are actually strengthening our presence in Ukraine,” stated Kostas Noreika, co-owner of Paysera.

Over the previous few months, Paysera has rented extra workplace house to accommodate further employees. The agency now has greater than 40 programmers in Ukraine and is constant to recruit know-how employees. Earlier than the conflict, Kyiv was a burgeoning hub for fintech within the area, and Paysera anticipates the expertise and demand will nonetheless be there.

However the conflict is current in each step.

“Russia is consistently shelling Ukraine’s electrical energy infrastructure, making it troublesome to offer customer support over the cellphone as a result of energy outages,” Noreika stated. Paysera is among the corporations counting on mills in an effort to restrict disruptions. “So, from a technical standpoint, we have now grow to be extra resilient to disruptions in Kyiv.”

ZABIL

‘We’re nonetheless beneath assault’

Regardless of optimism from Shevchenko and others, there may be nonetheless a way of deep mourning. Many have come to the belief {that a} technology of Ukrainians and others in surrounding nations will carry the heavy toll of conflict.

“We’re near Ukraine, so we’re at all times conscious,” stated Kasia Fatyga, a senior advisor for Uncover Monetary Companies based mostly close to Warsaw, about 480 miles from the Ukrainian border.

Fatyga’s job has modified over the previous 12 months in a approach that demonstrates how conflict can trample enterprise relationships. She used to handle relationships with Uncover Diners Membership purchasers in Russia.

“That has stopped for apparent causes,” Fatyga stated.

She was additionally engaged on a fintech partnership inside Ukraine with a agency that gives digital funds and e-commerce assist, although that is been paused for now.

“In Ukraine, they’re extra targeted on guaranteeing the banking system and companies are engaged on a day-to-day degree,” stated Fatyga, who added she hopes to renew work with potential purchasers in Ukraine.

Throughout the previous 12 months Fatyga has volunteered with native rescue organizations to assist Ukrainians relocate to Poland. This work has included discovering transportation, lodging and companies for refugees. Near 10 million Ukrainian refugees have entered Poland prior to now 14 months, in accordance with Statista.

“There was a nationwide rebellion right here in Poland,” Fatyga stated, referencing Poland’s previous as a communist nation. It was as soon as thought of a satellite tv for pc state of the Soviet Union. “This is not the primary time. We had been additionally involved in 2014 [when Russia annexed Crimea]. We’ve tried to do no matter we will for Ukranians. We in Poland even have a previous with Russia.”

Shevchenko, who has additionally labored for Visa and at considered one of Ukraine’s largest banks, Oschadbank, stated that there was discuss of conflict earlier than the invasion, however seeing the battle unfold has nonetheless been a shock.

“We needed to cease all of our initiatives and work to evacuate individuals from Ukraine,” Shevchenko stated. “We had plans to do that earlier than the conflict, however no one critically thought it could occur. We had been making small discuss throughout conferences concerning the conflict. We hoped it could by no means occur so the environment throughout work was fairly regular earlier than.”

As soon as the evacuations began following the invasion, the scenes round bus terminals, practice stations, and even acquiring cab companies, had been chaotic, Shevchenko stated. The airport was closed and never an choice.

“No person actually anticipated the conflict to occur and it was very exhausting for individuals to just accept. All the pieces that might go flawed went flawed,” Shevchenko stated. “Lots of people that we had been anticipating did not present up. And we had been additionally making an attempt to trace down members of the family and pets. However lots of people did not need to go.”

It took about 5 days to evacuate greater than 100 households with ties to Lugera to Budapest and different areas. Shevchenko helped discover areas for individuals the place they might reside and work remotely till they might return to Ukraine. Lugera had labored with monetary purchasers in Hungary, and plenty of of those corporations helped discover lodging for Lugera’s employees. “At first our employees and households simply introduced what they might carry. They had been popping out of bomb shelters and did not even have baggage.”

One 12 months into the conflict, most of Shevchenko’s colleagues are again in Kyiv.

“The primary wave began going again in August. They wished their children to go to highschool as regular,” Shevchenko stated, estimating about 80% of the employees are actually again in Ukraine and within the workplace.

Shevchenko began commonly touring to Kyiv late final summer season and has been capable of observe her nation’s progress. At first, the streets had been empty and the shops had been closed, and the conventional sounds of a thriving, vibrant metropolis — individuals, automobiles, honking horns — had been all absent.

“On the retailers that had been open individuals had been lining as much as get meals,” Shevchenko stated.

By the top of 2022, provide chains had improved sufficient, and the Russian military’s advance had been adequately contained, to permit Kyiv to slowly resume its acquainted churn. The town’s residents proved to be down, however not overwhelmed.

“All of us perceive now that it will take time. We’re nonetheless beneath assault and might see the missiles and injury,” Shevchenko stated. “It is not going to be a matter of months, it could take longer than that. However the individuals I am working with are tremendous resilient.”

‘Fundamental freedom is gone’

Ukraine’s monetary infrastructure is now working correctly after some challenges early within the conflict, stated Oleg Sadikov, co-founder and CEO of Devico, a Ukrainian firm that builds app know-how for fintechs, cost know-how companies and different companies, principally within the U.Okay. and European Union. Devico is one other firm counting on mills to assist its workplaces and has accounts with three completely different web service suppliers to make sure continuity.

“We’re truly working greater than earlier than,” Sadikov stated. His agency is ready to use digital cost rails to pay and current invoices and entry different banking companies.

Sadikov hopes for a lift in enterprise from companies that spend money on reconstruction. “Individuals who did not know a lot about Ukraine earlier than know now,” Sadikov stated.

Sadikov stays upbeat following a horrible 12 months. When the conflict began, Sadivok moved his dad and mom from an residence in Saltykova, a residential space in Kharkiv within the northeastern a part of Ukraine, to his in-law’s house close by. Russian assaults ravaged Kharkiv, which was usually with out meals and water through the conflict’s early days.

“I noticed lifeless individuals on the streets, ruined buildings that I used to go to prior to now, exploded automobiles, and other people screaming,” Sadikov stated. “We had been continuously sitting in shelters, sleeping there within the chilly. There was an absence of meals in supermarkets, oil in gasoline stations and medicines in pharmacies.”

Kharkiv turned virtually a lifeless metropolis, he stated. “There have been areas of town the place just a few individuals lived. Unsure should you noticed Chernobyl, however the feeling of Kharkiv was related. It was a 1.8 million inhabitants metropolis earlier than Feb. 24.”

Sadikov and his family members stayed in a house close to Kharkiv for about two weeks, then moved to the western a part of Ukraine. The four-day journey was fraught.

“I stayed for an evening in the home of an individual I by no means knew earlier than. He agreed to allow us to sleep in his home as a result of we could not discover anyplace. All the pieces was overbooked. He fed us and gave us a spot to sleep in separate rooms of his home,” stated Sadikov, who now volunteers for organizations that present related companies to these displaced by the conflict.

On the day earlier than Sadikov left Kharkiv, a rocket exploded close to the home.

“It was a nightmare. It is a scary sound when a rocket flies close to you. You hear the velocity of the rocket when it flies after which an explosion,” he stated.

Many Ukrainians have grow to be acquainted with the sound of air raid sirens and have realized to distinguish between the sound of Ukrainian troopers responding to an assault and enemy hearth.

“It is a scary expertise and I do not advocate it to anybody,” Sadikov stated.

The conflict has additionally affected and displaced monetary companies employees with ties to Russia.

“All the pieces in Russia is closed for us now. Fundamental freedom is gone,” stated Vangelis Kondratevi, a researcher in Tbilisi, Georgia, for the San Mateo, California-based cost fintech Tipalti. “If I used to be in Moscow, it could be difficult for me to talk like this about what’s taking place there. I’d have most likely stated no to this interview.”

Greater than 20,000 know-how employees have left Russia for the Georgian capital simply north of Turkey because the starting of the conflict. General, greater than 300,000 Russians have crossed from Russia into Georgia, partly out of concern of navy conscription and partly out of concern Russia would goal individuals who didn’t assist the conflict.

Kondratevi, who was born in Georgia, is half Russian and half Ukrainian. His dad and mom migrated to Canada shortly after the invasion started. Earlier than the conflict, Kondratevi had moved from Georgia to Moscow to do market analysis for a fintech he most popular to not identify. However as soon as the invasion started, he returned to his house nation.

“My spouse was pregnant and we determined to return to Georgia to be on the secure aspect,” he stated, including he began to work for Tipalti after the transfer.

Life in Georgia just isn’t with out hazard. Russia occupies about 20% of the nation, following its 2008 invasion, and individuals who have entered Georgia from Russia over the previous 12 months have confronted some opposition from Georgian residents.

Nonetheless, it is much better to be in Georgia than Russia proper now, Kondratevi stated. Fears of reprisals and crackdowns in Russia abound for many who are against Putin’s regime, Kondratevi stated. “As a lot as I want to return, I do not know,” Kondratevi stated, “Even when the [Putin] regime goes away, it does not imply that the risk has gone.”

And Kondratevi has one more reason to remain put.

“We’ve a 9-month-old child lady, Sara, now,” he stated.

Finance

Strong Hong Kong dollar weighing on tourist spending: finance chief Paul Chan

“But the external environment remains complicated and there are a lot of uncertainties,” Chan said in his weekly blog. “The US Federal Reserve last week held interest rates steady. Coupled with stubborn inflation, the market expectation for a rate cut has weakened compared with earlier this year.”

He said the conditions could “bring adverse impacts to global economic recovery, Hong Kong’s exports, as well as the sentiment of local investment and capital markets”.

The Fed announced last week it was holding its benchmark lending rate steady in the 5.25 per cent to 5.5 per cent range as core inflation remained above the target of 2 per cent.

Chan said the city’s tourism sector was one of the key drivers of the economy in the first quarter, but warned of the drawbacks of a strengthening Hong Kong dollar, which is pegged to the US dollar.

The number of arrivals for the first three days of the Labour Day “golden week” holiday reached nearly 650,000, up by 25 per cent against last year’s figures, he said.

The break runs from May 1 to 5 on the mainland.

He said “changing consumption patterns among locals and tourists”, coupled with the strong Hong Kong dollar, could hit the retailing and catering sectors in particular.

Chan urged companies to develop new products and to embrace technology.

“New products can not only meet the changing needs of consumers, but also create demand and thus boost sales,” he said. “As for new ways of management, companies can lower costs and enhance efficiency by adopting more digital solutions.”

Chan was attending the annual meeting of the board of governors of the Asian Development Bank in Tbilisi, Georgia, which is themed “From Billions to Trillions – Promoting Private Sector Development for Climate Change”.

He said many participants were interested in the development of Hong Kong’s digital economy, as well as the innovation and technology sector.

Chan said at the plenary session a huge funding gap of trillions of US dollars existed for climate and transition investments, as well as in helping developed and developing economies in climate financing.

He urged members to work together to mobilise private sector resources and channel funds to support green and climate transition projects through innovative financial products and services.

In his weekly blog post, Chan also noted Hong Kong’s gross domestic product had increased for five consecutive quarters, expanding 2.7 per cent year-on-year in the first three months of the year.

The city’s benchmark Hang Seng Index also gained almost 14 per cent recently, while the property market had become more active after authorities scrapped cooling measures in February.

Finance

M&M Finance’s Q4 Results: Net profit declines; ₹6.30 per share dividend declared

Mahindra Finance reported a total income of ₹3,706 crores, marking a 21 per cent increase year-over-year (YoY), for the quarter ending March 31, 2024, on May 4. However, the Profit After Tax (PAT) experienced a slight downturn by 10 per cent YoY, settling at ₹619 crores, attributed to a 14% increase in Net Interest Income (NII) which stood at ₹1,971 crores. The Net Interest Margin (NIM) remained fairly stable at 7.1%. The reported disbursements for the quarter saw an 11% rise, totalling ₹15,292 crores, and the Gross Loan Book grew by an impressive 24% YoY to ₹1,02,597 crores.

Also Read | Pakistan coach Gary Kirstein gets brutally trolled after meeting with team online, ‘Is this cricket or…?’

The company also showed marked improvement in asset quality, with a significant reduction in Stage 3 assets to 3.4%, down from 4.0% in December 2023. Credit costs for the year were maintained within the targeted range of 1.5% – 1.7%, indicative of effective risk management strategies.

Also Read | Justin Trudeau says ‘rule-of-law’ after 3 arrested for Nijjar killing, Jaishankar says ‘internal politics’

In its consolidated results, the company posted a total income of ₹4,333 crores for the fourth quarter, up by 23% YoY, and a marginal decrease in PAT by 1%, amounting to ₹671 crores. The consolidated disbursements also noted an increase of 11% YoY, reaching ₹16,174 crores.

Also Read | No Dunki route to London anymore: Why is Rishi Sunak deporting UK’s illegal immigrants to Rwanda? An explainer

The company’s strategic initiatives included bolstering its presence in vehicle finance, particularly in pre-owned vehicle finance, which grew by 18% during FY24. Moreover, Mahindra Finance announced plans to enhance its services in the non-vehicle finance segment, aiming to expand its Asset Under Management (AUM) to 15% over the medium term. This includes increasing investments in sectors such as Small and Medium Enterprises (SME) lending, Lease and Purchase (LAP), and leasing through its Quiklyz platform.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 09:46 AM IST

Finance

Transwarranty Finance Q4 results : profit at ₹2.73Cr, Revenue increased by 166.66% YoY

Transwarranty Finance Q4 Results Live : Transwarranty Finance declared their Q4 results on 02 May, 2024. The topline increased by 166.66% & the profit came at ₹2.73cr.

It is noteworthy that Transwarranty Finance had declared a loss of ₹6cr in the previous fiscal year in the same period.

As compared to the previous quarter, the revenue grew by 68.98%.

The Selling, general & administrative expenses rose by 12.53% q-o-q & increased by 13.69% Y-o-Y.

The operating income was up by 7726.27% q-o-q & increased by 154.53% Y-o-Y.

The EPS is ₹0.98 for Q4, which increased by 148.87% Y-o-Y.

Transwarranty Finance has delivered 0% return in the last 1 week, 24.19% return in the last 6 months, and -6.85% YTD return.

Currently, Transwarranty Finance has a market cap of ₹56.46 Cr and 52wk high/low of ₹15.5 & ₹8.25 respectively.

| Period | Q4 | Q3 | Q-o-Q Growth | Q4 | Y-o-Y Growth |

|---|---|---|---|---|---|

| Total Revenue | 5.12 | 3.03 | +68.98% | 1.92 | +166.66% |

| Selling/ General/ Admin Expenses Total | 1.16 | 1.03 | +12.53% | 1.02 | +13.69% |

| Depreciation/ Amortization | 0.13 | 0.12 | +9.2% | 0.12 | +1.13% |

| Total Operating Expense | 2.42 | 3.07 | -21% | 6.87 | -64.74% |

| Operating Income | 2.7 | -0.04 | +7726.27% | -4.95 | +154.53% |

| Net Income Before Taxes | 2.73 | -0.36 | +862.66% | -6.01 | +145.33% |

| Net Income | 2.73 | -0.36 | +863.53% | -6 | +145.44% |

| Diluted Normalized EPS | 0.98 | -0.07 | +1500% | -2.01 | +148.87% |

FAQs

Question : What is the Q4 profit/Loss as per company?

Ans : ₹2.73Cr

Question : What is Q4 revenue?

Ans : ₹5.12Cr

Stay updated on quarterly results with our results calendar

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Published: 05 May 2024, 02:36 AM IST

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

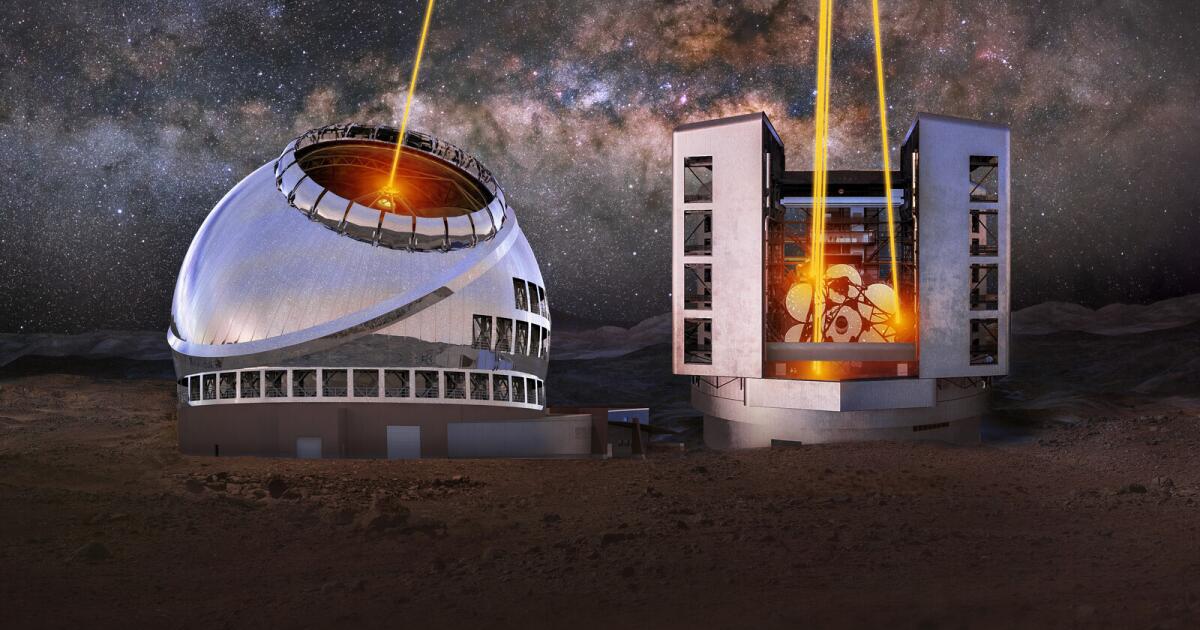

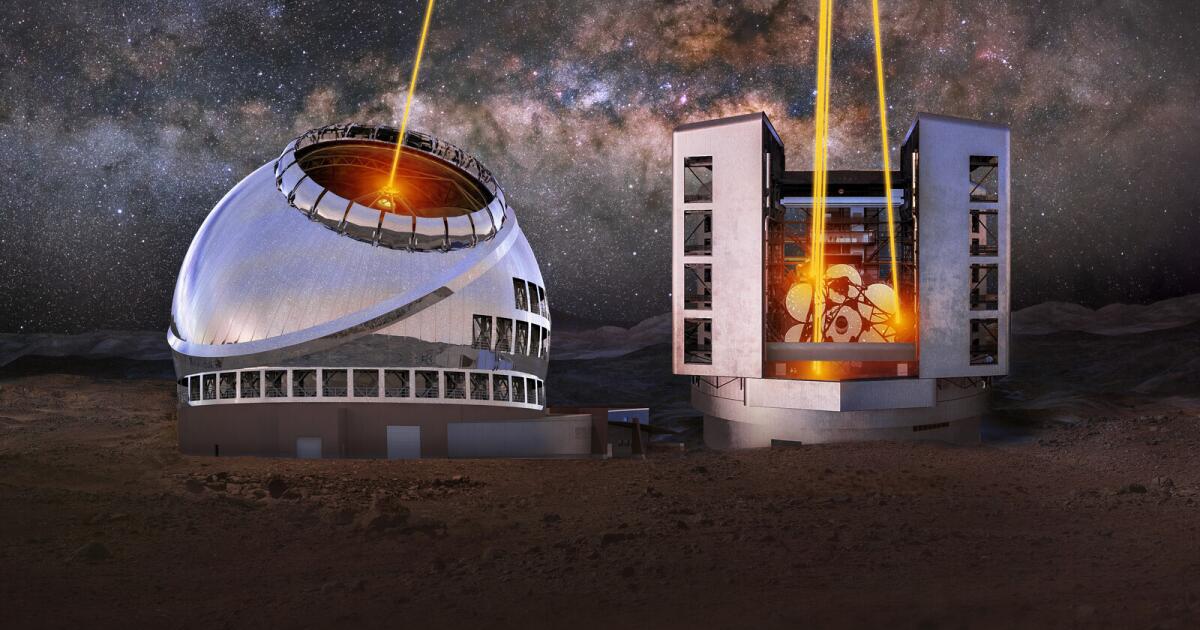

Science1 week ago

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire

/cloudfront-us-east-1.images.arcpublishing.com/gray/KHTBQQXUSZD5TF7KP45CWOYBEY.jpg)