Finance

China’s top financial data provider restricts offshore access due to new rules-sources

HONG KONG, Could 4 (Reuters) – China’s largest monetary knowledge supplier Wind Data Co advised some clients late final yr that it was limiting offshore customers from accessing sure enterprise and financial knowledge on account of the cybersecurity regulator’s new knowledge guidelines, two sources stated.

Restricted entry to Wind by offshore customers comes as China sharpens its give attention to knowledge utilization and safety amid rising geopolitical tensions and considerations about privateness on the planet’s second-largest financial system.

The transfer by Wind, whose companies are utilized by economists, fund managers and others, additionally comes as China is trying to entice extra overseas investments and revive an financial system struggling for a post-COVID lift-off. The curbs embrace entry to particulars on some corporations’ shareholding buildings.

Shanghai-based Wind has made a part of its knowledge reminiscent of house sale numbers, which was once up to date commonly, inaccessible for customers based mostly exterior mainland China since September final yr, one of many sources stated.

A Wind salesperson advised the supply in September the corporate had made the adjustments as per directions from the Our on-line world Administration of China (CAC), which requested it to cease offering offshore customers with sure knowledge.

The second supply was additionally advised by one other Wind salesperson that the restrictions had been put in place after the CAC unveiled new knowledge guidelines final yr.

The cybersecurity regulator issued last guidelines final July requiring knowledge exports to bear safety opinions, as a part of a brand new regulatory framework that may have an effect on a whole bunch, if not hundreds, of Chinese language corporations.

The brand new guidelines got here in to impact from Sept. 1.

Beijing has in recent times issued new cybersecurity, knowledge and privateness legal guidelines that require organisations with massive consumer bases to bear assessments and approvals when dealing with the info they accumulate.

Lawmakers additionally handed a wide-ranging replace to Beijing’s anti-espionage laws late final month, banning the switch of any info associated to nationwide safety and broadening the definition of spying.

The restrictions on offshore customers’ entry to sure Wind knowledge have expanded since final September, stated the primary supply. It’s unknown whether or not the CAC stepped up entry tightening necessities because the identical month.

Thus far, offshore customers’ entry to Wind info that has been blocked consists of enterprise registry particulars reminiscent of an organization shareholding construction and its final controller, in addition to financial knowledge reminiscent of house and land gross sales in sure cities, sources have advised Reuters.

Wind, which serves quite a few home and overseas monetary establishments, didn’t reply to requests for remark.

The CAC didn’t instantly reply to a faxed request for remark.

When requested about Chinese language monetary knowledge suppliers together with Wind having stopped offering key company info to abroad subscribers, overseas ministry spokesperson Mao Ning advised a information briefing that she was not conscious of the state of affairs.

The sources declined to be recognized as they weren’t authorised to talk to the media.

Based in 1998 by entrepreneur Lu Feng, private-held Wind is by far the most important participant in China’s fast-growing marketplace for monetary knowledge, as per estimates by dealer Guotai Junan Securities.

LIMITED ACCESS

Enterprise teams have warned concerning the imprecise wording of China’s new anti-espionage regulation, which bans the switch of any info associated to nationwide safety, the rise in use of exit bans on overseas enterprise executives within the nation and heightened scrutiny towards due diligence companies.

U.S. due-diligence agency Mintz Group stated in late March the authorities had raided the agency’s China workplace and detained 5 native workers. The overseas ministry stated on the time Mintz was suspected of partaking in illegal enterprise operations.

Police visited Bain & Co’s workplace in Shanghai and questioned workers, the U.S. administration consultancy stated final week.

Apart from Wind, China’s foremost tutorial database China Nationwide Data Infrastructure (CNKI) has restricted entry to abroad subscribers from April 1, in keeping with customers notified of the suspension.

The entry restrictions imposed on the database apply to dissertations and convention papers in addition to authorized and statistical knowledge, the Nationwide College of Singapore stated in March in a discover on its web site concerning the disruption.

CNKI didn’t reply to a request for touch upon the matter.

Reuters has reported, citing sources that Chinese language knowledge suppliers together with firm databases Qichacha, partially owned by Wind, and TianYanCha have stopped opening to offshore customers for no less than months.

Headquartered in Shanghai’s monetary district Lujiazui, Wind has expanded its footprint exterior China to locations together with Hong Kong, Singapore, New York and London, and competes with Refinitiv and Bloomberg LP.

Wind raked in 2.5 billion yuan ($361.84 million) in gross sales in 2021, in keeping with Guotai Junan’s estimate, virtually doubling from 2016 income of 1.33 billion yuan.

($1 = 6.9091 Chinese language yuan renminbi)

Reporting by Julie Zhu and Xie Yu in Hong Kong, Yew Lun Tian in Beijing and the Shangahi newsroom; Modifying by Sumeet Chatterjee and Kim Coghill

Our Requirements: The Thomson Reuters Belief Rules.

Finance

TikTok Star Behind Viral 'Looking for a Man in Finance' Song Says Life Has Completely Changed (Exclusive)

:max_bytes(150000):strip_icc():focal(462x390:464x392)/megan-boni-051124-89aa21cdf541419b972544078fadcfb7.jpg)

One TikTok star wasn’t looking for a job in showbiz — but that’s what’s happening.

Nine days ago, creator Megan Boni, who goes by the username Girl On Couch on the social media platform, was just your typical 26-year-old working a day job in sales and making funny videos on the side.

Then her satirical song “Looking for a Man in Finance” went viral. Now it’s been remixed endlessly, has gone viral all around the globe, and Boni says her life has turned completely upside down.

“I haven’t slept. I feel like I’ve been blacked out for a week,” she tells PEOPLE. “I suddenly have an agent.”

Boni, who went to Penn State and moved to New York City after graduation in 2019, adds, “I’m about to hire a manager. I even quit my job!” (She notes that her company was cool about it. “They were like, ‘We get it! You do you,’ ” she says.)

But Boni notes that it’s all been beyond surreal.

“I have calls with major companies. I have all these DJs who want to release the first single with me, so I’m suddenly navigating the music industry,” she explains.

Boni also says that the song is already in heavy rotation at concerts and clubs.

“People are asking if I’m annoyed that I’m not getting credit, and I’m like no way, I literally asked for DJs to remix it!” she says.

Still, Boni adds that she’s looking forward to releasing the official single so she can get royalties.

According to the TikToker, the idea for the song stemmed from making fun of girls who complained about being single but then had a laundry list of expectations for potential partners.

“It was just making fun of that, so I started thinking of the most outlandish, hardest things to find in a man and wrote it down, then I came up with that rhyme.” (The tune goes, “I’m looking for a man in finance / Trust fund, 6’5,” blue eyes.”)

Not only have plenty of people added beats to the lyrics, but the next trend is putting their own spin on the lyrics.

Music producer FINNEAS posted, “I’m looking for the WiFi network. Friend’s house. Hotel. Airport.”

As for what’s next, Boni says the song will be released as a single, and she hopes to make appearances at shows and festivals. She also wants to try her hand at comedy.

“I’d love to take some stand up or improv classes, maybe some acting classes. And I’ll probably head to YouTube,” she explains.

The up-and-coming star adds that her family and friends can’t believe what’s going on.

“I have two brothers who probably hate me right now because everyone keeps asking them about it. But my parents are over the moon,” she says.

Boni adds, “You always hope that your content will get views, but I had no idea this was going to resonate. It’s turned into a monster! The Internet is crazy.”

Finance

Mother’s Day 2024: Five useful tips to manage finances for a caregiver woman

In the words of American writer Washington Irving, “A mother is the truest friend we have, when trials heavy and sudden fall upon us; when adversity takes the place of prosperity; when friends desert us; when trouble thickens around us, still will she cling to us, and endeavour by her kind precepts and counsels to dissipate the clouds of darkness, and cause peace to return to our hearts.”

As Mother’s Day approaches, it’s a poignant moment to recognize the unsung heroes among us—mothers who find themselves balancing the demands of caring for both their children and ageing parents. In this modern era, characterised by its unique blend of emotional, physical, and financial challenges, mothers stand at the intersection of caregiving and financial stewardship.

For these mothers, the responsibility of managing their family’s financial well-being can feel like navigating uncharted waters. From juggling medical emergencies to providing for their children’s future, the burden can be overwhelming. However, amidst these challenges, there are practical strategies that can offer solace and stability.

Here are some actionable steps for managing finances as a mother caring for both ageing parents and children, especially on this occasion of Mother’s Day:

Support fund and health insurance for parents

In an era of escalating healthcare costs, having robust health insurance coverage is essential. Setting up a dedicated parents’ support fund, alongside investing in health insurance, can provide a safety net for unforeseen medical expenses. This fund should be distinct from contingency funds and can be invested in instruments such as arbitrage or liquid funds for liquidity and stability.

Maximising post-retirement funds for elderly parents

Many elderly parents may have traditionally favoured investments in real estate, gold, or traditional insurance plans. Assisting elderly parents in diversifying their post-retirement investments can ensure a steady income stream while safeguarding their financial security. Investing in avenues like Senior Citizens Savings Scheme (SCSS), annuity plans, or Pradhan Mantri Vaya Vandana Yojana can provide regular income while safeguarding capital, ensuring lower pressure on your financial status.

Protecting their wishes by facilitating parental will drafting

While it is painful to think of the finality of old age, encouraging parents to draft a will enables them to retain control over their assets. This can facilitate a smooth transition of assets, reducing the likelihood of disputes among heirs.

Investing today for a better future for children

For mothers managing the financial well-being of their children, investing early in children’s futures through equity SIPs can harness the power of compounding, laying a strong financial foundation for their education and beyond. Further, instilling financial discipline in children from an early age and involving them in discussions about family finances can impart valuable lessons about responsible money management, making them capable of handling their finances optimally in their adulthood.

Avoid high-risk products and follow prudent paths to prosperity

While striving for financial security, it’s prudent to steer clear of high-risk investment ventures and opt for well-understood, diversified portfolios.

By implementing these practical strategies and fostering open communication, mothers can navigate the challenges of caring for ageing parents and children while safeguarding their own financial well-being. Here’s to the mothers who embody strength, resilience, and unwavering love. Celebrating the ONE woman who shaped your world and believed in you, always – Happy Mother’s Day!

Anupama Sharma is Executive Director, 360 ONE Wealth.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 12 May 2024, 10:25 AM IST

Finance

State mobilises resources to boost private sector as economic growth driver: Finance Minister – Dailynewsegypt

Finance Minister Mohamed Maait has reiterated President Abdel Fattah Al-Sisi’s commitment to implementing robust measures to ensure the nation’s economic, financial, and food stability, which are fundamental components of Egypt’s comprehensive national security strategy amidst the current global and regional challenges. These efforts aim to enhance the government’s capacity to elevate the standard of living for its citizens and fulfil their essential, developmental, and public service requirements.

Speaking at the economic forum organized by the Egyptian Association for Political Economy, Statistics, and Legislation, under the theme “Navigating the Egyptian Economy: Regional and Global Perspectives… Addressing Food Economy Challenges,” Maait highlighted that the ongoing global crises underscore the soundness of Egypt’s approach in harnessing collective efforts to bolster state capabilities. This is achieved by meeting strategic agricultural development goals, which include providing citizens with quality products at reasonable prices, thereby ensuring food security and shielding the nation from international and regional market volatility. This is in line with the political leadership’s initiative to broaden agricultural and food production projects aimed at self-reliance and boosting export figures, as well as maintaining sustainable strategic reserves of vital commodities for six months.

Maait added that the government has embarked on a series of reformative actions to reshape the economic landscape and foster recovery, prioritizing agricultural and industrial output and exports in the next phase. The state is fully committed to deploying its resources to fortify the private sector’s role as the main propellant of economic growth, ensuring a more robust structure and agility in adapting to both external and internal economic perturbations, as part of the economic reform agenda backed by the IMF and global development allies.

The programme, which is garnering increased investment interest, is predicated on sustained fiscal prudence, aiming to achieve a primary budget surplus of 3.5% of GDP and setting deficit and debt ratios on a declining path, with a debt ceiling not surpassing 88.2% in the forthcoming fiscal year. International credit rating agencies have conveyed optimism regarding the prospects of the Egyptian economy, recognizing the potential for more invigorating opportunities for local and international investors. They have favourably evaluated Egypt’s new economic direction and foresee a potential upgrade in the country’s credit rating in 2024.

The Finance Minister elucidated that the government is collaborating with investors to alleviate the financial load of fostering agricultural and industrial ventures by continuing the interest rate support initiative, offering financing provisions of approximately EGP 120bn for these sectors. The national treasury is allocating EGP 8bn annually to cover the interest rate differential for beneficiaries, alongside budgetary provisions in the upcoming fiscal year to assist farmers, reinforcing the agricultural domain and fortifying Egypt’s food system.

He noted that the Egyptian economy has been grappling with intricate challenges over the past four years, exacerbated by the succession of regional and global crises. These difficulties are further intensified by the severe consequences of the ongoing conflict in Gaza, tensions in the Red Sea area, and other forms of instability in the Middle East, coupled with the adverse effects of the conflict in Ukraine.

The geopolitical unrest and regional as well as international disputes have engendered a volatile economic environment marked by decelerated economic activities, diminishing growth and investment rates, and escalating inflation on both the global and domestic fronts. This has manifested in increased financing and developmental costs, particularly due to the central bank’s tightening monetary policies, rising interest and exchange rates, and elevated transportation and logistics expenses, leading to augmented production and import costs, as well as higher prices for essential commodities, food, and services, while also considering the ramifications of the COVID-19 pandemic.

Maait pointed out that the nation’s overall fiscal intake has suffered in the last four years, owing to reduced economic dynamism and the detrimental impacts of international and regional discord on certain economic sectors like tourism, manufacturing, exports, Suez Canal revenues, and foreign investments. Expenditures have surged to unprecedented levels to counteract the severe economic jolts and mitigate their inflationary impacts, with swift interventions and extraordinary social protection measures targeting the most vulnerable segments of society, including low and middle-income households, and bolstering the sectors most affected by the economic upheaval.

-

Education1 week ago

Education1 week agoVideo: President Biden Addresses Campus Protests

-

News1 week ago

News1 week agoSome Florida boaters seen on video dumping trash into ocean have been identified, officials say

-

World1 week ago

World1 week agoUN, EU, US urge Georgia to halt ‘foreign agents’ bill as protests grow

-

World1 week ago

World1 week agoEuropean elections: What do voters want? What have candidates pledged?

-

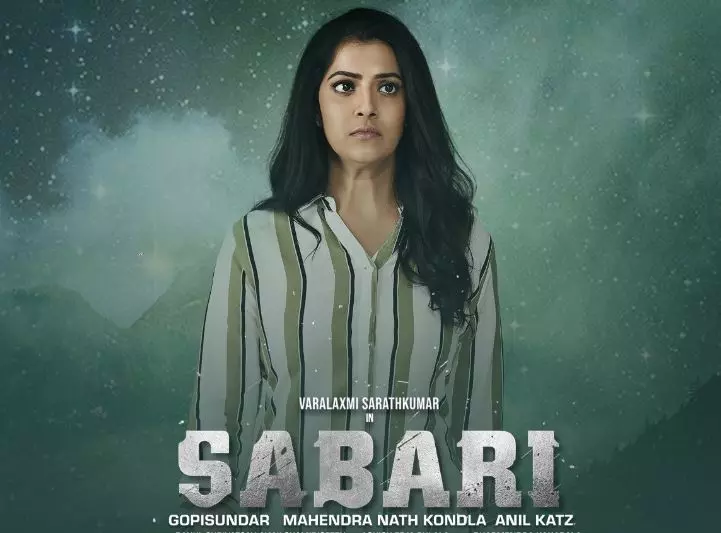

Movie Reviews1 week ago

Movie Reviews1 week agoSabari Movie Review: Varalaxmi Proves She Can Do Female Centric Roles

-

News1 week ago

News1 week agoWhistleblower Joshua Dean, who raised concerns about Boeing jets, dies at 45

-

Politics1 week ago

Politics1 week agoAustralian lawmakers send letter urging Biden to drop case against Julian Assange on World Press Freedom Day

-

World1 week ago

World1 week agoBrussels, my love? Champage cracked open to celebrate the Big Bang